Gold Rises as US Economic Indicators Weaken, Boosting Rate Cut Expectations【May 16, 2024】

Fundamental Analysis

US CPI and US Retail Sales Show Weak Results

US Consumer Price Index Slows to a Six-Month Low

US FOMC Officials Comment on Persistent Rate Policy

XAUUSD technical analysis

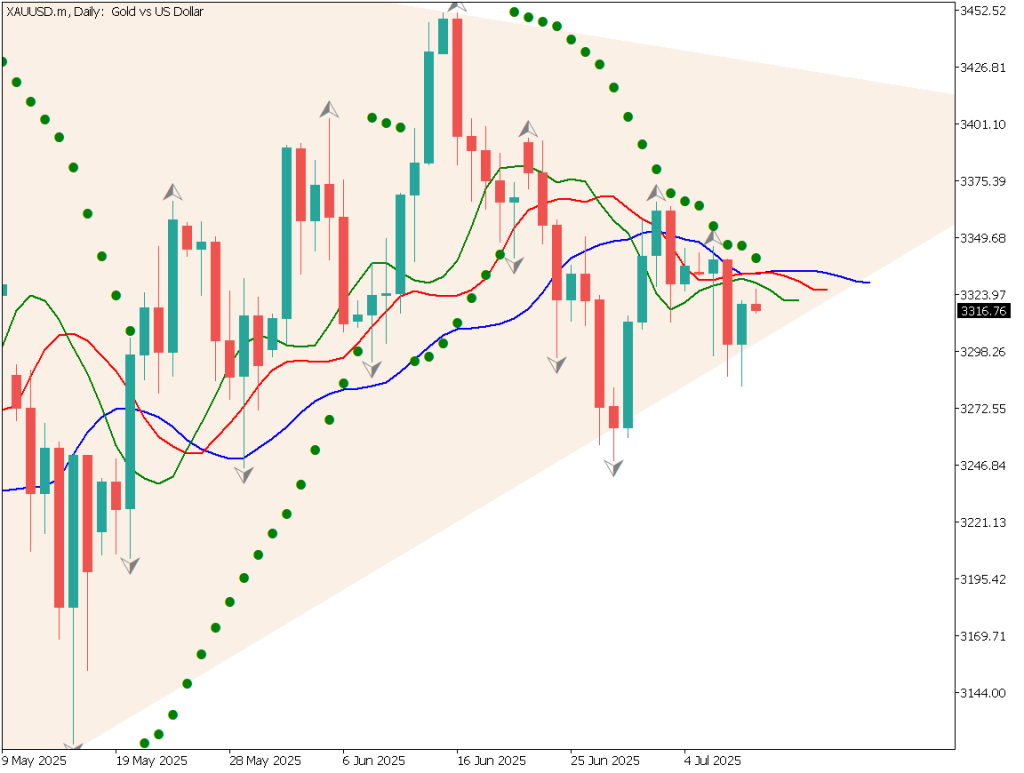

Analyzing the daily chart of gold. With the weak US CPI results and lower-than-expected retail sales, the view that inflation and the economy are being restrained has become dominant. After the CPI announcement, rate cut expectations increased, and gold rose to around 2393 USD, with 2400 USD now in sight.

The 28-day moving average is functioning as a support line, and gold continues to rise, aiming to update the recent highs. The all-time high is around 2430 USD, and if surpassed, it may aim for 2500 USD. If rate cut expectations increase, gold may become easier to buy, accelerating its rise.

Day trading strategy (1 hour)

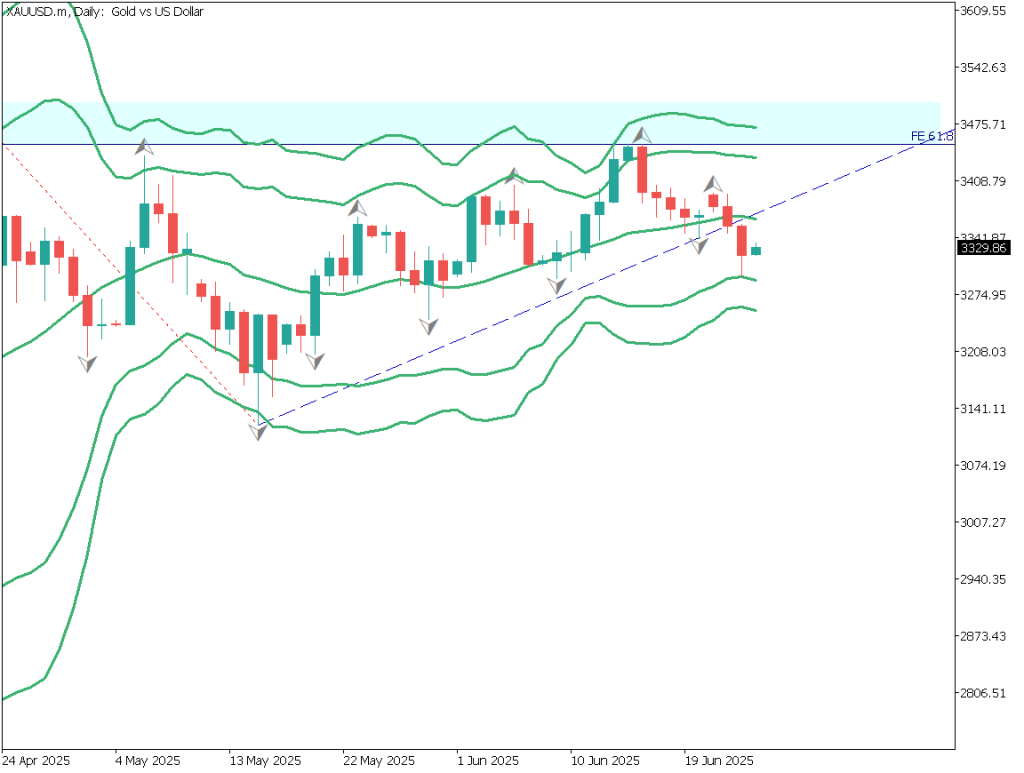

Analyzing the hourly chart of gold. Drawing the Fibonacci expansion, gold rebounded at 61.8% of 2377 USD and rose to around 2393 USD. It may aim to rise to around 2404 USD, which corresponds to 100%.

Due to weak US economic indicators, rate cut expectations increased, which supports gold’s rise. Therefore, the day trading policy is to buy. Specifically, buy in the 2380 USD range, close around 2400 USD, and set a stop if it falls below 2375 USD.

Support/Resistance lines

The support and resistance lines to consider going forward are as follows:

2404 USD: 100% of the Fibonacci expansion

Market Sentiment

XAUUSD: Sell: 59%, Buy: 41%

Featured Currency Pair of the Week (AUDNZD)

AUDNZD stopped declining at 61.8% of the daily Fibonacci retracement. It can be judged that the downward trend is strengthening as it fell below the 28-day moving average. Although it rebounded at 1.09 NZD, it may test this level again.

The pair has already broken below recent lows, indicating a downward trend. If trading, consider entries in the downward direction.

Today’s important economic indicators

Economic indicators and eventsJapan timeJapan GDP8:50Australia Employment Statistics10:30US Jobless Claims21:30FOMC Member Speech23:30FOMC Member Speech0:30 the next day

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.