Treasury Secretary Yellen expresses confidence that a U.S. recession is not expected; currency markets risk-on【April 12, 2023】

Fundamental Analysis

- Major U.S. Stock Indices Mixed, Dow Jones Industrial Average Rises

- U.S. Treasury Secretary Yellen expresses confidence in the U.S. economy

- Markets focus on U.S. consumer price index to see if inflation is under control

- High interest rates impact business activity as U.S. companies enter earnings season

- Currency markets are risk-on, recession fears recede

- Crude oil rises sharply against fundamentals

- Crude Oil Steady Despite Outlook for Supply to Outpace Demand

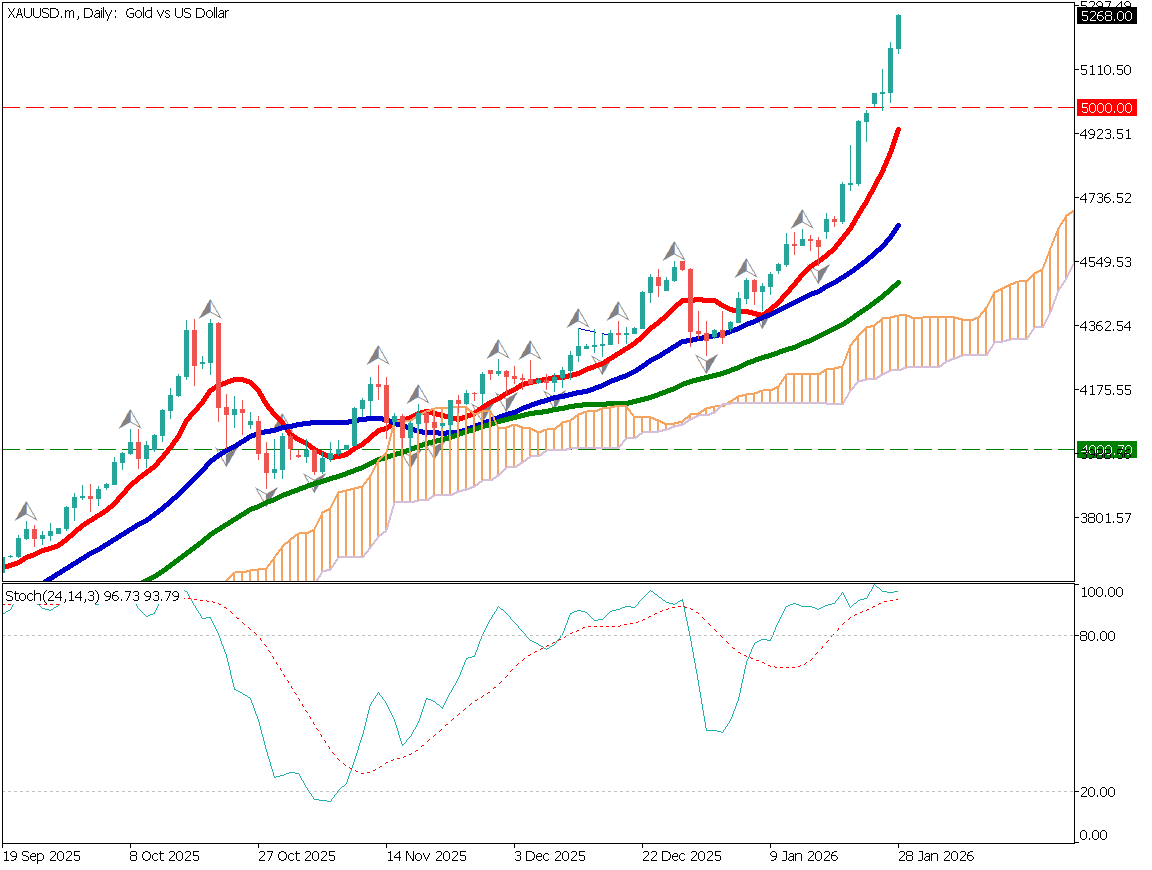

- Gold moves slightly higher, remaining within a narrow range

- Bitcoin rose for the second day in a row, hitting the milestone USD 30,000 level

Technical Analysis

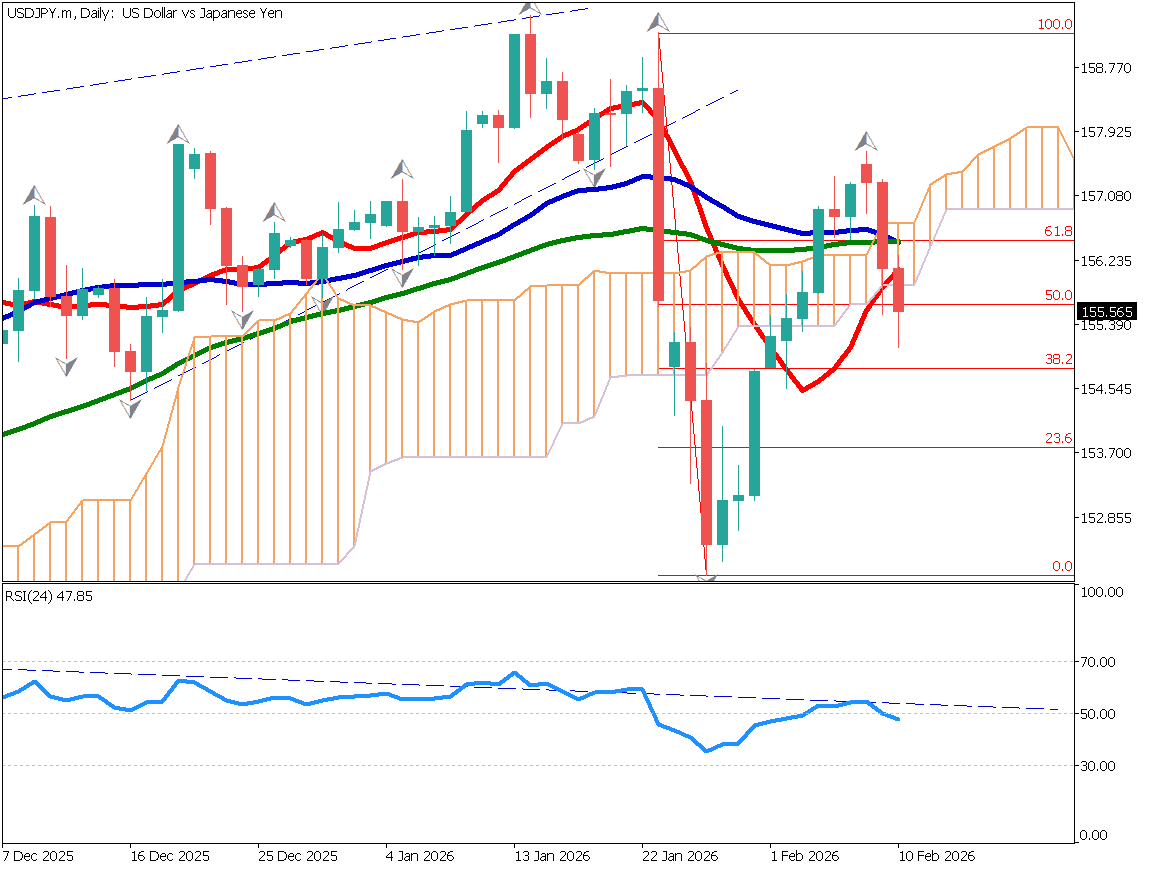

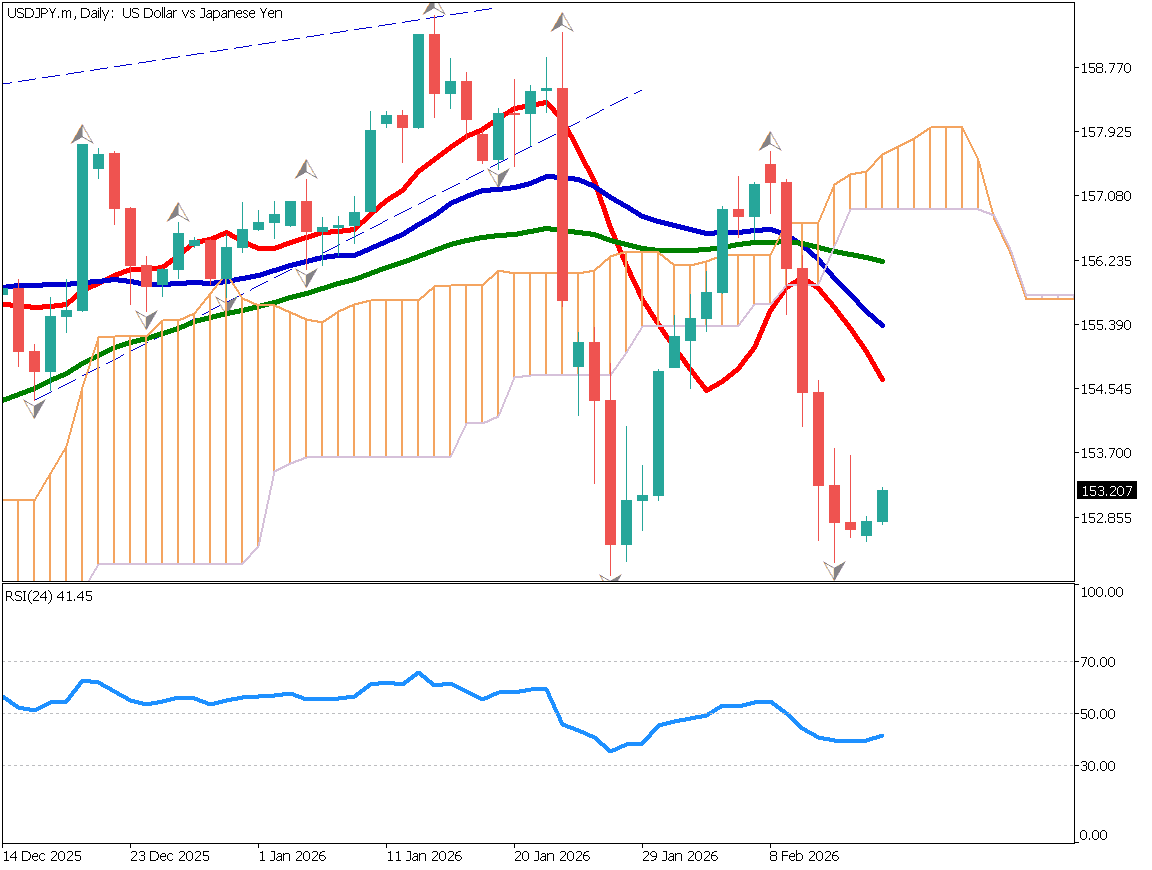

There is a currency market loading movement. The cross-yen movement is notable. The yen is selling off more as the view that there will be no change in Japanese policy in the foreseeable future grows. As a result, the cross yen is rising. Bitcoin, EURJPY, GBPJPY, and USDJPY broke out of the range and reached new highs. An upward trend is about to occur in each issue.

However, U.S. stock indices are unstable. Attention will be focused on the Consumer Price Index to be released today and the FOMC meeting minutes to be released before dawn.

Euro-Yen (EURJPY)

Euroyen can be confirmed to have broken above JPY 145.30, which was a resistance zone. Since sell positions are believed to be accumulating, there is a possibility that the price will rise with the stops rolled in. The target is expected to be JPY 146.50, which is the previous high.

RSI is hovering at 57, suggesting an upward trend. The JPY continues to sell off, so the new buying policy is to buy at the push. However, we should pay attention to the U.S. CPI as it is released today.

| Estimated range | JPY 144.30 – JPY 147.30 |

| Resistance line | JPY 146.85 |

| Support line | JPY 145.50 |

Bitcoin (BTCUSD)

Bitcoin broke above the range and entered the milestone USD 30,000 level. However, a break through has been difficult due to strong selling pressure in the USD 30,200 – USD 30,500 range. Even if it touches $30500 by the end of this week, it will be a while before it breaks through the USD 30,000 level due to a large resistance zone at USD 30,800.

If the release of indicators strengthens the weakness of the U.S. dollar, a move into the USD 31,000 level is conceivable.

| Estimated range | USD 29,000 – USD 31,500 |

| Resistance line | USD 30,650 |

| Support line | USD 29,500 |

Nikkei Stock Average (JP225)

The Nikkei Stock Average has been moving above its moving average, and the lows are gradually cutting up. From a long-term perspective, the market has not been able to break out of the range, but if the market continues to rise to new highs near JPY 28,300, a recovery to the JPY 30,000 level is possible.

| Estimated range | JPY 27,600 – JPY 28,380 |

| Resistance line | JPY 28,200 |

| Support line | JPY 27,800 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Consumer Price Index (CPI) | 21:30 |

| Canada Policy Rate | 23:00 |

| FOMC Minutes | 3:00 a.m. the next day |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.