Yen all over the place, additional rate hike likely even if U.S. economic indicators deteriorate?【April 6, 2023】

Fundamental Analysis

- U.S. ADP Employment Report Falls Short of Estimates

- U.S. ISM Non-Manufacturing Index falls short of expectations

- U.S. economic deterioration begins to show up in indicators and stock prices are on a downtrend

- Yen strengthens on risk aversion

- Cross currency weakness, with the dollar falling to the 130-yen level

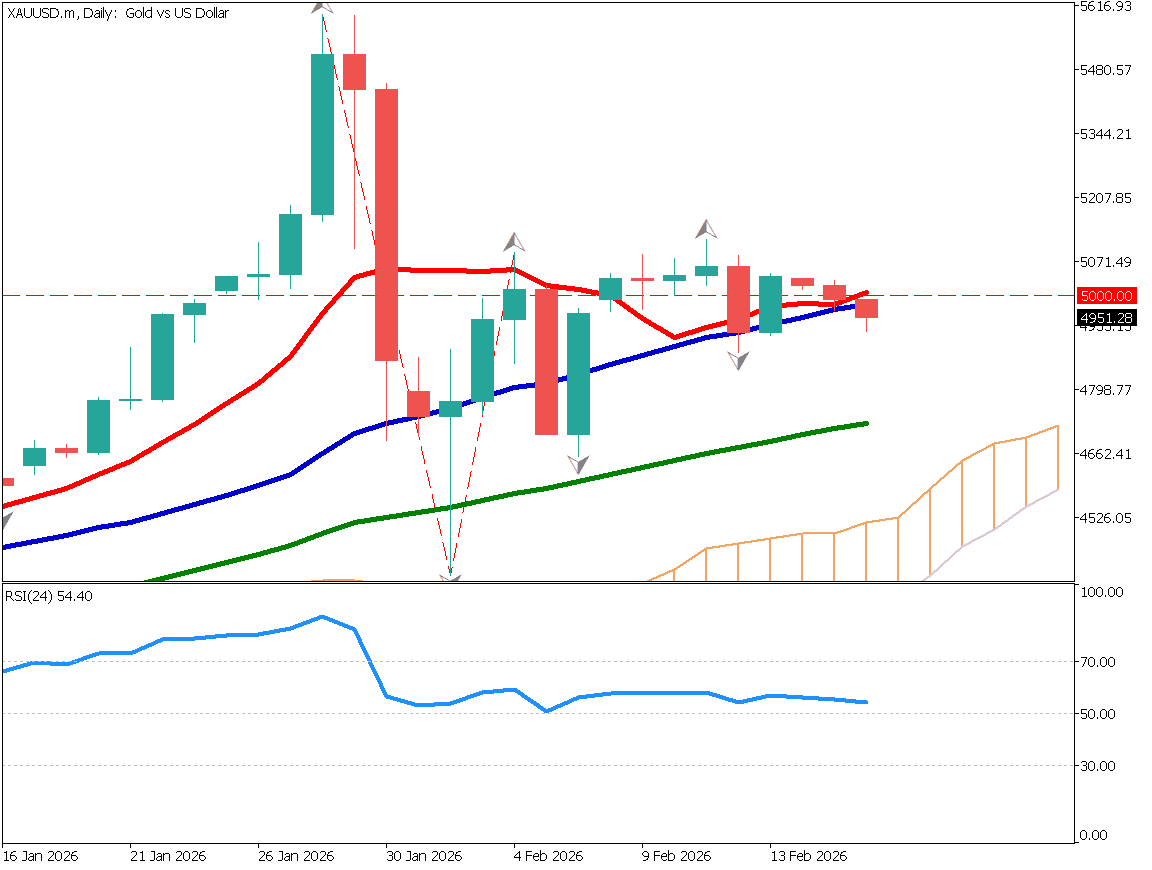

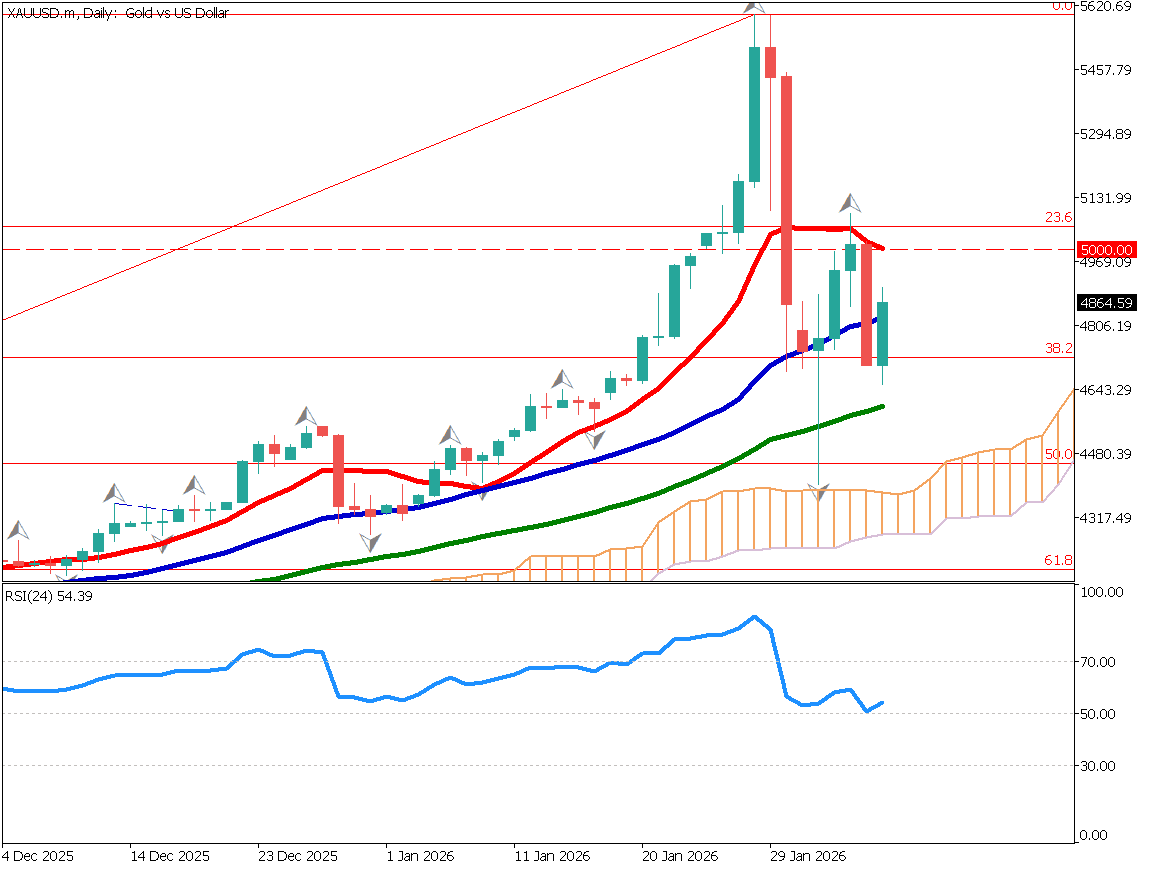

- Gold hovering near USD 2020, looking for a new high for the year

- Crude oil lacks direction, economic deterioration becoming clearer

- U.S. monetary officials hint at additional rate hikes

- Fears that rate hikes could accelerate recession, putting downward pressure on stock prices

Technical Analysis

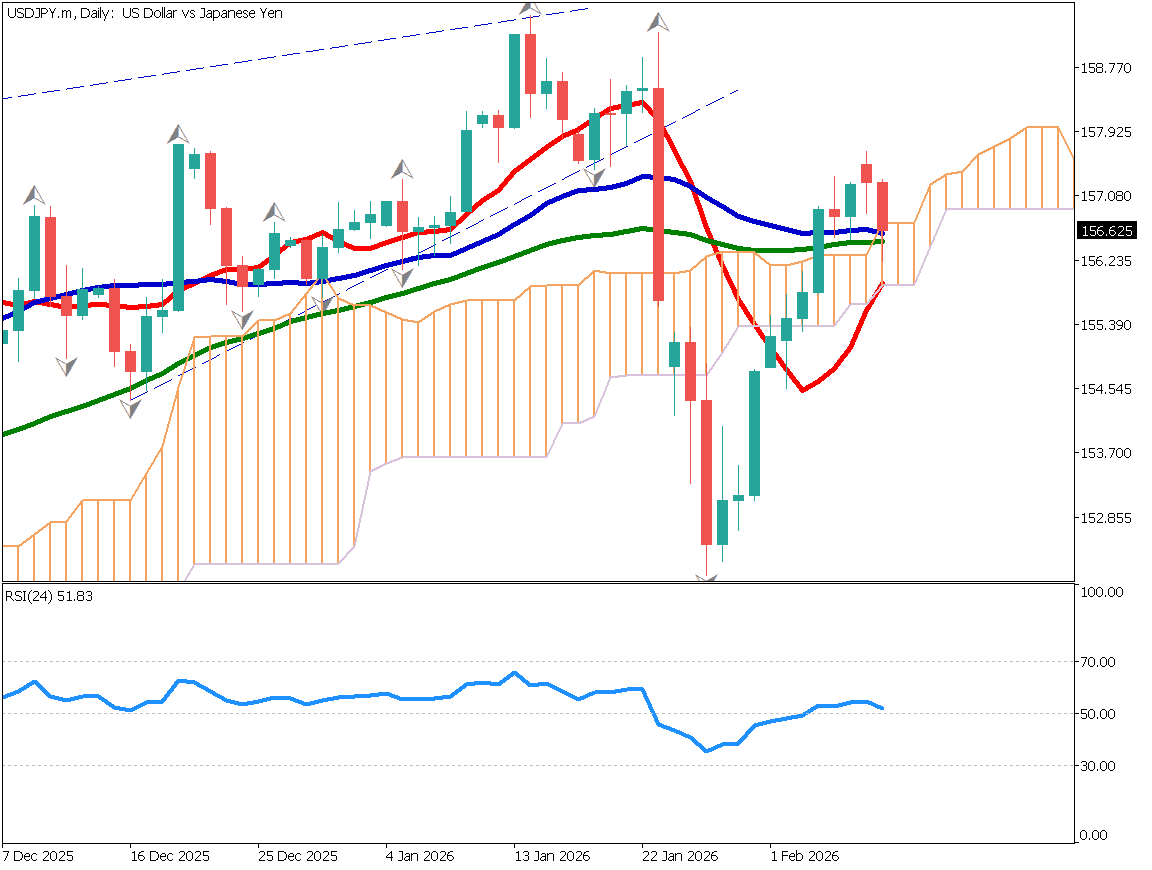

On the currency markets, the yen is appreciating across the board. The dollar dropped for the third day in a row to the JPY 130 level. The market is quiet as countries around the world are preparing for the holiday season, including Easter. Technical analysis does not work well in a market with low trading volume, and caution should be exercised as unexpected moves may occur.

Although profit-taking selling is taking place, we do not believe that it is a new order. Today & tomorrow will be holidays in many countries around the world, and market participants will be extremely small. Under such circumstances, the U.S. employment data could have a large impact.

Euro-Yen (EURJPY)

Analyzing the 1-hour chart, we see a nice reversal at the moving average. The price is below the lows and we believe that the probability of a decline is high; the RSI is at 33, so this is the phase where we would consider a sell order, although it may be short term. The policy is to flatten once above the moving average.

| Estimated range | JPY 141.67 – JPY 143.88 |

| Resistance line | JPY 143.080 |

| Support line | JPY 141.75 |

Ethereum (ETHUSD)

Ethereum is on a daily basis and is rebounding at its moving average. After the rebound, a large upper window (gap) was formed, and it is still rising, making it understandable that there is a very strong buying interest. With the major update “Shanghai” coming up, the price may be rising due to a sense of anticipation.

The round number of USD 2,000 is in sight.

| Estimated range | USD 1810 – USD 1970 |

| Resistance line | USD 1940 |

| Support line | USD 1880 |

Australian Dollar-Yen (AUD/JPY)

Looking at the daily chart of AUDJPY, a bearish wrapping leg (outside bar) has appeared near the return high. This is a signal of a turn to a downtrend, with the RSI also hovering below 50, and the cross yen as a whole is softening. Therefore, we expect the pair to fall toward the 86-yen level in the near term.

| Estimated range | JPY 86.85 – JPY 88.55 |

| Resistance line | JPY 88.26 |

| Support line | JPY 87.50 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Canada Employment Statistics | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.