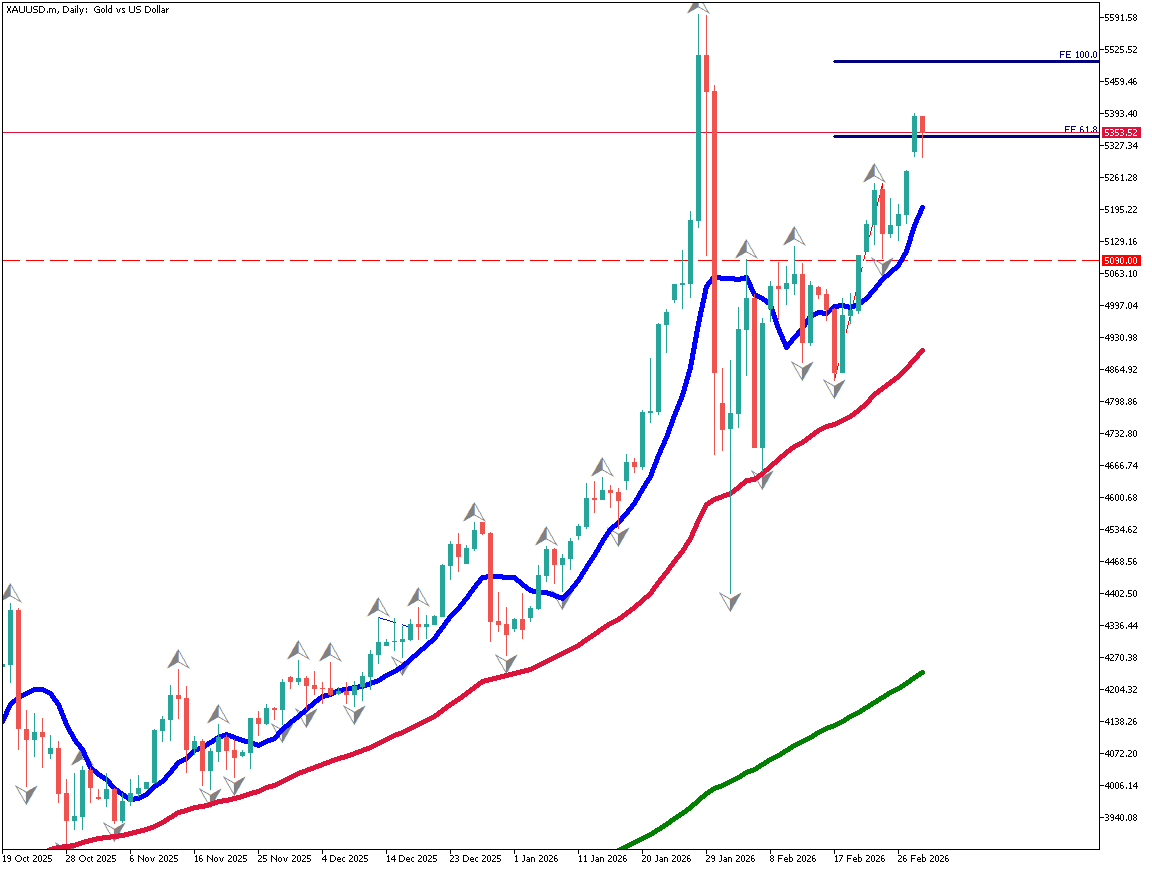

Gold Near USD 5,000 as Risk-Off Sentiment Grows

Fundamental Analysis

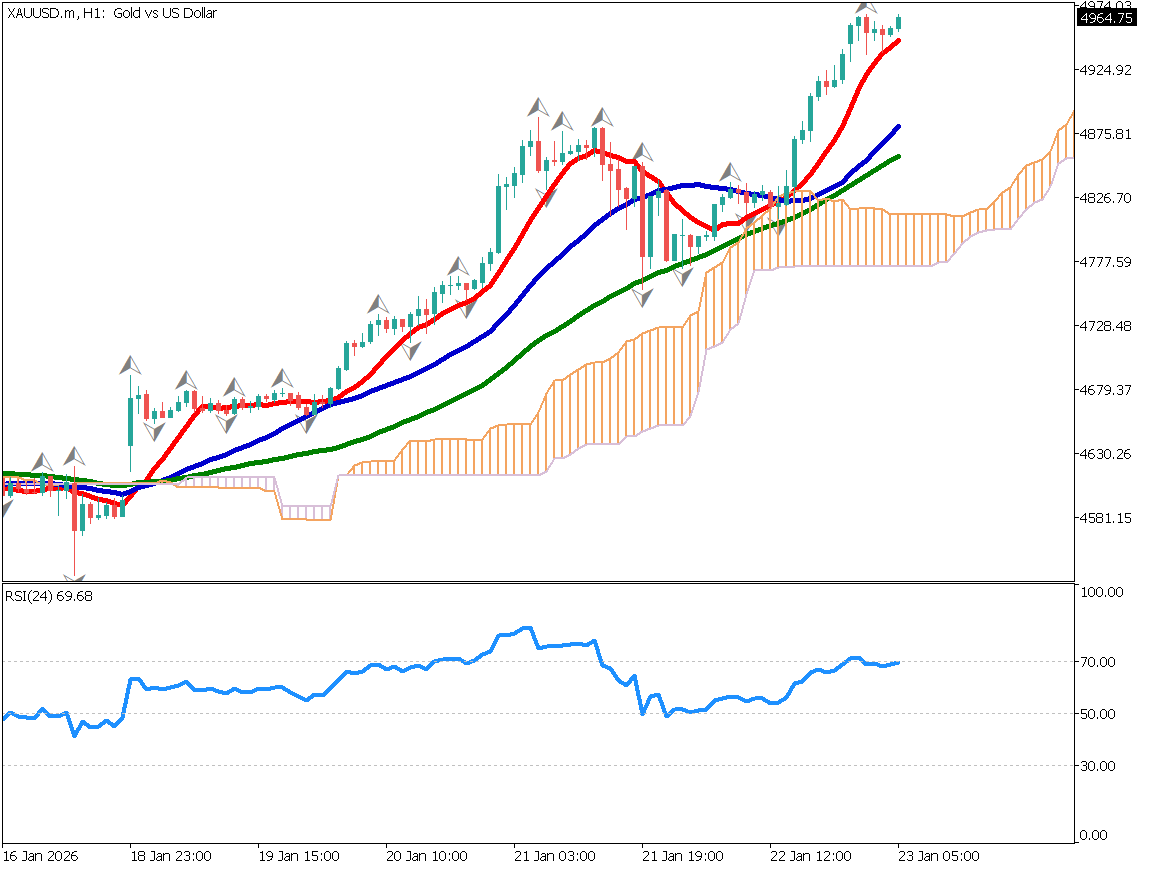

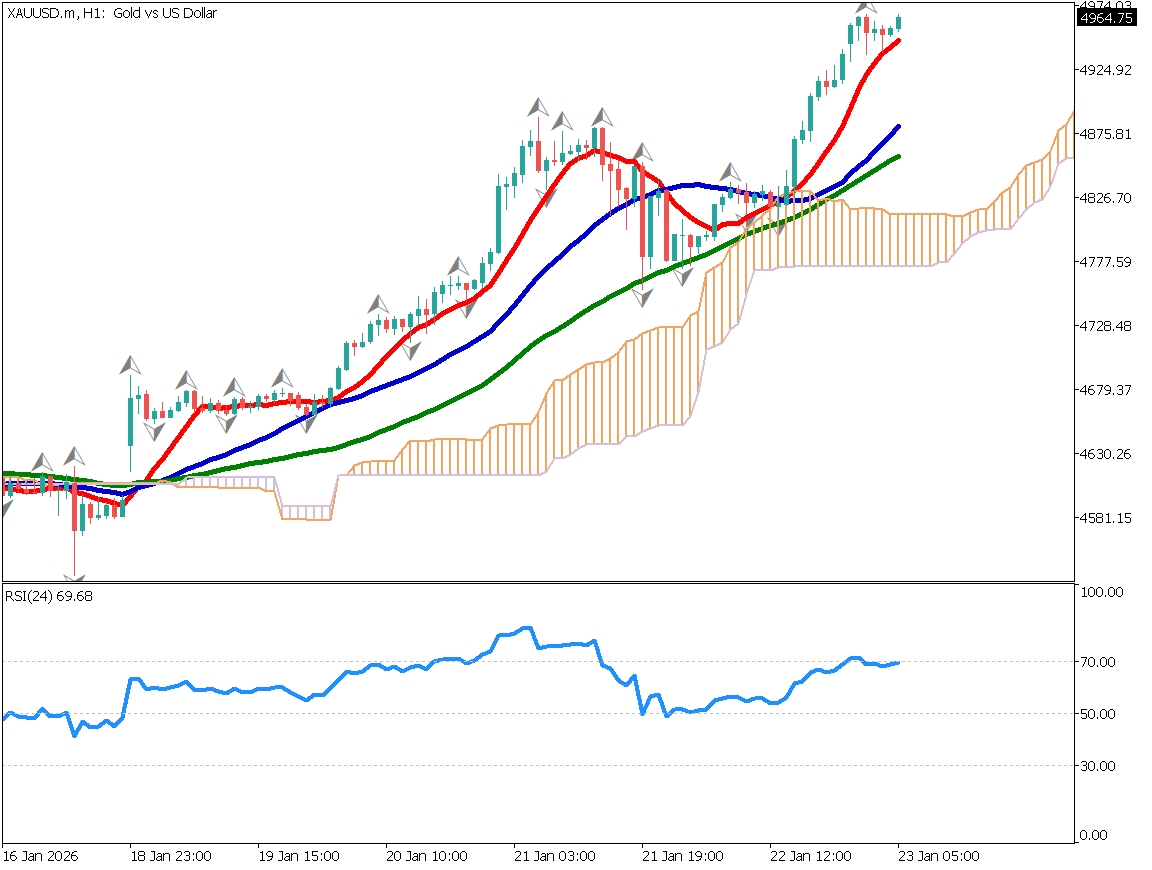

- Gold has surged to around USD 4,964, approaching the key psychological level of USD 5,000. Since breaking above USD 4,000 in November 2025, prices have risen nearly USD 1,000 in less than four months. All moving averages are trending upward, but the RSI at 78 suggests overbought conditions. While profit-taking may occur near USD 5,000, strong dip-buying interest remains despite the risk of short-term corrections.

Fundamental Analysis

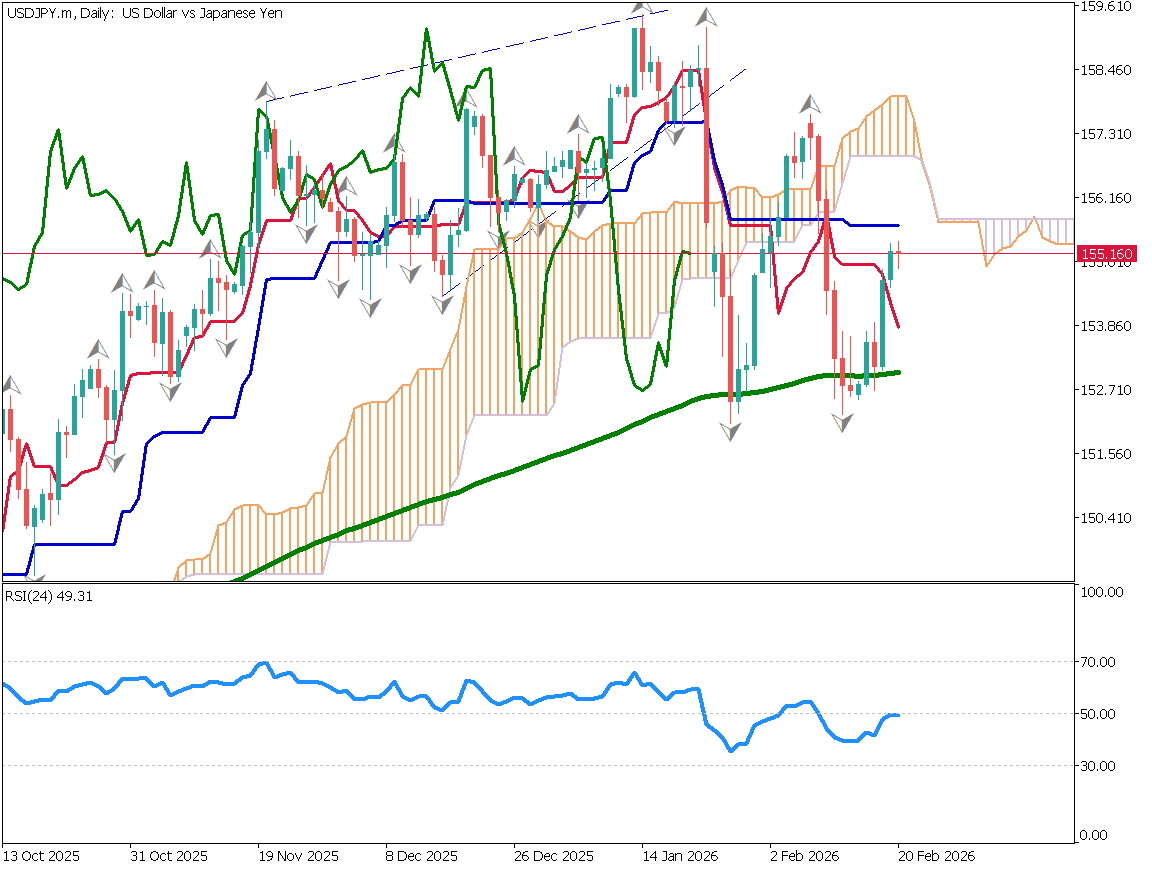

Gold is approaching the USD 5,000 level as precious metals continue to surge. The Bank of Japan announced its policy decision, keeping the policy rate unchanged at 0.75%.

Gold has reached major psychological price levels at an unprecedented pace. After breaking above USD 4,000 on November 2, 2025, gold has risen by nearly USD 1,000 in less than four months—an extraordinary rate of increase. Short-, medium-, and long-term moving averages are all trending upward.

The 10-day moving average has rebounded at the 26-day moving average, confirming the strength of the uptrend. If gold reaches USD 5,000, profit-taking is likely to emerge. Major financial institutions had forecast that gold would reach USD 5,000 sometime in 2026, yet prices are now approaching that level within roughly one month.

Candlesticks have moved significantly away from the 10-day moving average, increasing the possibility of a pullback. As it is heading into the weekend, position adjustments are more likely. With the RSI at 78, a certain degree of correction should be anticipated.

Gold / Daily Chart

Uptrend Remains Intact

Gold is trading around USD 4,964, with a countdown toward the USD 5,000 level. Prices continue to make new highs, indicating a textbook uptrend. USD 5,000 is a major psychological resistance level and is likely to attract profit-taking.

In the short term, caution toward a pullback is warranted. However, heading into the weekend, potential fundamental catalysts such as social media posts from President Trump could emerge. Strong buying interest on dips remains evident in gold.

If prices correct toward the USD 4,550 area, it may present a favorable opportunity for dip-buying.

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.