BOJ Governor Ueda hints at continuation of YCC, Yen sells off and USDJPY rises【April 11, 2023】

Fundamental Analysis

- U.S. Stock Markets Slightly Rebound, Sold Off on Additional Rate Hike Speculation, but Bought Back

- New BOJ Leadership Starts, Markets Focus on Possible Policy Changes

- BOJ Governor’s press conference hints at continuation of negative interest rate policy and YCC policy

- The yen fell sharply and the dollar rose to late JPY 133

- Cross Yen also rises across the board, trading starts today in Europe

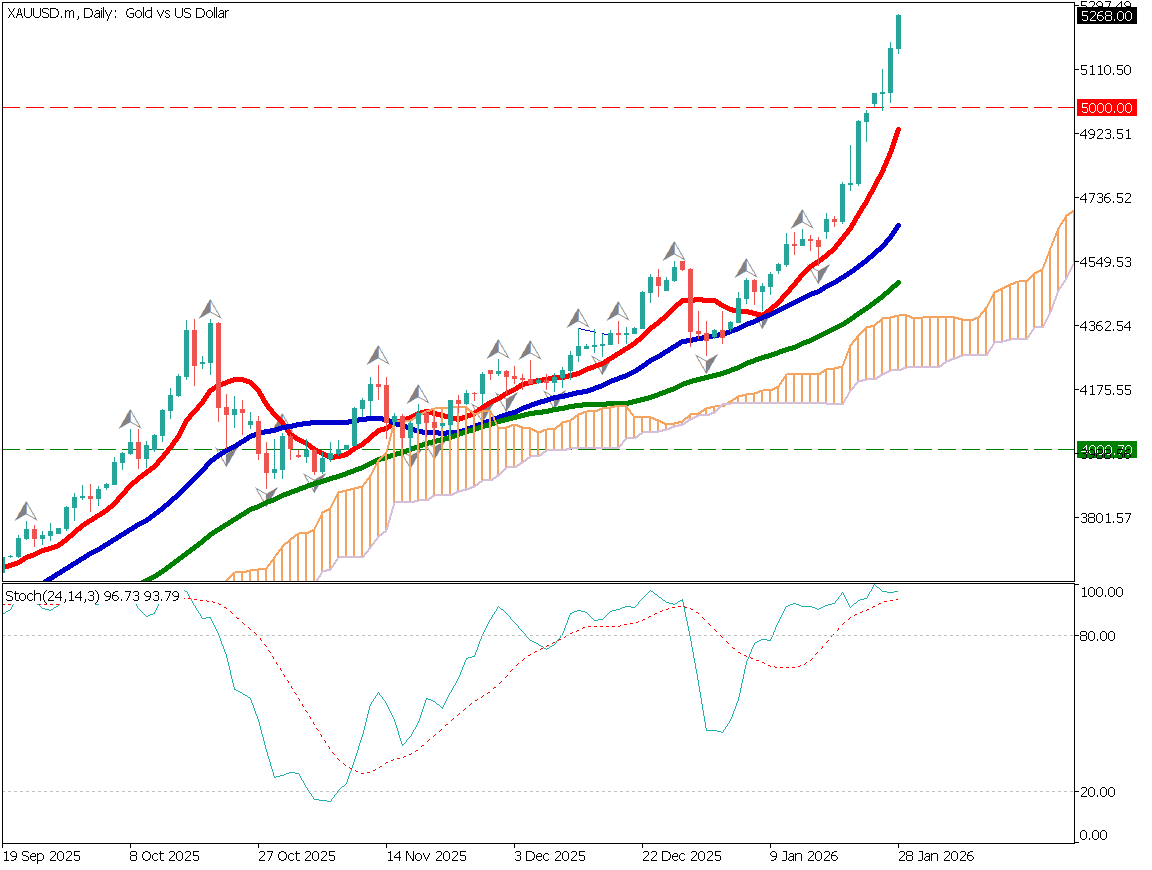

- Gold falls, upside is heavy on speculation of additional U.S. interest rate hikes

- Crude oil falls against the backdrop of a stronger US dollar, with caution needed to fill the window

Technical Analysis

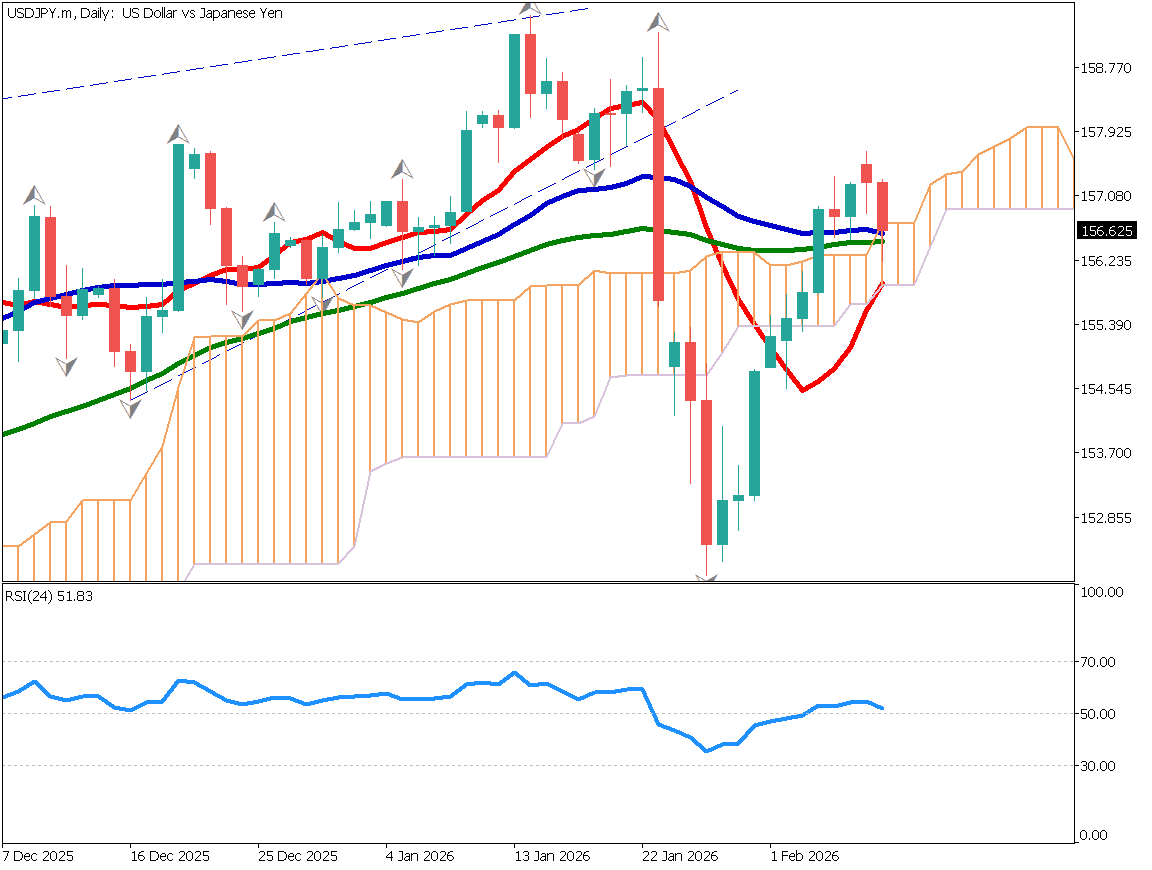

The yen was sold off as the BOJ governor’s press conference indicated that there would be no change in Japan’s interest rate policy for the time being. On the other hand, the U.S. dollar has seen increased speculation of an additional interest rate hike, which can be considered to have created a weaker yen and a stronger dollar structure. The dollar is now above the milestone of JPY 133.45 and approaching the downtrend line.

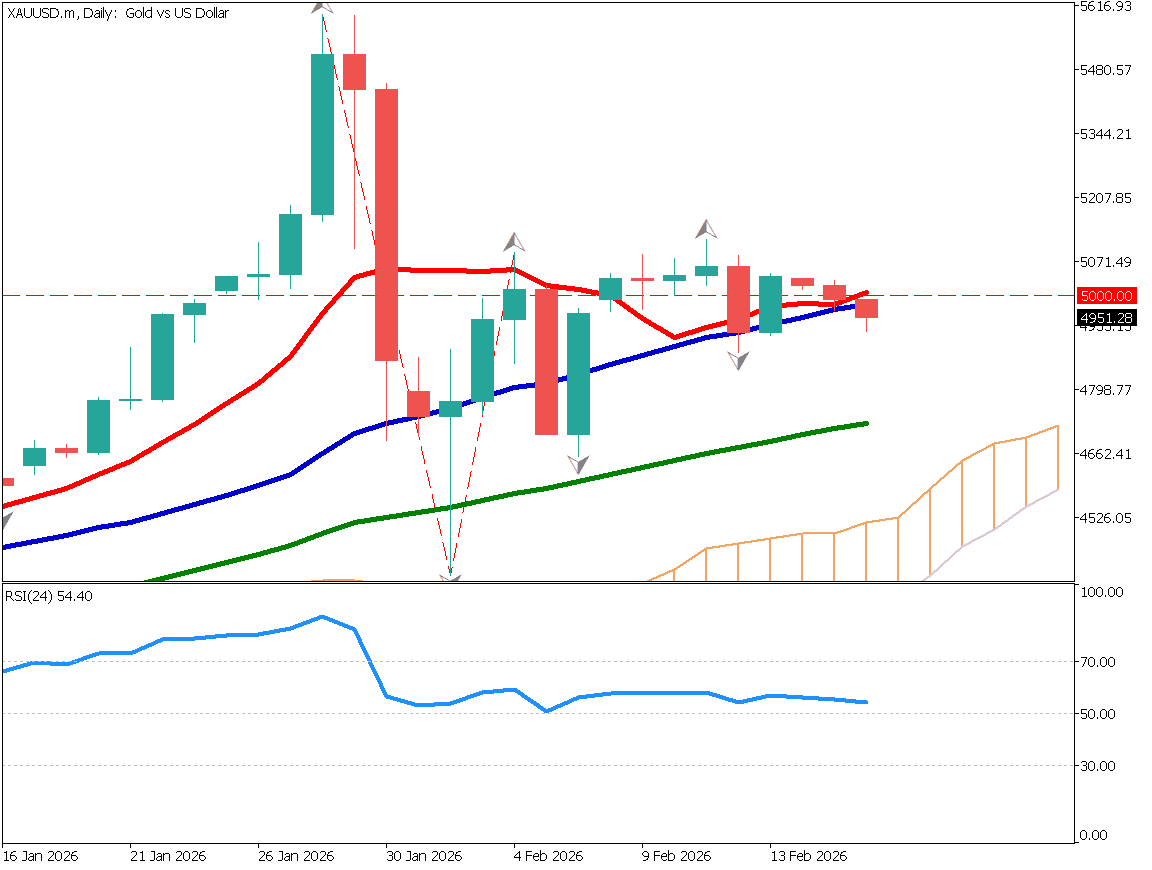

Dollar-Yen (USDJPY)

Analyzing the daily chart of the USDJPY. The pair has surpassed the JPY 133.45 mark, which had been a milestone, and a short-term uptrend is now in place. The next upside guide is considered to be around JPY 134.20, near the downtrend line.

From a medium- to long-term perspective, the market remains sideways, but we think the dollar/yen is likely to rise due to the difference in interest rate policies between Japan and the U.S. We would like to maintain an upward trend for a while.

| Estimated range | JPY 132.20 – JPY 134.85 |

| Resistance line | JPY 134.00 |

| Support line | JPY 133.10 |

Bitcoin (BTCUSD)

Bitcoin has been in a range, but we can confirm that it is closing above the range. Despite the strong dollar, the bitcoin market is firm and approaching the USD 30,000 level.

Considering the “N-shape,” we believe the price will reach the USD 35,000 level in the medium to long term, but we expect our near-term targets to be USD 30,200 and USD 32,200.

| Estimated range | USD 28500 – USD 30500 |

| Resistance line | USD 30200 |

| Support line | USD 29000 |

Pound-Yen (GBPJPY)

The Pound-yen price rose sharply as the market sold off the yen. The pair was unable to break out of the range, sticking to the moving average, and two large whiskers appeared around JPY 165, which engulfed the stops on selling positions and took the form of a rally. Since the yen sell-off is likely to continue for some time, we can expect the GBPJPY to rise as well.

| Estimated range | JPY 164.25 – JPY 166.70 |

| Resistance line | JPY 166.170 |

| Support line | JPY 165.00 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Eurozone Retail Sales | 18:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.