Exchange rates are risk-on; authorities consider further support measures for financial institutions【March 28, 2023】

Fundamental Analysis

- Dow Jones Industrial Average and S&P 500 rise, risk on as financial worries ease

- Nasdaq 100 falls, money flows out to financial stocks

- U.S. regional bank stocks rise 2.5%, authorities reportedly considering additional support measures

- Oil prices rise sharply, risk-on buying spreads

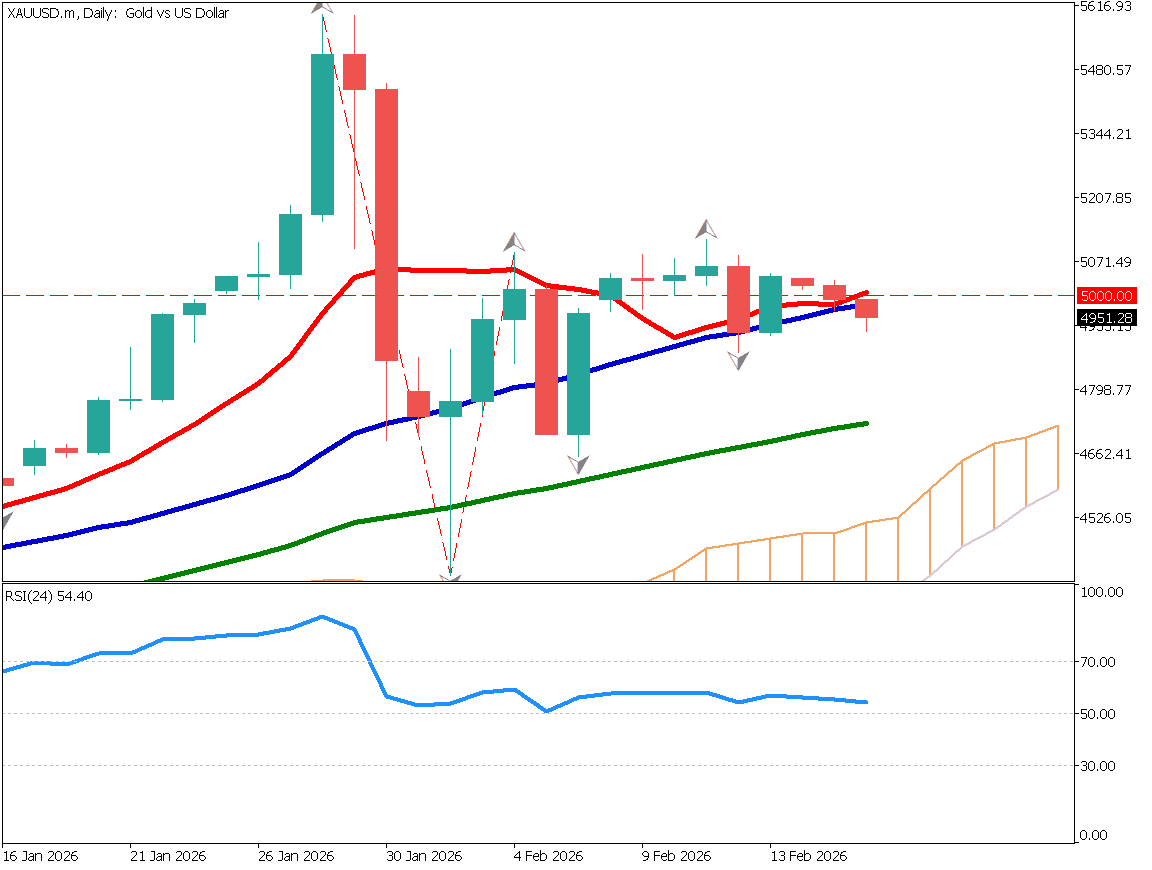

- Gold, a safe-haven asset, falls, may fail to break the $2,000 level

- Inverse yield between 10- and 2-year Treasuries remains, recession fears high

- Banking turmoil subsides, but probability of economic downturn increases

- Beware of temporary stock market rally; risk of yen strength remains

Technical Analysis

The overall currency market is clearly weakening against the dollar. The Japanese yen, a safe-haven asset, became the most easily sold currency, and the dollar continued to weaken. On the other hand, the Canadian dollar strengthened across the board due to the significant rise in crude oil prices.

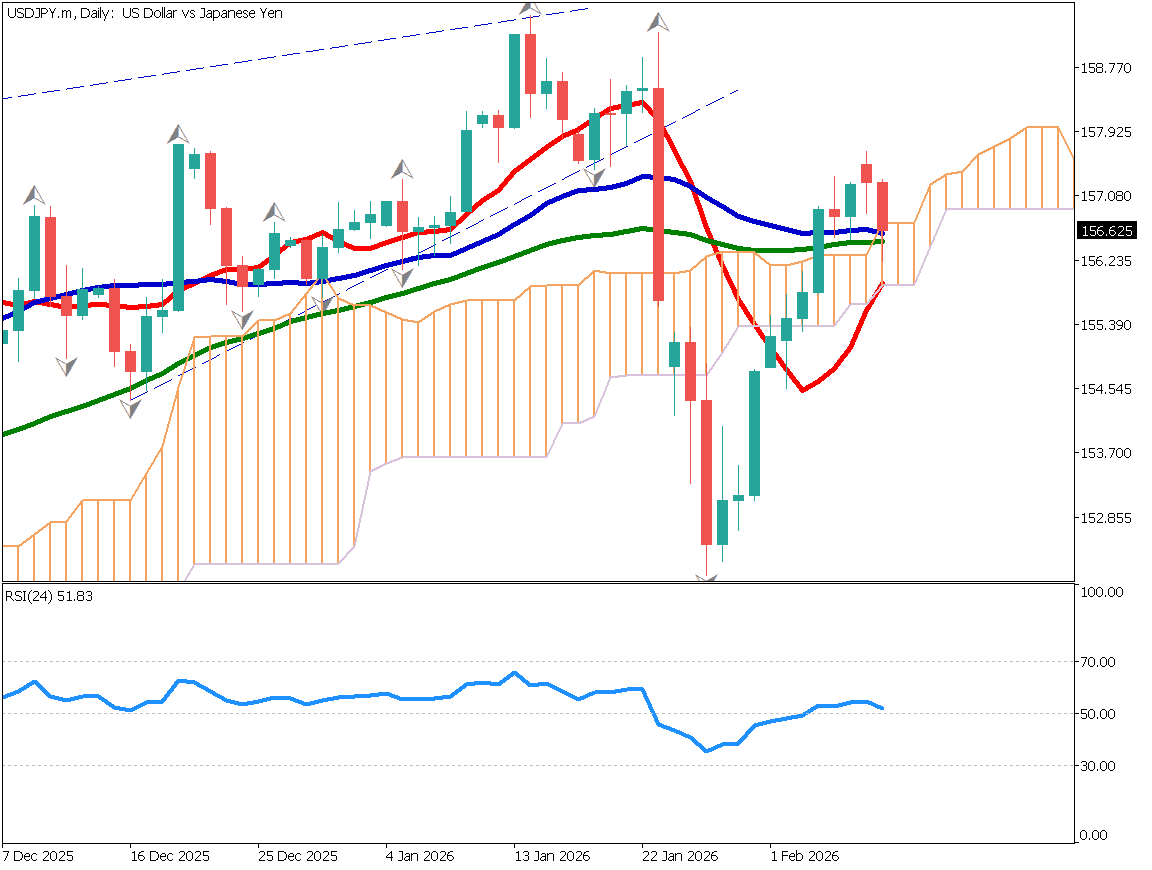

Dollar-Yen (USDJPY)

Analyzing the 4-hour chart of the USDJPY, a descending channel can be drawn. Currently, the pair is falling back at the upper band of the channel. Although the banking turmoil has calmed down, there are still concerns about a recession in the U.S., and it is difficult to imagine that the yen will remain weak forever. There is a probability that the yen will fall again, and a drop to the 130.60 area should be taken into account.

| Estimated range | JPY 130.57 – JPY 132.27 |

| Resistance line | JPY 131.80 |

| Support line | JPY 130.90 |

Canadian Dollar Yen (CADJPY)

The Canadian dollar strengthened across the board on the sharp rise in crude oil prices. On the other hand, risk-on awareness made it easier to sell the Japanese yen, and the Canadian dollar-yen rallied; the hourly chart shows that the pair is falling back at the 240 moving average (about 2 weeks).

We would consider the downside risk as the yen continues to be more easily bought overall.

| Estimated range | JPY 94.950 – JPY 96.950 |

| Resistance line | JPY 96.50 |

| Support line | JPY 95.60 |

Bitcoin

Analysis of the daily chart of Bitcoin shows the divergence in the RSI. The price had been soaring until last week, but there is a lull; we need to be wary of a major selloff, as divergence in the RSI is one of the signals that indicate a market turnaround.

A drop to around USD 27,360 should be taken into account.

| Estimated range | USD 25690 – USD 28420 |

| Resistance line | USD 27720 |

| Support line | USD 26730 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Bank of England Governor’s Parliamentary Testimony | 17:45 |

| Richmond Fed Manufacturing Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.