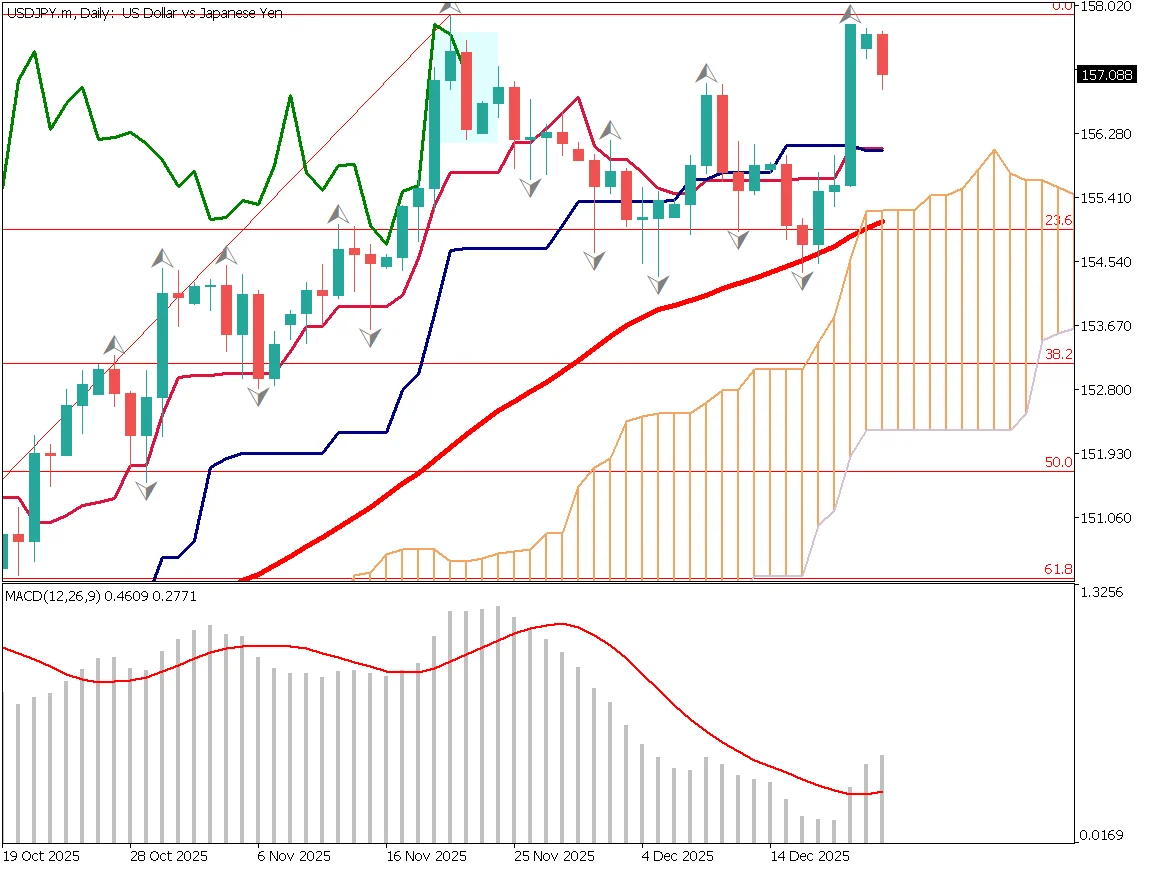

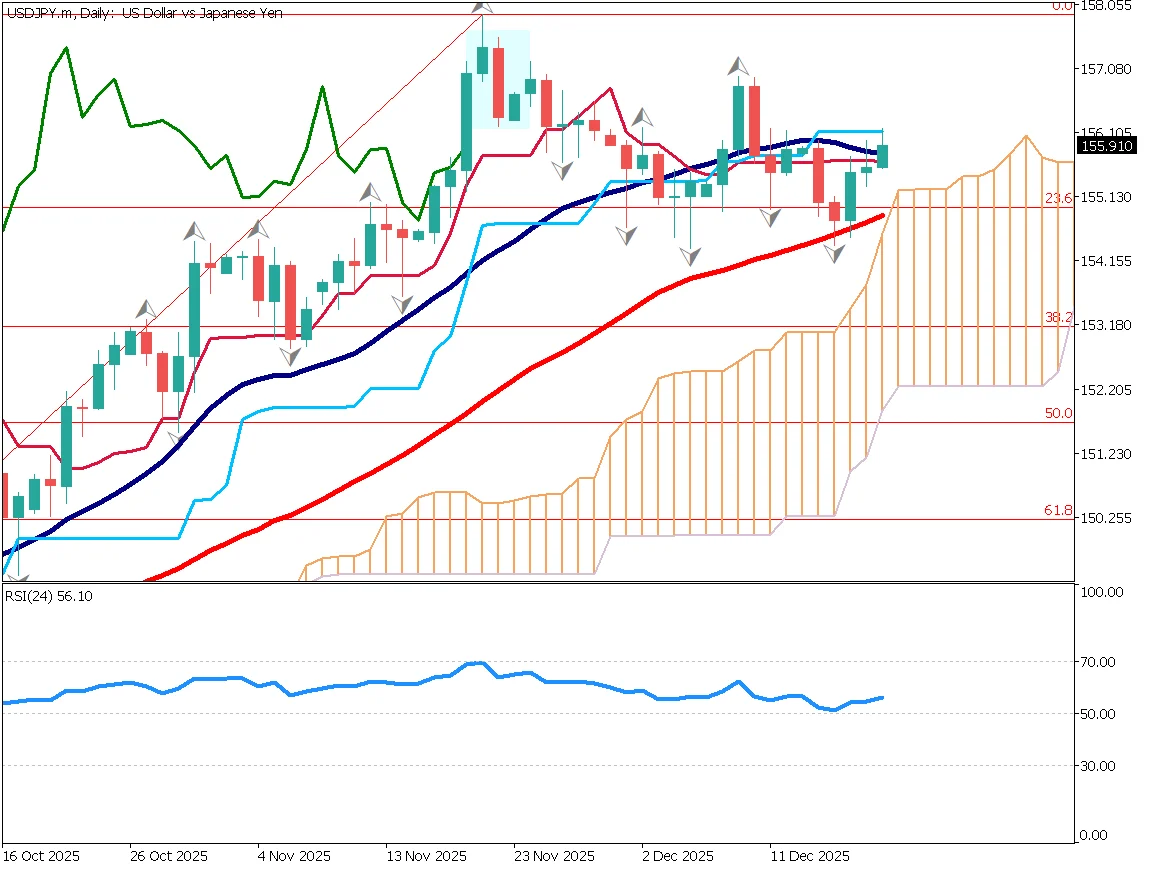

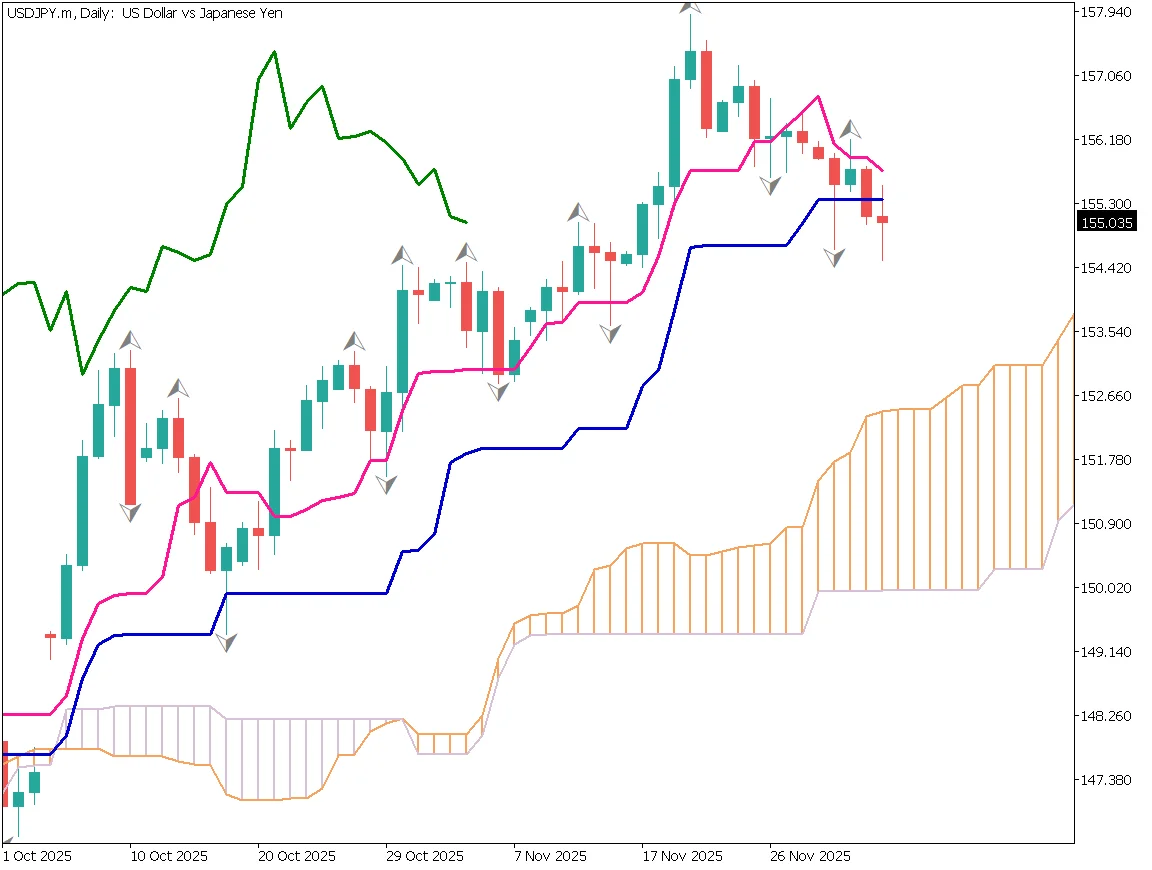

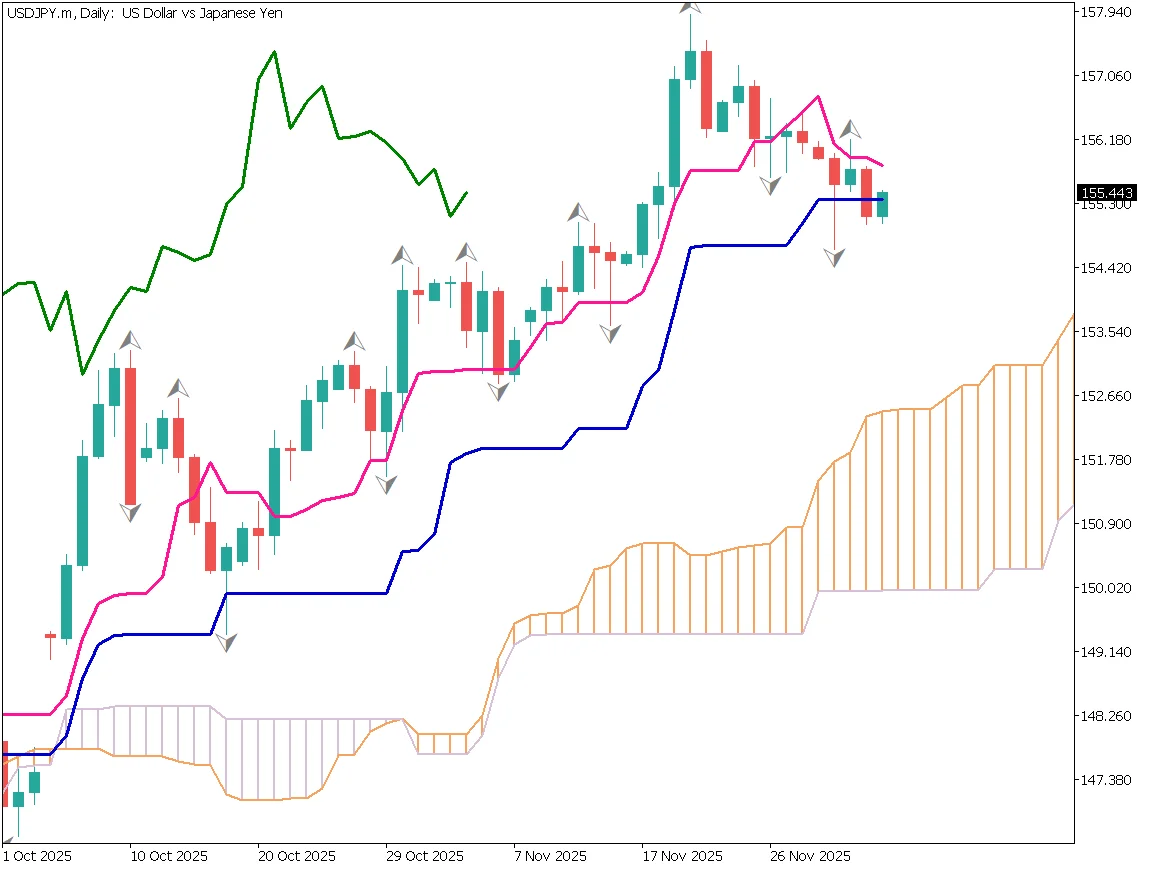

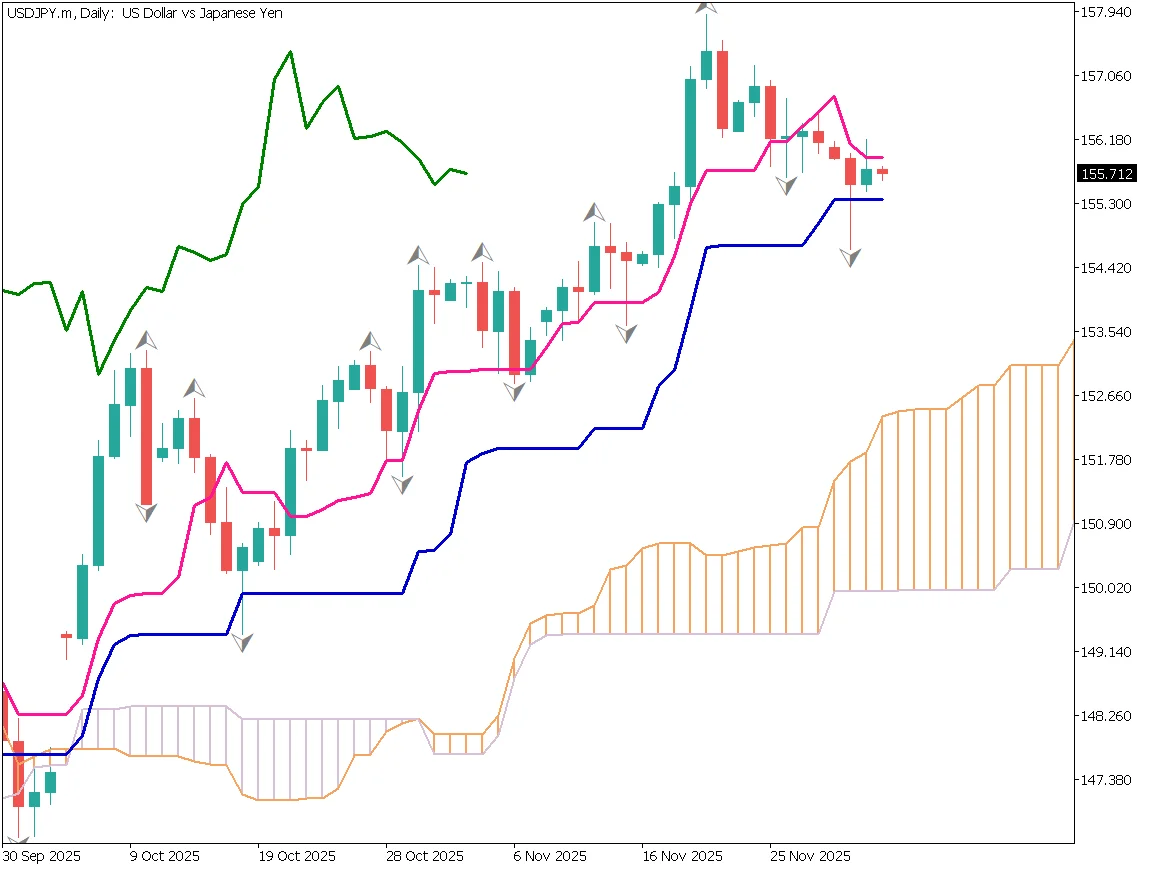

USD/JPY Loses Momentum Near 158 Ahead of Christmas Holidays

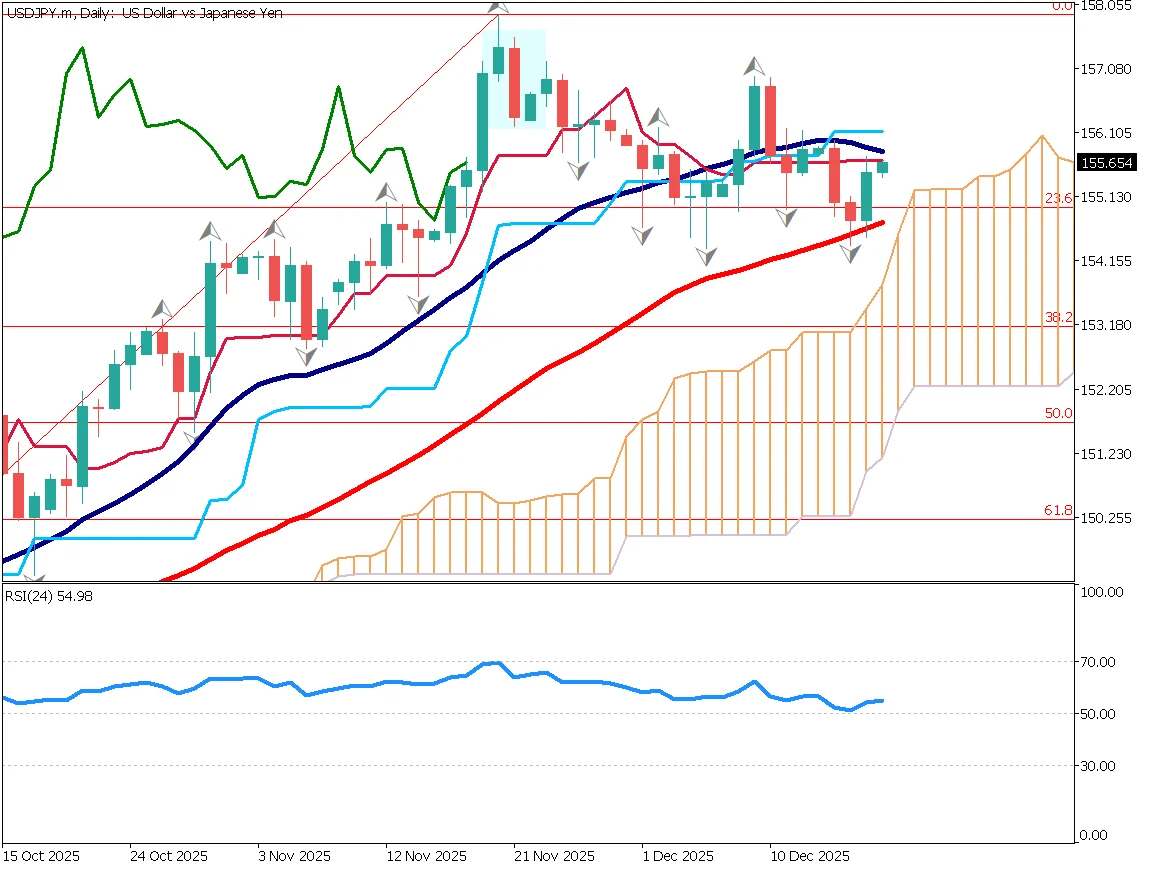

USD/JPY pulled back after failing just below the 158 level. Markets shift into Christmas holiday mode with thin liquidity. Double-top risk emerges with neckline support at 155.

Expert market analysis and insights from Milton Markets professional traders and analysts.

685 analysis articles

USD/JPY pulled back after failing just below the 158 level. Markets shift into Christmas holiday mode with thin liquidity. Double-top risk emerges with neckline support at 155.

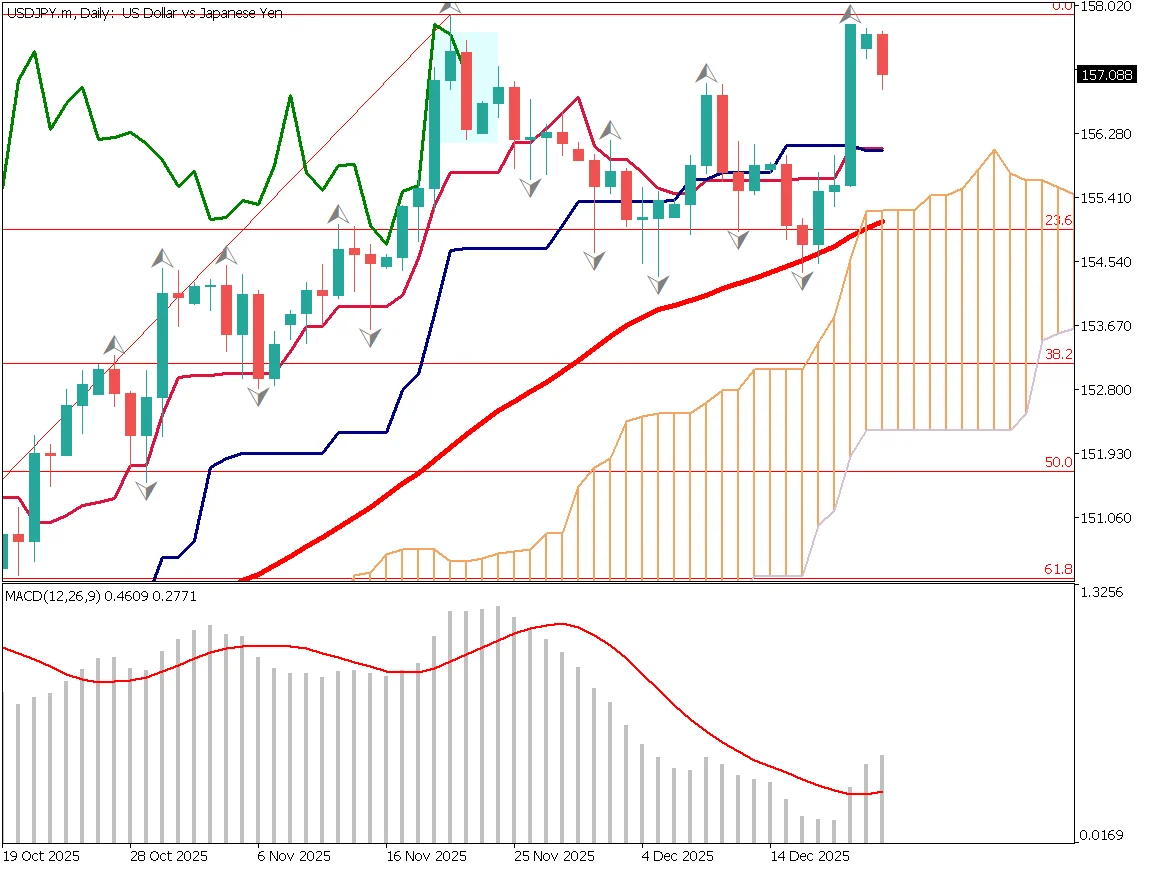

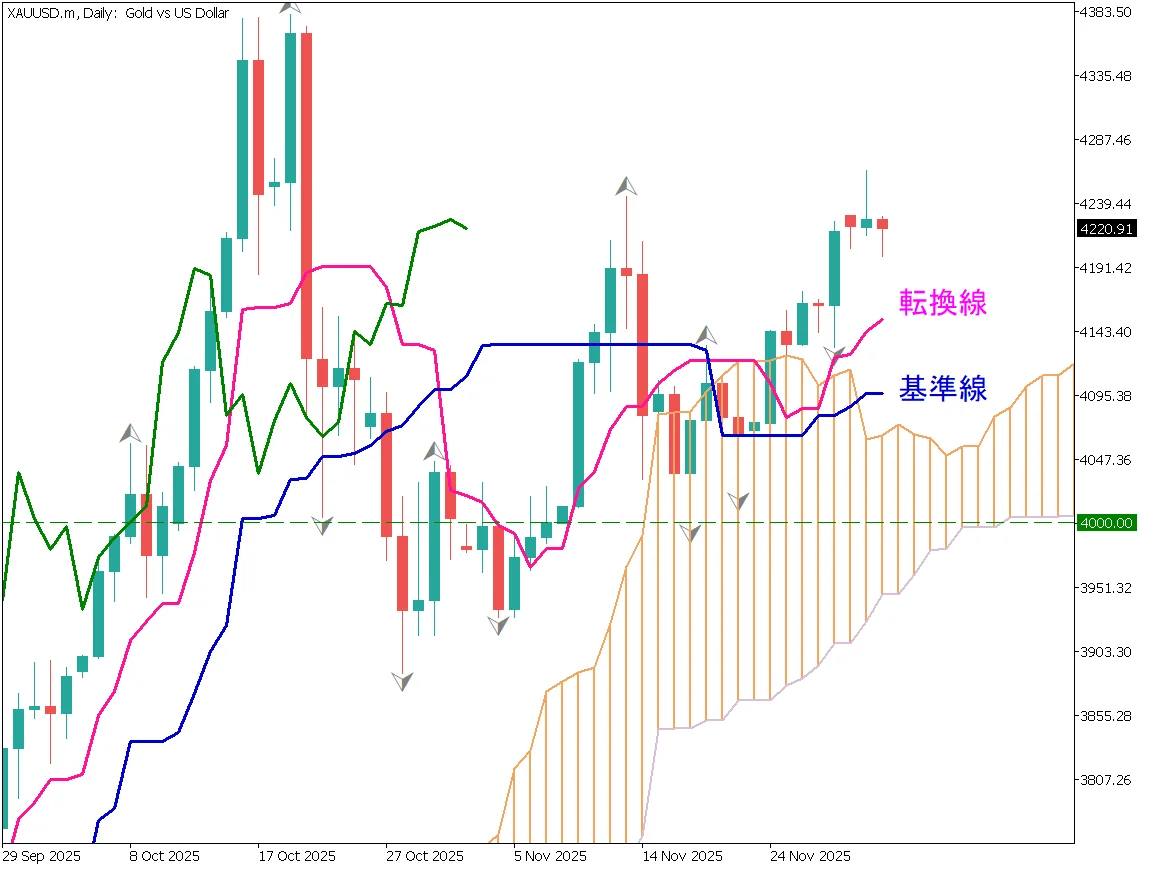

Gold breaks through the $4,400 level marking a new all-time high. Weekly RSI at 75 suggests strong momentum driven by capital shifting away from the U.S. dollar.

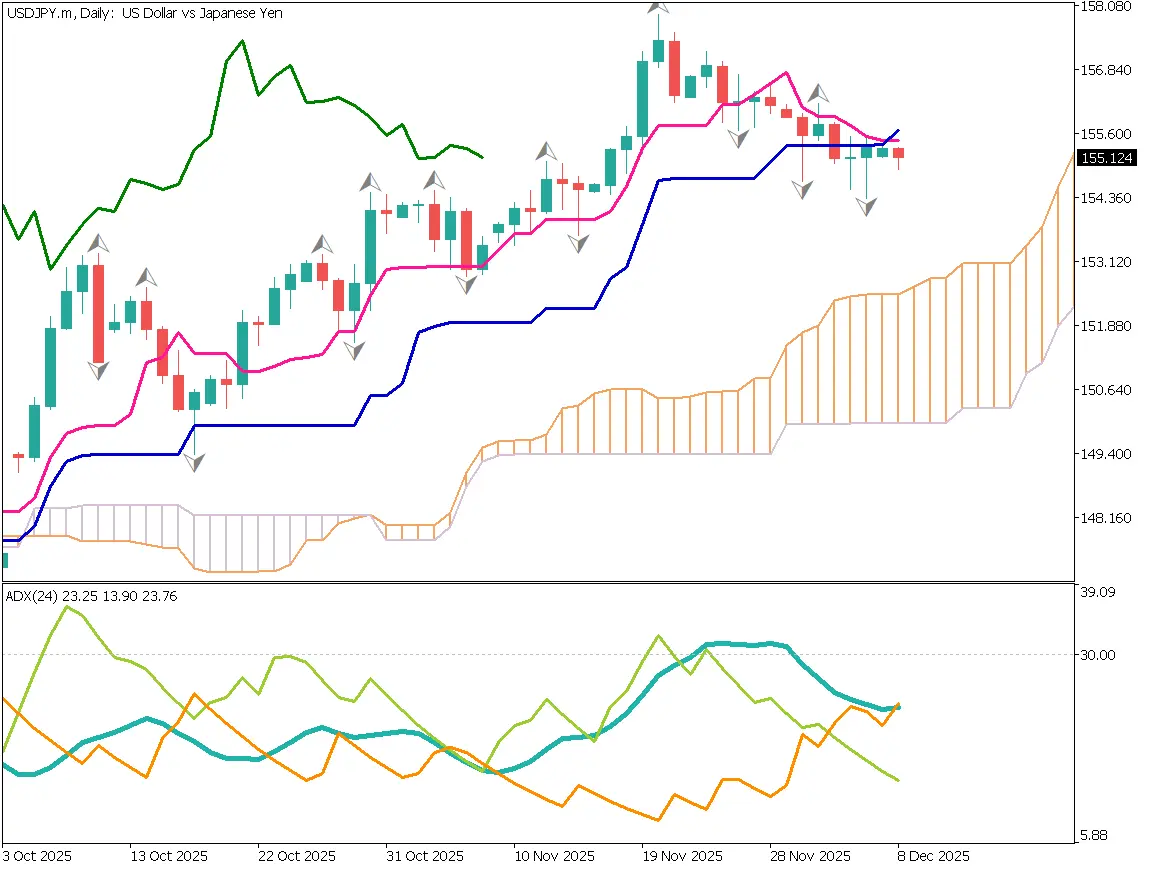

The Bank of Japan decided to raise its policy rate to 0.75%, reaching the highest level in 30 years. However, contrary to expectations, USD/JPY moved higher, showing continued yen weakness.

The market is gradually entering Christmas holiday mode, and position adjustments may intensify in the coming days. At the Bank of Japan policy meeting, a rate hike is widely expected.

The U.S. employment report passed without major market volatility. Gold continues to struggle with upside resistance as the market enters a consolidation phase ahead of key events.

Markets are closely watching the U.S. employment report. Whether the data is too strong or too weak, sharp market moves are possible. Ideally, the market is looking for a moderate slowdown.

![[London Session] Ahead of U.S. Employment Report Tomorrow, USD/JPY Trends Mildly Lower](/images/market-analysis/20251215USDJPYDAY.webp)

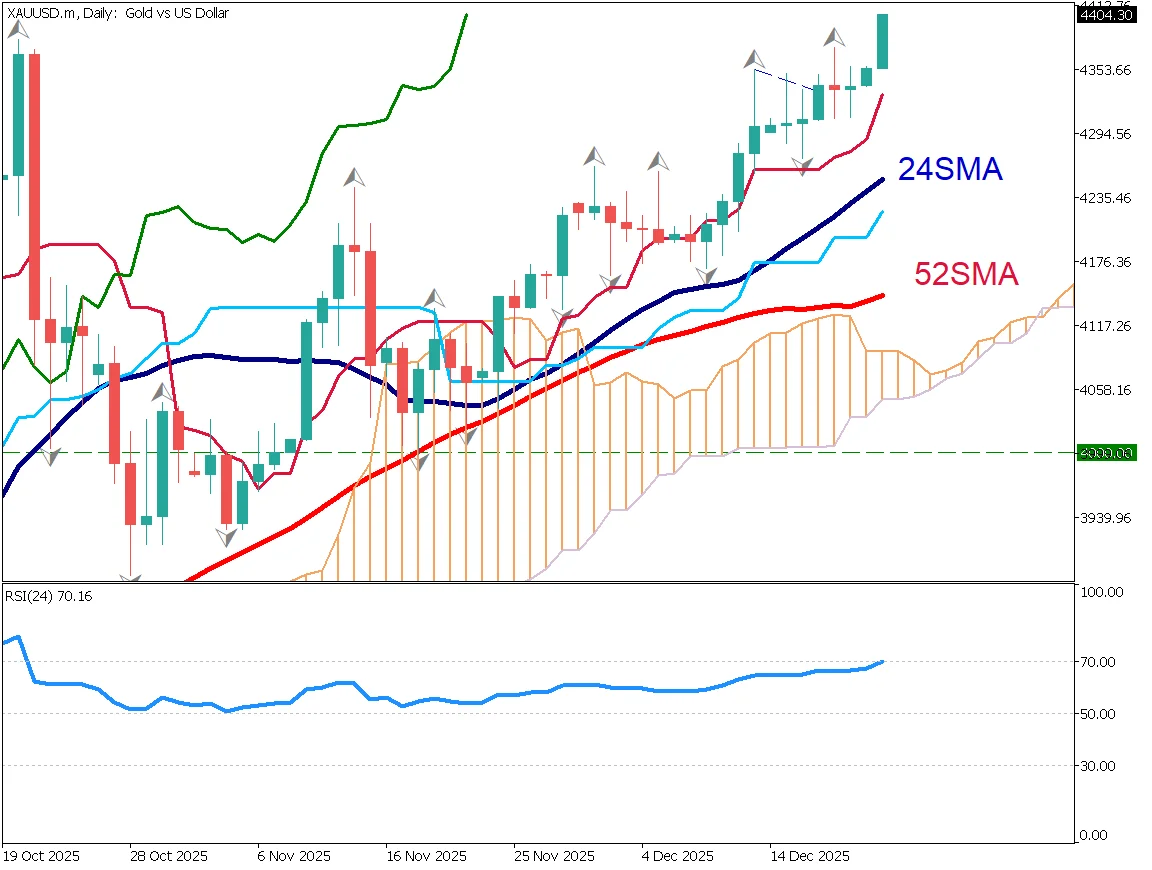

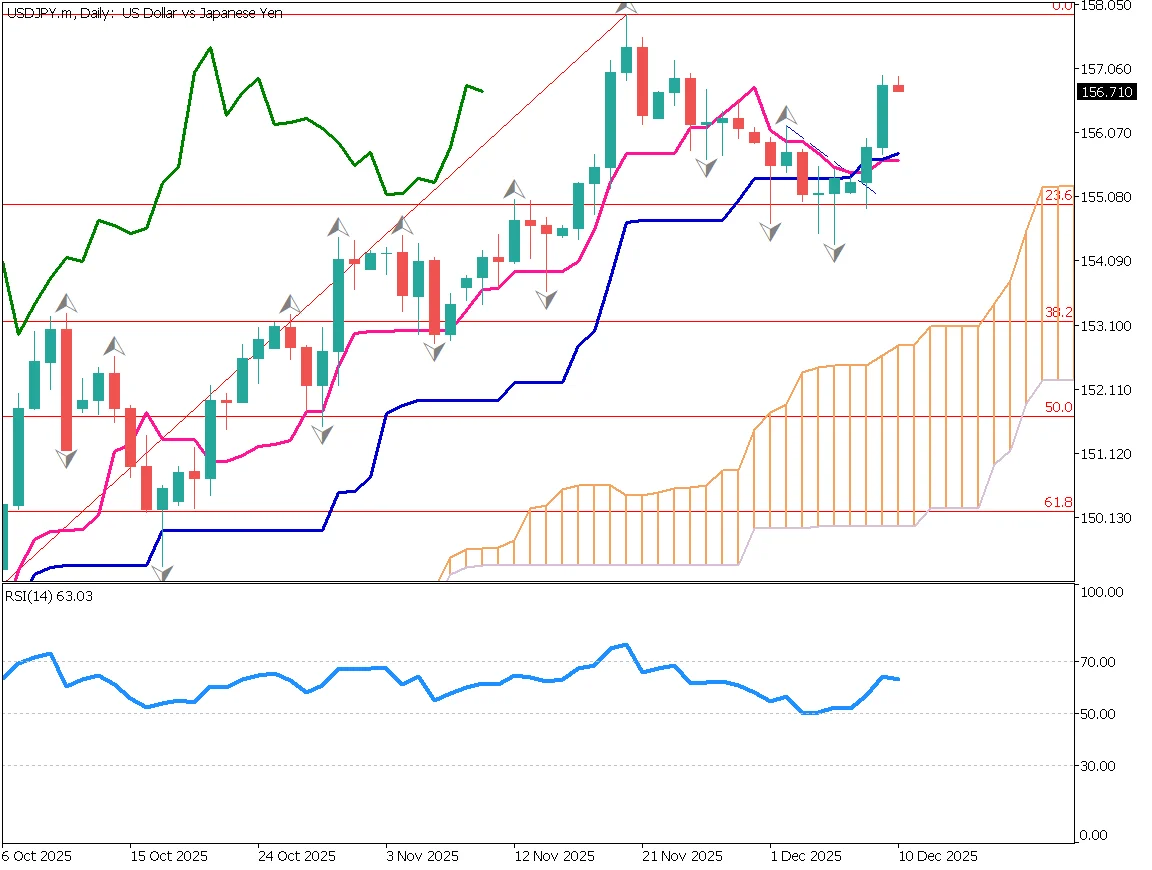

Tomorrow's U.S. employment report will be released on a non-standard schedule, so caution is advised. At the Bank of Japan policy meeting, a rate hike is largely priced in, yet USD/JPY continues to show a mildly bearish trend.

U.S. interest rate cuts continue to support gold prices. A rare "cup with handle" pattern has appeared on the gold chart, suggesting potential for further gains toward $4,400.

The U.S. Federal Reserve decided to cut rates, with three dissenting votes. The dollar index fell, and selling pressure increased on USD/JPY as well.

USD/JPY rebounded at the 23.6% Fibonacci level and regained its upward momentum. A December rate hike by the Bank of Japan is now fully expected, yet the yen continues to weaken.

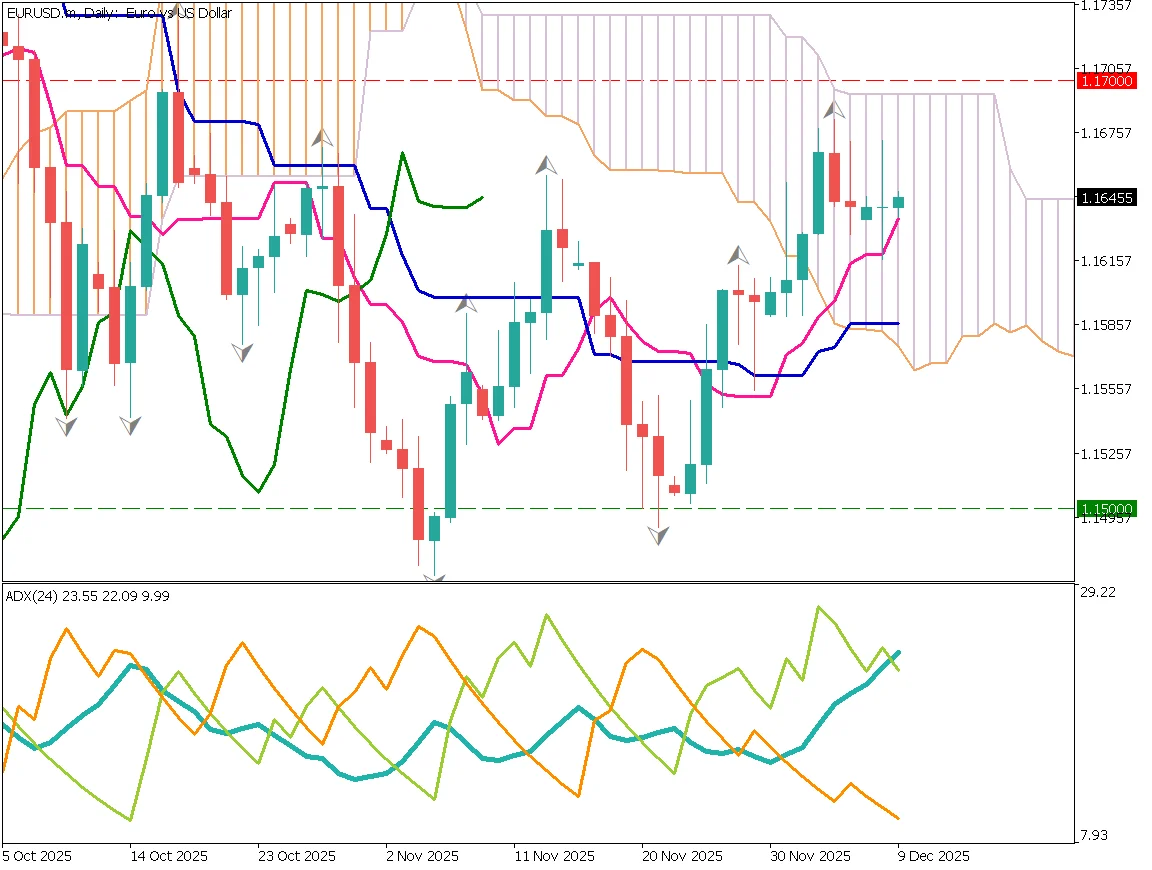

ECB board member Schnabel stated that "there is no disagreement that the next move could be a rate hike." Following this comment, EUR/USD briefly surged above 1.167.

The market is simultaneously pricing in a Bank of Japan rate hike and a Federal Reserve rate cut. Whether these expectations will materialize depends on comments from key officials.

Daily Market Report – December 5, 2025

Selling pressure on the U.S. dollar is growing as investors expect rate cuts under the incoming Chairman Hassett. USD/JPY is trading in the mid-155 range and has dropped below the Ichimoku base line.

President Trump plans to announce the next Federal Reserve Chair early next year. Rate-cut expectations are increasing, leading to stronger dollar selling. USD/JPY is showing heavy topside.

Daily Market Report – December 2, 2025

The Nikkei declined, pressured by real estate stocks, while bank stocks held firm. USD/JPY fell toward the 155 level as expectations for a December rate hike grew.

The ECB minutes suggested that policymakers are in no hurry to cut rates. Bitcoin recovered to 90,000 dollars after briefly falling below 80,000.

Hawkish comments from several Bank of Japan officials have increased market expectations for a possible rate hike in December. However, a major trend reversal in USD/JPY still appears unlikely at this stage.

Japan's 10-year yield rises to 1.81%. Fed Governor Waller highlights labor market slowdown, and rate-cut speculation grows. Dollar selling pressure increases across currency markets.

Diplomatic friction between Japan and China is drawing attention, but its impact on the currency market appears limited. In the United States, the release of GDP data is expected to be postponed, leaving the market with insufficient information to assess the economic outlook.

Although diplomatic friction continues between Japan and China, the impact on the market appears limited. Gold is still searching for direction as it forms a triangular consolidation pattern.

Daily Market Report – November 21, 2025

NVIDIA's strong earnings triggered a rebound in the Nikkei 225. However, diplomatic tensions between Japan and China have not fully eased, creating temporary uncertainty. Japan's long-term government bond yield has surged past 1.8%, raising serious concerns about a decline in Japan's creditworthiness.