US–EU Tensions Deepen, EUR/USD Declines

Fundamental Analysis

- The United States announced additional tariffs on EU countries, and Europe is considering countermeasures

- The Trump administration may be using tariffs as leverage in its claim over Greenland

- Conflict within NATO as US and EU are allies but tensions rising over Greenland

Conflict Within NATO

The US and EU countries are NATO allies. However, the US claim over Greenland has increased opposition from European nations. Europe is prepared to respond, and the US has not ruled out the use of force. If the US military were to occupy Greenland, geopolitical risks would rise sharply.

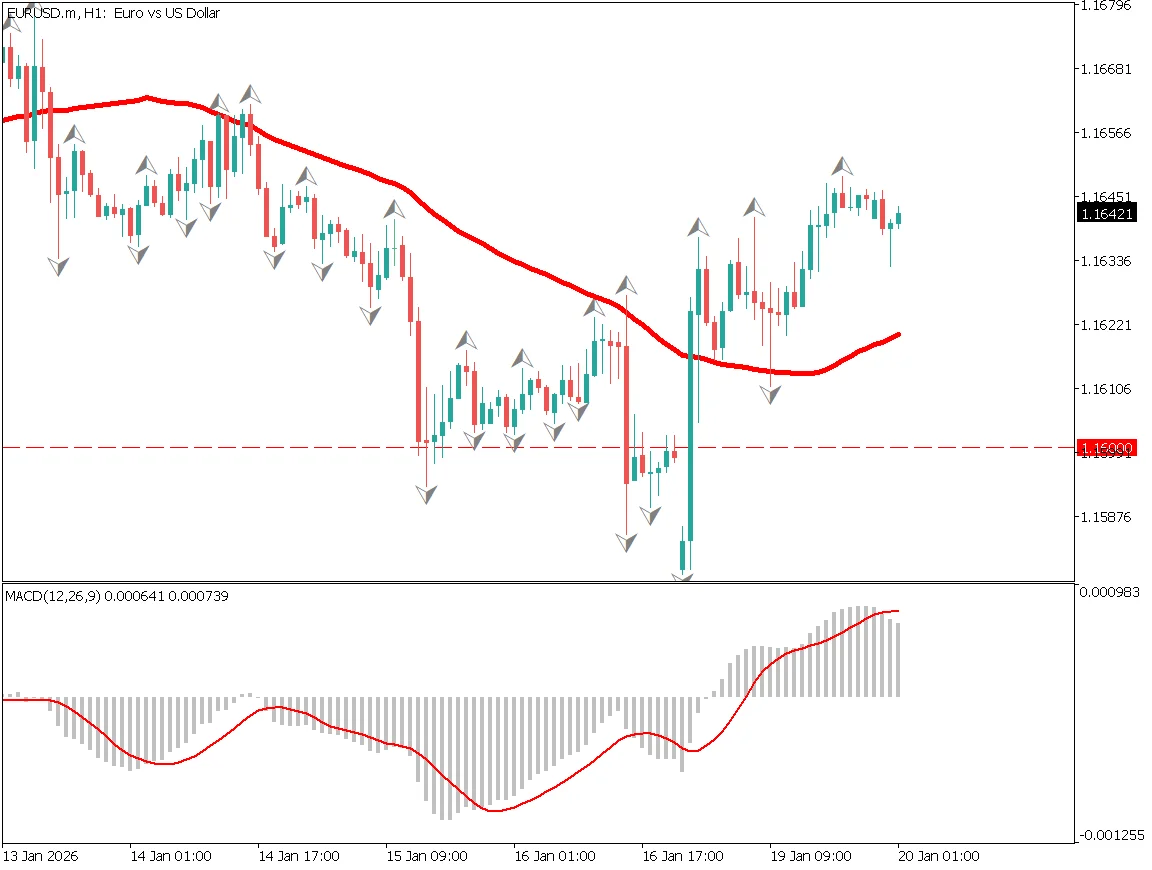

EUR/USD has not moved significantly and remains within a range, though euro selling has slightly increased. The pair briefly fell below 1.16 but quickly rebounded, likely due to buying interest at this round number.

The most important support level is 1.15. Moving averages are flat, indicating a lack of clear trend.

Round Number Behavior

After falling below 1.16 to around 1.1580, strong buying emerged early in the week, pushing the pair up to around 1.1650. The large bullish candle suggests dip buying. Although prices are above the moving averages, 1.1650 may act as resistance. The round number at 1.17 is also likely to function as a resistance level.

Selling on a rebound near 1.1680 could be considered.

Key Economic Events Today

| Economic Indicators | Time |

|---|---|

| UK Employment Data | 16:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.