Gold Dip-Buying Opportunity, U.S. Approves Missile Use in Russian Territory【November 19, 2024】

Fundamental Analysis

The U.S. reportedly grants Ukraine permission to use long-range missiles within Russian territory.

Gold sees dip buying, reacting to Fibonacci retracement and trendlines.

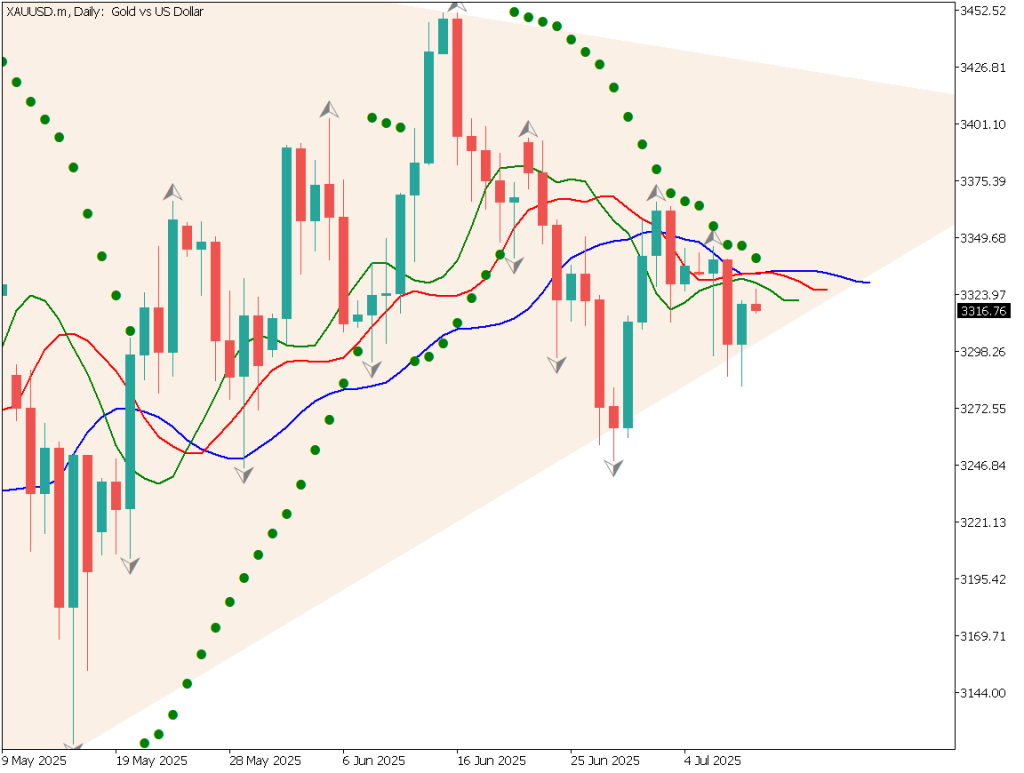

XAUUSD Technical Analysis

Analyzing the daily chart for gold: Gold has declined to approximately 2,535 USD, aligning with the 50% Fibonacci retracement level, after falling over 200 USD from its peak. The post-presidential election profit-taking appears to have subsided.

With support from the 50% Fibonacci retracement and overlapping trendlines, gold has rebounded from 2,535 USD to around 2,610 USD. Despite the ongoing strength of the USD, it has exceeded the 38.2% retracement, potentially rising further to the 23.6% level near 2,670 USD.

Fundamentally, reports of U.S. approval for Ukraine’s use of long-range missiles within Russian territory may have bolstered gold as a safe-haven asset.

Day trading strategy (1 hour)

Analyzing the 1-hour chart for gold: Gold saw significant selling around 2,635 USD, followed by a strong rebound. It is climbing along the +2σ line of the Bollinger Bands, suggesting a possible target of 2,675 USD if it surpasses 2,625 USD.

The focus is on whether gold can break through resistance levels at 2,615 USD and 2,627 USD.

For a day trading strategy, consider entering new buy positions. If gold falls near 2,600 USD, actively buying on dips could be favorable. Set a profit target near the recent monthly resistance at 2,635 USD, with a stop below 2,598 USD.

Support/Resistance lines

Key support and resistance lines to consider:

- 2,536 USD: Recent low

Market Sentiment

XAUUSD Sell: 50% / Buy: 50%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeRBA Meeting Minutes9:30BOE Governor Bailey Speech19:00EU Consumer Price Index19:00U.S. Housing Starts22:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.