Gold Rises as Expectations for a Fed Rate Cut Grow

Fundamental Analysis

- Expectations for a Federal Reserve rate cut are increasing, giving gold strong support

- U.S. employment conditions are worsening, and several Fed officials have made dovish remarks

- The Trump administration is also openly calling for rate cuts, increasing political pressure on the Fed

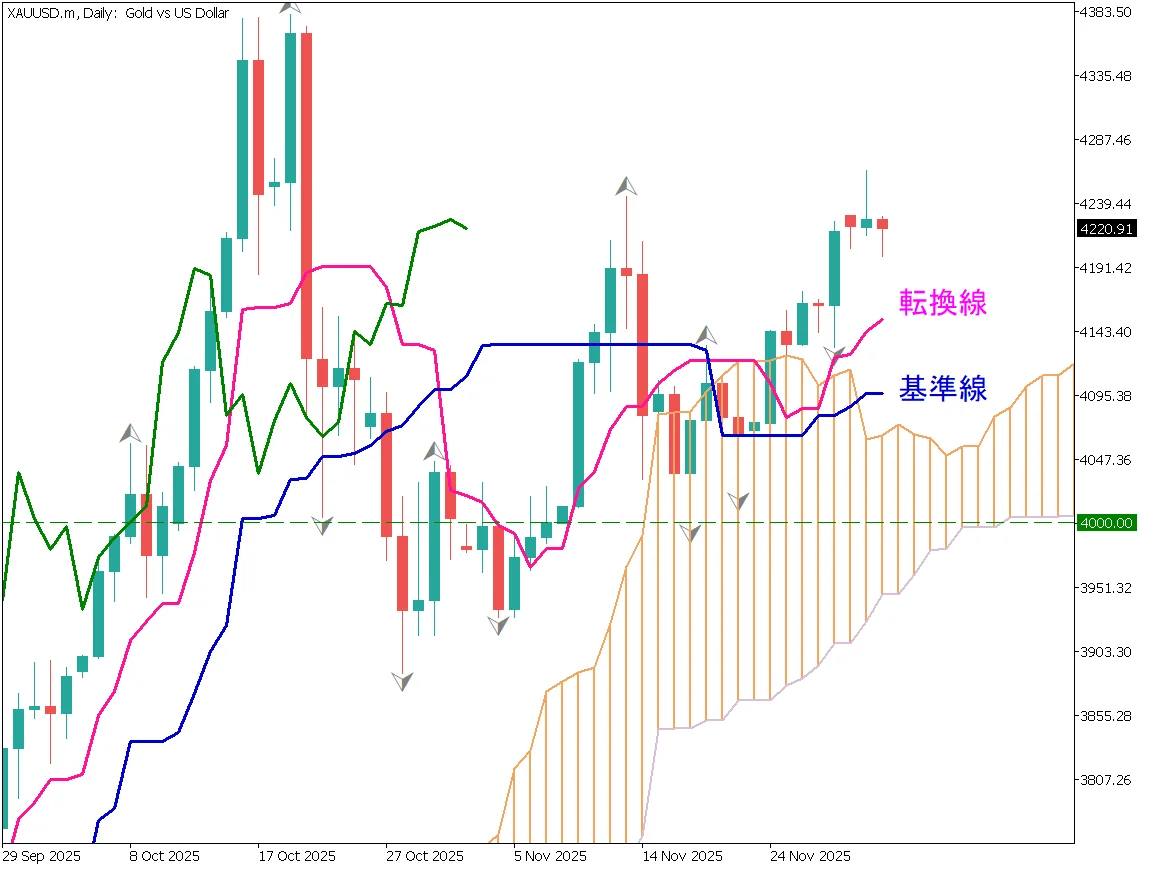

Gold – Daily Chart

Gold rebounded from the Ichimoku Cloud and has broken the recent high, surpassing $4,245. When expectations for U.S. rate cuts rise, gold — which does not yield interest — tends to gain. A breakout may not be immediate, but a move toward a new all-time high is possible, with $4,400 as the next target.

Technical signals also support the uptrend: the conversion line is above the base line, price has bounced from the cloud, and the lagging span has crossed above the candlesticks.

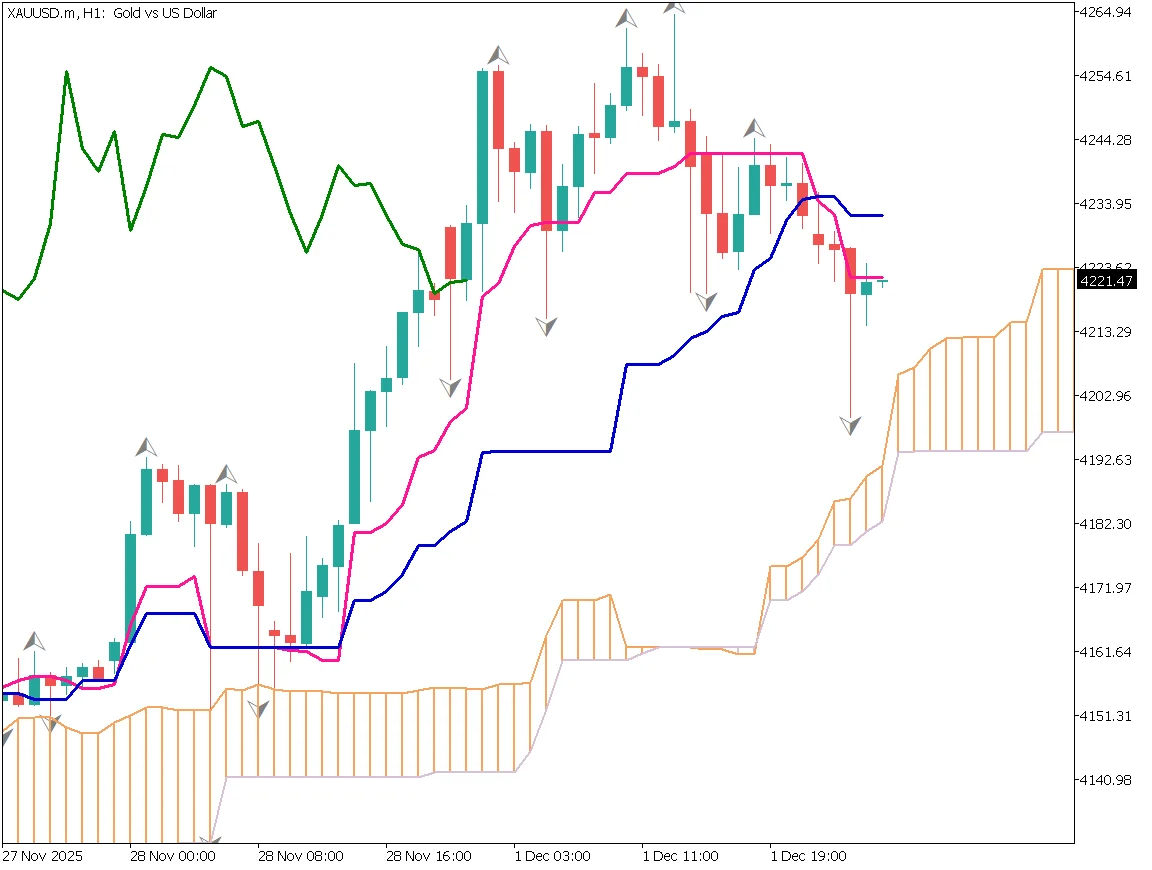

Gold Day-Trading Strategy

On the 1-hour chart, resistance is strong above $4,260, leading to profit-taking and a temporary drop. However, fundamentals still favor an upward move, making a buy-the-dip strategy reasonable.

A rebound from the $4,200 support level looks attractive. As the cloud thickens, another upward bounce is likely. If price breaks below $4,190, a stop-loss is recommended, and traders should wait for a new entry opportunity.

Major Indicators Today

| Economic Data & Events | Time |

|---|---|

| Eurozone Employment Data | 19:00 |

| Eurozone Consumer Price Index | 19:00 |

Ready to trade?

Open live accountThis material is for informational purposes only and does not constitute investment advice. Trading leveraged products involves significant risk of loss. Past performance is not indicative of future results.