Gold and Silver Continue to Hit Record Highs

Fundamental Analysis

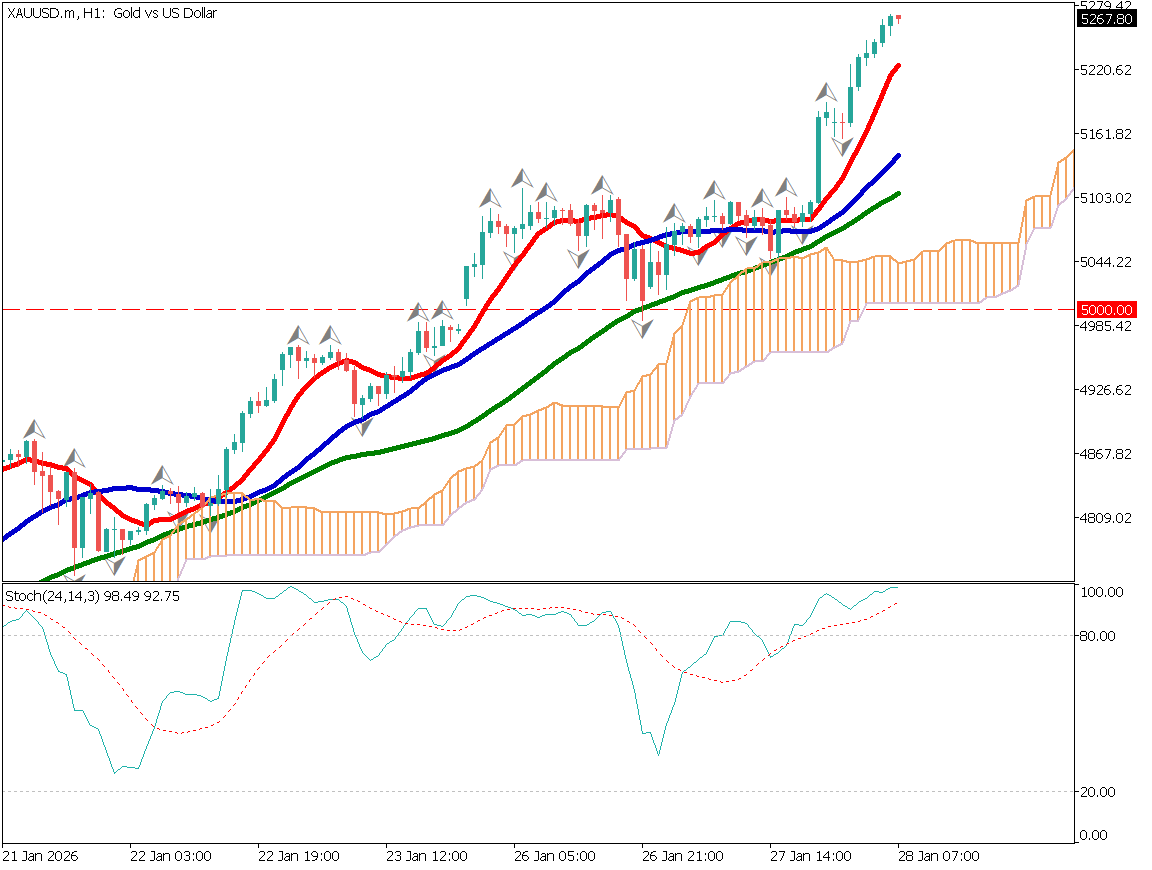

- Gold and silver are both hitting record highs, with strong capital inflows into the precious metals market. Gold continues to rally beyond $5,000, driven by FOMO-style buying, and has surpassed $5,200. Renewed U.S. government shutdown concerns, a weaker dollar, and steady central bank purchases are supporting prices. However, oscillators indicate overbought conditions, suggesting attention to potential pullbacks toward the $5,100 level.

Gold continues to rise even after breaking above the $5,000 level, showing no sign of losing momentum. Concerns over a renewed U.S. government shutdown have resurfaced, with the budget deadline approaching on the 30th. Silver has also surpassed $100, and its upward momentum remains strong. Large-scale funds are flowing into the precious metals market.

Significant capital inflows are entering the entire precious metals sector. Although gold has already broken the psychological $5,000 level, the strength of the trend remains intact. Fear of missing out (FOMO) appears to be driving continuous buying, as traders rush to enter the market. Gold has now exceeded the $5,200 level.

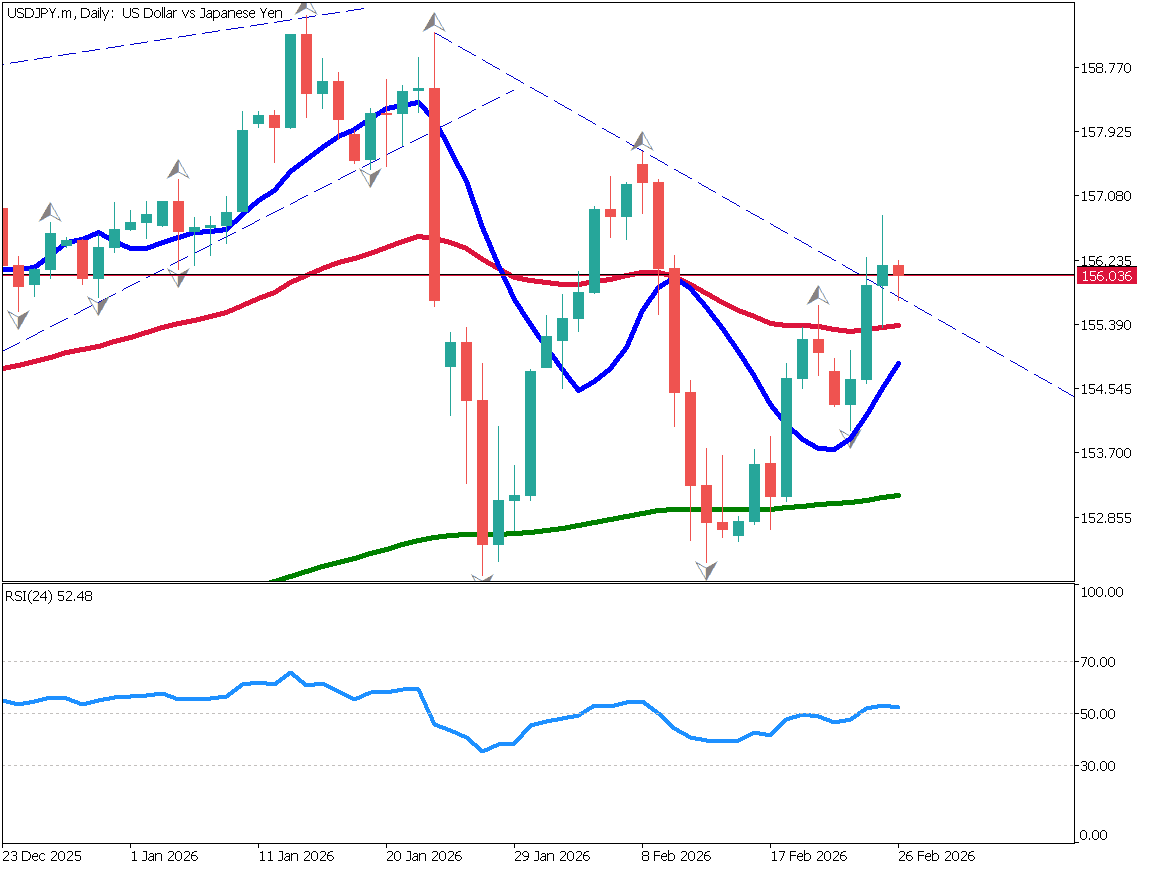

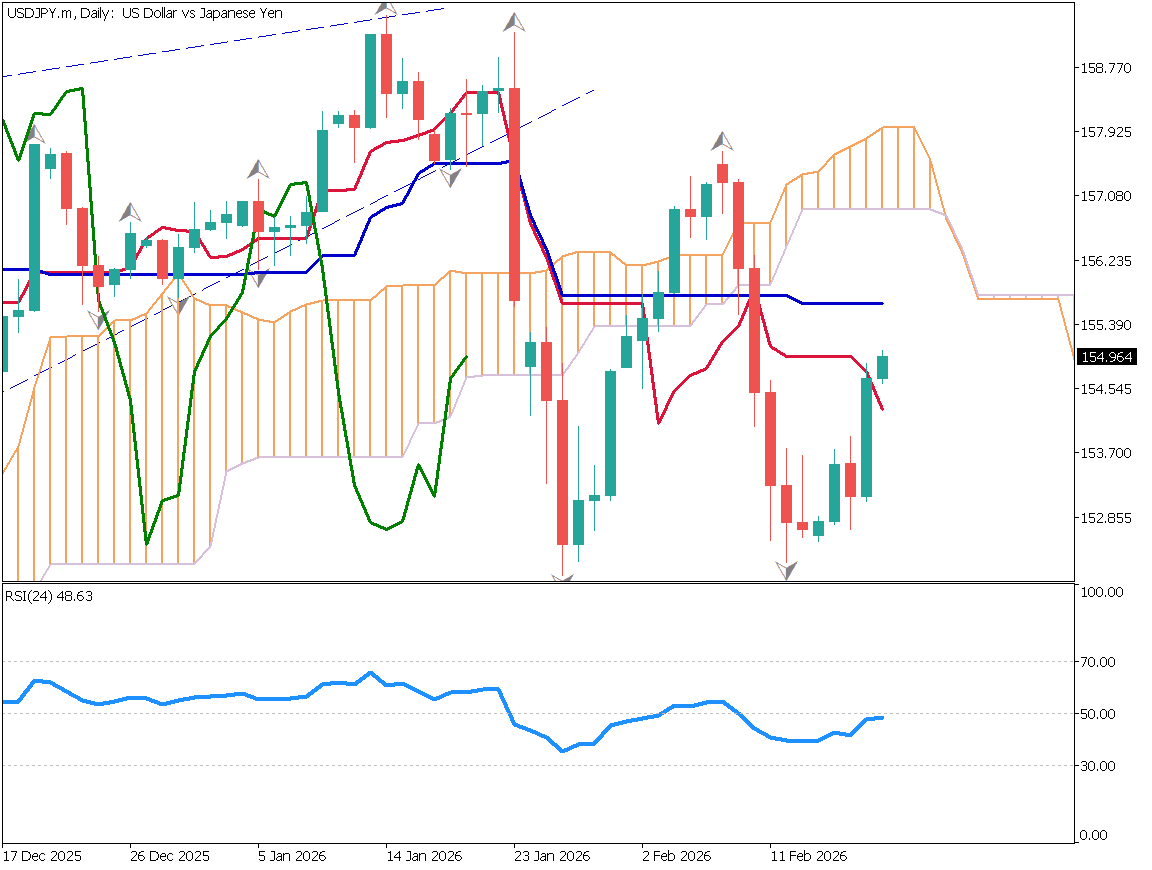

Concerns about a potential U.S. government shutdown have re-emerged as the temporary budget deadline approaches. As a result, funds are flowing out of the U.S. dollar. In addition, comments by President Trump favoring a weaker dollar may be accelerating dollar depreciation.

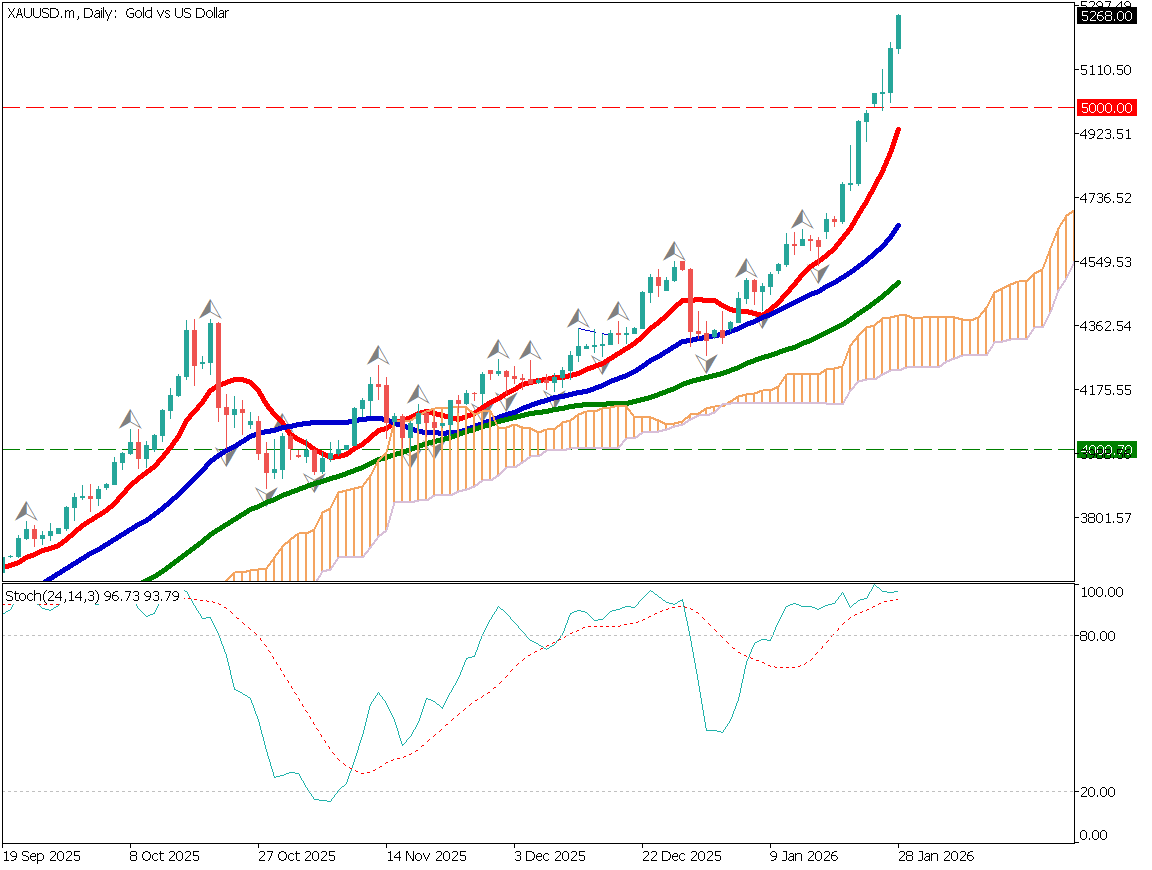

Oscillator indicators such as stochastic are staying at elevated levels. The stochastic oscillator, which shows where the current price lies within the recent high-low range, is currently at 96.7, near the highest level over the past 24 days.

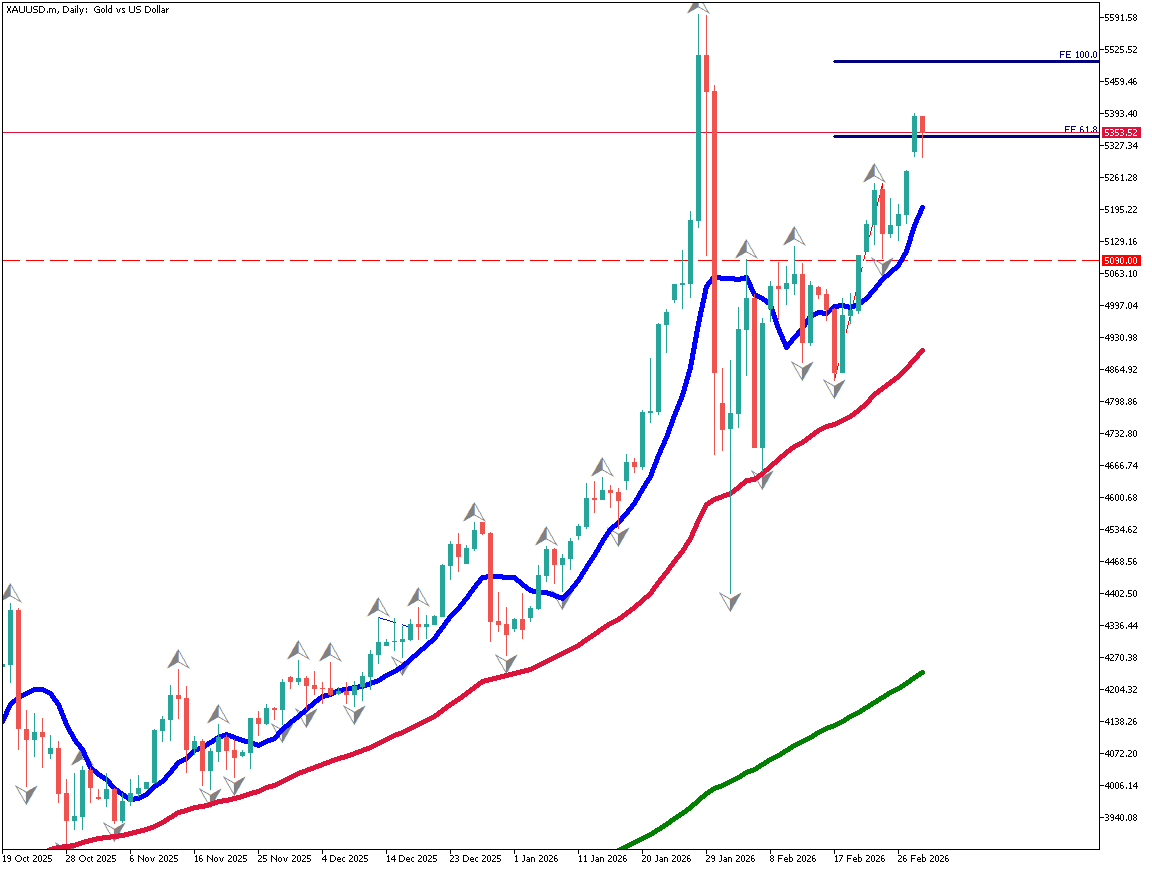

[Gold / Daily Chart]

Gold buying is being supported by a weaker dollar. It may be prudent to wait for a pullback toward the $5,100 area. Central banks continue to actively purchase gold, suggesting that buying on dips is likely to persist. Dollar weakness and risk-off sentiment are also contributing factors.

Buying opportunities may emerge around the $5,100 level. Traders should carefully assess entry points while referring to RSI and stochastic readings.

[Gold / 1-Hour Chart]

Today’s Economic Indicators

Canada Policy Interest Rate (23:45 JST)

U.S. Federal Reserve Policy Rate (January FOMC): 4:00 JST (next day)

Federal Reserve Chair Powell Press Conference: 4:30 JST (next day)

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.