No Currency Intervention Conducted; Reports of Additional Tariffs on South Korea

Fundamental Analysis

- USD/JPY plunged into the 153 range amid fears of coordinated Japan–U.S. intervention, although no actual intervention was confirmed. Technical indicators suggest a bearish outlook, favoring sell-on-rallies. However, concerns over Japan’s fiscal expansion remain a yen-weakening factor, meaning a rebound is possible if intervention fears fade. Caution is advised for now.

No Currency Intervention Conducted; Reports of Additional Tariffs on South Korea

Daily Market Report – January 27, 2026

Fundamental Analysis

USD/JPY fell sharply amid reports suggesting heightened vigilance following so-called “rate checks” between Japan and the United States, fueling speculation over possible coordinated intervention. However, it has been reported that no actual currency intervention has taken place. At the same time, U.S. President Donald Trump was reported to be considering additional tariffs on South Korea, adding to market tension.

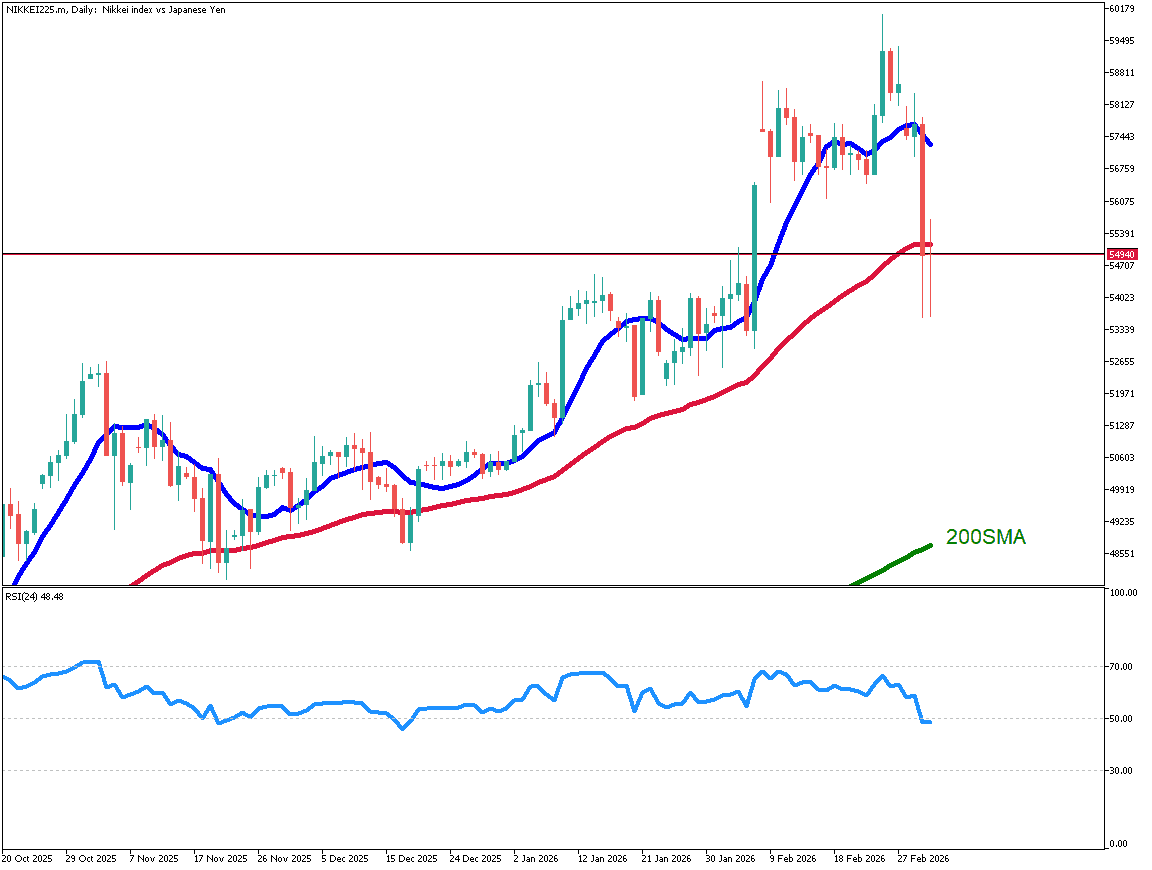

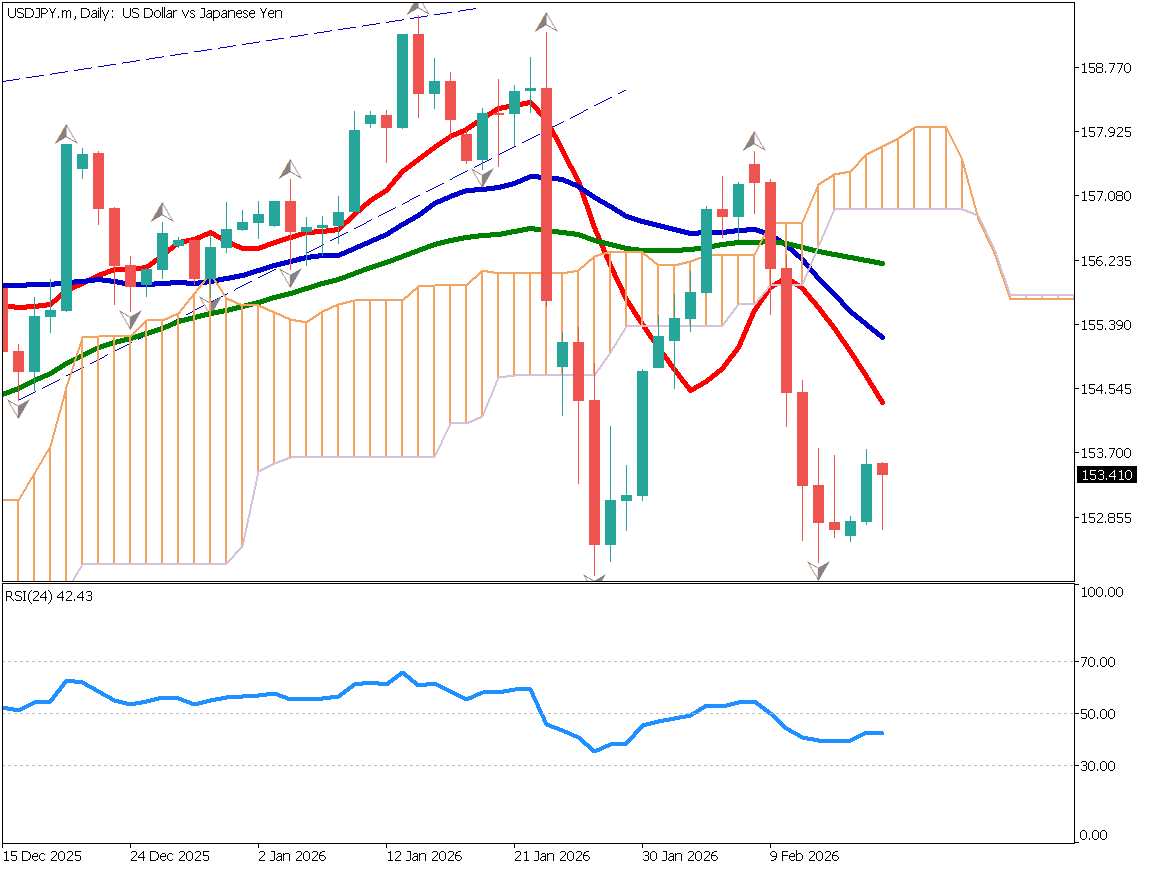

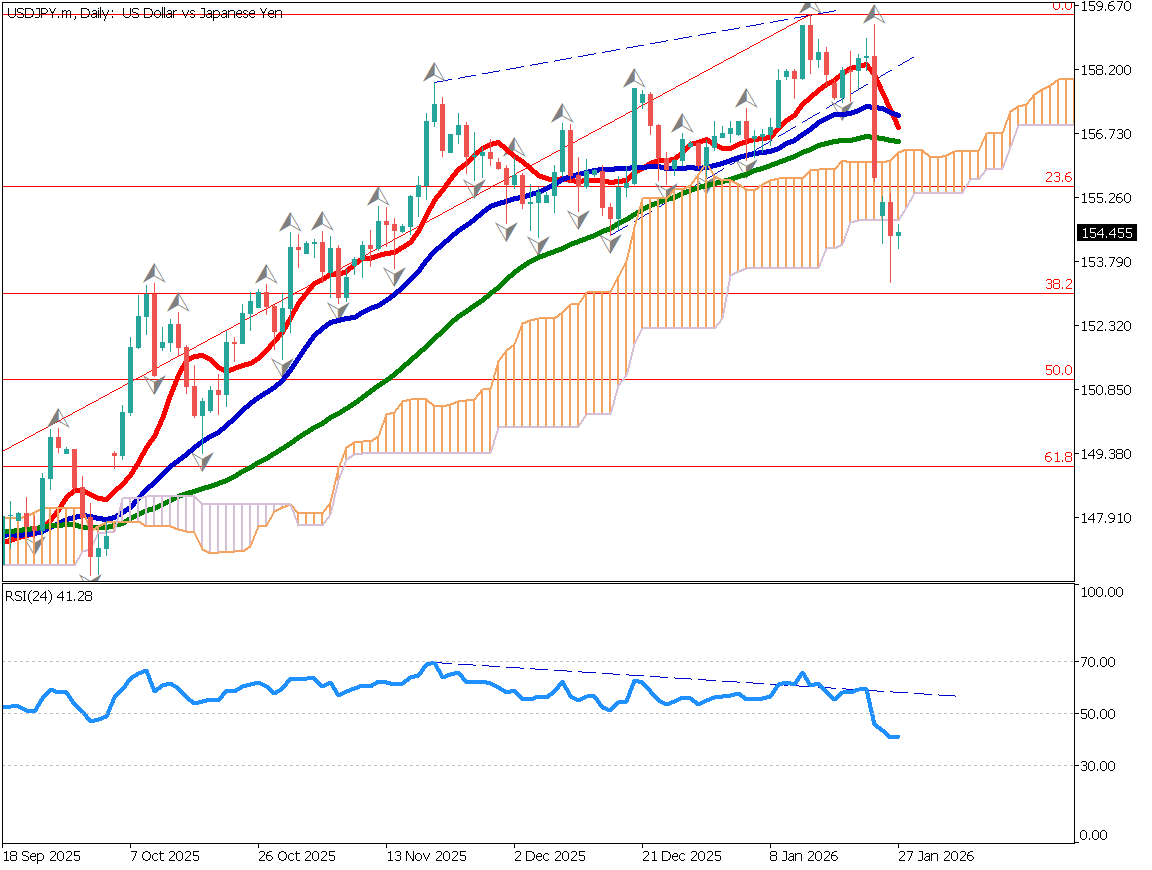

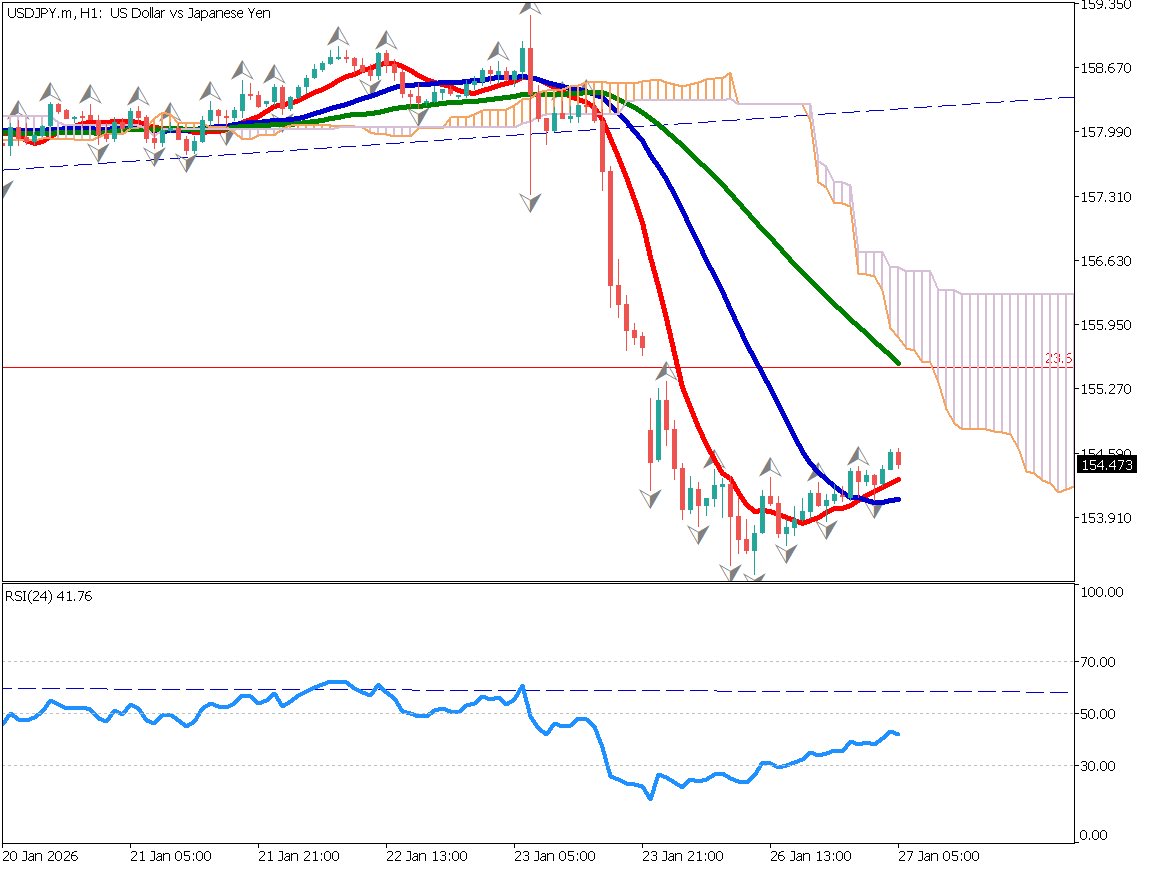

USD/JPY dropped into the 153 range on fears of joint Japan–U.S. intervention, with 153.60 acting as a temporary support level. Ichimoku analysis shows the pair breaking below the cloud, indicating heavy upside resistance. Although the pair did not reach the 38.2% retracement level around 153.00, the presence of lower wicks suggests some dip-buying activity.

The 10-day moving average has crossed below the 26-day moving average, forming a dead cross. Given the current chart structure, there is potential for a further decline toward the 150 level. This is not a favorable environment for aggressive long positions, and the market appears better suited for sell-on-rally strategies.

Even without actual intervention, the sharp decline highlights market sensitivity. Should coordinated intervention occur, the impact could be substantial, potentially driving USD/JPY rapidly toward the 146 area.

USD/JPY – Daily Chart

While the pair has stabilized slightly around 153.30 with a modest rebound, buying interest remains weak, reflecting strong caution toward potential intervention. Entering long positions too aggressively could expose traders to sudden stop-loss selling if intervention materializes.

From a fundamental perspective, both Japan’s ruling and opposition parties are advocating consumption tax cuts, and defense spending is expected to increase. These factors suggest a continued risk of weakened fiscal discipline in Japan. If intervention speculation subsides, the yen could quickly weaken again.

One possible scenario is a gradual rise toward the 155 range, followed by a sharp drop toward 145 if intervention occurs, and then a rapid rebound driven by renewed dollar buying. For now, given the difficulty of the current environment, a wait-and-see approach is recommended.

USD/JPY – Hourly Chart

Today’s Economic Indicator

U.S. Consumer Confidence Index (24:00 JST)

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.