U.S. economic indicators fell short of expectations; expectations of a halt in interest rate hikes but fears of economic deterioration【April 4, 2023】

Fundamental Analysis

- Crude Oil Surges, Rises in Big Window, Hovering Above USD 80

- Australian and Canadian dollars continue to appreciate

- U.S. ISM business sentiment index falls short of expectations, dollar weakens

- S&P 500 Rises; Energy Stocks Gain Significantly

- Stocks rise, gold rises

- Gold sensitive to signs of U.S. economic deterioration in addition to dollar weakness

Technical Analysis

Oil prices rose sharply, and as expected, the resource-based currencies were heavily bid up. The impact of the coordinated production cut was significant and remained above USD 80/bbl. While there were expectations for a halt in interest rate hikes due to U.S. economic indicators falling below market expectations, there was a noticeable flow of funds into gold, a safe-haven asset, as it implies a worsening economy.

Today, the dollar is weakening and the Australian dollar is appreciating. Attention will be focused on the Australian policy rate announcement and the statement.

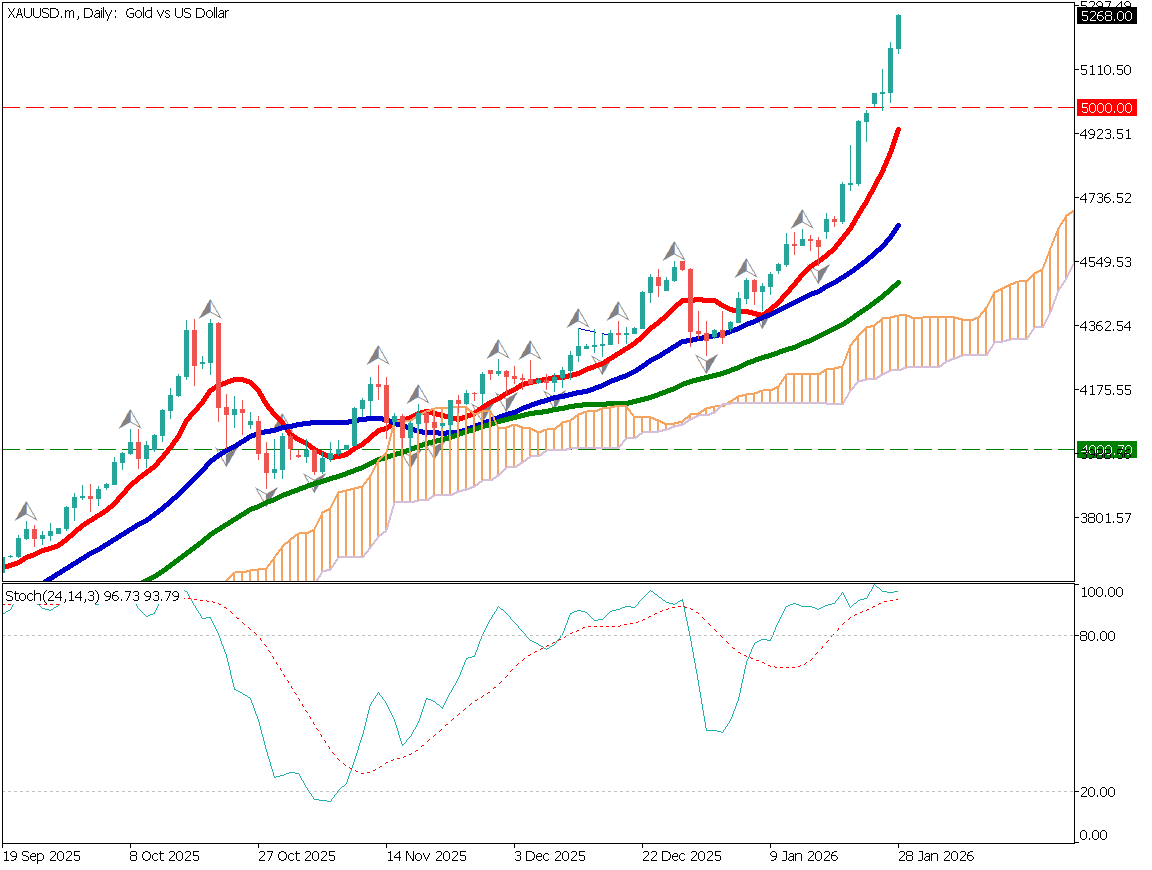

Gold (XAUUSD)

Gold rallied sharply after falling to USD 1950. The daily chart shows that the market remains range-bound, but the lower price looks very firm. The focus will be on whether or not the recent high of USD 2009 will be exceeded.

Since the U.S. economy is expected to deteriorate, a break above USD 2009 for some reason this month could lead to a big rally with stop-losses involved.

| Estimated range | USD 1953 – USD 2014 |

| Resistance line | USD 1998 |

| Support line | USD 1969 |

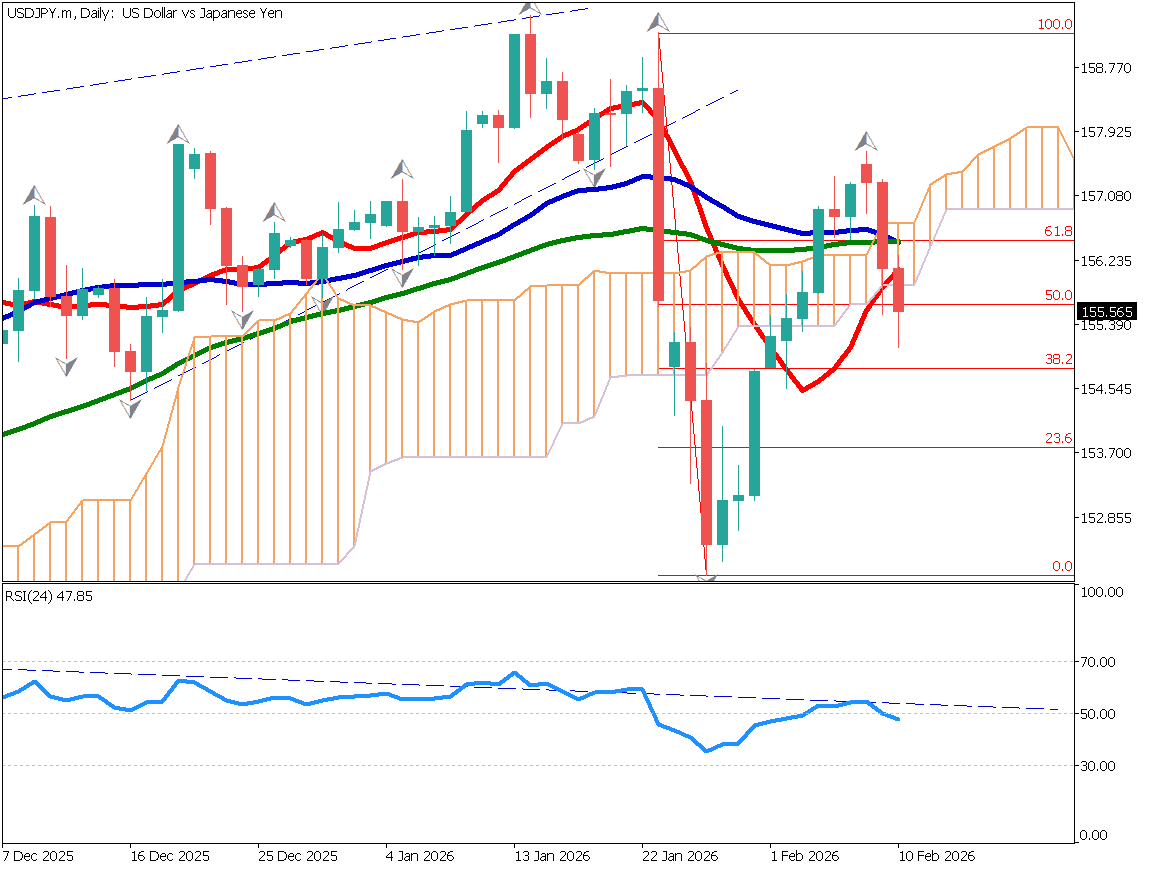

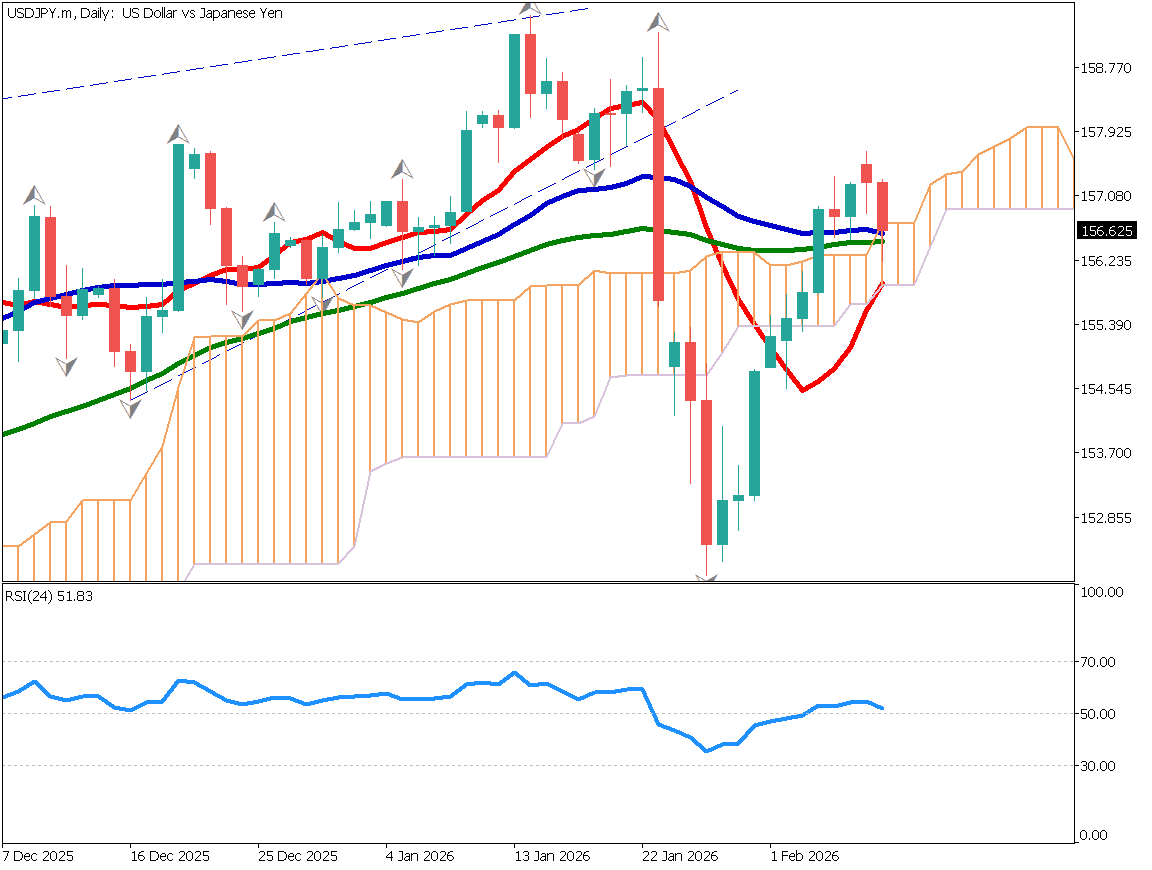

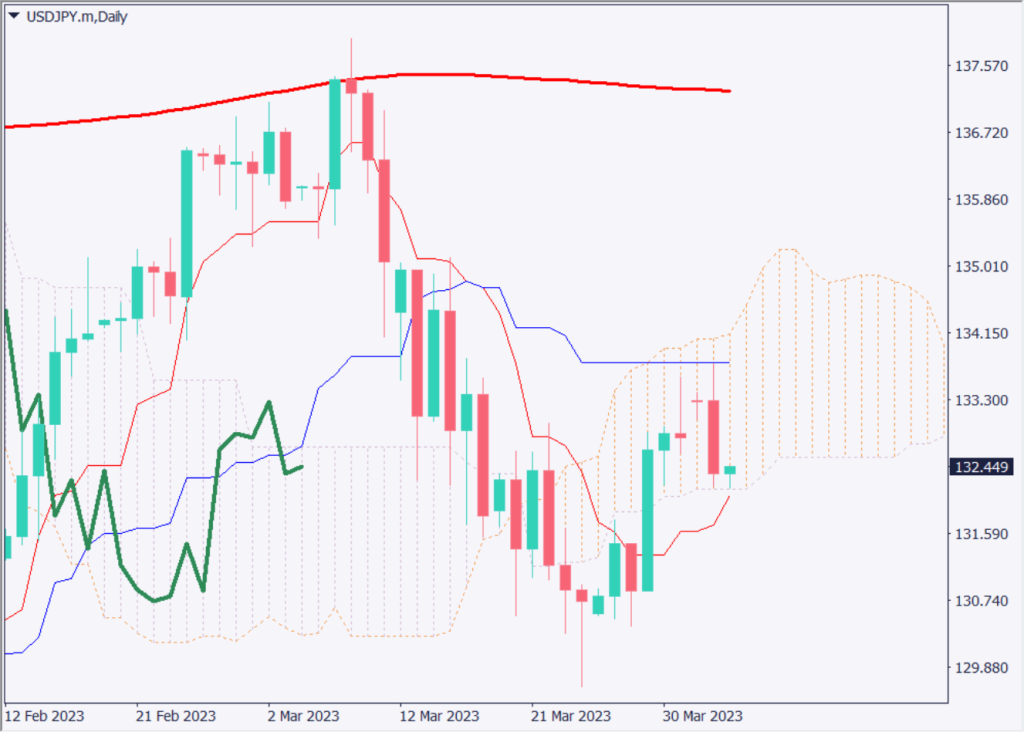

U.S. Dollar/Yen (USDJPY)

The dollar dropped sharply from the JPY 133 level. Analysis of the daily chart confirms that the pair is reacting to the reference line on the Ichimoku Kinko Chart. The pair is currently in the clouds, making it difficult to discern a sense of direction. The focus will be on this week’s U.S. employment data.

| Estimated range | JPY 131.70- JPY 133.45 |

| Resistance line | JPY 133.10 |

| Support line | JPY 132 |

Australian Dollar Yen (AUDJPY)

The AUDJPY has exceeded the 50% Fibonacci retracement and is targeting 61.8%. The Australian dollar, a resource-rich currency, is becoming more easily bought, and we expect a target of JPY 90.35 going forward; a clear break above JPY 90 could lead the pair higher, with stops rolling in.

| Estimated range | JPY 88.60 – JPY91.00 |

| Resistance line | JPY 90.50 |

| Support line | JPY 89.00 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Policy Rate Announcement | 13:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.