Will Gold Aim for USD 5,000? TACO Trades Re-emerge

Fundamental Analysis

- Gold surged to as high as USD 4,888 as funds flowed into safe-haven assets amid concerns over escalating U.S.–EU tensions and a sharp decline in U.S. equities. Although U.S. stocks rebounded strongly after President Trump quickly withdrew proposed tariffs on the EU—reviving so-called “TACO trades”—gold’s pullback remained limited. Ongoing risk aversion supports persistent dip-buying, with Fibonacci analysis pointing to USD 4,950 as the next target and USD 5,000 increasingly within reach.

Fundamental Analysis

President Trump has withdrawn tariffs on the European Union.

TACO trades re-emerge, sending U.S. stocks sharply higher.

Despite rising equity markets, gold has surged as massive funds flow into precious metals.

Stocks Rise While Gold Is Bought Simultaneously

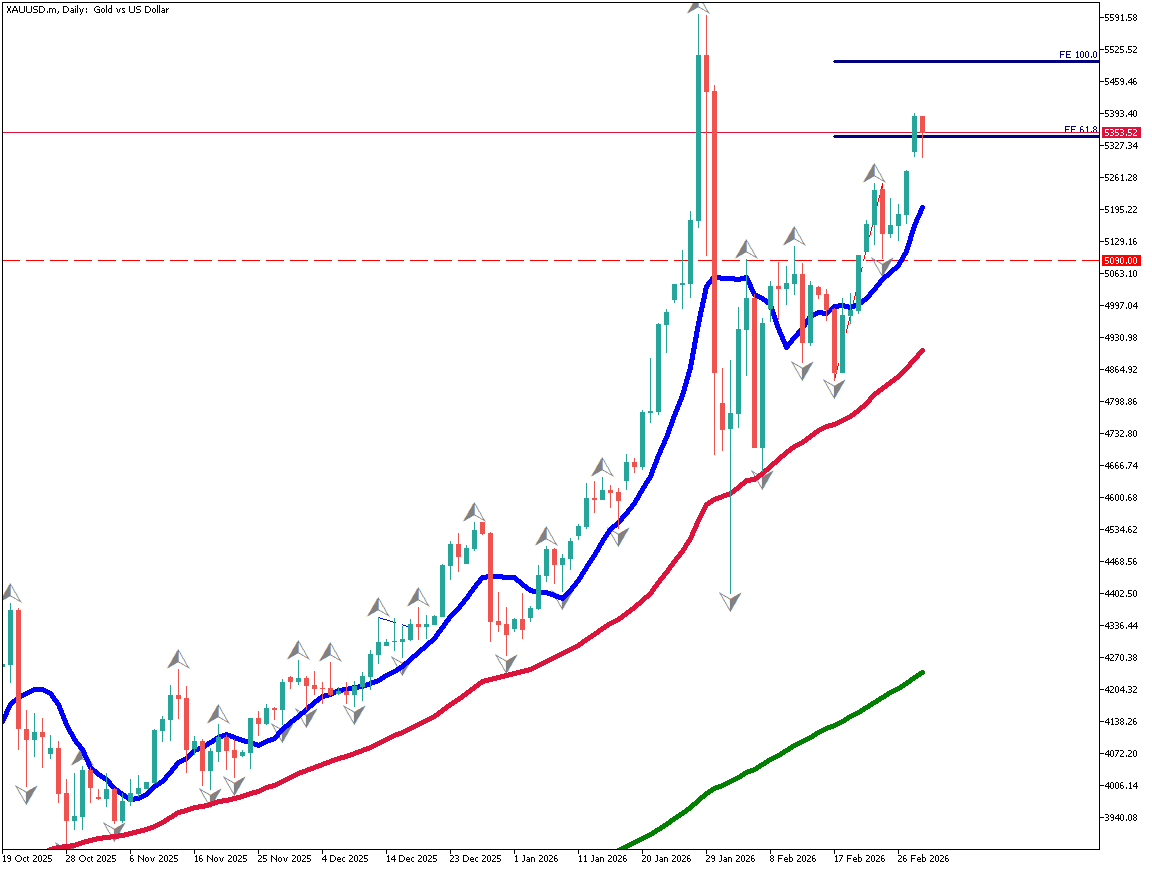

Gold climbed sharply, reaching a high of USD 4,888. Heightened concerns over worsening U.S.–EU relations appear to have driven funds into gold as a safe-haven asset. The sharp drop in U.S. equities likely triggered a rotation of capital from stocks into gold.

TACO trades have resurfaced once again. President Trump withdrew the proposed EU tariffs in less than two business days. Investors who bought the dip were once again proven correct. U.S. equities rebounded sharply, and the Nikkei Average also saw short-covering and renewed buying.

However, the decline in gold prices has been limited. Underlying risk-off sentiment persists, and many investors continue to buy gold aggressively on pullbacks.

Using Fibonacci expansion analysis, the next target price is calculated at USD 4,950. A move toward USD 5,000 no longer appears far off.

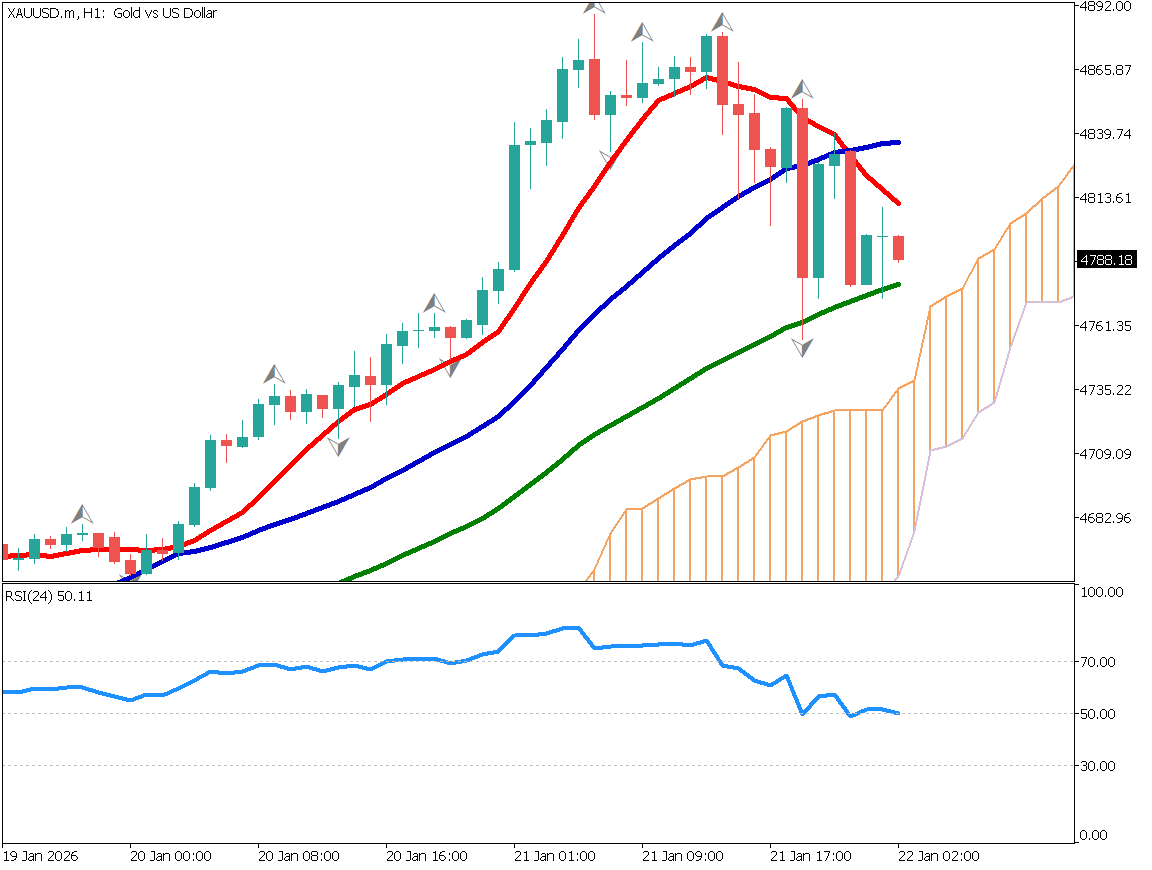

Gold / Daily Chart

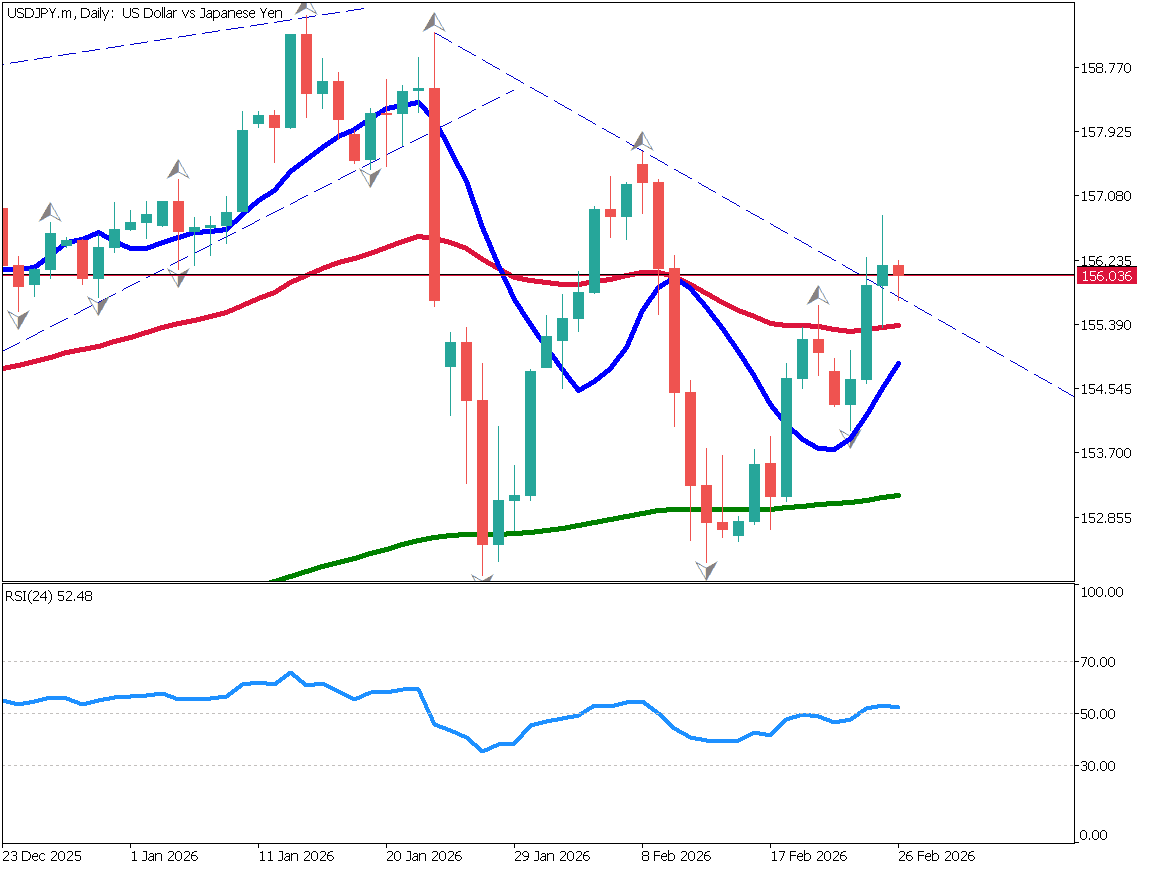

Profit-Taking Followed by Dip-Buying

After rising to USD 4,888, gold has pulled back slightly, likely due to profit-taking. On the hourly chart, the 52-period moving average is functioning as support. If prices fall below this moving average, the Ichimoku cloud lies below, which could strengthen dip-buying interest.

A preferred buying zone is around USD 4,550, the previous recent high that has now turned into a support level during sharp declines. There are few fundamental reasons to sell gold, and it remains uncertain when President Trump may post another market-moving comment.

Notably, such developments often occur over weekends.

The strategy remains to continue buying gold on dips.

Gold / 1-Hour Chart

Key Economic Indicators and Events Today

U.S. GDP: 22:30 JST

U.S. Personal Consumption Expenditures (PCE): 22:30 JST

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.