Low volatility in the currency markets, wait-and-see market continues as we await the U.S. Consumer Price Index【May 10, 2023】

Fundamental Analysis

Major U.S. Stock Indexes Slightly Lower, U.S. Debt Ceiling Issue Revealed

Conflict between Republicans and Democrats in Congress leaves debt ceiling issue unresolved

U.S. regional bank stocks fall again, risk concerns remain

U.S. Consumer Price Index in Focus, Currency Markets Wait and See

U.S. Monetary Officials Deny Cutting Interest Rates, But Not Halting Rate Hikes

ECB official says it is too early to expect a rate cut next spring

Technical Analysis

The market as a whole is short of materials, and the market continues to be quiet. Today, the U.S. Consumer Price Index is scheduled to be released, which is the focus of market attention, and the market is expected to move significantly depending on the result. The dollar is hovering in the low JPY 135 range, and since it falls on a day with a 10 (Multiple of 5) immediately after GW, we need to be careful of large fluctuations in the morning in Tokyo.

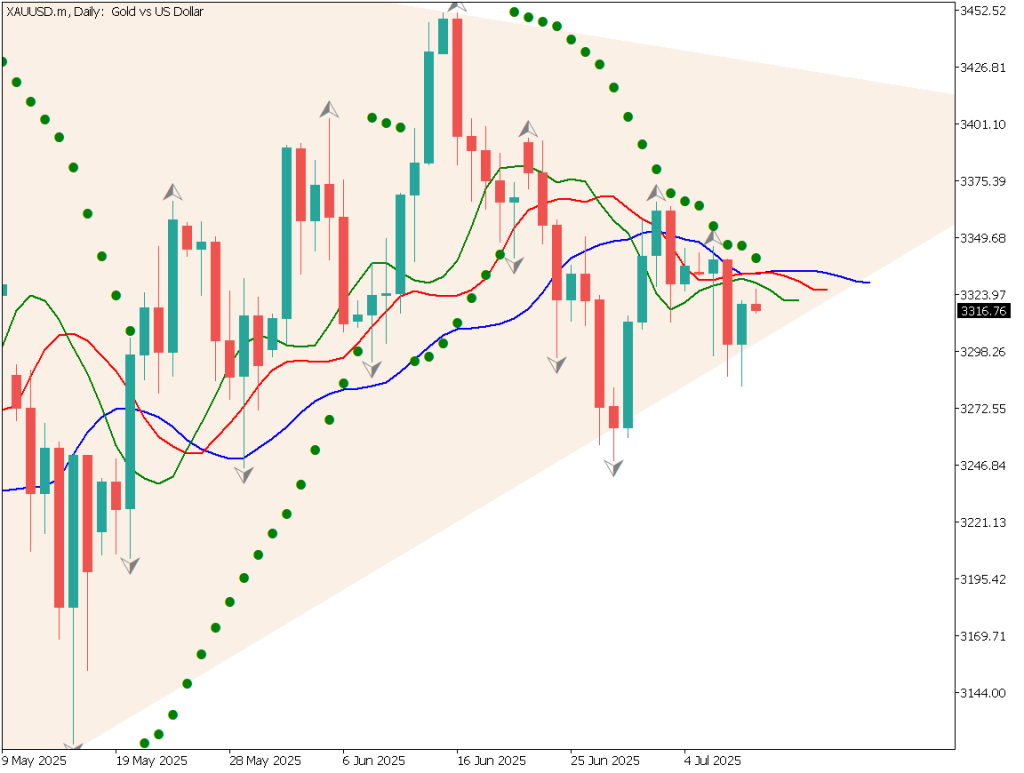

GOLD (XAUUSD)

Gold fell to near USD 2,000 in early trading, but has been consolidating on the downside and has rebounded without breaking below USD 2,000. With investors becoming more aware of the risk of default on the U.S. debt ceiling issue, we believe that funds are flowing into safe assets.

Although this is likely to change with today’s U.S. CPI results, the USD 2,060 area is expected to be a guide for the future. If the U.S. CPI is higher than market expectations, a shift to lower interest rates will be far away, which will put downward pressure on gold. A slowdown would be positive for Gold as it would at least provide grounds for a rate hike halt.

Estimated rangeUSD 2,005 – USD 2,063Resistance lineUSD 2,042Support lineUSD 2019.5

Nikkei Stock Average (NIKKEI 225)

For a larger perspective, we analyze the weekly chart of the Nikkei Stock Average. The market has been in a range for most of the year 2022, but it has recently broken through the upper end of the range and is approaching the milestone of JPY 30,000. The near-term target is JPY 29,550.

The market is being bought on expectations of a post-Corona recovery in inbound demand and economic recovery, following news reports that prominent investor Buffett is bullish on Japanese stocks.As a policy, we would like to maintain a buy-and-hold policy.

Estimated rangeJPY 28,870 – JPY 29,550Resistance lineJPY 29,470Support lineJPY 29,000

Bitcoin (BTCUSD)

In the virtual currency market, reports of the virtual currency exchange Bitterx filing for bankruptcy and reports of stricter virtual currency regulations have increased fundamental downward pressure. Analysis of the 4-hour chart confirms that the upward trend is pausing as the price has fallen below the 240 moving average line.

Although it is difficult to know the direction, we believe that whether the price can maintain the USD 26,470 level will give us a hint to predict the future trend. We will keep an eye on future developments.

Estimated rangeUSD 26,470 – USD 28,820Resistance lineUSD 28,230Support lineUSD 27,200

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)U.S. Consumer Price Index21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.