Gold Hits Record High as U.S. Jobs Data Misses Expectations

Fundamental Analysis

- U.S. employment data shows 50,000 jobs added vs. 70,000 forecast, strengthening rate-cut expectations

- Gold hits record high, precious metals market shows buying interest

- Geopolitical concerns rise from President Trump's statements

Record High

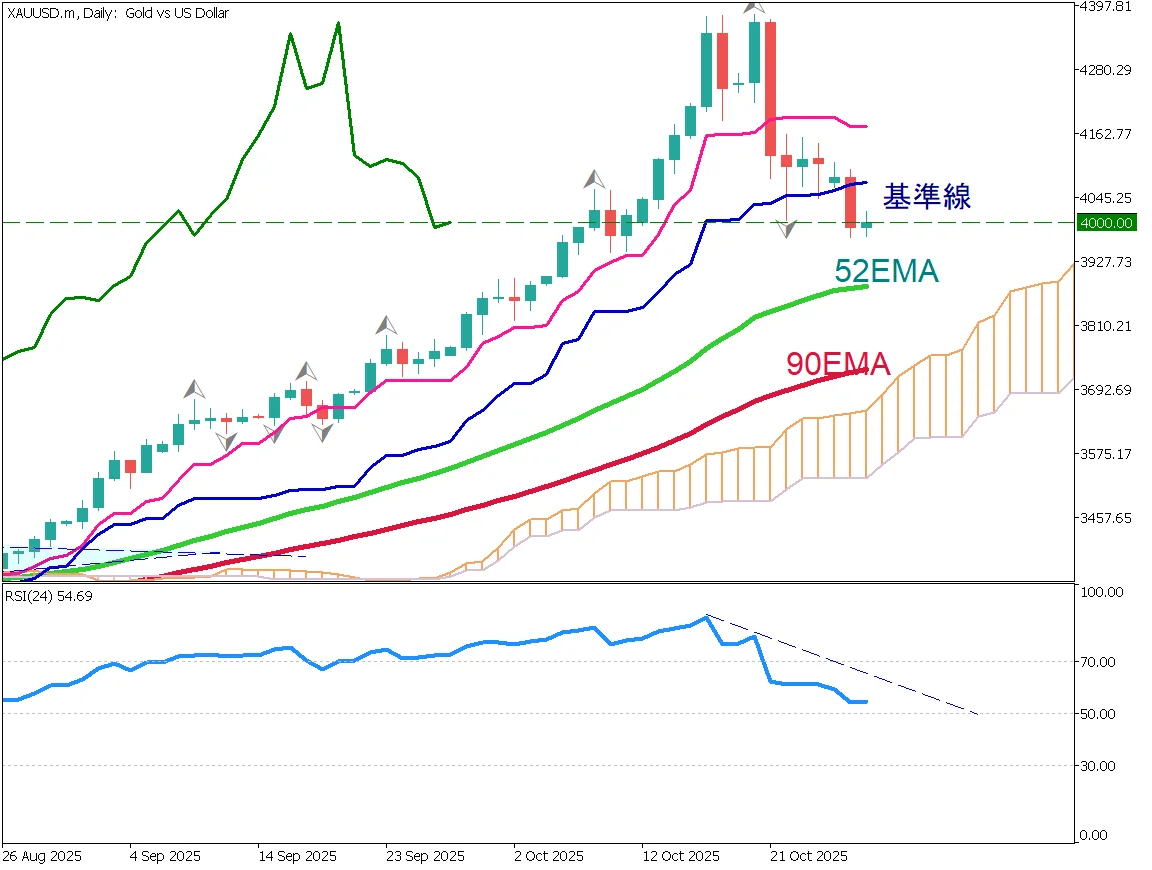

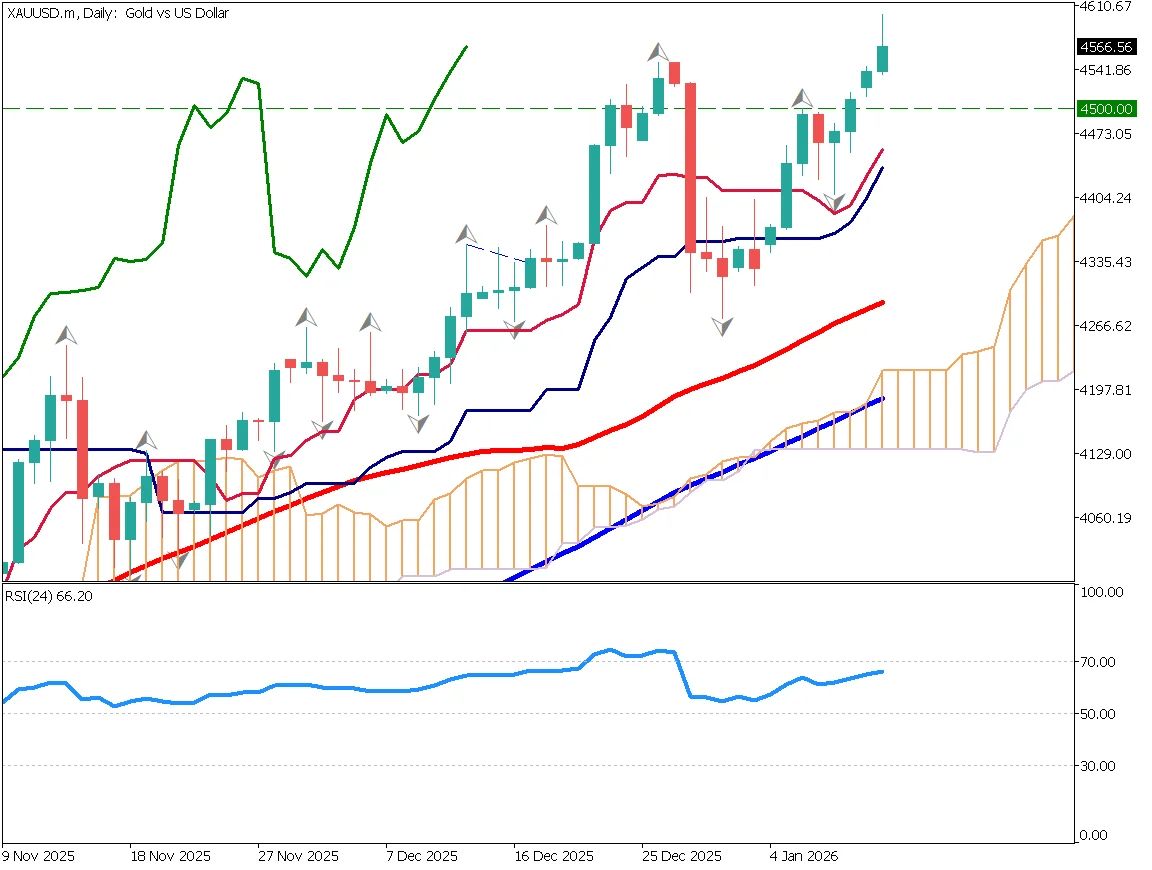

Gold reached a new record high, briefly touching $4,600. U.S. employment data released last Friday showed an increase of 50,000 jobs, below the market forecast of 70,000. This result strengthened expectations for interest rate cuts, leading to a weaker U.S. dollar and pushing gold prices higher.

In addition, President Trump has repeatedly made remarks suggesting the use of U.S. military power abroad. These include a sudden attack on Venezuela, claims over Greenland, possible military intervention in Iran, and ground operations in Mexico. Such statements have significantly increased geopolitical risks, although it remains unclear how serious these intentions are.

Gold is likely to maintain its upward trend, supported not only by dollar weakness but also by safe-haven demand and continued purchases by central banks. The strategy of buying on pullbacks remains unchanged.

Suggesting invasion of allied nations

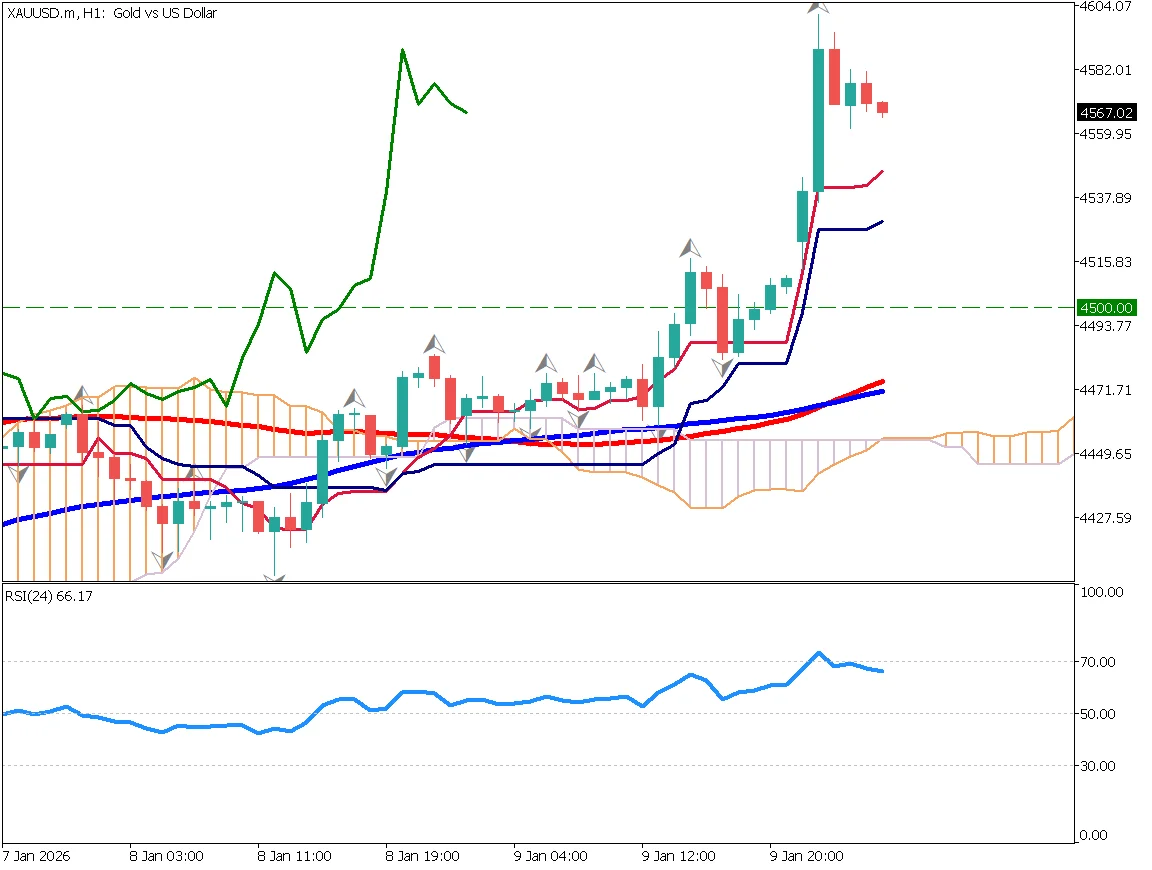

If the U.S. were to invade a NATO member country, security guarantees would be undermined. Looking at the 1-hour chart, profit-taking emerged around the $4,600 level. However, buying interest is expected to reappear near $4,500. Gold prices are currently driven more by fundamentals than by technical factors.

For day trading, a buy limit around $4,530 is considered, with profit-taking near $4,630 and a stop-loss below $4,500.

Today's Key Economic Events

| Event | Time |

|---|---|

| None | - |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.