Gold Hits New Highs, Investigation Reports Into Fed Chair

Fundamental Analysis

- Risk-off sentiment grows amid investigation reports into the Fed Chair

- Gold closes in the 4,600-dollar range

- Potential move toward 5,000 dollars

- Fed Chair criticizes Trump administration pressure

New All-Time High

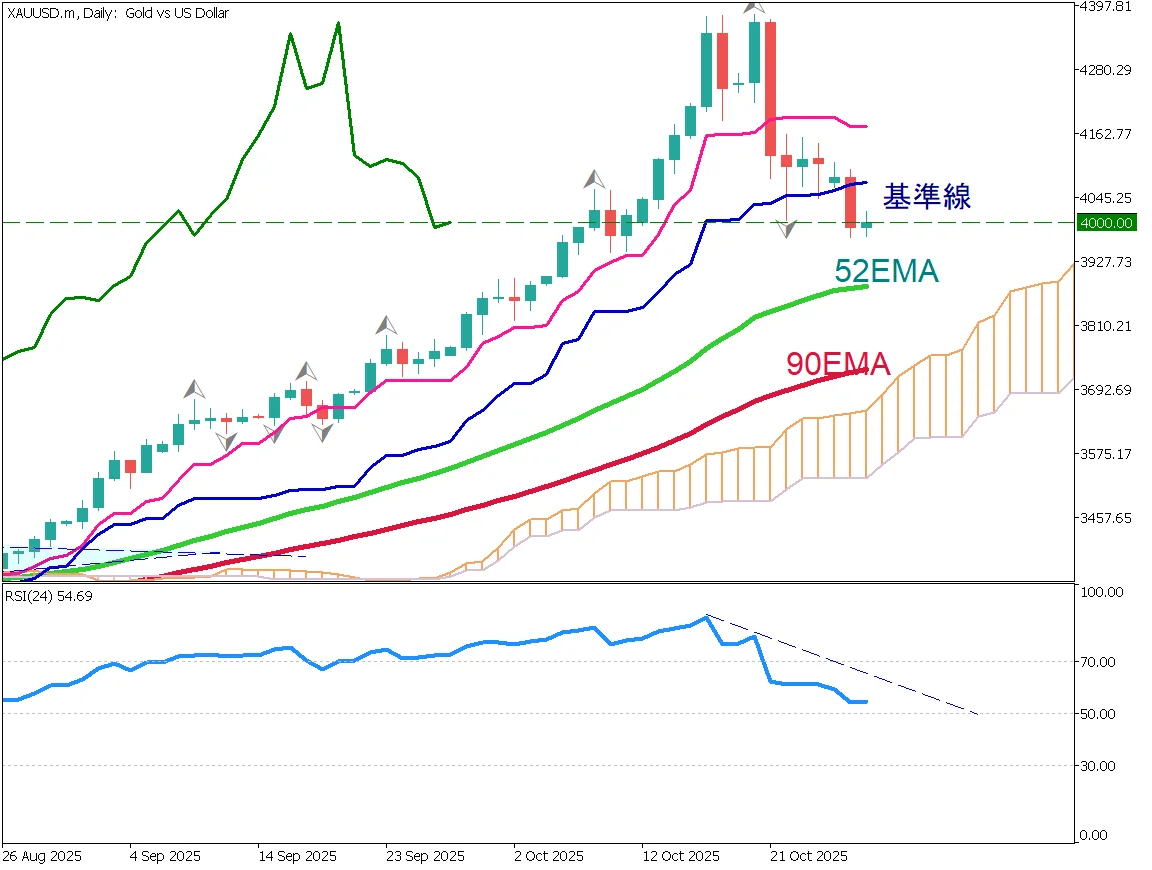

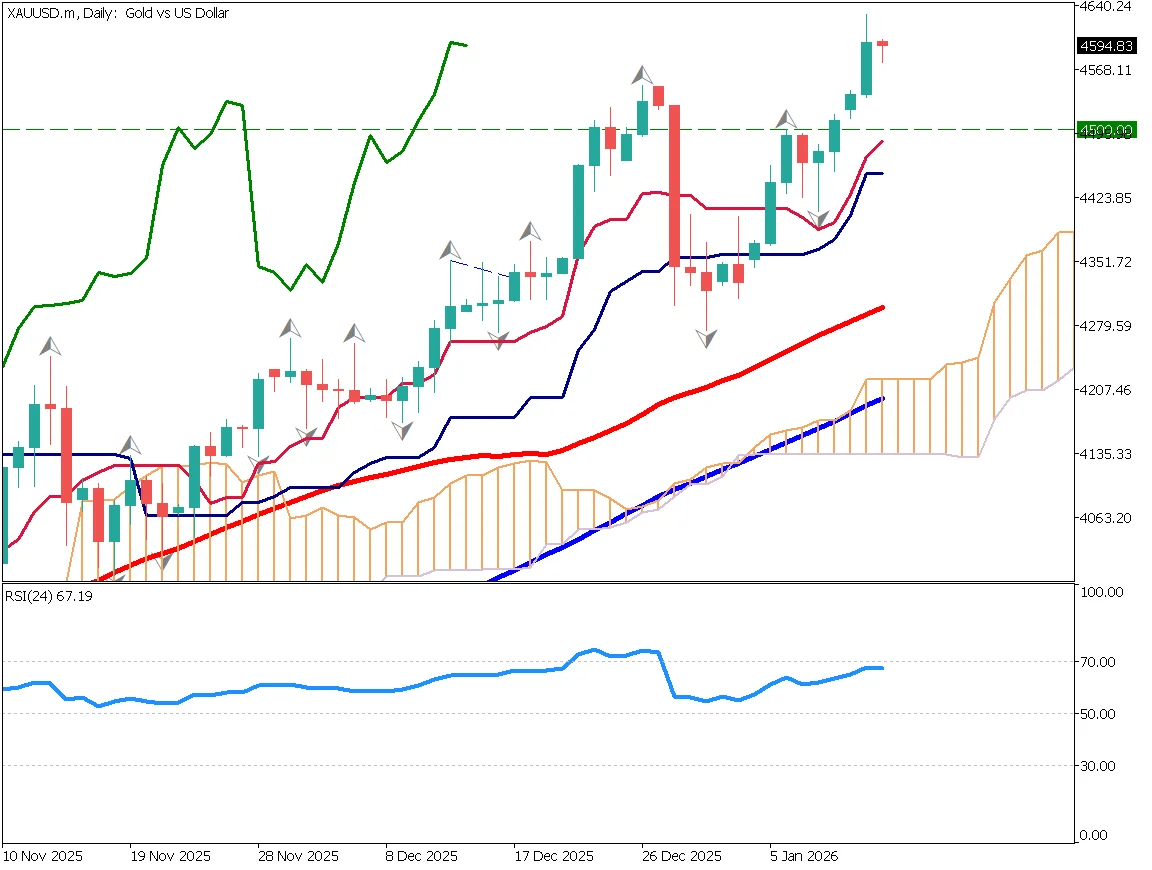

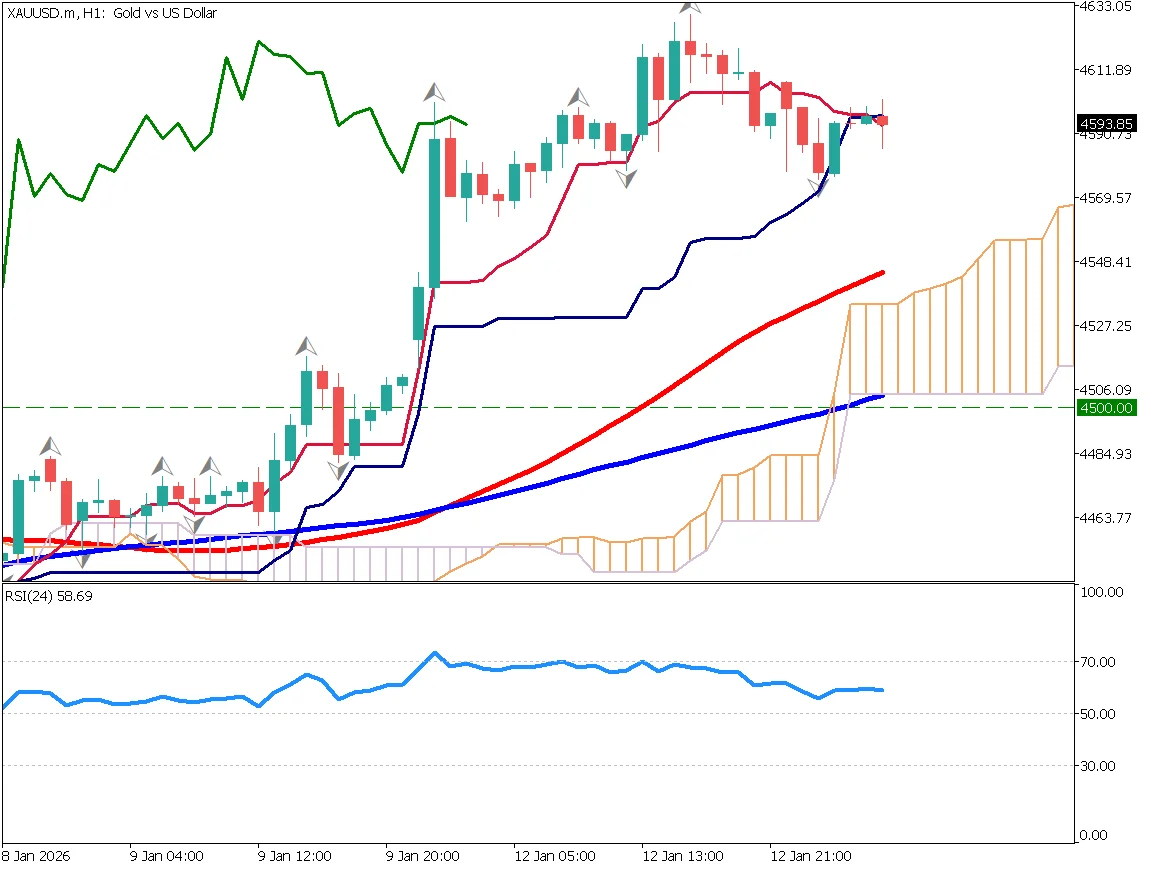

Gold has updated its all-time high. Prices temporarily reached the 4,600-dollar level, marking a strong continuation of the rally. By breaking the previous high, an uptrend has been confirmed under Dow Theory. After recovering from the sharp decline at year-end, the upward trend remains intact.

A criminal investigation into the Fed Chair has begun, prompting a two-minute public statement. The Chair clearly criticized pressure from the Trump administration. Such pressure undermines confidence in the US dollar, leading to clear dollar selling in the market.

Depending on today's US CPI results, gold could surge further.

Sharp rallies often face pullbacks

After breaking above 4,500 dollars, gold quickly advanced into the 4,600-dollar range. The market shows signs of overheating, making it vulnerable to short-term selling. However, any decline is likely to attract dip buyers. With ongoing geopolitical risks and declining confidence in the dollar, funds are expected to continue flowing into gold as a safe-haven asset.

A pullback toward the 52-day moving average is possible.

Attention is focused on whether buying emerges around the 4,550-dollar level.

Today's Key Economic Events

| Economic Indicator | Time |

|---|---|

| US Consumer Price Index (CPI) | 22:30 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.