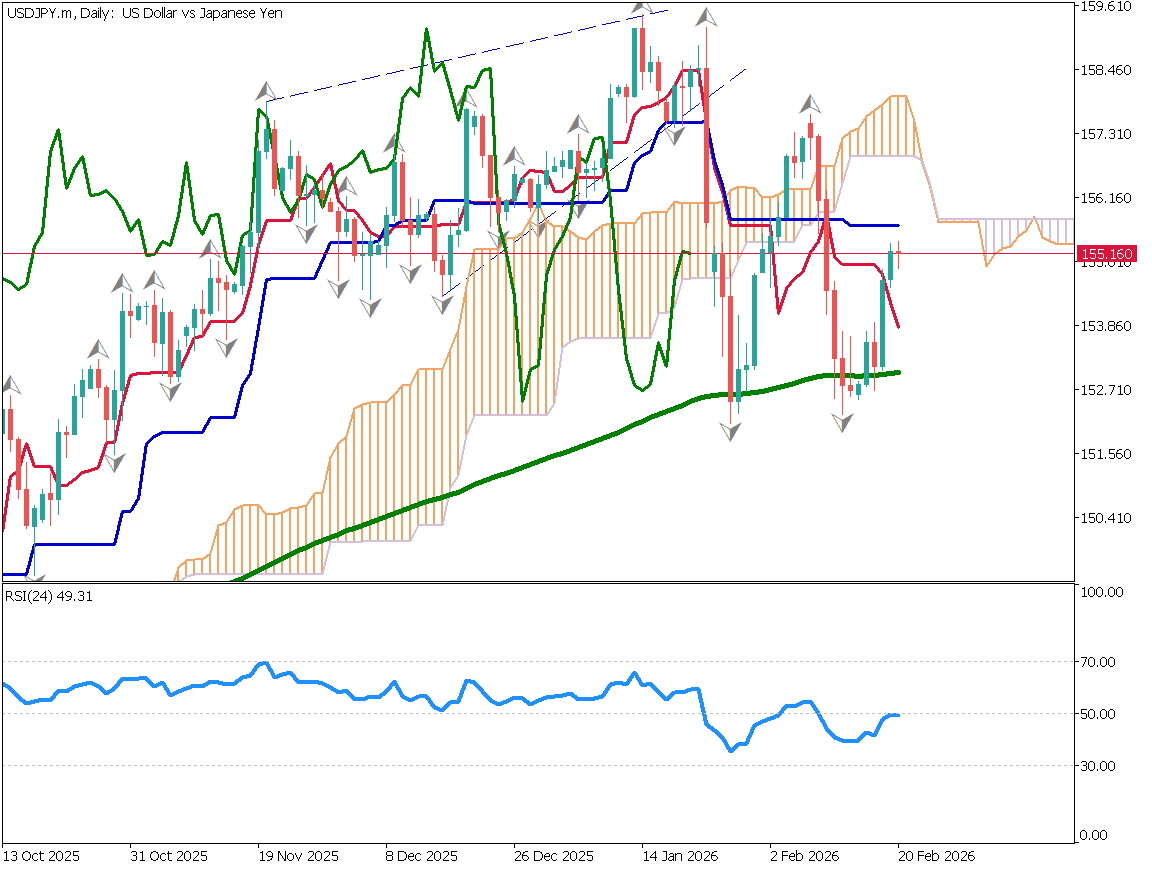

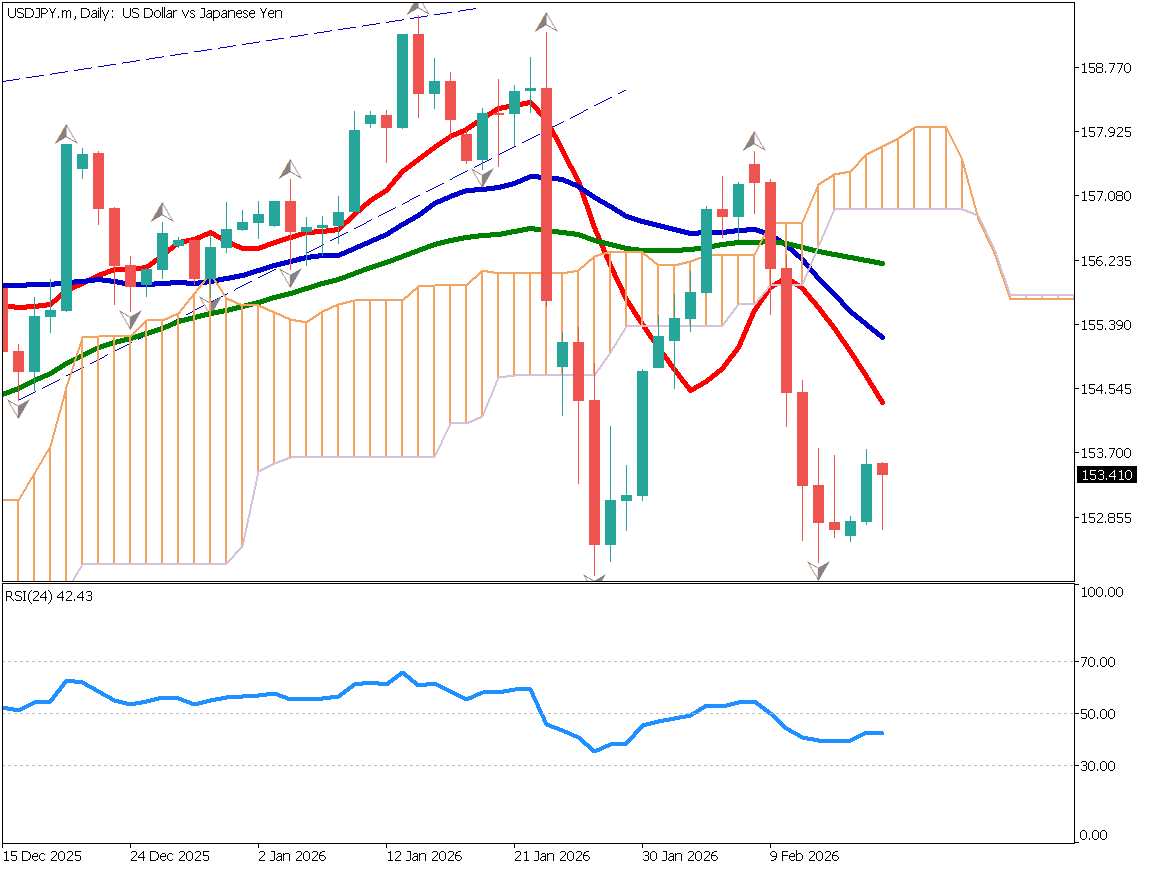

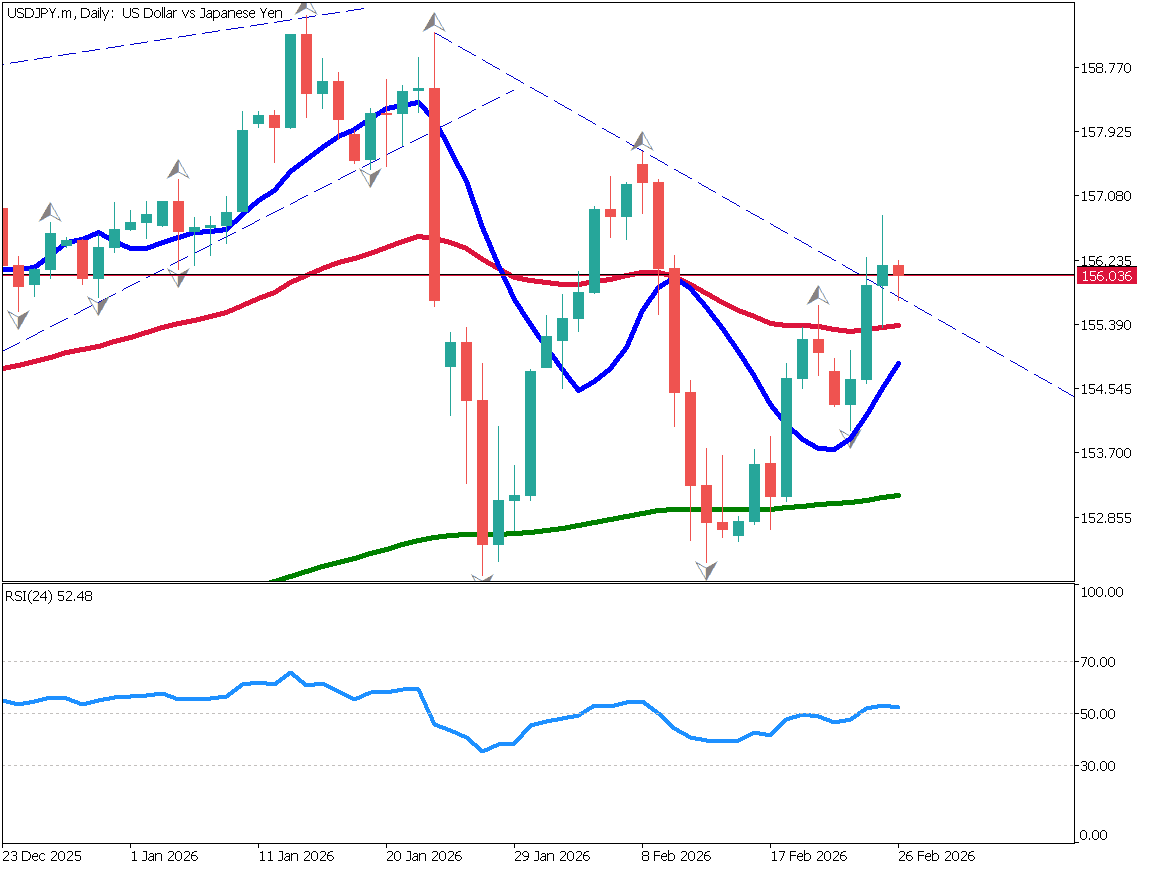

USD/JPY Forms a Rising Wedge

Fundamental Analysis

- USD/JPY is forming a rising wedge with higher lows, but upside momentum remains limited and direction is unclear. The 52-day moving average acts as support, while concerns over currency intervention discourage buying. Weak U.S. stocks, bonds, and the dollar also weigh on the pair. With the Bank of Japan expected to keep policy rates unchanged, a range-bound market is likely to continue until the announcement.

Fundamental Analysis

Japanese government bond yields are rising, which may spill over into U.S. Treasuries. U.S. stocks continue to decline, and caution is needed regarding a potential sharp drop.

Rising Wedge Formation

USD/JPY is currently forming a rising wedge. Lows are gradually rising, and the 52-day moving average is acting as a support level. However, the trend lacks clarity and upside pressure remains strong. Concerns over possible currency intervention persist, making institutional investors hesitant to build long positions.

The Bank of Japan is scheduled to announce its policy rate this week, and rates are expected to remain unchanged. The key focus is whether USD/JPY can test the 160 level following the announcement.

With U.S. stocks falling, bonds weakening, and the U.S. dollar softening, USD/JPY has become less likely to rise.

[USD/JPY / Daily Chart]

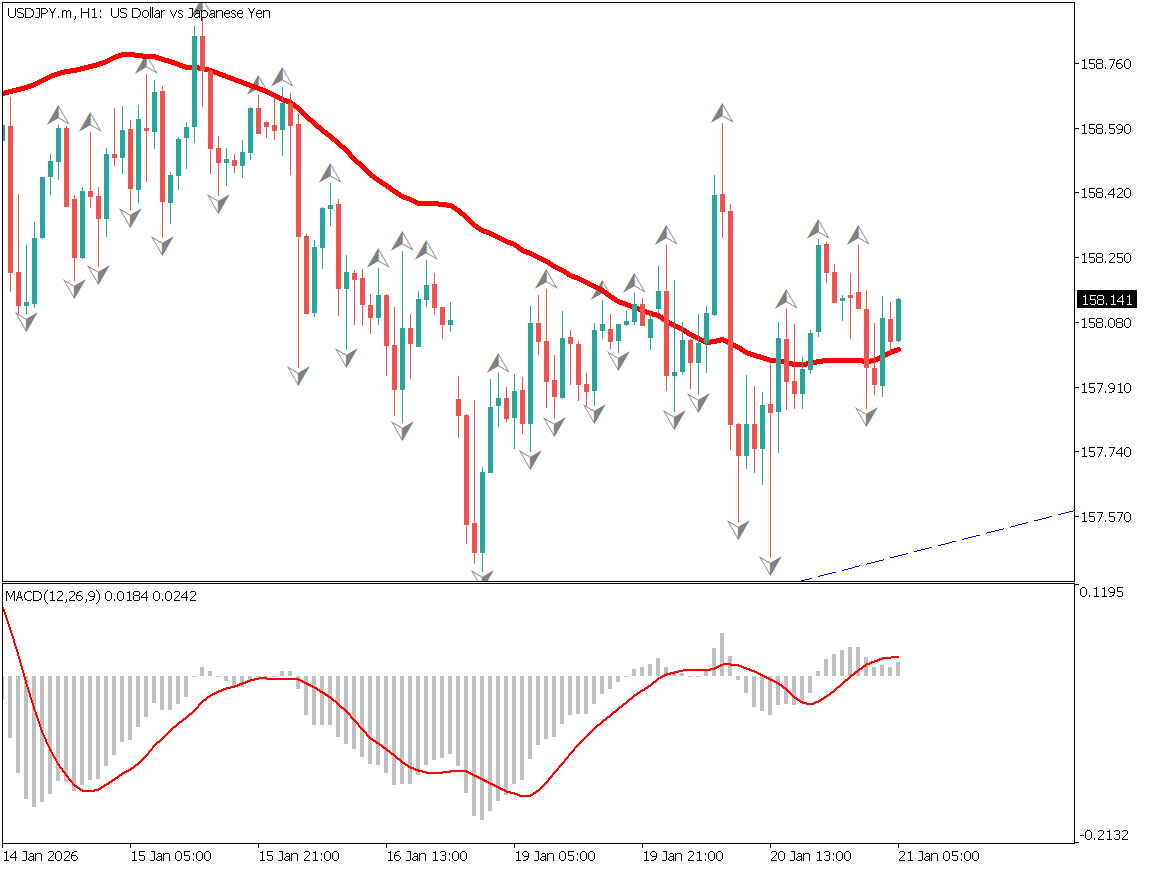

Volatility is increasing

Although a sideways range continues, volatility has picked up slightly, possibly due to weakness in Japanese bonds. Concerns among institutional investors about excessive fiscal spending are growing. If the Bank of Japan does not take a hawkish stance, yen selling could intensify further, leading to yen depreciation. Until Friday’s BOJ announcement, a range-bound market is expected.

[USD/JPY / Hourly Chart]

Today’s Key Economic Indicator

UK Consumer Price Index – 16:00

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.