Can Gold Renew Its Record High?

Fundamental Analysis

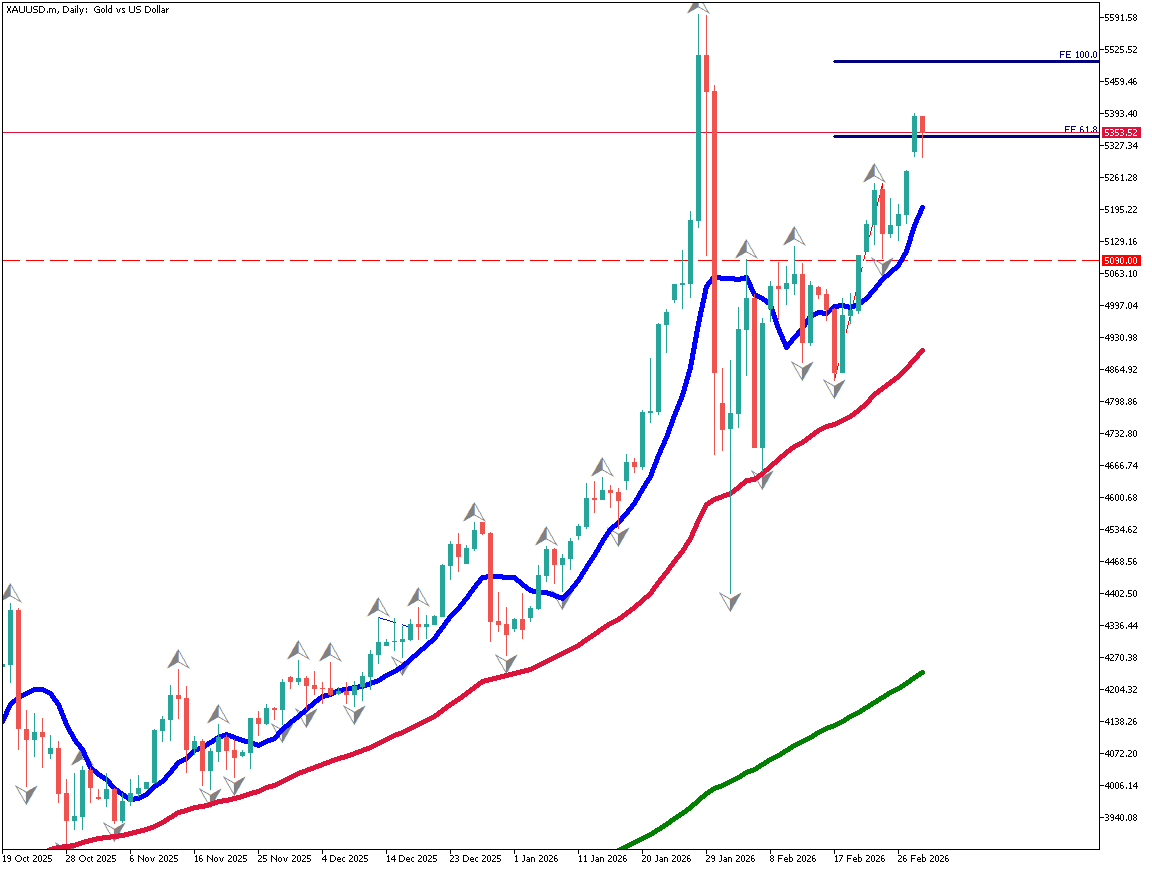

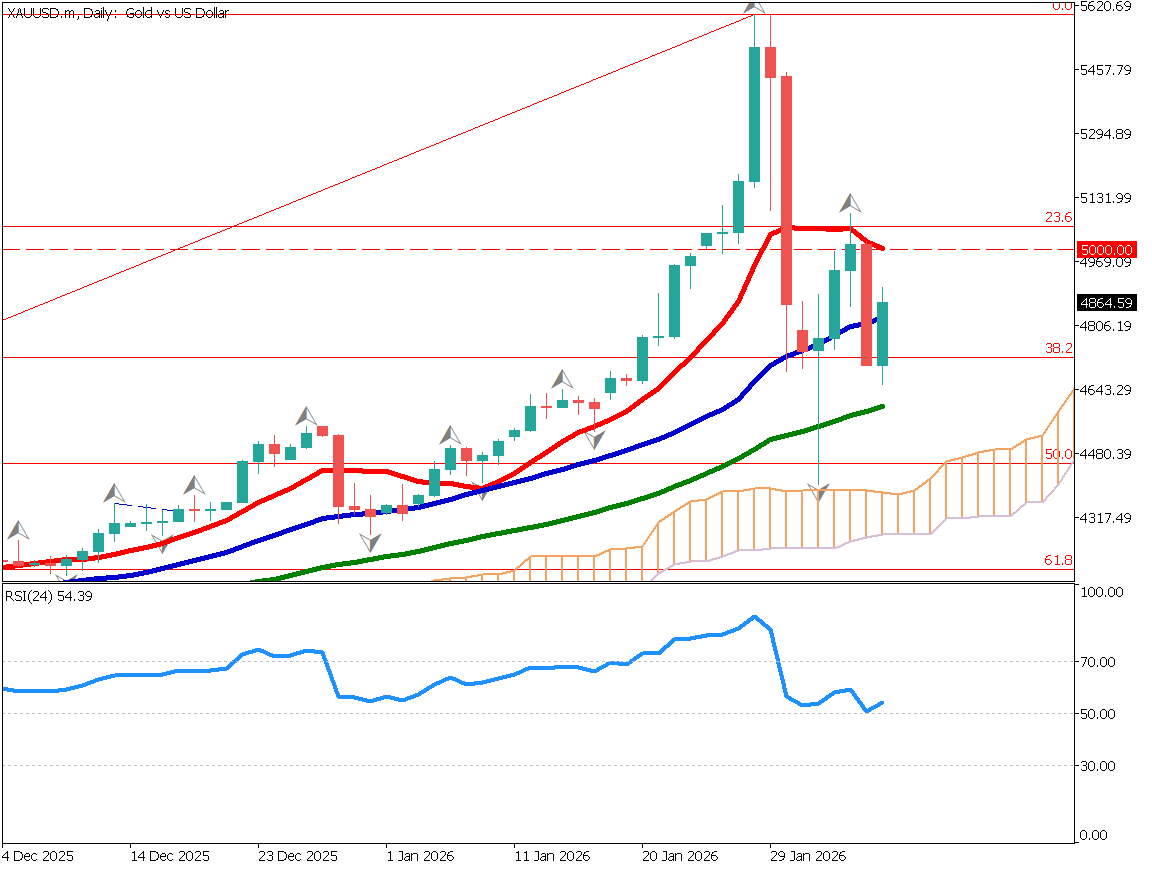

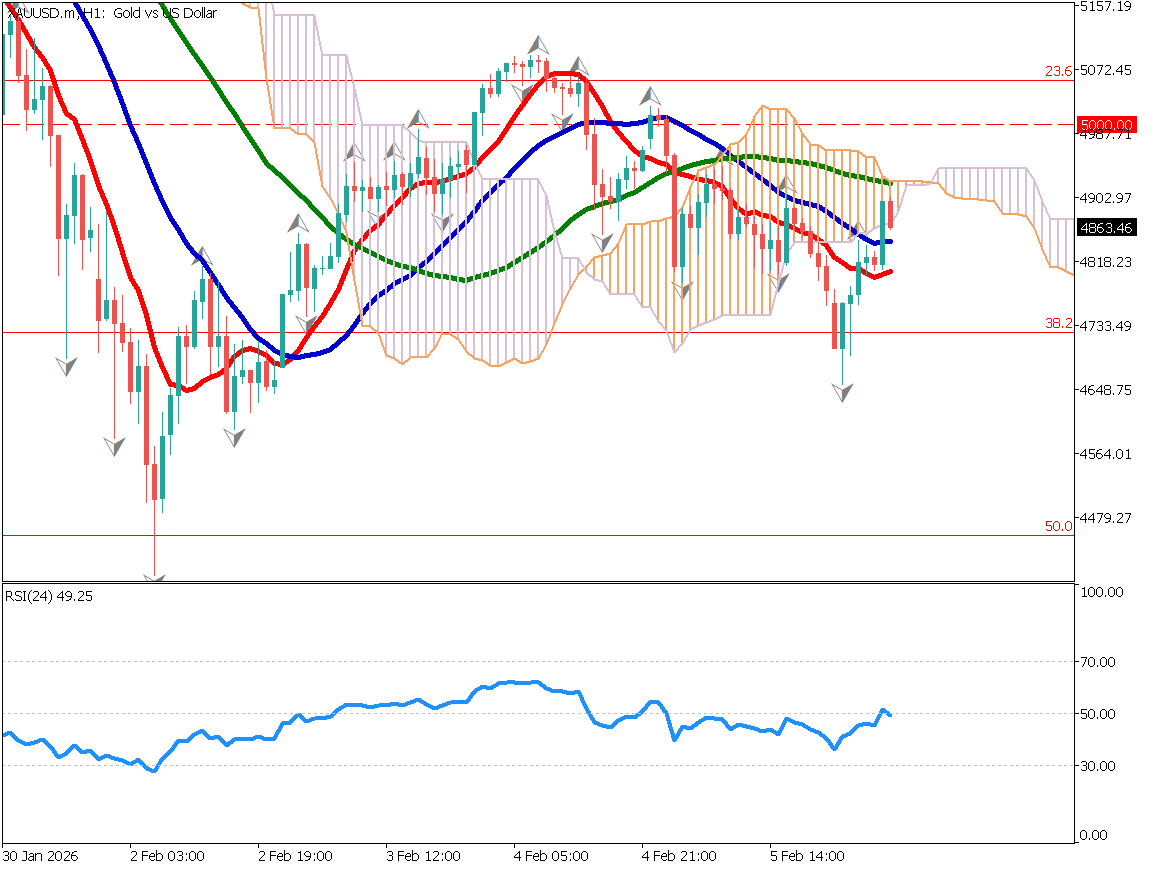

- Gold rebounded from the lower boundary of a parallel channel but pulled back near the 10-day moving average. A renewed break above the recent high would signal a continuation of the uptrend.

Gold Lacks Clear Direction

Gold rebounded at the 52-day moving average but was rejected near the 10-day moving average. Fibonacci retracement shows the 38.2% level acting as support. Although upside pressure above $5,000 remains heavy, buying interest is still strong near lower levels, leaving the market without clear direction.

RSI has rebounded around the 50 level, indicating that the market has not yet entered a downtrend. Whether gold can close above $5,000 again will be a key focus. While a fractal pattern near $5,000 suggests a potential bearish signal, a successful breakout could open the way toward the $5,600 level.

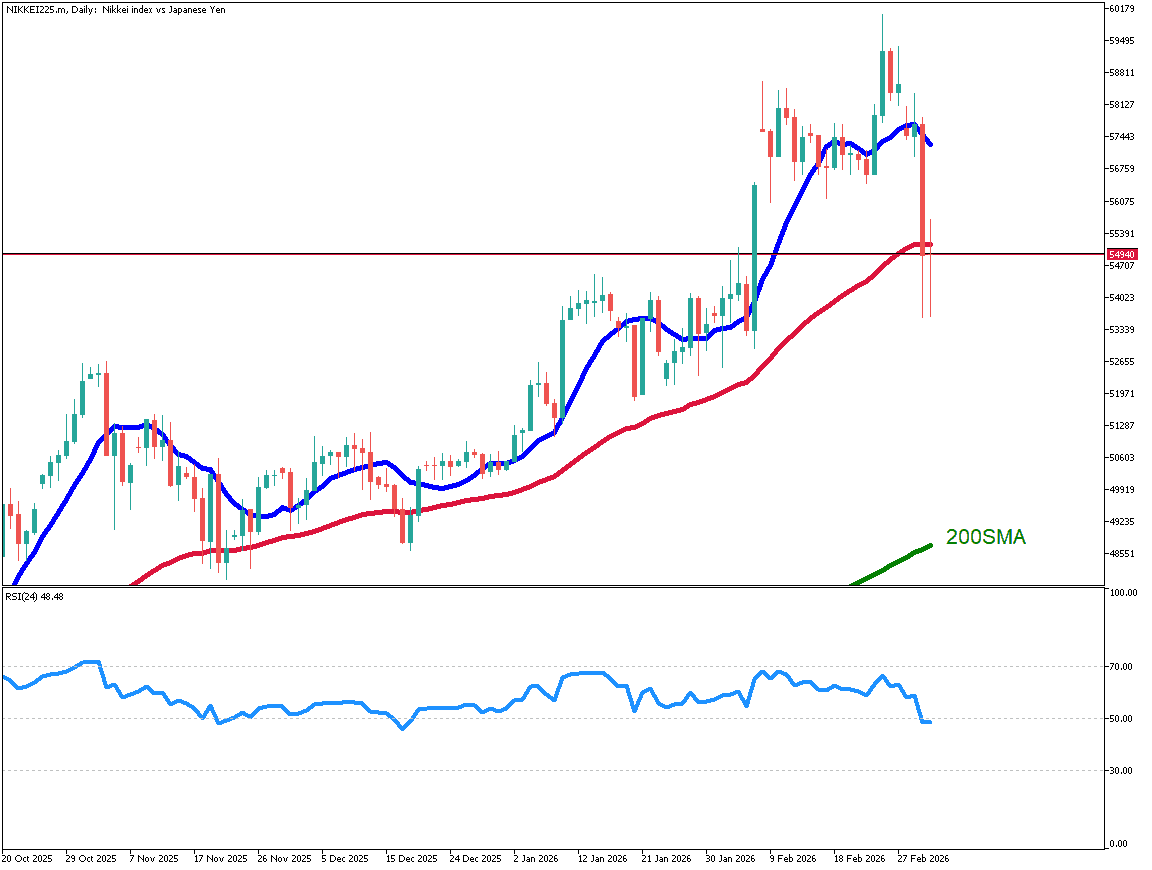

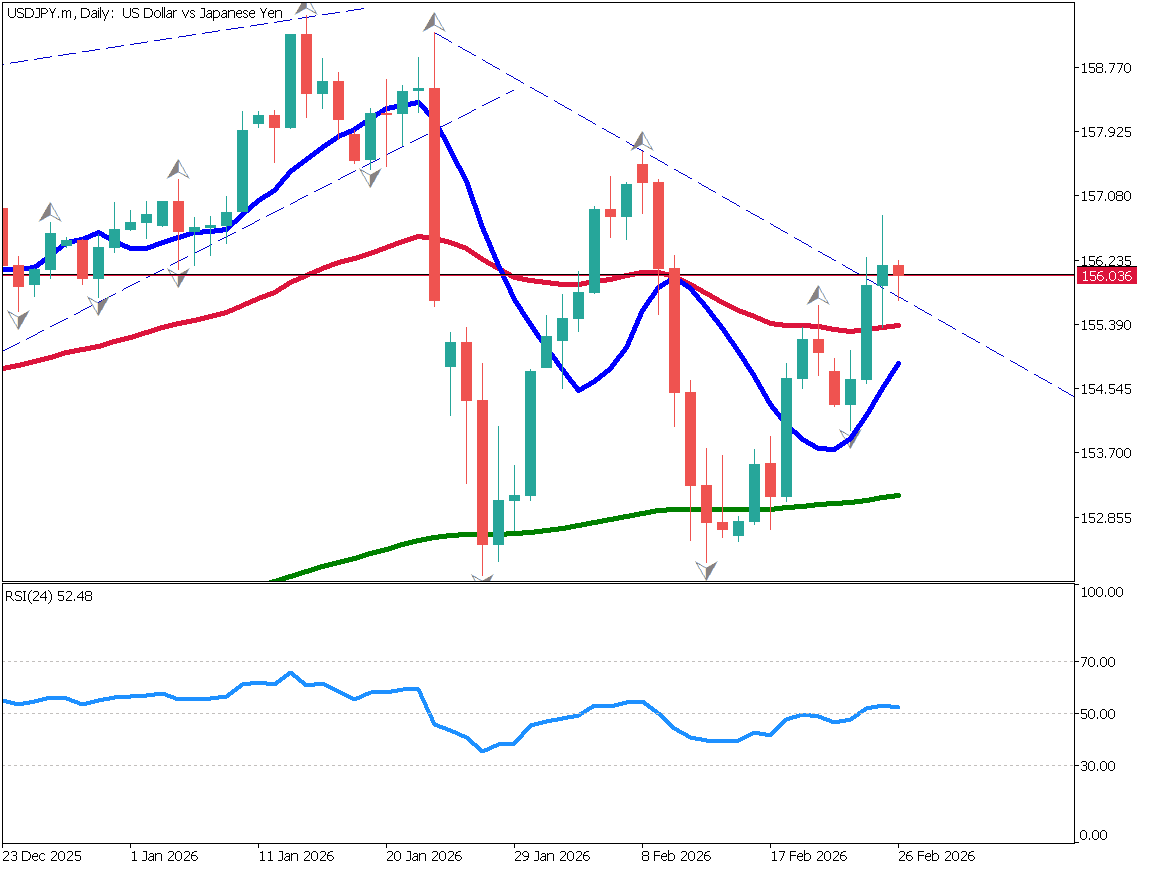

U.S. technology stocks have weakened and failed to make new highs, remaining in a bearish range. The Nikkei 225 has also struggled to break higher. After several years of strong gains through 2025, markets may be entering a corrective phase. As gold has become more widely recognized as an investment, caution is warranted regarding potential selling pressure from hedge funds and institutional investors.

Gold / Daily Chart

For now, gold is likely to trade within a range, fluctuating around Fibonacci levels without clear direction. A bullish bias remains appropriate, though resistance above $5,000 is strong. The 52-day moving average will be an important reference point. A trading range between $4,700 and $5,000 is expected.

A range-trading strategy is preferred in the near term.

If gold falls below $4,700, the $4,500 area may become the next downside target.

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.