Gold Hits Record High for Second Consecutive Day as USD Weakens Rapidly【April 14, 2025】

Fundamental Analysis

The U.S. administration announced a temporary delay in tariffs on smartphones and PCs. However, a cooling remark from the Secretary of Commerce followed the announcement.

President Trump stated he would release further details on April 14.

The market may initially rise at the beginning of the week, but the details remain unclear.

XAUUSD Technical Analysis

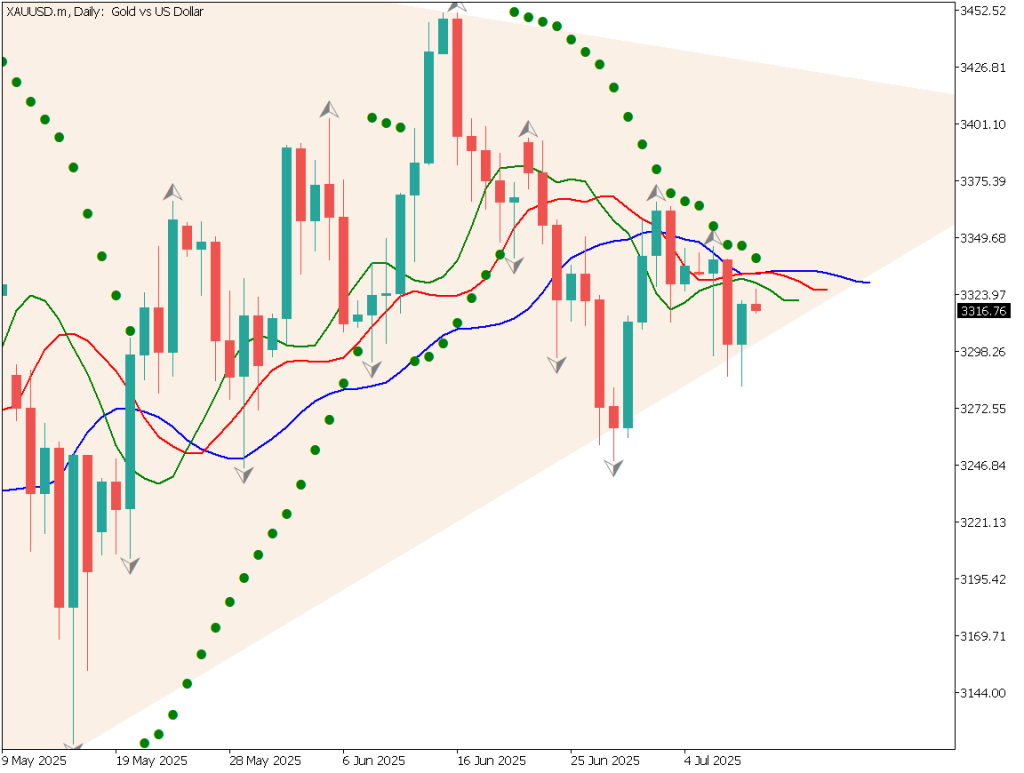

Analyzing the daily chart of gold, XAUUSD has surged to USD 3,235, setting a record high for the second straight day. It rebounded at the 52-day moving average and has jumped USD 300 in just three days. Prices have broken above the 100% level of the Fibonacci expansion, and moving averages are forming a “perfect order,” indicating a strong upward trend.

Additionally, the +DI has risen to 38, and the price is currently above the +2σ line of the Bollinger Bands. While a pullback is likely as USD 3,430 corresponds to the 161.8% Fibonacci level, this price could be targeted in the future.

Day trading strategy (1 hour)

Looking at the 1-hour chart of XAUUSD, resistance is forming around the USD 3,200 level. A decline to around the previous high of USD 3,167 is possible. If USD 3,167 is broken, prices could fall further to around USD 3,130, where the +1σ line of the Bollinger Bands on the daily chart is located.

The basic strategy is buying on dips. We aim to buy near USD 3,130, expecting support at the +1σ line on the daily Bollinger Bands. Take profit at USD 3,200. If prices fall below USD 3,100, the dip-buying strategy will be invalidated.

Support/Resistance lines

Key support and resistance lines to consider:

- USD 3,167 – Previous high

Market Sentiment

XAUUSD: Sell: 63% / Buy: 37%

Today’s important economic indicators

Economic Indicators and EventsJapan TimeJapan Industrial Production13:30OPEC Monthly Report20:00

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.

Risk Disclaimer

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

This analysis is for educational purposes only and does not constitute investment advice. Trading forex and CFDs involves significant risk and may not be suitable for all investors. Past performance is not indicative of future results.