Major currency pairs take a wait-and-see stance, focusing on Fed Chair Powell’s congressional testimony【March 7, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Slightly Higher; Some Market Traders See Short-Term Gains

- U.S. 10-year Treasury yields fall in the first half of New York, then rise later in the day

- Fed chairman’s congressional testimony and employment data ahead, making it difficult to see a sense of direction

- USD/JPY directionless, wait-and-see attitude ahead of key economic indicators

- Eurodollar rises, influenced by hawkish comments from ECB officials

- Some ECB officials support a 0.5% rate hike for the next four consecutive meetings

- Inflation in Europe, like in the U.S., is unexpectedly accelerating

- Focus on oil’s ability to break out of range, expectations for China’s economic recovery

- Oceania currencies weaken; China growth target remains at 5

Technical Analysis

The Bank of Australia’s policy rate announcement and Congressional testimony by Fed Chairman Jerome Powell are scheduled for today. The market forecast for the Bank of Australia’s policy rate is 0.25%.

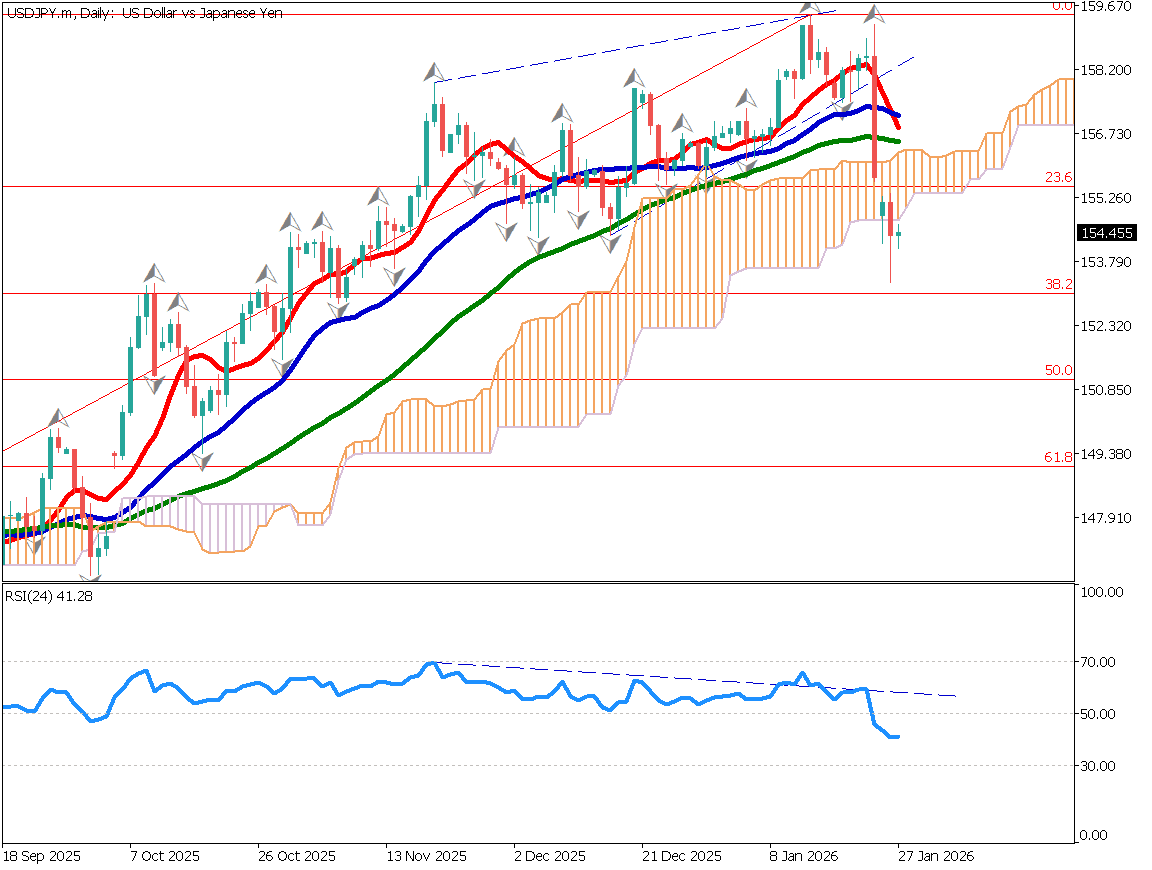

Dollar/Yen (USDJPY)

The hourly chart of the dollar/yen is analyzed. Today’s expected range is 134.90-137.12 JPY, with the 200 moving average acting as a support line, while the dollar’s weakening trend and wait-and-see attitude are restraining upside.

All eyes are on FRB Chair Jerome Powell’s congressional testimony to see how hawkish it will be; a possible 0.5% rate hike in March could trigger a sharp dollar rally and send the dollar surging.

| Estimated range | JPY 134.90 – 137.12 |

| Resistance line | JPY 136.57 |

| Support line | JPY 135.46 |

Euro Yen (EURJPY)

Euro buying is strengthening as speculation of an additional interest rate hike by the ECB is gaining strength. On the other hand, Japan’s policy of continued monetary easing is likely to raise awareness of the Japan-Europe interest rate differential. Euroyen has a large resistance zone at the JPY 145 level, and the focus will be on whether it can rise.

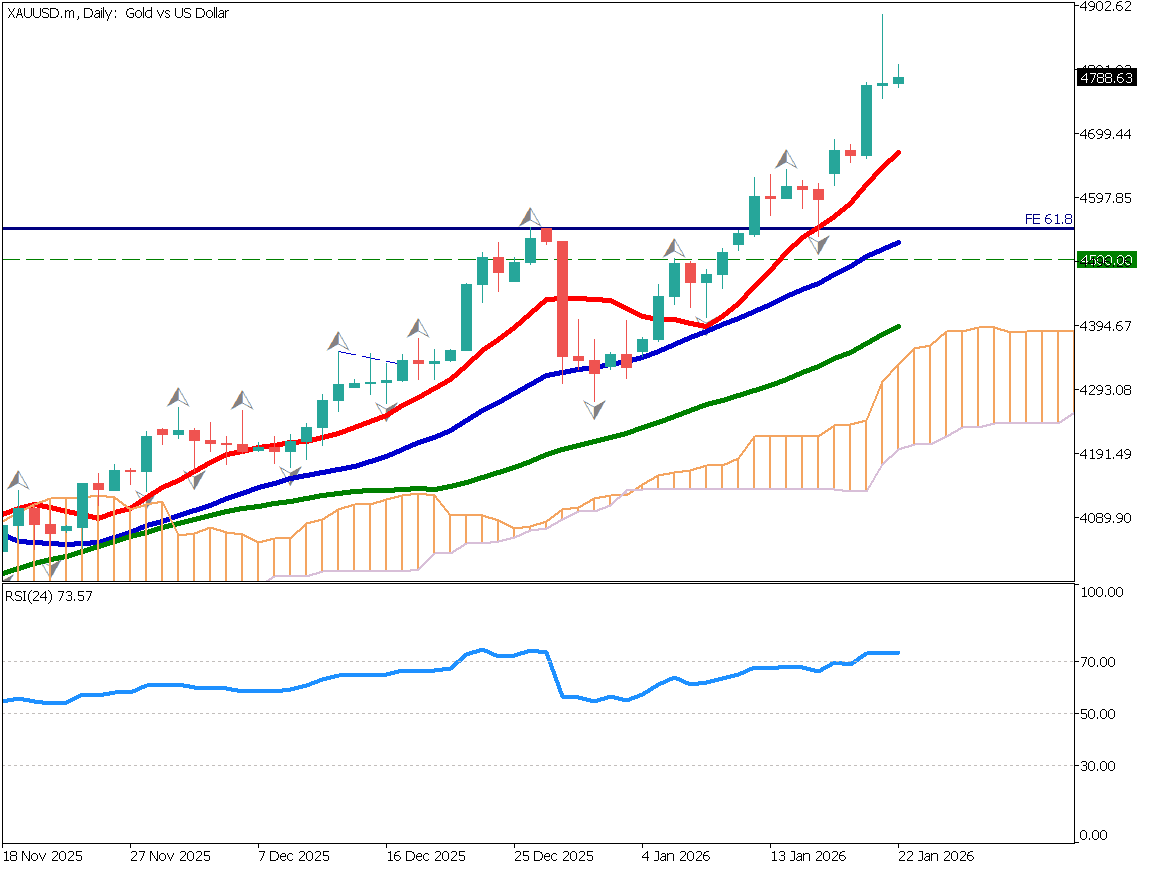

Drawing the Fibonacci Expansion on the 4-hour chart, we are aware of the 61.8% level at JPY 145. We expect the price to eventually rise to JPY 146.70, which corresponds to the 100% level. We would like to buy at the push, but if the price breaks below 61.8%, we will flatten out our position and wait and see.

| Estimated range | JPY 143.48 – JPY 145.57 |

| Resistance line | JPY 145 |

| Support line | JPY 144.25 |

Australian Dollar (AUDUSD)

An analysis of the Australian dollar’s daily trend shows that the pair is firmer around the 200-day moving average. Today’s Bank of Australia policy rate will be the focus of attention. A surprise would be likely to buy the Australian dollar, but the consumer price index released last week came in below expectations, suggesting that inflation has passed its peak. It is also susceptible to economic developments in China.

A move below USD 0.6720 would likely trigger stop losses and a possible decline.

| Estimated range | USD 0.668 – 0.6820 |

| Resistance line | USD 0.6780 |

| Support line | USD 0.672 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Bank of Australia Policy Rate | 12:30 |

| FRB Chairman Powell’s Congressional Testimony | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.