EUR/USD Turning Upward? USD Weakness Becoming More Pronounced

Fundamental Analysis

- The U.S. dollar is weakening across most markets, with USD/JPY being the only major exception due to extreme yen weakness

- With the U.S. government reopening, upcoming economic data releases will attract attention

USD Weakness

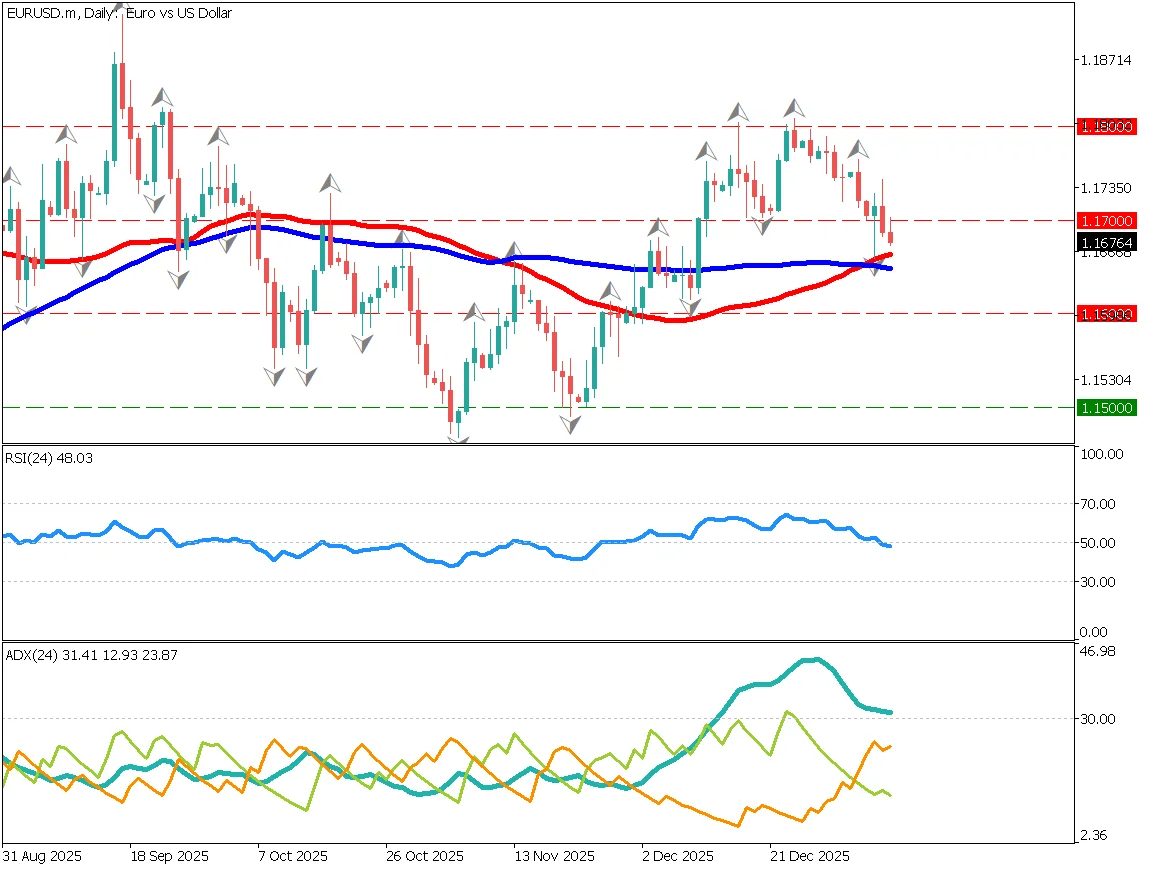

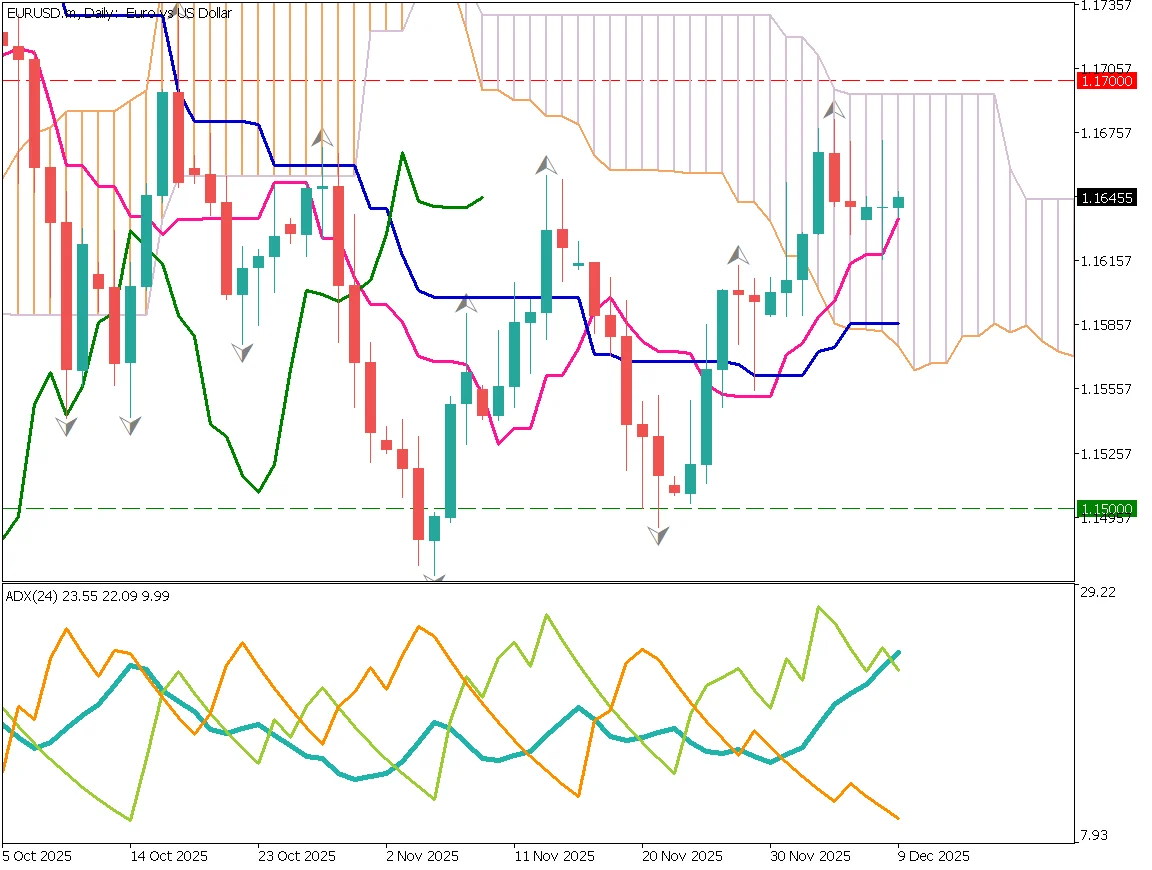

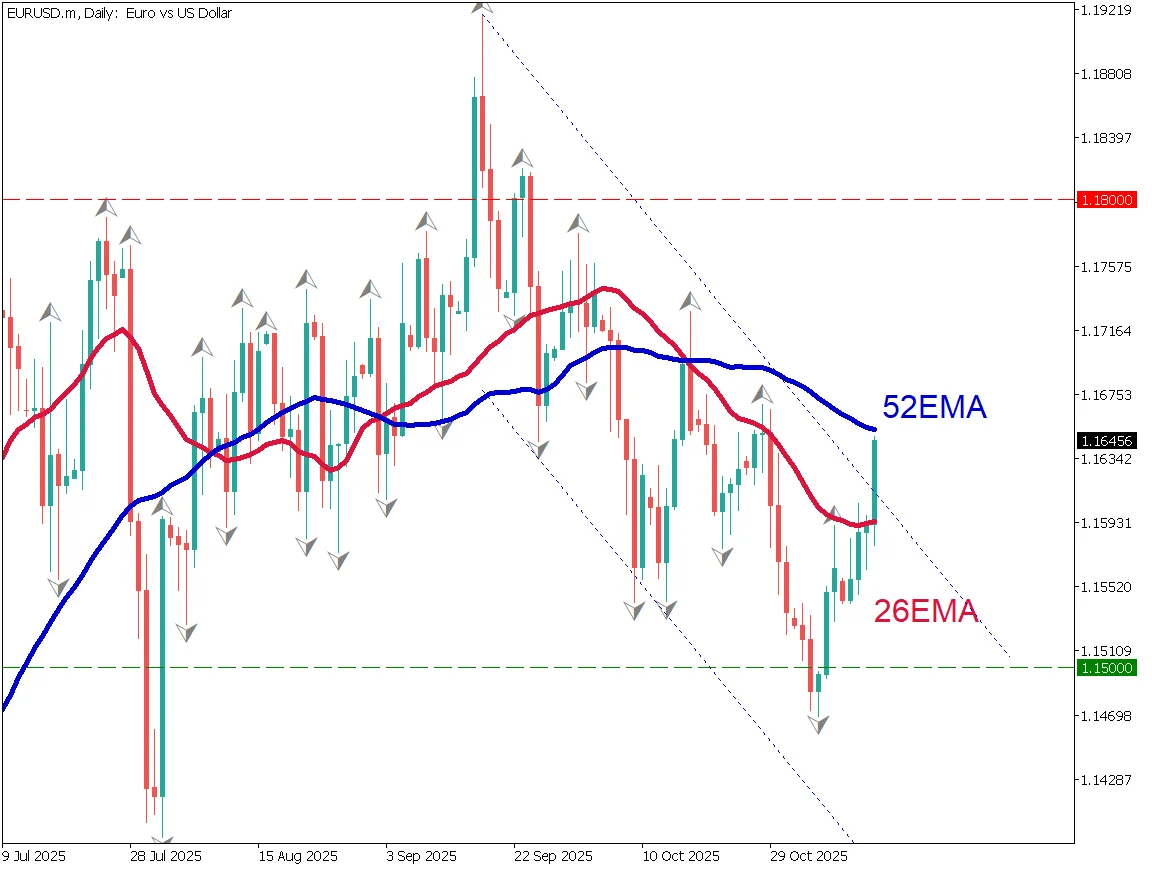

Analyzing the EUR/USD daily chart: After hitting a peak in mid-September, EUR/USD entered a downtrend but reversed at 1.15 in late October, breaking out of the downward channel. The next focus is whether the 52EMA will act as resistance.

Overall, USD weakness is noticeable across markets, though USD/JPY alone remains dominated by powerful yen weakness.

If EUR/USD breaks above the 52EMA, it may aim again for the 1.18 level. The direction will largely depend on the incoming U.S. economic indicators. However, the impact of the U.S. government reopening is severe; even with operations restored, the damage will not disappear immediately.

If economic stagnation spreads, U.S. recession fears could grow and trigger a sharp stock market decline. Caution is necessary.

EUR/USD Day-Trading Strategy

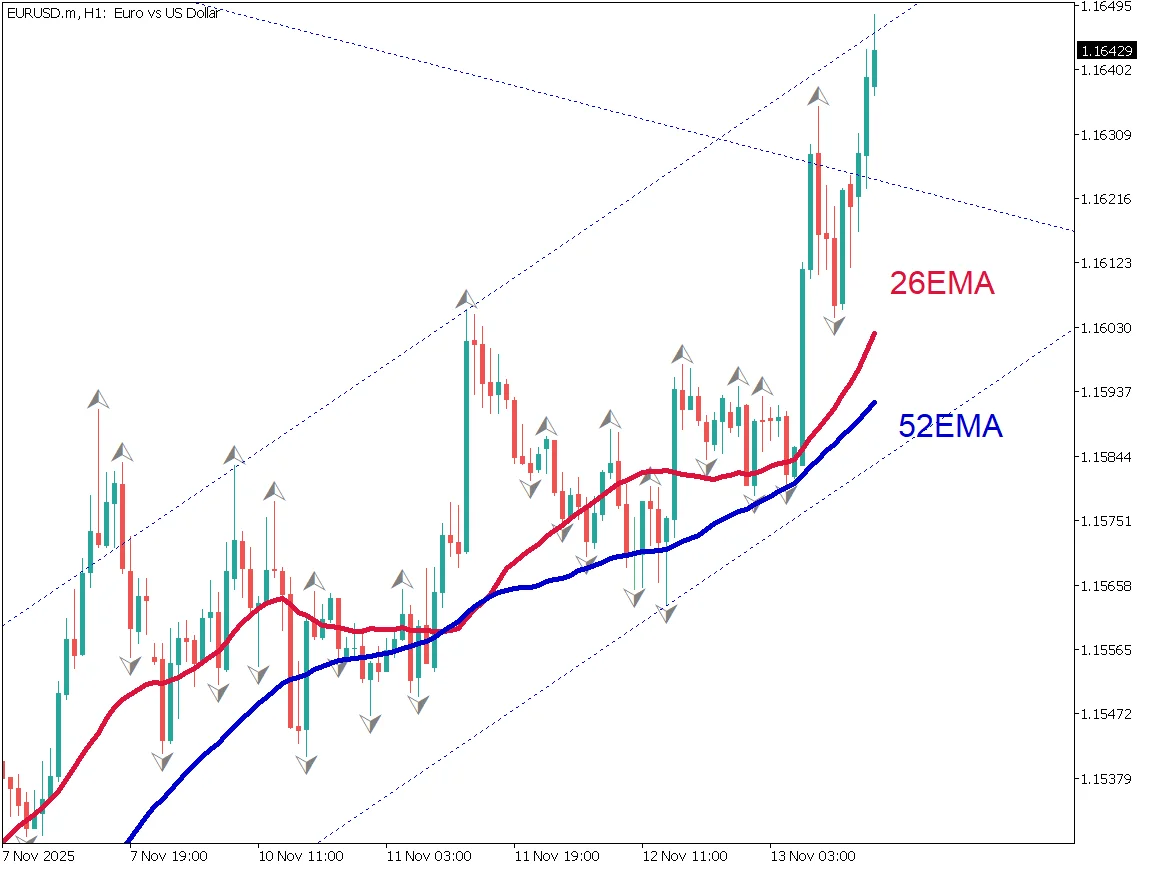

Focus on the moving averages. The 26EMA appears to be bouncing off the 52EMA, suggesting a mild but steady upward trend. When drawing a channel, the current price is touching the upper boundary.

A temporary pullback is possible, as the price has moved far from the 26EMA. It is safer to wait for a return toward the 26EMA. The main strategy is to buy on dips.

Important Indicators Today

Note: U.S. economic data may be delayed due to the previous government shutdown.

| Indicator / Event | Time |

|---|---|

| U.S. Retail Sales | 22:30 |

| U.S. Producer Price Index | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.