Wait-and-see market awaits U.S. jobs report; FRB Chairman does not rule out a major rate hike in March【March 9, 2023】

Fundamental Analysis

- Major U.S. stock indexes move mixed; Dow Jones Industrial Average falls

- Fed Chair Jerome Powell did not rule out a major rate hike in March during his second day of congressional testimony

- FRB Chairman Powell said that he will focus on CPI, PPI, and employment data

- ADP jobs report beat market expectations, highlighting tight U.S. labor market

- Major currency pairs remain in a small range, waiting for US jobs data

- Canadian Dollar Continues to Gain, Bank of Canada Decides to Maintain Policy Rate

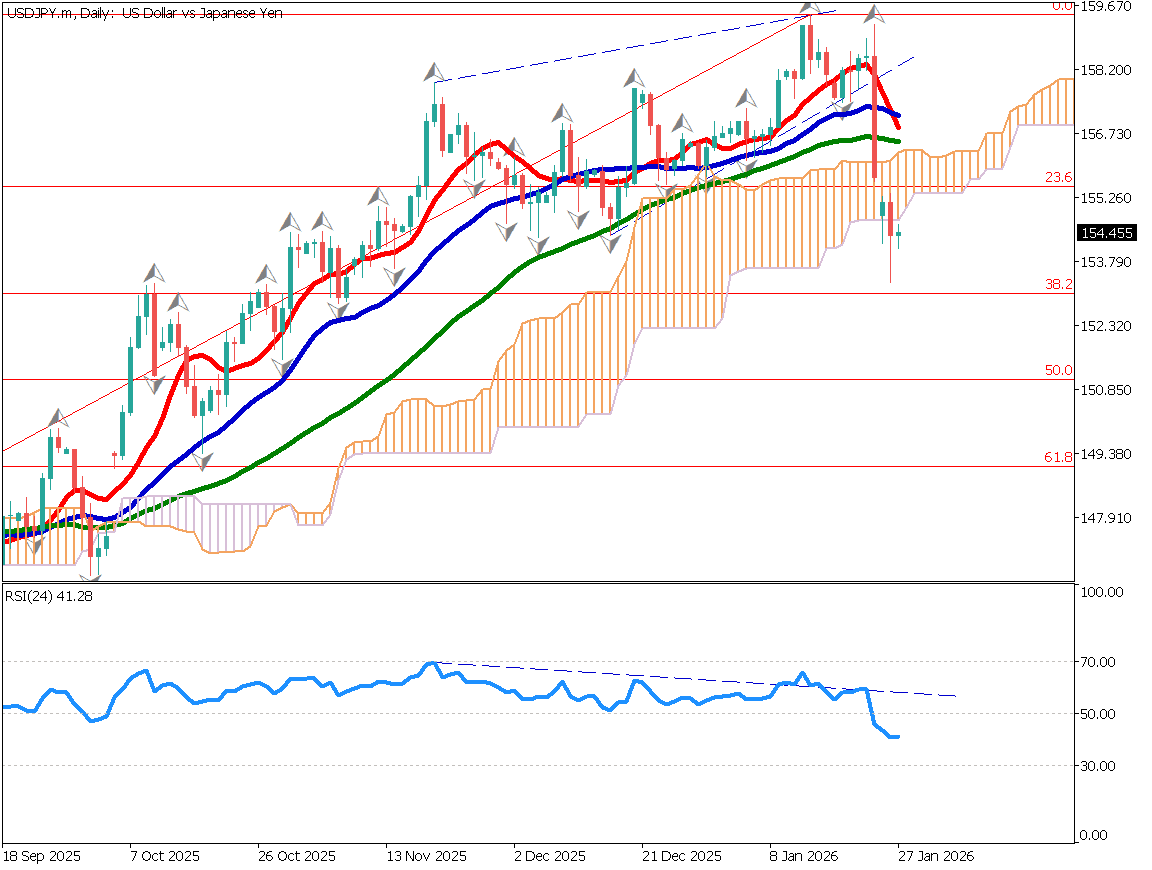

- USD/JPY falls back at 200 moving average, resistance zone at USD 137.80 is large?

- Dollar/Yen is expected to break out of JPY 137.80 and aim for JPY 140.00

- Eurodollar will focus on whether it can break out of the USD 1.050 round number

- A rebound at USD 1.050 is expected until the U.S. employment data

- Pound dollar will return to the 200 moving average, an opportunity to sell back to the 200 moving average

- Dollar index falls back at the 200 moving average, waiting for employment data as a buying opportunity for the dollar

Technical Analysis

U.S. unemployment insurance claims will be released today, but no other significant economic indicators are scheduled to be released. Although the dollar continues to appreciate across the board, the U.S. employment data is still in the spotlight and is expected to remain largely unchanged.

USD/JPY (USDJPY)

The dollar was restrained by a large resistance zone at JPY 137.80 and temporarily fell to JPY 136.47. It has since recovered to JPY 137.25 on pushback. Modest price movements are expected today. Range trading is likely to be the main strategy. Fundamentally, we are buying the dollar, so we would like to pick up the falling part.

| Estimated range | JPY 136.15~JPY 138.60 |

| Resistance line | JPY 137.87 |

| Support line | JPY 136.81 |

Eurodollar (EURUSD)

The market continues to be in a small range. The pair fell sharply in the wake of Fed Chair Jerome Powell’s congressional testimony, but is running out of material and appears to be waiting for tomorrow’s U.S. jobs report; if the pair breaks clearly below USD 1.050, it is expected to roll over stop-losses and search for lower prices.

| Estimated range | USD 1.046 – USD 1.062 |

| Resistance line | USD 1.0582 |

| Support line | USD 1.0520 |

Pound Sterling Dollar (GBPUSD)

The market is in a small range, but the daily chart shows that the price has fallen below the 200-day moving average, and the 200-day moving average is acting as a resistance line. We expect the price is likely to decline in the medium to long term. On the other hand, USD 1.180 is a very large support band, so it is doubtful that it will break today. The market is likely to remain range-bound pending tomorrow’s U.S. employment data.

| Estimated range | USD 1.1749 – USD 1.1921 |

| Resistance line | USD 1.1896 |

| Support line | USD 1.1810 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. unemployment insurance applications | 22:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.