EURUSD Declines Amid Lack of Progress in EU-US Trade Talks【April 16, 2025】

Fundamental Analysis

Despite ongoing trade negotiations between the EU and the US, no progress has been made. Meanwhile, expectations are rising in the market for a potential US-UK trade agreement.

EURUSD failed to break above 1.15USD and is now showing signs of a gradual pullback.

EURUSD Technical Analysis

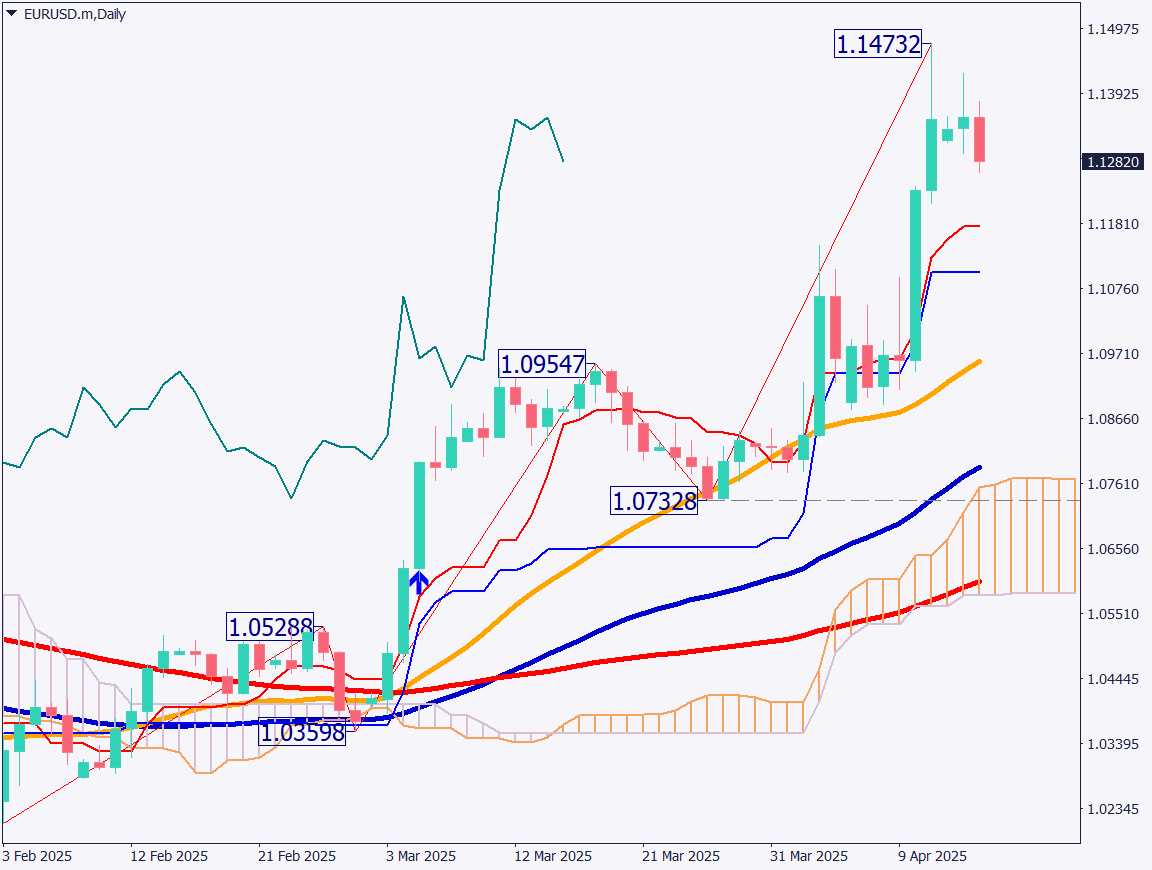

The daily chart shows EURUSD climbed up to 1.147USD, but faced strong resistance around 1.15USD and subsequently declined. The lack of progress in EU-US trade talks is contributing to this downward movement.

Looking at the moving averages, the 26-day, 52-day, and 90-day lines are aligned from top to bottom, forming a perfect order. Although there may be some corrective selling due to the wide gap from the 26-day moving average, the overall trend is still upward.

The area around 1.12USD, where the conversion line and base line are located, may serve as a key support level.

Day trading strategy (1 hour)

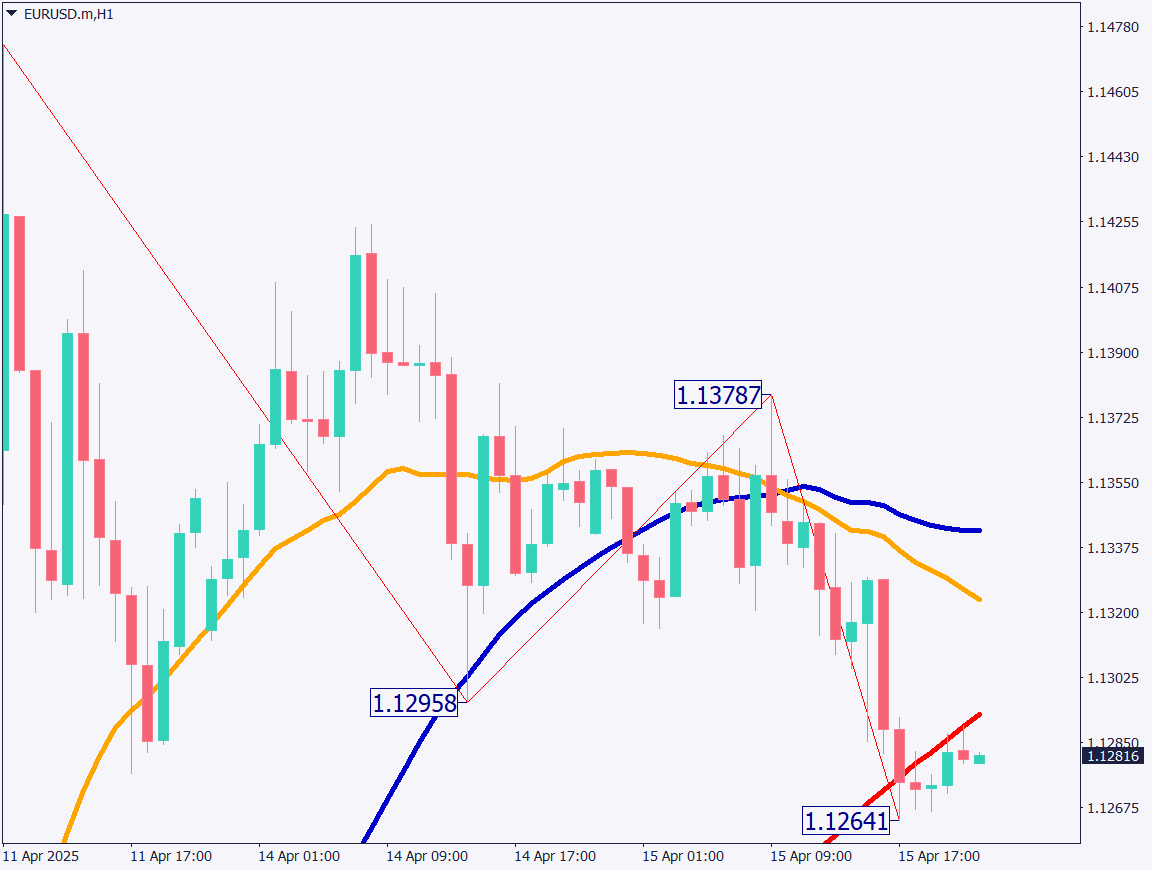

On the 1-hour chart, EURUSD has formed a death cross as the 26-period moving average crosses below the 52-period moving average. The price is now trending below the 90-period moving average, suggesting a possible gradual decline ahead.

Applying Fibonacci expansion to the 1-hour chart indicates the 100% level is near 1.12USD. This is consistent with the daily chart, where the conversion and base lines are also found around this price, making it a notable support level. Additionally, it is a round number.

Since the overall trend remains bullish, this may be a good opportunity for dip-buying.

**Day Trading Plan:**Place a buy limit at 1.12USD, a stop at 1.1165USD, and take profit around 1.13USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 1.12USD – 100% Fibonacci expansion on the 1-hour chart

Market Sentiment

EURUSD: Sell: 66% / Buy: 34%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeChina GDP11:00UK Consumer Price Index15:00Eurozone Consumer Price Index18:00US Retail Sales21:30Canada Interest Rate Decision22:45

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.