Gold Closes Above 3000USD, Safe-Haven Demand Remains Strong【March 18, 2025】

Fundamental Analysis

Gold closes above 3000USD.

The Trump administration is increasing pressure on Iran.

XAUUSD Technical Analysis

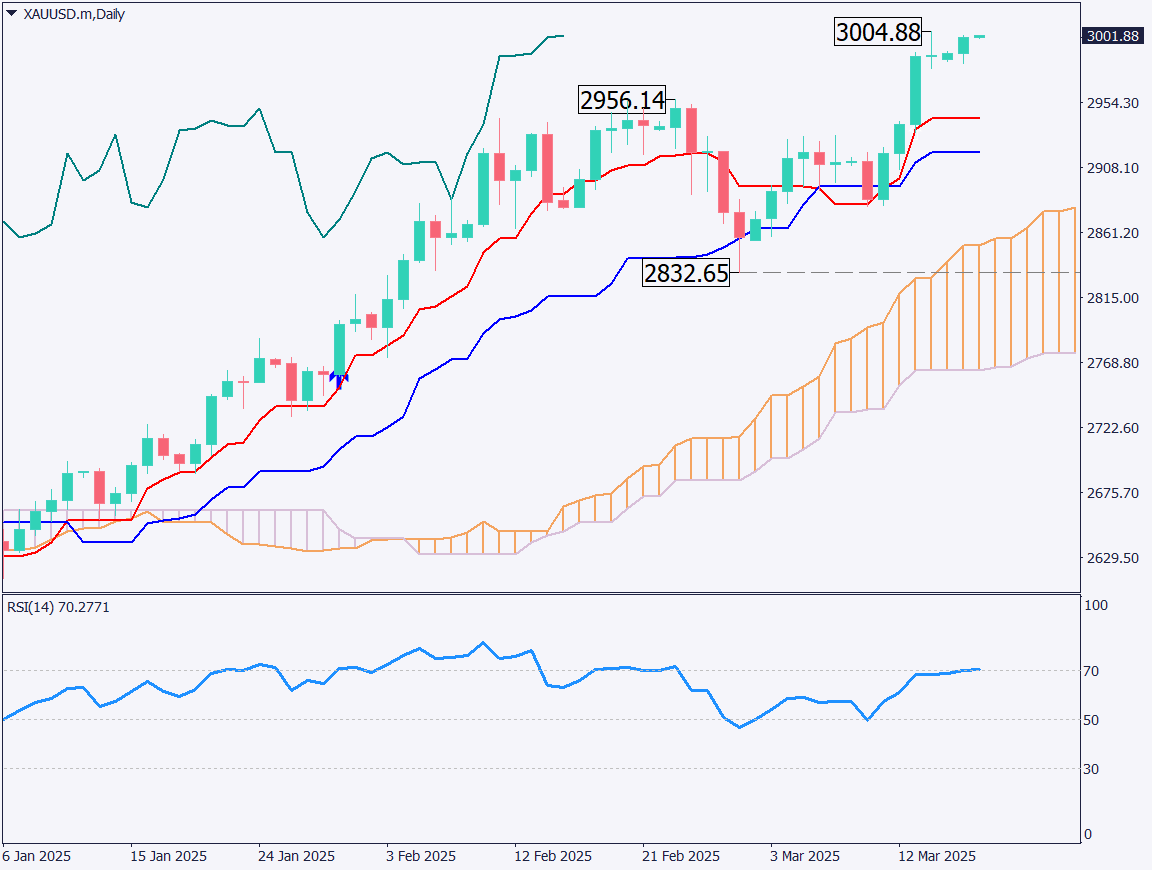

Analyzing the daily chart of Gold. Gold broke the recent high and reached the 3000USD level. This represents a 1000USD increase in just one year, indicating strong demand for safe-haven assets. The baseline has acted as support twice, forming a double bottom pattern with higher lows, leading to new highs.

Since Gold broke above 3000USD, strong selling pressure could emerge at any time due to a sense of achievement. While chasing highs is risky, fundamental factors suggest that Gold may continue its long-term uptrend.

Day trading strategy (1 hour)

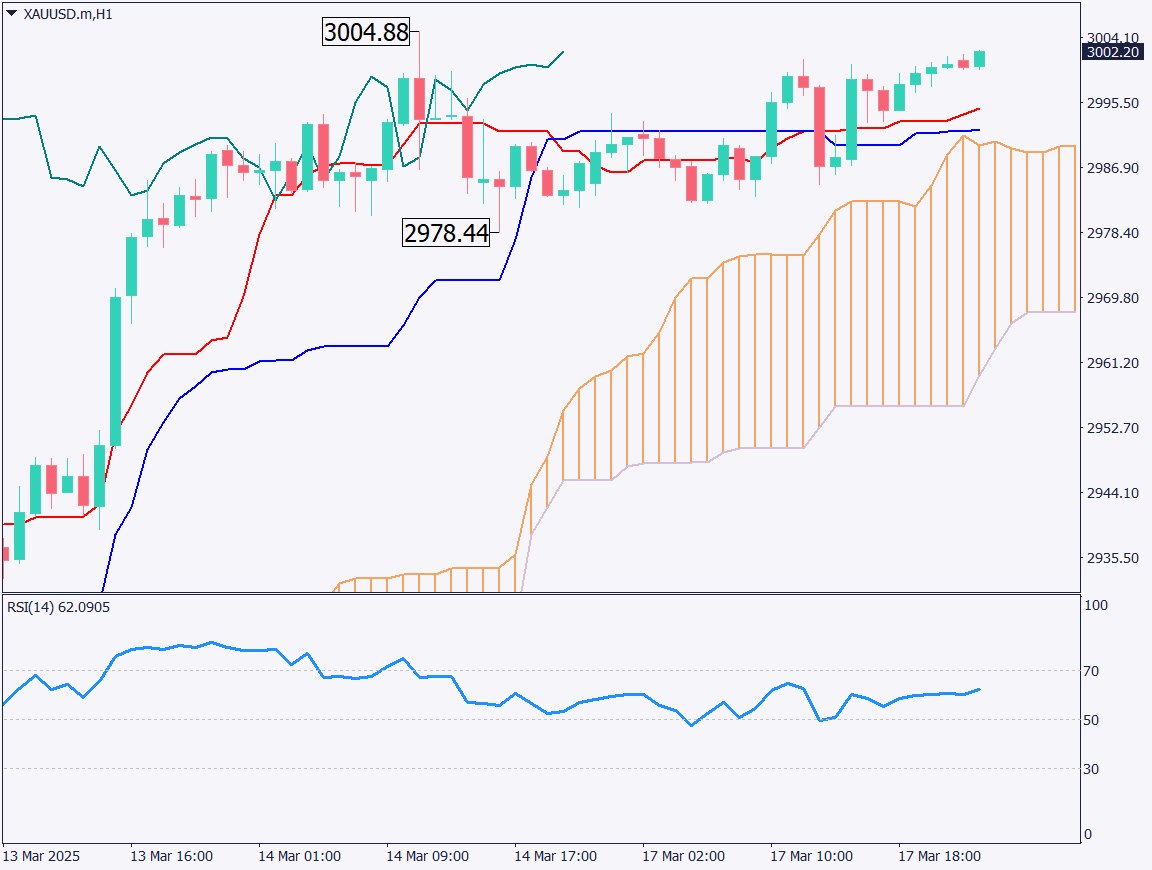

Analyzing the 1-hour chart of Gold. Gold had been trading in a range, but even after reaching 3000USD, no significant selling pressure was observed. Although it fell to 2978USD, the price stayed within a narrow range and is now attempting to break above the upper range again.

Avoid chasing highs. Place a buy limit order at 2979USD. Set the target for profit-taking around 3028USD. Set the stop-loss below 2959USD.

Support/Resistance lines

Key support and resistance lines to consider:

3028USD – Major resistance

3004USD – Recent high

Market Sentiment

XAUUSD Sell: 72% / Buy: 28%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeHousing Starts21:30Canada Core CPI21:30

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.