The cross yen rallied across the board, with absolute demand flows driving the yen lower【March 30, 2023】

Fundamental Analysis

- U.S. stock indexes are sharply higher; financial-related risk-off mood recedes

- The yen weakened across the board, with the dollar rising to around JPY 132.60

- Potential for large moves due to the coincidence of Multiple of 5 days, fiscal year-end, and quarter end

- Cross-yen currency pairs also rallied across the board, with the Canadian yen up 1.79

- Virtual currency markets are also steady, with bitcoin recovering to the USD 28,000 level

- Bitcoin has a major resistance zone at USD 29,000

- Bitcoin’s focus is on whether it can break out of the range

Technical Analysis

Analysis of currency strength and weakness showed that the yen was all around weak and the Canadian dollar was all around strong. The Canadian dollar rose significantly as expected the previous day. The yen selling is expected to pause today. Stock prices are bullish, with the NASDAQ, which mainly consists of high-tech stocks not including financial stocks, sticking to the upper end of its range.

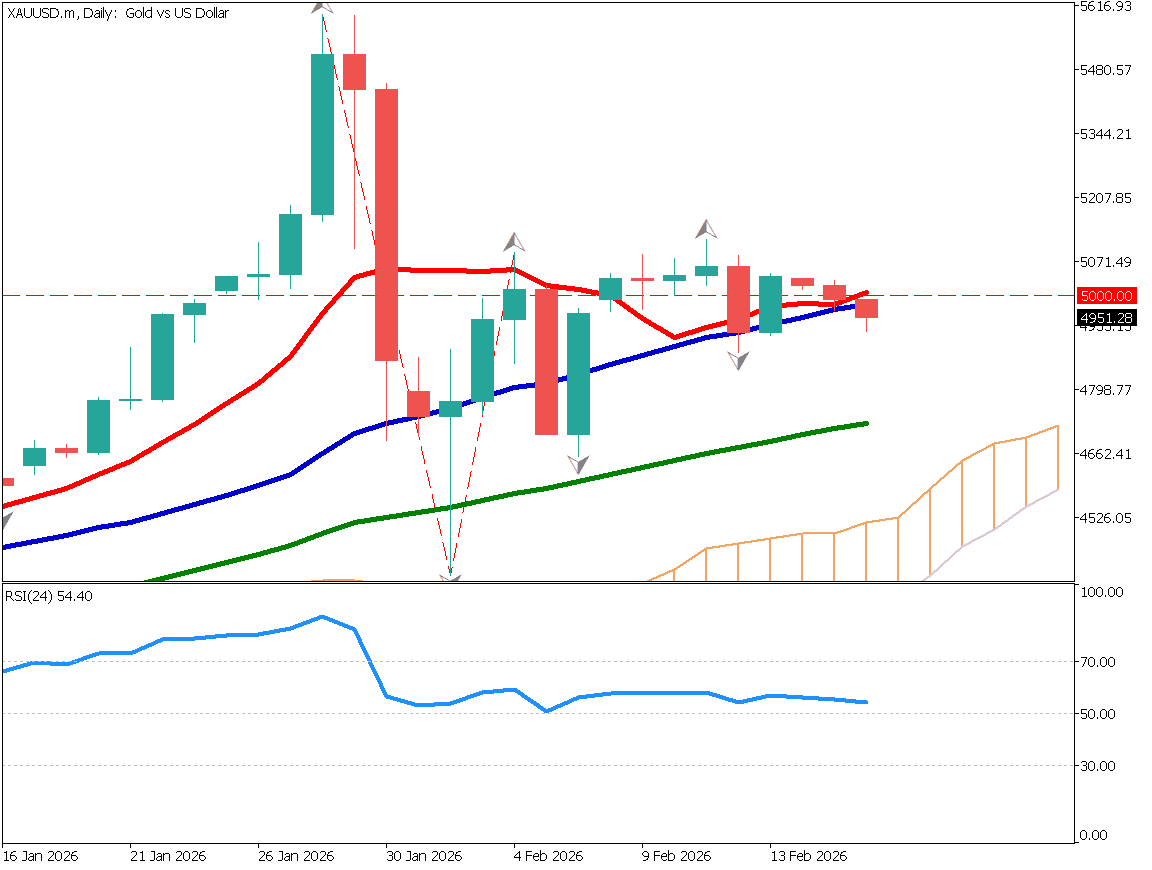

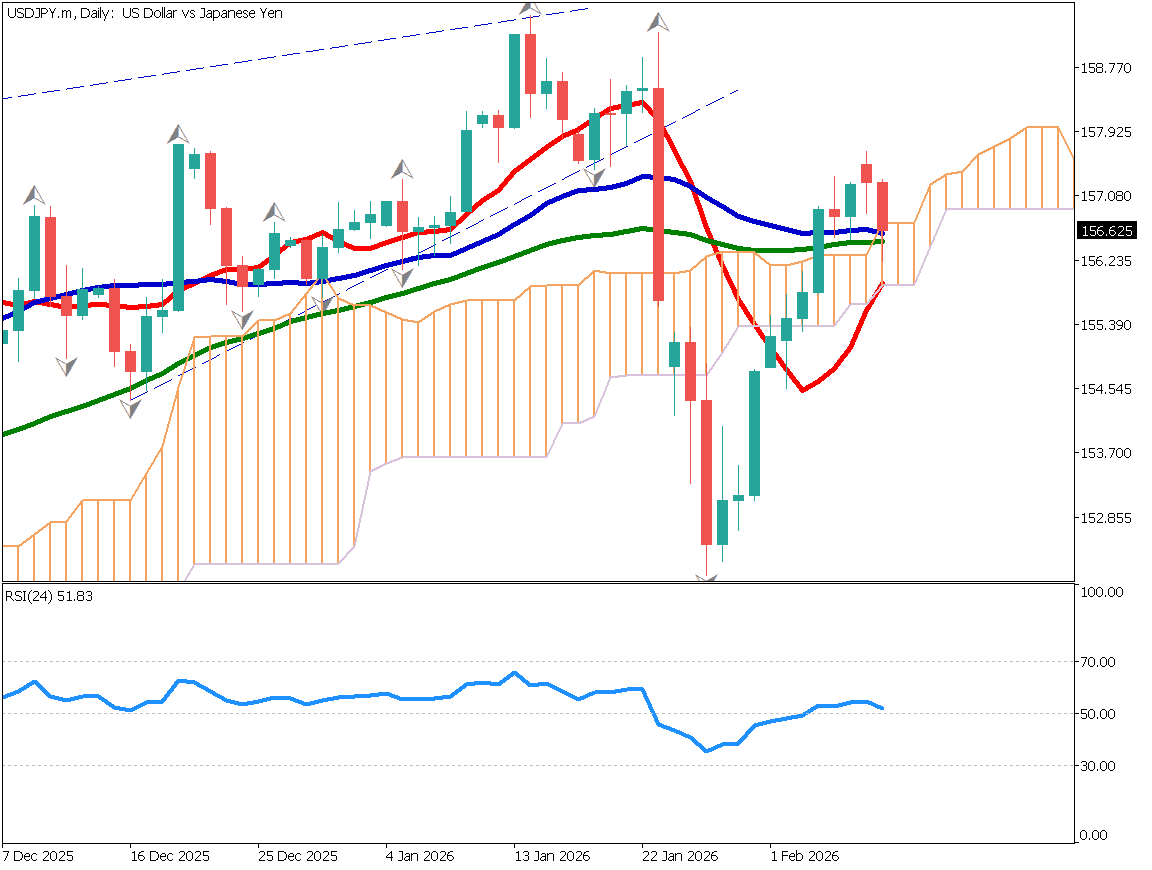

Dollar/Yen (USDJPY)

The dollar is completely out of its 4-hour downtrend. Drawing the Fibonacci Expansion, it rises to 132.65 nearly 100%. However, this level is a good level for a return to the upside: major resistance at 132.90.

A break of 132.90 would involve stops at the first half of JPY 133 and a move toward JPY 133.780 would need to be anticipated.

| Estimated range | JPY 131.130 – JPY 134.160 |

| Resistance line | JPY 133.470 |

| Support line | JPY 131.870 |

Pound Sterling Yen (GBPJPY)

Analyzing the daily chart of GBPJPY, the lows are cutting up and closing above the 240 moving average. We would like to target a deep push, which we consider around JPY 162.35 as a guide. However, if the price falls below JPY 162.10, we need to flatten our position and consider news material again.

The U.S. GDP is also scheduled to be released today, so we will pay close attention to the movements before and after the announcement.

| Estimated range | JPY 161.550 – JPY 165.20 |

| Resistance line | JPY 164.620 |

| Support line | JPY 162.780 |

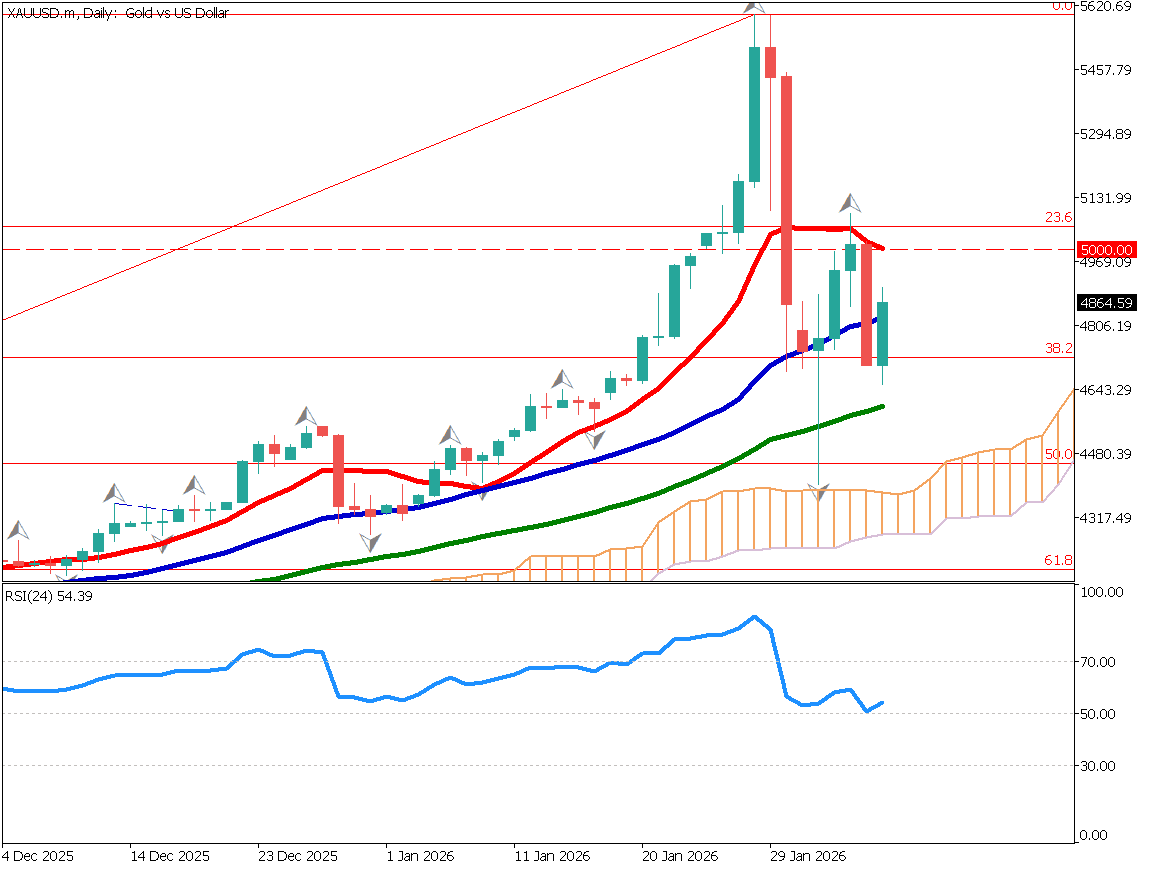

NASDAQ (NASDAQ 100)

Analyzing the daily chart of the NASDAQ, we can see a chart form supported by the 240-day moving average. The moving average is clearly perceived as a support band. Technically, the market is expected to rise.

Assuming a large long-term N, the price could rise to around USD 13860 above the N-calculated value. The USD 13,000 level is a major milestone price, and a breakout could come in April. The USD 13,000 level is likely to be the stage for April.

| Estimated range | USD 12600 – USD 13070 |

| Resistance line | USD 12950 |

| Support line | USD 12770 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| German Consumer Price Index | 21:00 |

| U.S. GDP | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.