EUR/USD Rises Gradually as the Rate-Cut Cycle Ends

Fundamental Analysis

- ECB board member Schnabel stated that "there is no disagreement that the next move could be a rate hike"

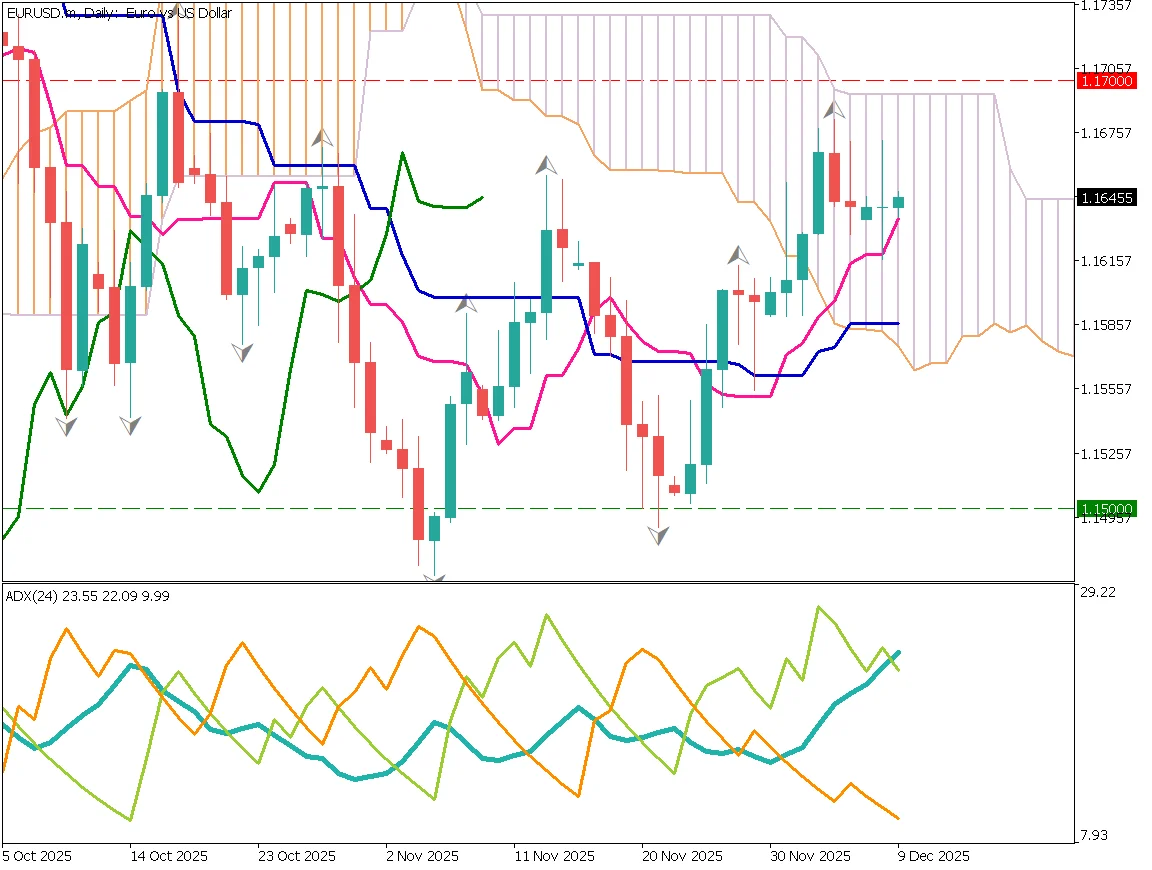

- EUR/USD briefly surged above 1.167 before quickly dropping back to 1.162

EUR/USD Gradual Uptrend

ECB board member Schnabel stated that "there is no disagreement that the next move could be a rate hike." Following this comment, EUR/USD briefly surged above 1.167. However, because an immediate hike is not expected, the pair quickly dropped back to around 1.162. The conversion line of the Ichimoku Cloud is acting as support.

Since the U.S. Federal Reserve is moving toward rate cuts, upward pressure on EUR/USD is likely to increase. From a technical perspective, ADX is trending higher, suggesting that the upward trend is strengthening.

EUR/USD tends to react to round numbers. The 1.1650 and 1.1700 areas are likely to serve as resistance. The 1.17 level also aligns with the upper edge of the Ichimoku Cloud, and a breakout above it could accelerate the uptrend.

EUR/USD Day-Trading Strategy

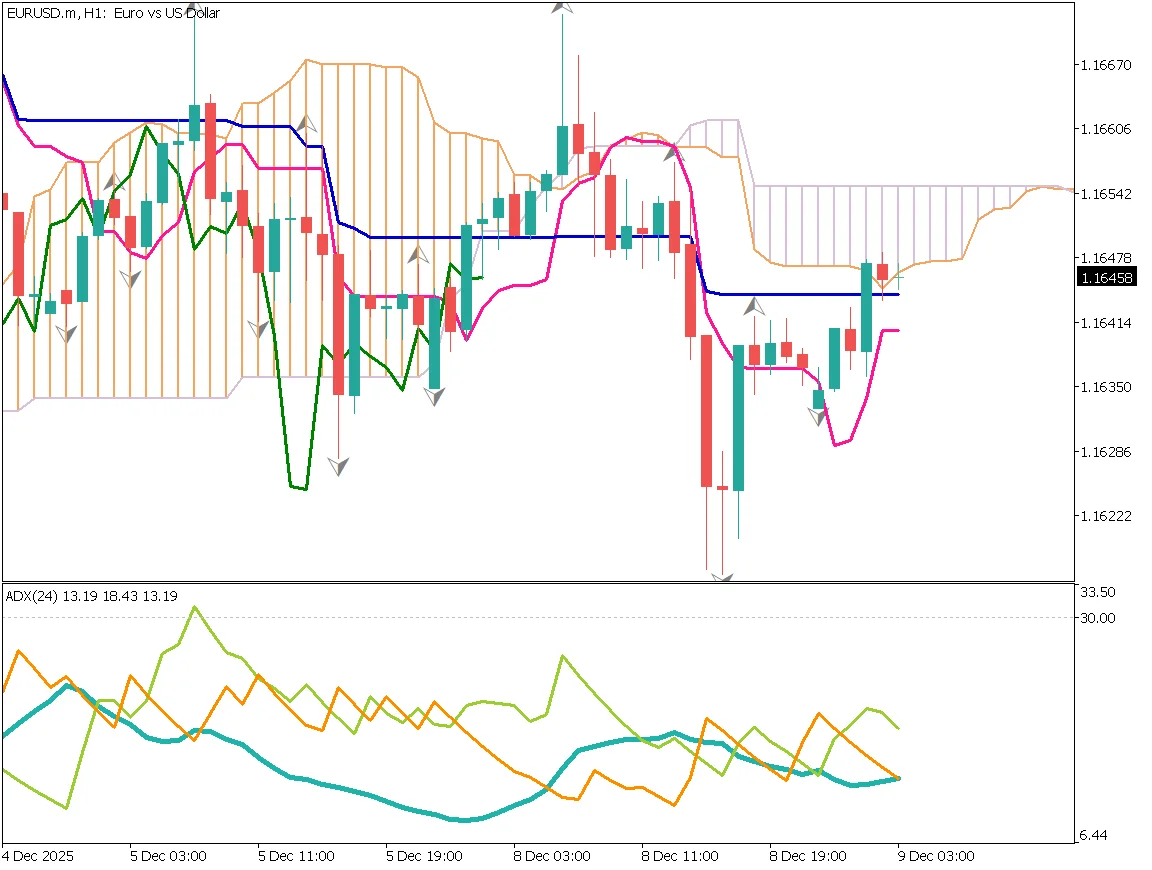

On the 1-hour chart, a Morning Star pattern has formed—large bearish candle, doji, and large bullish candle—indicating a possible trend reversal. As long as the price does not fall below the doji's low at 1.1616, the trading bias remains to the upside.

Today is likely to be a range-bound session, so buying on dips is preferred.

A buy limit around 1.1620 is reasonable, with a short-term stop loss below 1.1615.

Today's Key Events

| Event | Time |

|---|---|

| Reserve Bank of Australia (RBA) Interest Rate Decision | 12:30 |

| U.S. JOLTS Job Openings (October) | 24:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.