Gold Faces Heavy Resistance as Market Consolidates

Fundamental Analysis

- U.S. employment report showed mixed results – job creation exceeded expectations but unemployment rate also rose

- Market reaction was limited as investors interpreted the data as a sign of moderate slowdown

Mixed U.S. Employment Data

The U.S. employment report passed without major market volatility. While job creation exceeded expectations, the unemployment rate also rose above forecasts. The market interpreted this as a sign of a moderate slowdown. Although the dollar weakened briefly, the overall impact on the market was limited.

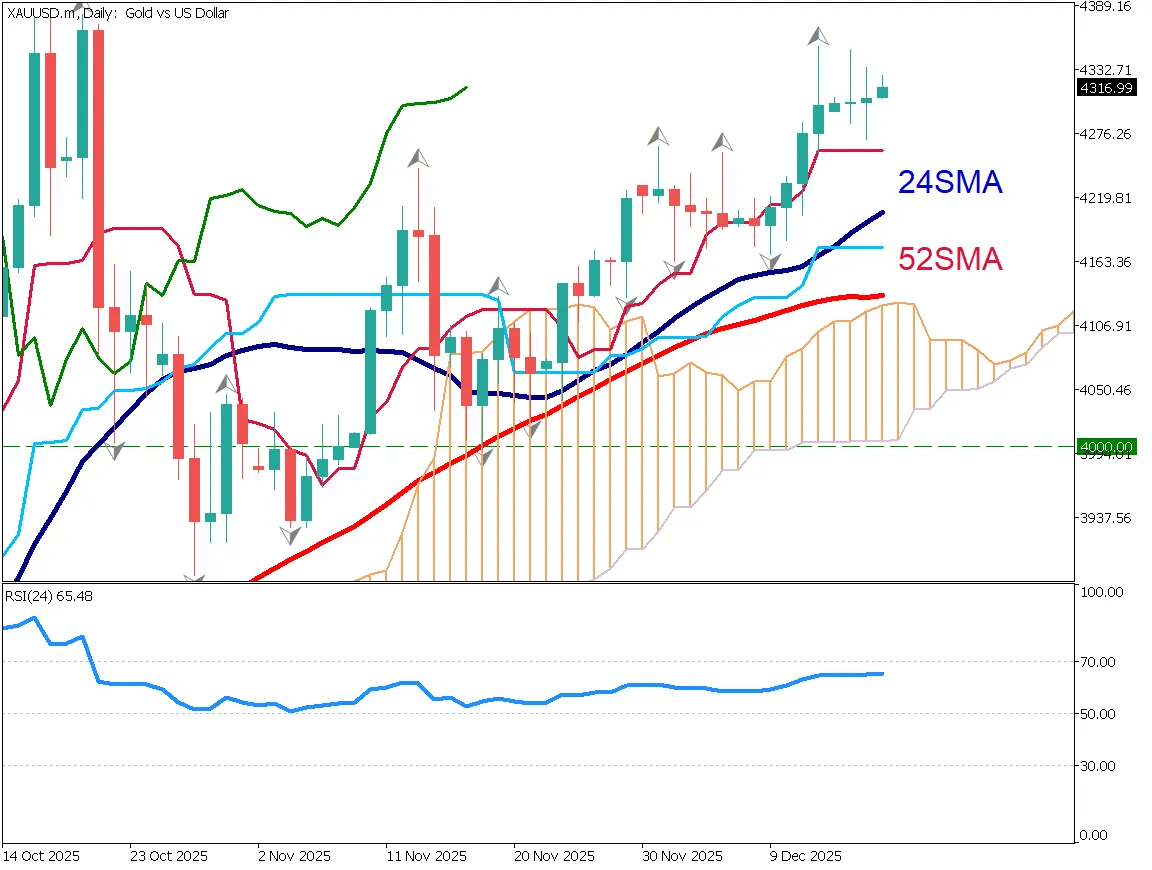

Gold continues to struggle with upside resistance and lacks clear direction. The conversion line is acting as support, and the 24-period simple moving average is trending upward, suggesting a bullish bias. The recent high around $4,353 serves as a key reference level, supported by a fractal formation. At the same time, U.S. equities have started to decline, raising the possibility of increased volatility in early 2026.

If the AI bubble were to collapse, the market could experience sharp movements.

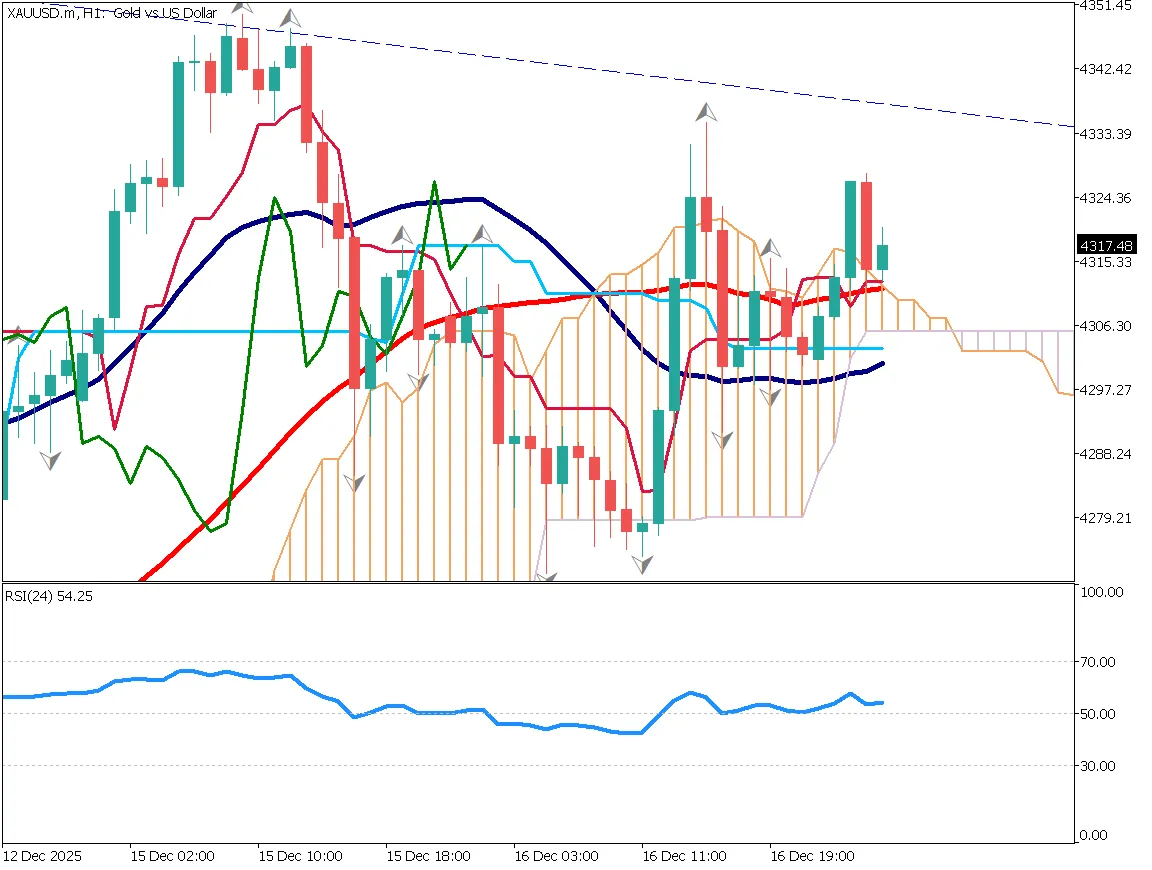

Day Trading Strategy

For day trading, the lower boundary of the Ichimoku cloud is functioning as support. Highs are gradually declining, indicating that a breakout will require strong momentum. The $4,300 level remains heavy, but stronger dollar selling or further declines in U.S. stocks could provide the catalyst needed to push prices higher.

The basic strategy remains focused on buying opportunities. However, with major events such as U.S. CPI and the Bank of Japan's monetary policy meeting scheduled before the Christmas holidays, careful position management is essential.

Today's Key Economic Events

| Economic Indicator / Event | Time |

|---|---|

| UK Consumer Price Index | 16:00 |

| Eurozone Consumer Price Index | 19:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.