USD/JPY Declines, Geopolitical Risks Rise as Israel Declares War on Hamas【October 10, 2023】

Fundamental Analysis

Israel declares war on Hamas, causing a sharp rise in geopolitical risks near the Middle East.

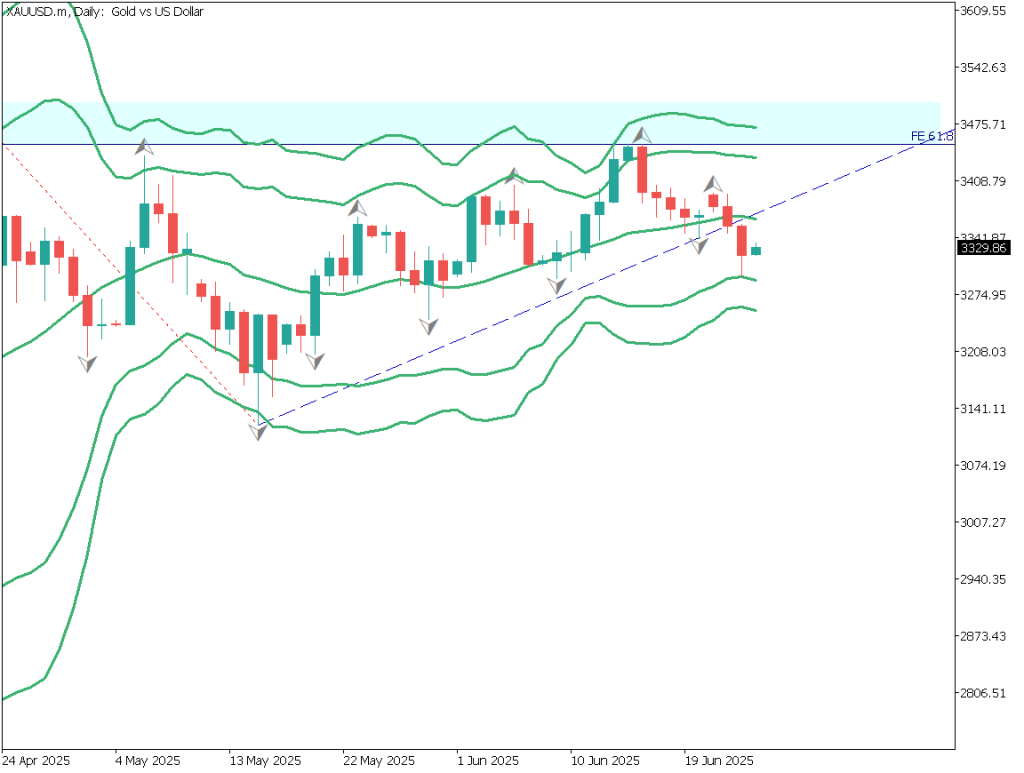

Tendency to buy safe assets strengthens, with yen, Swiss franc, and gold all rising.

Potential for the sudden attack on the US ally Israel to involve Western countries.

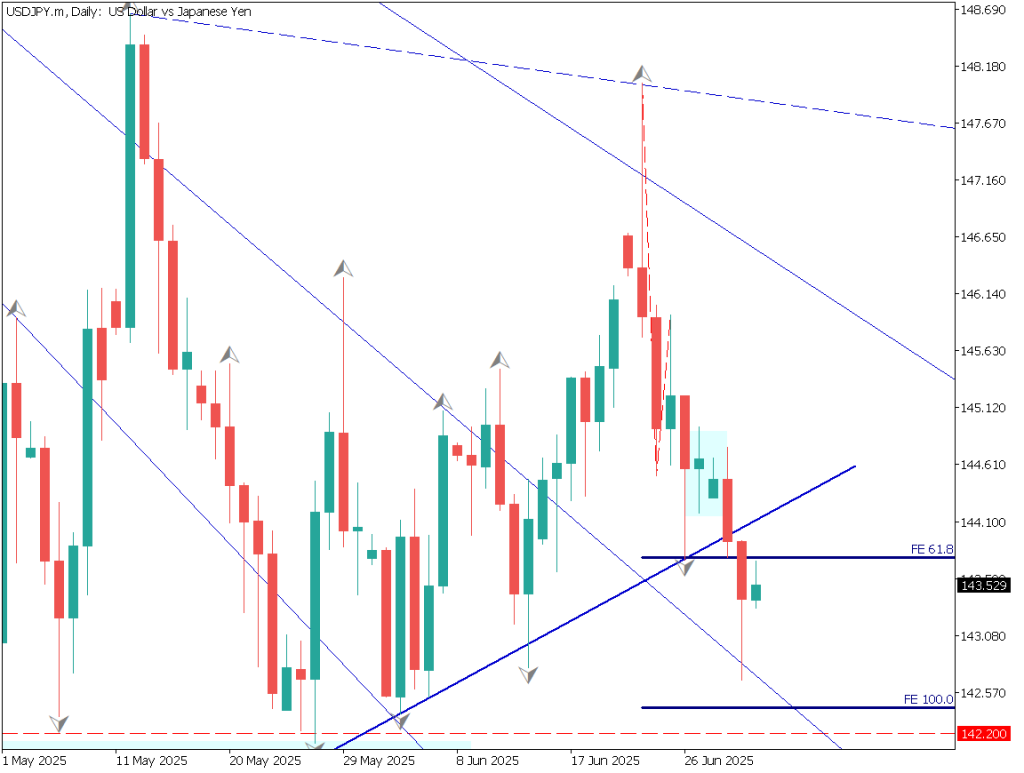

USDJPY Technical Analysis

Analyzing the 4-hour chart of the USD/JPY exchange rate. 148.25 JPY can be identified as the current range’s lower limit. If this level breaks, the yen could strengthen further.

From a fundamental perspective, market focus on the Middle East situation has increased. With the US’s additional rate hike prospects receding, there’s a potential for increased risk-averse movement. Particularly in the current state of war declaration, a quick resolution to the conflict is unlikely, negatively impacting the dollar. On the other hand, there’s noticeable capital inflow to safe assets including the yen, which acts as a factor for yen appreciation.

The Ichimoku Cloud indicates a bearish triple crossover, with multiple bearish signals including the RSI nearing 40.

Day Trading Strategy (Hourly)

Analyzing the 1-hour chart of the USD/JPY exchange rate. A dead cross has occurred following a reaction at the 240 moving average line, quickly dropping to the lower limit of 148.25 JPY. Whether it breaks this level is the focus. If it does, the downside targets are 147.71 JPY, followed by 147.30 JPY. If it breaks below 147.30 JPY, a strong downtrend can be confirmed.

The impact of the Middle East situation is uncertain, but if tensions escalate between major countries, there’s potential for accelerated inflow into safe assets like yen and gold.

For day trading, consider a sell entry at 148.50 JPY, with a target for settlement at 147.75 JPY and a stop at 149.0 JPY.

Support and Resistance Lines

The resistance line to be considered in the future is as follows

147.71 JPY – Main support line147.30 JPY – Recent lowest price

Market Sentiment

USDJPY Sell: 60% Buy: 40%

Today’s Important Economic Indicators

Economic Indicators and EventsJST (Japan Standard Time)Remarks by ECB President Lagarde21:00FOMC Member Remarks22:30FOMC Member Remarks4:00 (next day)

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.