No Yen Strength Despite Risk-Off Mood

Bond yields hit a 17-year high as selling pressure continues. Nikkei plunges; bonds fall; yen weakens — a triple decline. Concerns grow over the Kishida administration's expansionary fiscal policy.

Expert market analysis and insights from Milton Markets professional traders and analysts.

685 analysis articles

Bond yields hit a 17-year high as selling pressure continues. Nikkei plunges; bonds fall; yen weakens — a triple decline. Concerns grow over the Kishida administration's expansionary fiscal policy.

U.S. stocks extended their losses, and the positive sentiment in the market has disappeared. Gold is also lacking strong catalysts, and the Federal Reserve's hawkish stance is adding downward pressure.

Fed's December rate-cut expectations decline; U.S. stocks tumble. Takaichi administration announces large-scale economic measures.

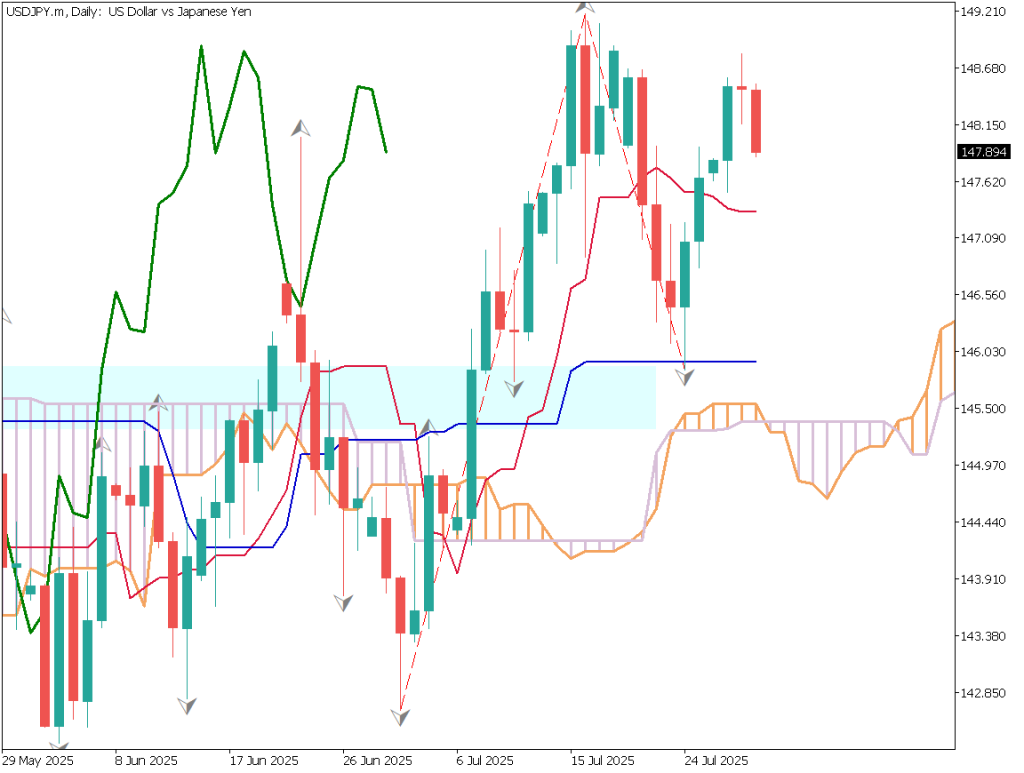

The U.S. dollar is weakening across most markets, with USD/JPY being the only major exception due to extreme yen weakness. With the U.S. government reopening, upcoming economic data releases will attract attention.

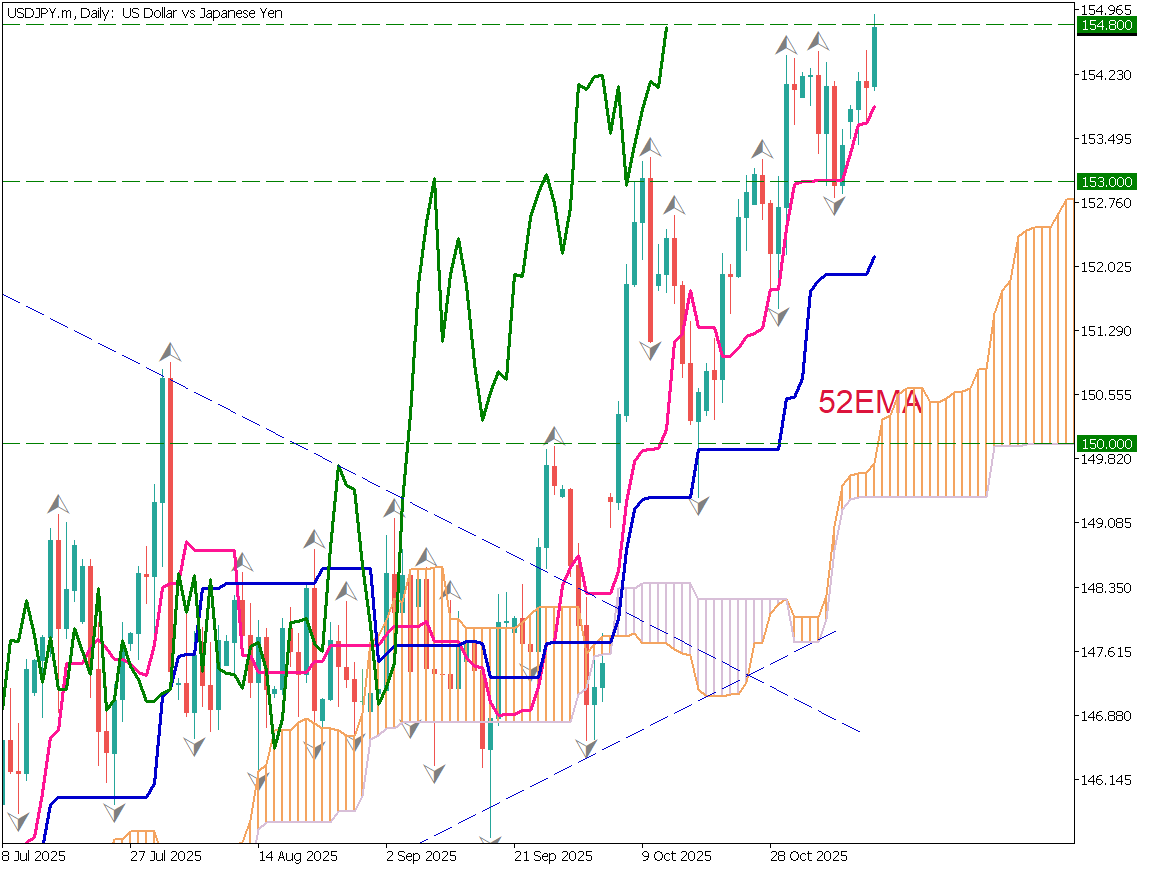

The market appears to have determined that Japan will not intervene, and the pair has broken through important resistance. The yen weakness trend remains unchanged, testing how far it can rise.

![[London Market] Has Gold Returned to an Uptrend?](/images/market-analysis/20251112XAUUSDDAY.png)

Signs of the U.S. government reopening have emerged, and investors should watch for upcoming U.S. economic data releases. The UK ILO unemployment rate worsened to 5.0%, exceeding expectations, indicating a deteriorating labor market.

Expectations for the end of the U.S. government shutdown have boosted global stock markets. The USD/JPY remains range-bound, and traders are watching for a possible breakout.

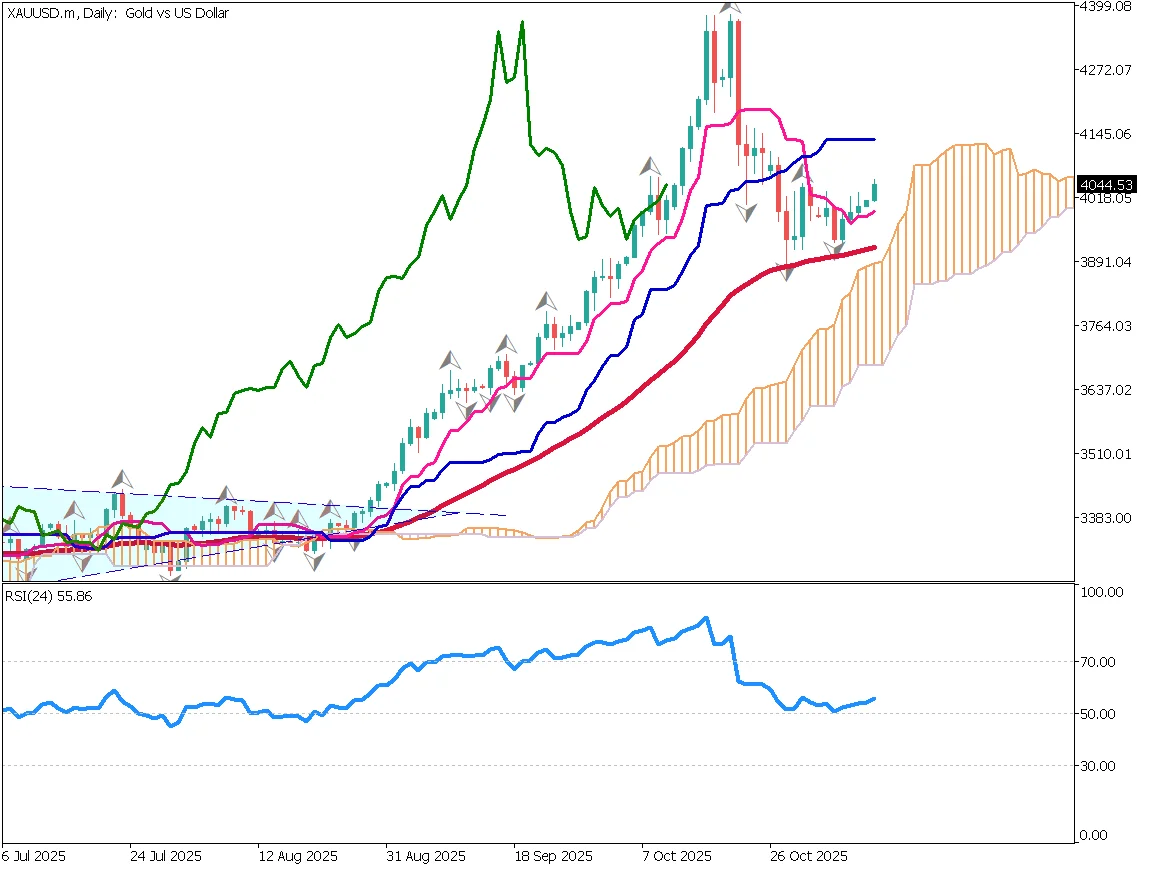

Expectations for the end of the U.S. government shutdown have boosted market sentiment. Weak U.S. employment data has encouraged dip-buying in gold. Gold rebounded from the 52EMA, trading around $4,040 after briefly dipping below $4,000.

U.S. stocks tumbled sharply, with the Nasdaq falling below its 10-day moving average. Japan's Nikkei index also dropped, suggesting signs of reversal across global markets. USD/JPY failed to break above 153.45, with 153.00 acting as key support.

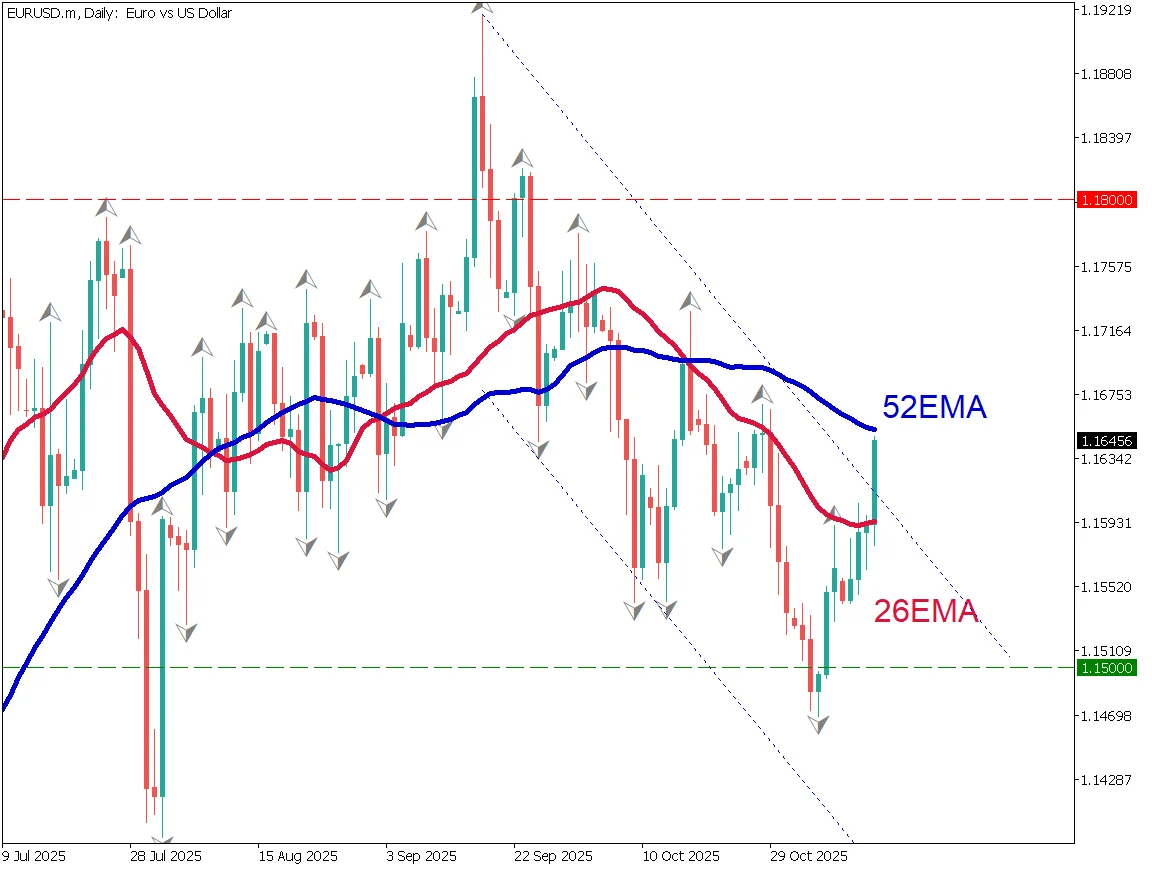

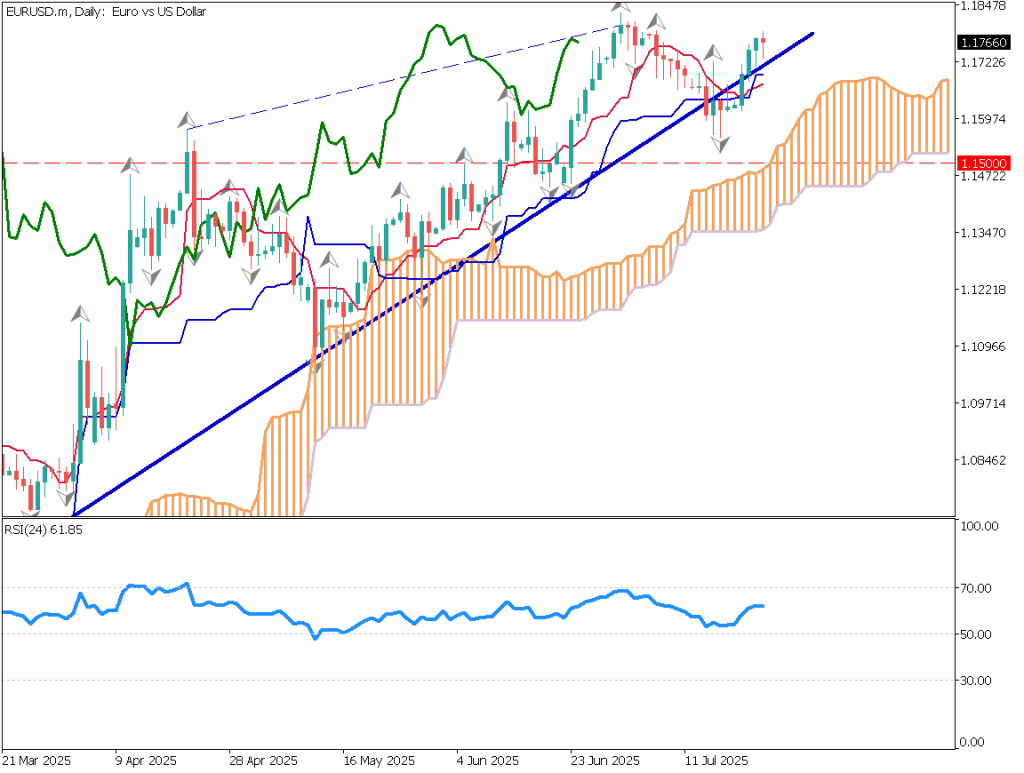

EUR/USD forms a short-term downward channel as the ECB may end its rate-cut cycle. The pair struggles to hold above 1.15, with RSI resistance at 50 indicating weak upside momentum.

U.S. stocks fell sharply, with analysts divided in their outlook. The S&P 500 and Nasdaq posted major losses, while Bitcoin dropped below $100,000. The Nikkei 225 also plunged more than 2,000 points at one stage.

The U.S. ISM Manufacturing Index has contracted for eight consecutive months. Chicago Fed President expressed concern over inflation rather than the labor market. Opinions within the Federal Reserve remain divided.

Federal Reserve Governor Waller advocated for a rate cut in December, citing a weakening labor market. In Japan, despite the holiday, the yen continues to weaken gradually.

![[Special Edition] When Will the Bank of Japan's Next Rate Hike Come?](/images/market-analysis/20251031USDJPYDAY.webp)

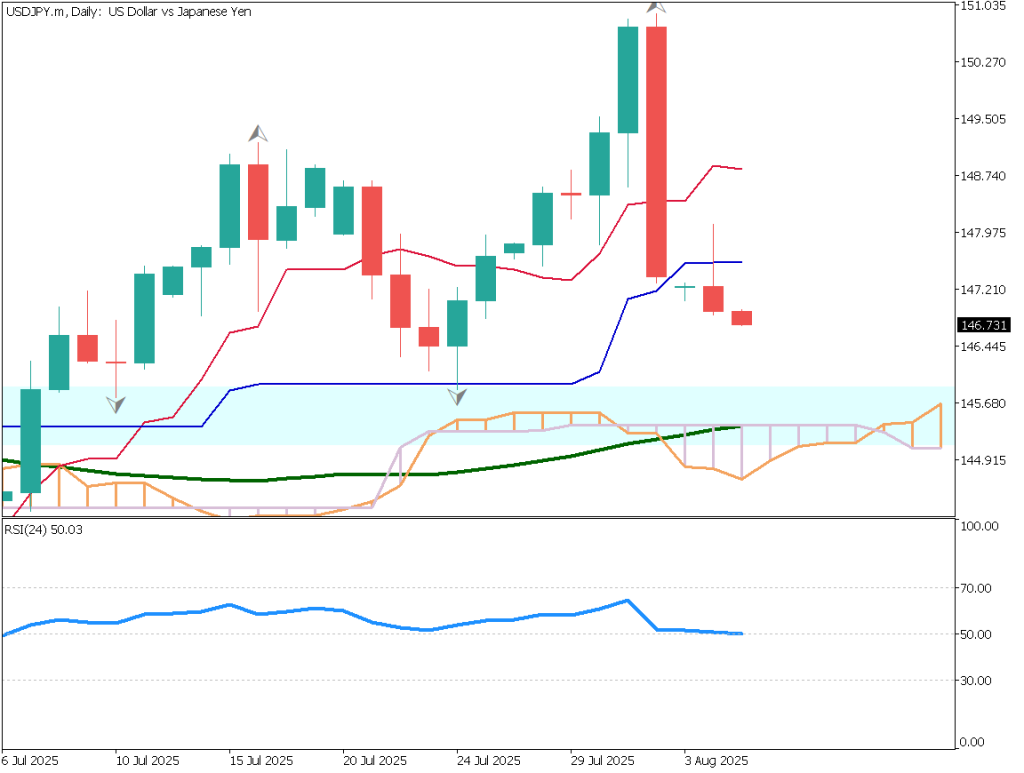

The Bank of Japan decided to keep its policy rate unchanged at around 0.5%. Governor Kazuo Ueda stated that the BOJ would closely watch wage negotiations in next spring's "Shuntō" before making any policy changes.

The Bank of Japan decided to maintain its current policy settings. Markets are focusing on whether the Governor will mention a possible rate hike in his press conference. Meanwhile, although the U.S. has already begun rate cuts, opinions differ on a possible additional cut in December.

USD/JPY is forming a double top pattern, trading in the low 151 range. Goldman Sachs forecasts a potential return to around 100 if interest rates continue rising over the next decade. The FOMC meeting is scheduled for early tomorrow with a rate cut already priced in.

Gold briefly fell below $4,000 as risk-off sentiment eased after the U.S.–China trade agreement. The metal is correcting after a sharp rally, with potential support near $3,955 and $3,880.

Nikkei tops 50,000; focus shifts to the BOJ, FOMC, and ECB this week.

Fundamental Analysis USDJPY Technical Analysis Analyzing the USD/JPY daily chart:The pair formed a large beari… 続きを読む USD/JPY Leans Towards Yen Strength Amid Growing Rate Cut Expectations

Fundamental Analysis USDJPY Technical Analysis This is a daily chart analysis of USD/JPY.Last week’s U.S. emp… 続きを読む U.S. Jobs Data Worsens! President Trump Fires Job Statistics Chief

Fundamental Analysis EURUSD Technical Analysis Let’s analyze the daily chart of EUR/USD. Last night’s AD… 続きを読む EUR/USD Reverses at High Levels! Strategy to Target Downtrend

Fundamental Analysis USDJPY Technical Analysis Analyzing the daily chart for USD/JPY: The pair rebounded at th… 続きを読む USD/JPY Strengthens in Yen’s Favor – Position Adjustment Ahead of Major Events

Fundamental Analysis EUR/USD Technical Analysis We analyze the EUR/USD daily chart. The trade negotiations bet… 続きを読む EU Agrees on 15% Tariffs — Is There More Upside for EUR/USD?

Fundamental Analysis EUR/USD Technical Analysis Analyzing the daily EUR/USD chart: Although the pair remains i… 続きを読む EUR/USD Rising as ECB Holds Rates After Eight Consecutive Cuts