Deutsche Bank share price plunges, renewed selling pressure on European banking stocks【March 27, 2023】

Fundamental Analysis

- Officials and market expectations diverge on US and European policy rates; officials stress continued rate hikes

- Markets Factor in June Rate Hike Halt; Stock Prices a Factor in the Rally

- Australia clarifies policy on next rate hike halt, leading to AUD sell-off

- Russia Announces Plans to Deploy Strategic Nuclear Weapons in Belarus; Will This Affect Geopolitical Risks?

- Adjustment of last week’s strong JPY movement, yen selling starts today morning

- Markets focus on Deutsche Bank, share price down 14% at one point

- On the other hand, analysts point to Deutsche Bank’s 8H surplus

- Crude oil falls, closes below USD 70/bbl

Technical Analysis

Financial instability continues to simmer, and caution is needed in selling the euro and the dollar. Many statements defending Deutsche Bank have been made, and the euro-dollar, which had fallen sharply for a while, has been recovering. The yen’s strength has eased, but we are wary of the risk of yen appreciation. With Europe adding financial instability risk and geopolitical risk, caution will be needed on the downside risk of the EUR/JPY.

Eurodollar (EURUSD)

Drawing a large parallel channel on the Eurodollar, we can see that it is currently in an ascending channel. If Deutsche Bank concerns begin to dissipate, the pair could retest USD 1.10. On the other hand, if geopolitical risks become a concern and the euro sells off, USD 1.050 would be the main support line.

The daily RSI is near 54 and the upward trend remains intact. Therefore, we would like to maintain our push-buy policy today. However, once the price breaks below USD 1.07, we will liquidate our positions and check for any new material.

| Estimated range | USD 1.0690 – USD 1.0863 |

| Resistance line | USD 1.07820 |

| Support line | USD 1.0730 |

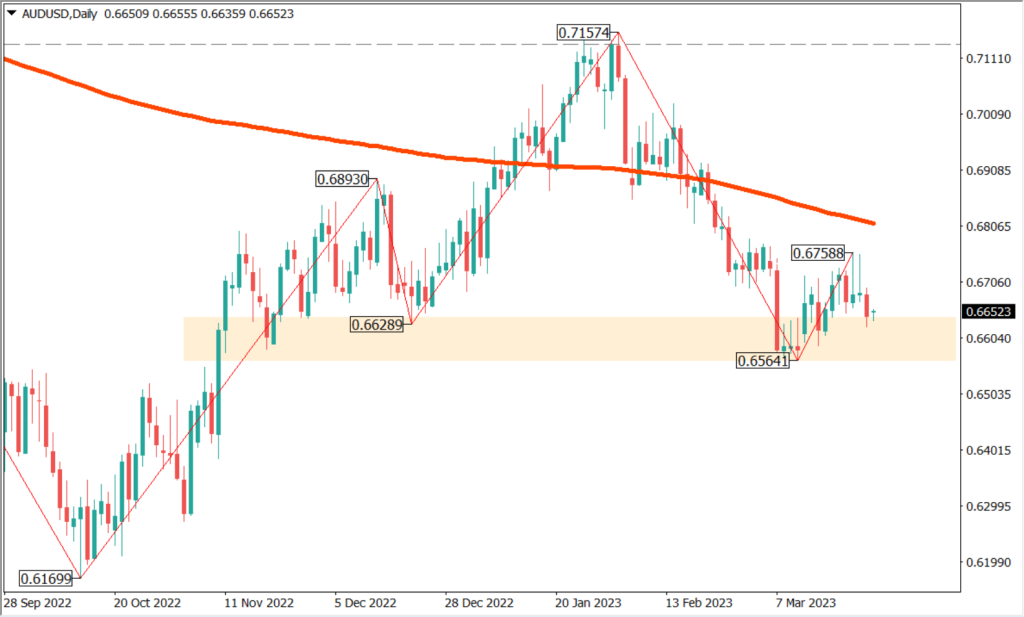

Australian dollar / U.S. dollar (AUDUSD)

The Australian dollar is fundamentally susceptible to increased selling pressure. However, USD weakness will also need to be considered. The resistance zone between USD 0.6560 and USD 0.6620 should be considered for the AUD. A range is expected here, but the shape of the market suggests that this is a neckline.

A break below USD 0.6560 would increase the likelihood of a significant decline. In that case, a decline to USD 0.6390 should be noted.

| Estimated range | USD 0.6583 – USD 0.6720 |

| Resistance line | USD 0.6686 |

| Support line | USD 0.6617 |

NASDAQ 100 (NASDAQ 100)

The NASDAQ 100, a stock index that does not include financial stocks, is in an uptrend. This is evidence that funds are flowing from financial stocks to other companies. Although officials are calling for continued rate hikes, the market also expects a halt in rate hikes at the June meeting, and stock prices are rising.

There is a major resistance line at USD 13070, and the focus today will be on whether the price can try to reach USD 13,000. However, if the U.S. economy worsens, it will be a factor for stocks to fall overall, so attention will be focused on the U.S. GDP scheduled for release this week.

| Estimated range | USD 12570 – USD 13070 |

| Resistance line | USD 12930 |

| Support line | USD 12750 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Speech by Governor, Bank of England | 2:00 a.m. the next day |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.