Credit Suisse shares plunge, European banking shares also plunge in chain reaction, wreaking havoc【March 16, 2023】

Fundamental Analysis

- European Markets in Turmoil Over Credit Suisse Bank

- Credit Suisse shares plunged 32.9% at one point, to CHF$1.8

- European bank shares also fall across the board, thrown together by management concerns

- Credit Suisse’s largest shareholder refuses to provide additional support, widening fears of a business collapse

- Euro slumps sharply, euro-related currency pairs fall across the board

- ECB policy rate announcement, but market focus shifts to the future of the banking system

- Credit Suisse’s main focus is on services for high net worth individuals, and the impact is significant

- Credit Suisse’s stock price decline is similar to that of Lehman Brothers

- Swiss Financial Authorities Mention Possibility of Providing Needed Liquidity to Credit Suisse

- Credit Suisse is a huge bank and the government may not be able to bail it out

Technical Analysis

The stock price of Credit Suisse Bank, based in Zurich, plummeted. Naturally, the Swiss franc, which is supposed to be a safe-haven asset, was considered a risk currency and came under selling pressure. The U.S. dollar also suffered a string of three bank failures in one week. The U.S. dollar is also a risk currency. The remaining safe assets are gold and the Japanese yen. Both have rallied sharply. The decline in the Euro-Yen was particularly severe, and the all-around weakness of the Euro continued during the European and U.S. hours.

Euro-Yen (EURJPY)

The Euro-Yen fell violently due to the composition of the weaker Euro and stronger Yen, but rebounded after the Swiss authorities released a statement against Credit Suisse. JPY 140.60 area was a significant rebound and the pair recovered to JPY 141 level. if the pair recovers to JPY 141.37 area, the pair may fall back as the return highs will be recognized. Looking at the daily chart, the 200-day moving average has been broken and the RSI is at 44. There is a possibility that the pair may aim for the JPY 138 level in the future. Caution is needed as the market is sensitive to news related to Credit S.

| Estimated range | JPY 139.55 – JPY 142.37 |

| Resistance line | JPY 141.95 |

| Support line | JPY 140.59 |

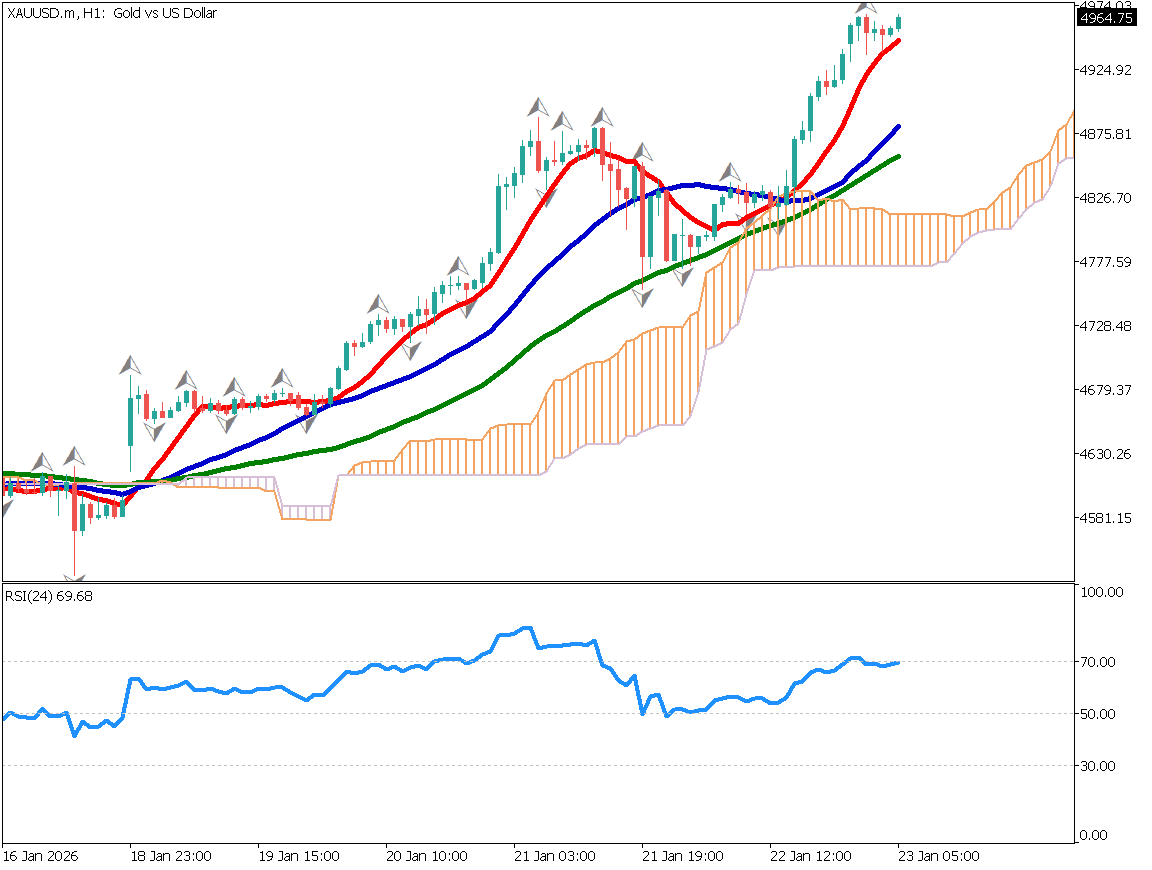

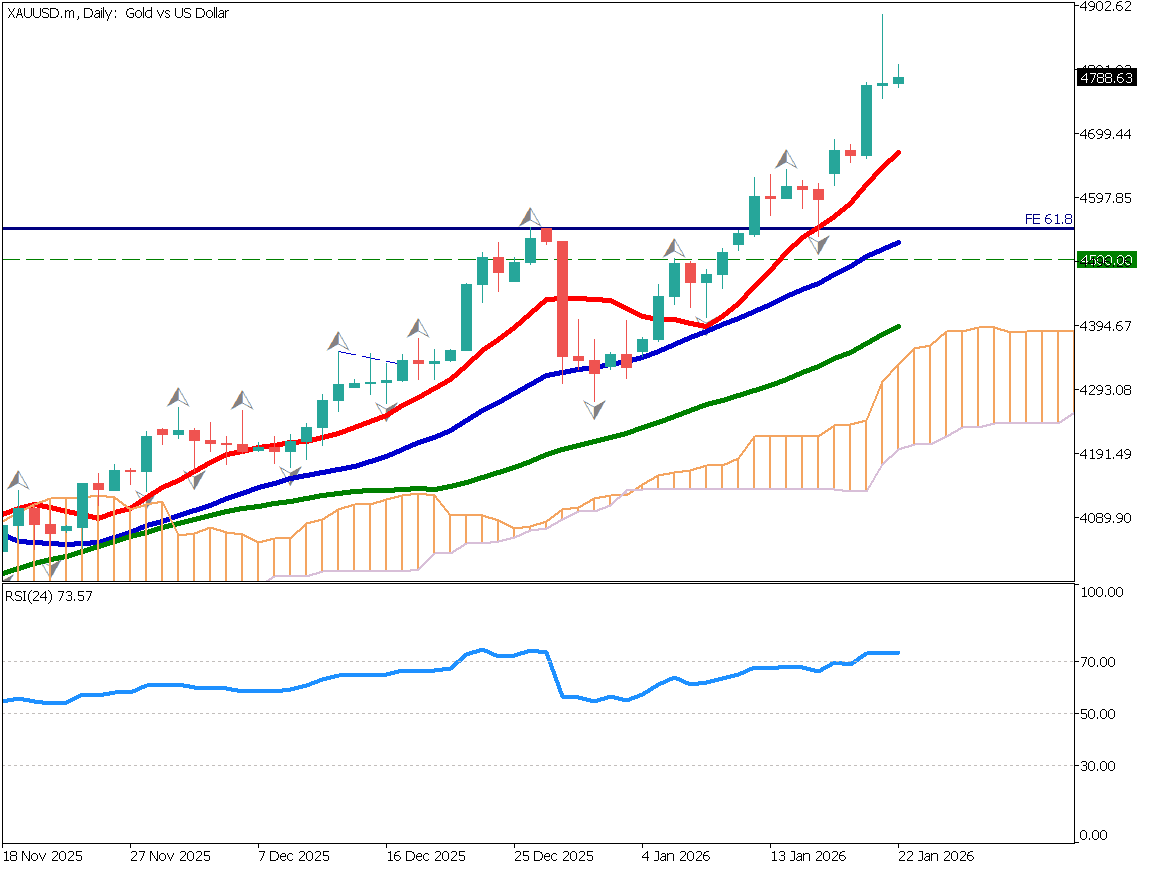

GOLD (XAUUSD).

Gold has a large resistance zone at USD 1922, forming an upper whisker. Risk aversion is expected to continue for the time being as the Swiss authorities’ statement has not eliminated concerns. While a pullback due to adjustments and profit-taking is possible, a push-back policy is in order; a clear trend can be seen on the hourly timeframe, and the focus will be on whether the uptrend can be maintained without falling below the high of USD 1914.

| Estimated range | USD 1902.00 – USD 1941.00 |

| Resistance line | USD 1911.00 |

| Support line | USD 1930.00 |

Dollar-Yen (USDJPY)

The dollar failed to fall below JPY 132.20. The rebound movement has brought the dollar back to the JPY 133 level. Although it is likely to settle down for a time, we still expect a high probability of a decline due to the strong yen factor. Therefore, our trading policy is to return to the market. The daily chart shows the RSI at 47, a downtrend level, and the 200-day moving average has become a resistance line and is falling back, and from the shape of the chart, the direction is to the downside. We will keep an eye on the news.

| Estimated range | JPY 131.60 – JPY 134.08 |

| Resistance line | JPY 133.75 |

| Support line | JPY 132.65 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Employment Statistics | 9:30 |

| European Central Bank Policy Rate Announcement | 22:15 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.