[London Market] Has Gold Returned to an Uptrend?

Fundamental Analysis

- Signs of the U.S. government reopening have emerged, and investors should watch for upcoming U.S. economic data releases

- The UK ILO unemployment rate worsened to 5.0%, exceeding expectations, indicating a deteriorating labor market

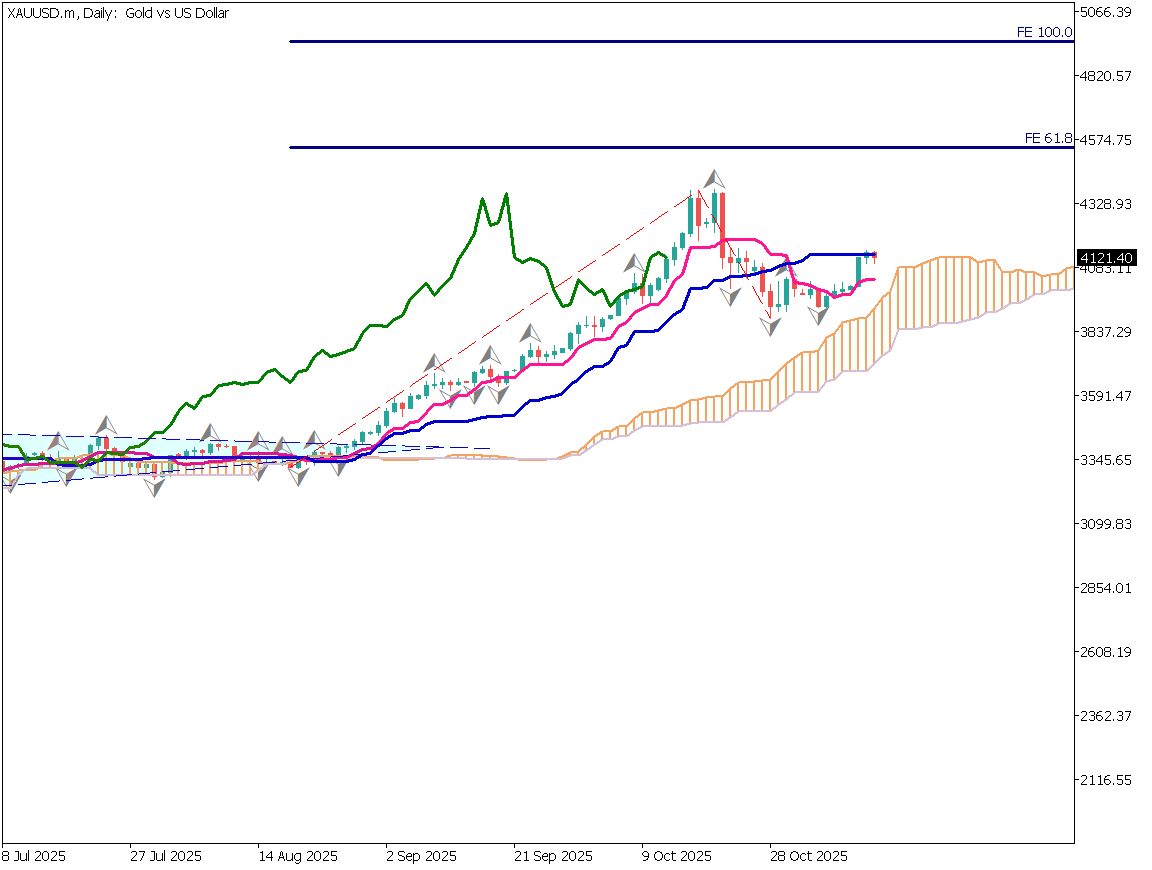

Gold Daily Chart

In the U.S., stock prices remain strong on the remnants of the AI boom. However, if U.S. unemployment rises, the dollar could weaken sharply, leading to renewed gold buying.

On the daily chart, gold faces resistance at the base line near 4,150 USD. A breakout above this level could pave the way toward a new record high. Based on Fibonacci expansion, targets can be projected at 4,550 USD (61.8%) and 4,950 USD (100%).

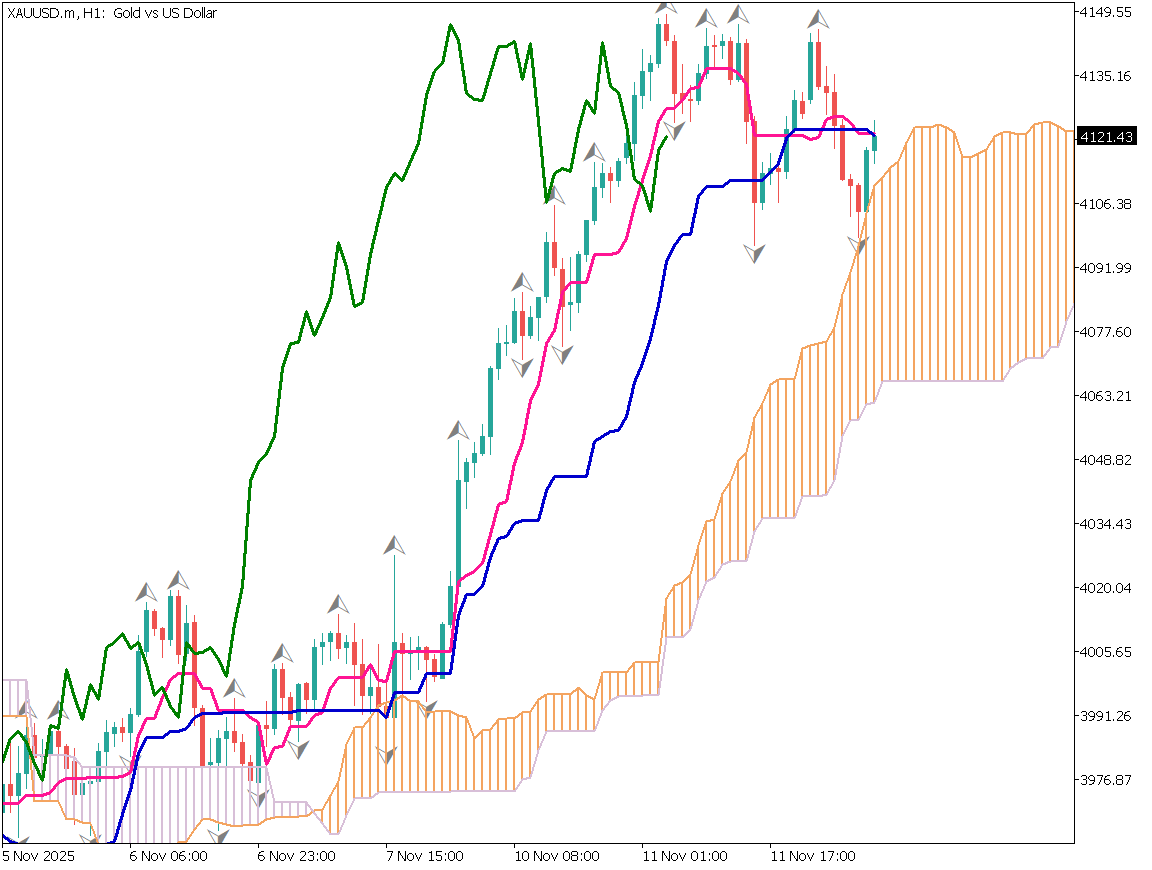

Gold Day-Trade Strategy

Four fractals have appeared around the 4,150 USD area. If positive catalysts for gold emerge, a strong breakout may occur. The Ichimoku Cloud offers solid support below, keeping the downside firm.

Gold remains in a range between 4,100 USD (support) and 4,150 USD (resistance). The cloud serves as a strong support zone, suggesting a potential upward move.

Given recent news, the U.S. labor market likely continues to weaken. If unemployment rises while AI-driven stock gains persist, the Fed may be forced to cut rates.

Rate cuts would lead to dollar selling and increased demand for gold as a safe haven.

Suggested Trading Plan

- Buy limit: around 4,100 USD

- Take profit: around 4,230 USD

- Stop loss: below 4,095 USD

Today's Key Indicator

Note: U.S. data releases may be delayed due to the government shutdown.

| Event | Time |

|---|---|

| Germany CPI | 16:00 (JST) |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.