EUR/USD in a Range Market, Focus on US–EU Tensions

Fundamental Analysis

- Attention is on how tensions between the United States and the European Union will develop

- The US ADP employment report came in below expectations

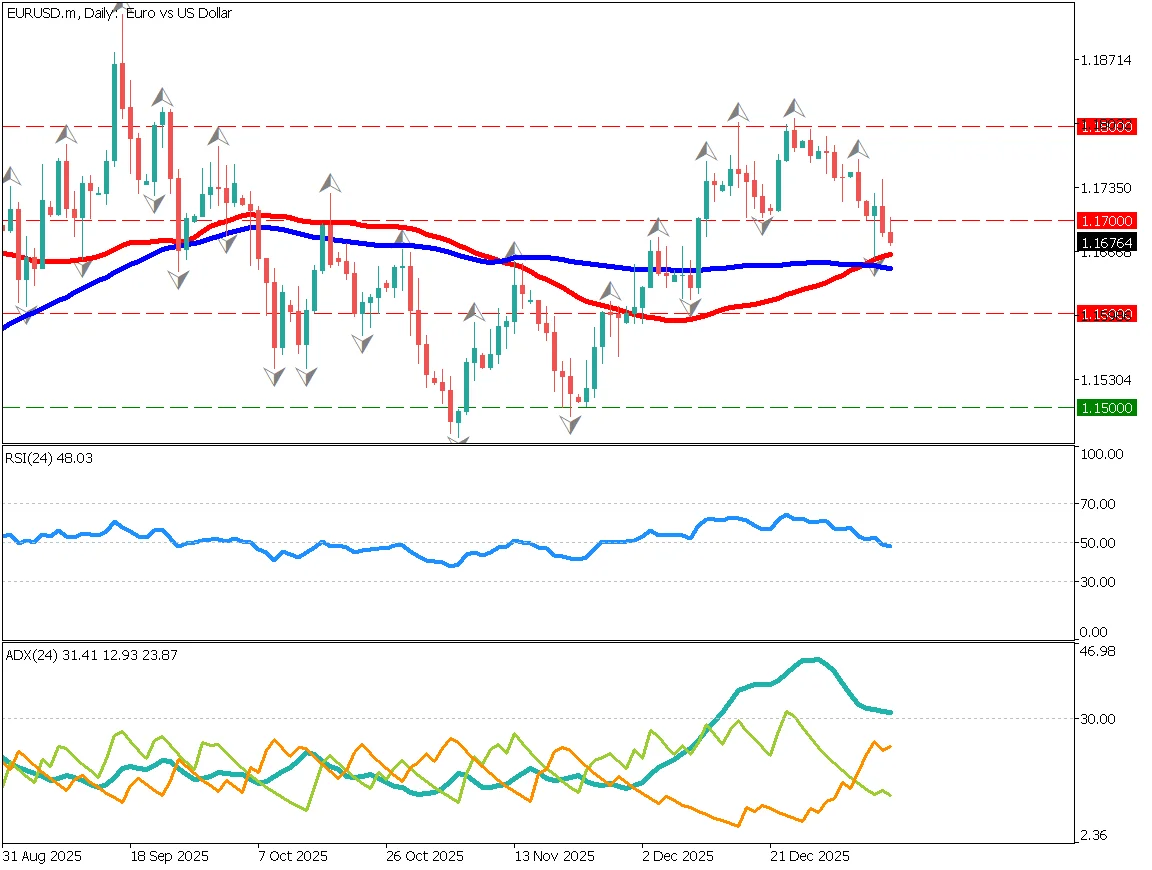

- A double bottom has formed

Double Bottom Formation

EUR/USD formed a double bottom at 1.15 and rose to 1.18. However, it failed to break higher and turned lower. The 90-day moving average is flat, and the 52-day moving average also shows no clear direction. This is a typical range-bound market.

The failure to make a new high has strengthened the downward bias. However, a strong and sustained dollar rally is unlikely. The pair may rebound again around 1.15.

The United States has made comments regarding Greenland, and if tensions escalate between the US and Europe, EUR/USD may lose clear direction. A continuation of range trading is expected for now.

Bearish Bias on Hourly Chart

On the hourly chart, the trend is clearly downward. The 1.17 level is acting as resistance, and the price has failed to break above it. Moving averages are also capping the upside, confirming the bearish trend. If 1.17 is not broken, the pair may head toward 1.16.

Although the daily chart suggests a range market, EUR/USD can be viewed as bearish for day trading. However, with the US employment report scheduled for tomorrow, position adjustments may occur. The pair could consolidate around the low 1.16 area.

Today's Key Economic Indicator

| Event | Time |

|---|---|

| US Initial Jobless Claims | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.