USDJPY is Forming a Range Market, MACD Shows Divergence【March 5, 2024】

Fundamental Analysis

The US Supreme Court has allowed Trump’s candidacy for president, with the market preparing for his potential re-election.

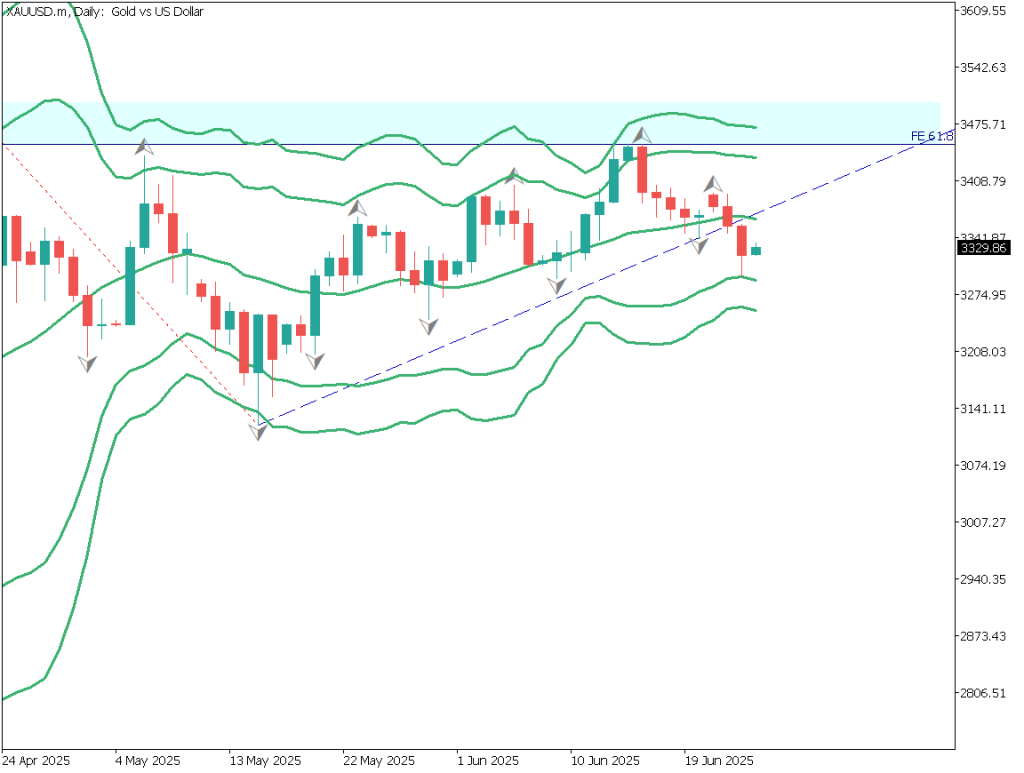

Gold has surged, marking its highest increase since December 2023.

The trend of yen weakening continues across cross-yen currency pairs.

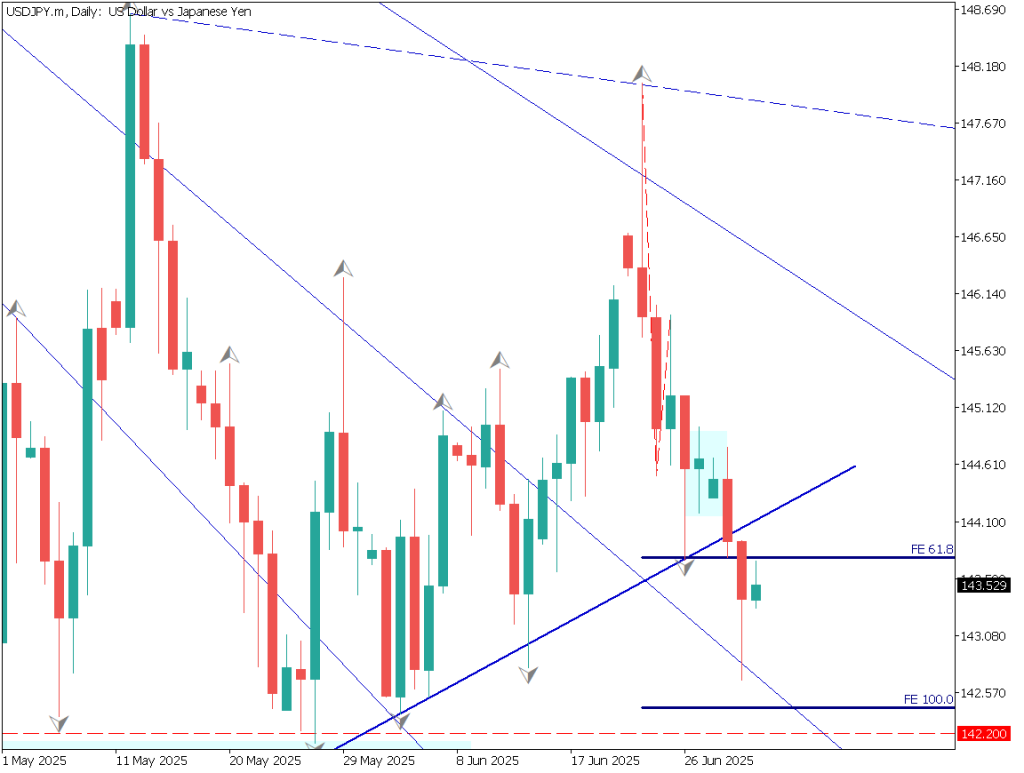

USDJPY Technical Analysis

Analyzing the daily chart of USDJPY, the range market has been ongoing since February 13, fluctuating between 149.68 JPY and 150.80 JPY. A key point is its movement without breaking below the Ichimoku conversion line.

Today, the Tokyo CPI and the Bank of Japan Governor’s speech are scheduled, which could impact USDJPY. With the USD weakening, focus is on how far the Bank of Japan Governor will go in his statements regarding the end of negative interest rates and the outlook for interest rate hikes.

Looking at the MACD, despite the price reaching new highs, the MACD is declining, indicating divergence. If it falls below 150 JPY, we should consider the possibility of a drop to around 149.25 JPY, near the Ichimoku baseline, including stops.

Day Trading Strategy (1-Hour Chart)

Analyzing the 1-hour chart of USDJPY, the direction of position holding changes depending on whether it breaks upwards or downwards due to the range market. The 240 moving average is horizontal, suggesting a preparation phase for the next trend market.

Attention should be paid to today’s Tokyo CPI and the Bank of Japan Governor’s speech. Additionally, Powell’s semi-annual congressional testimony is scheduled for early tomorrow morning. Volatility is expected to increase in both the Tokyo and NY markets.

The day trading strategy is to adopt a bearish stance in the Tokyo market and a bullish stance in the NY market for short-term trading. Institutional investors are likely to target movements including stop losses, so caution is advised.

Support and Resistance Lines

The following are the support and resistance lines to consider:

153.50 JPY – Major monthly resistance line

152.79 JPY – Major weekly resistance line

151.46 JPY – Weekly resistance line

149.68 JPY – Daily Ichimoku baseline

148.78 JPY – Weekly support line

Market Sentiment

USDJPY Sell: 69% Buy: 31%

Today’s important economic indicators

Economic indicators and eventsJapan timeTokyo Core Consumer Price Index8:30Nikkei Services PMI9:30US Services Sector Purchasing Managers’ Index by the Institute for Supply Management23:45US ISM Non-Manufacturing IndexMidnightComments by Federal Reserve Officials2:00 AM

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.