U.S. Consumer Price Index falls short of expectations, dollar selling prevails in exchange rate【April 13, 2023】

Fundamental Analysis

- U.S. Stock Indexes Sell Off, U.S. Consumer Price Index Falls Short of Estimates

- Expectations of a rate cut by the end of the year increase, with some U.S. officials emphasizing continued tightening

- FOMC meeting summary reveals discussion of reducing or halting rate hikes

- Currency markets sell off more against the dollar, with USDJPY hitting the JPY 132 level

- Eurodollar rises, suggesting that the ECB will continue to raise interest rates in the future

- Differences in the direction of interest rate policy in the US and Europe, Euro buying prevails

- Crude oil rises sharply, breaking out of the upper end of the range to the USD 83/bbl level

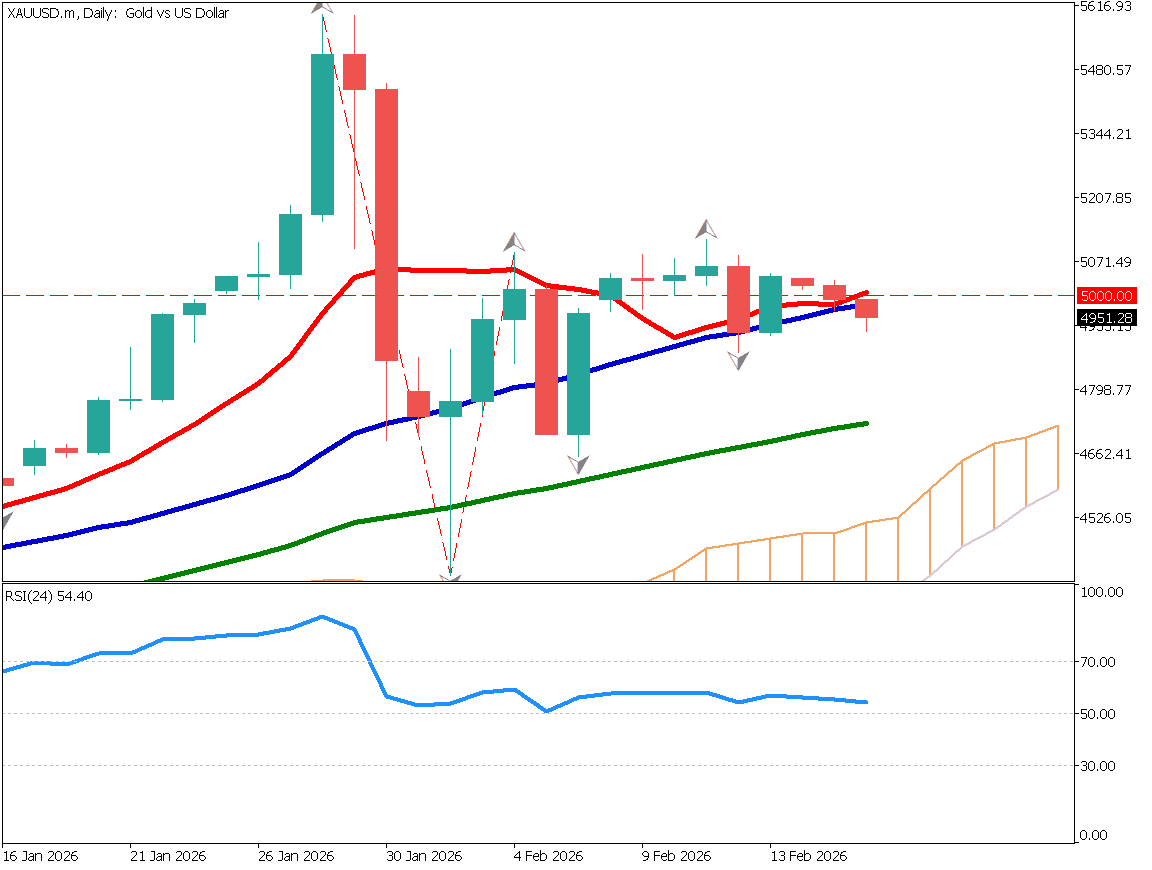

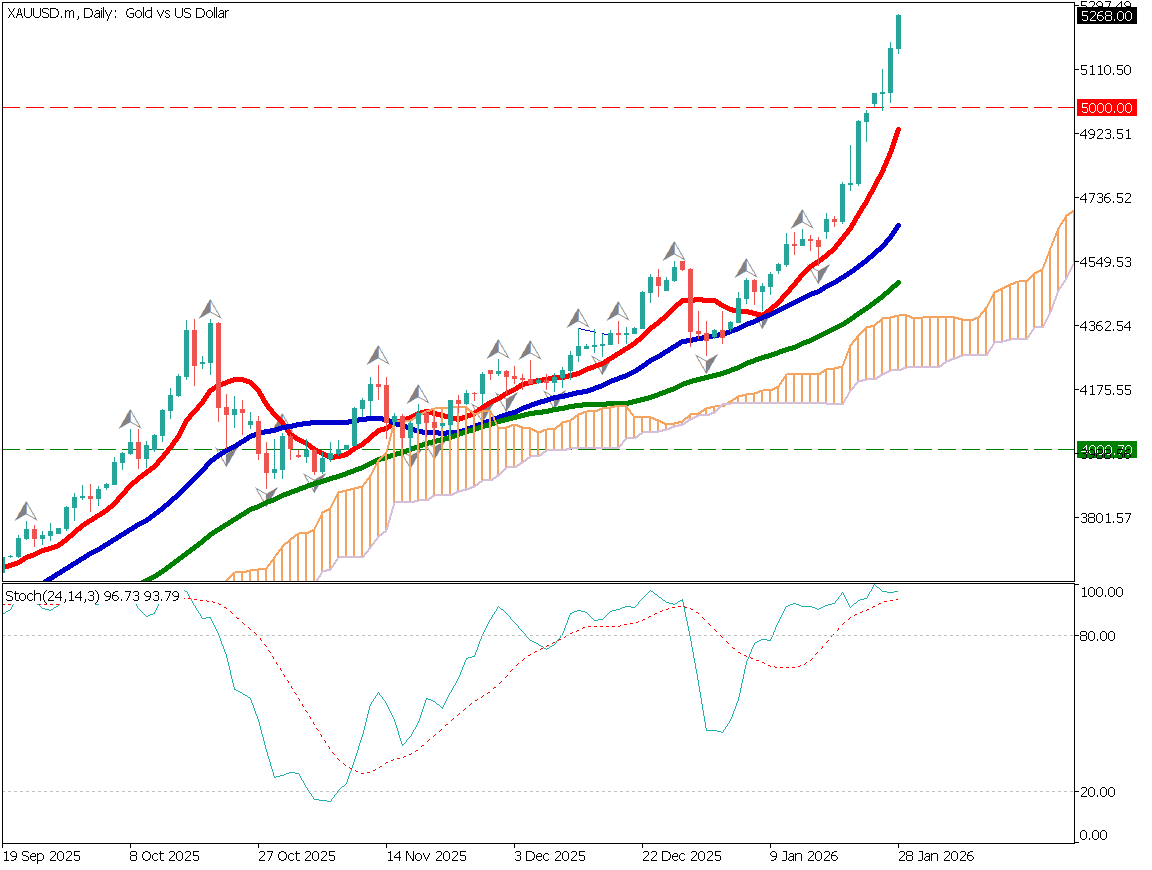

- Gold holds above the USD 2,000 level, but upside is limited

- Gold has room to rise if interest rate cuts are expected

Technical Analysis

The overall exchange rate was dominated by dollar selling. U.S. CPI came in below expectations, indicating a slowdown in U.S. Inflation. However, a rate hike at the May FOMC meeting has been factored in. Therefore, if no rate hike is implemented at the May FOMC meeting, the impact could be significant.

The GBPUSD, EURUSD, and AUDUSD are rising steadily. In particular, the U.K. and Eurozone are expected to continue raising interest rates and are stronger than the U.S. Dollar.

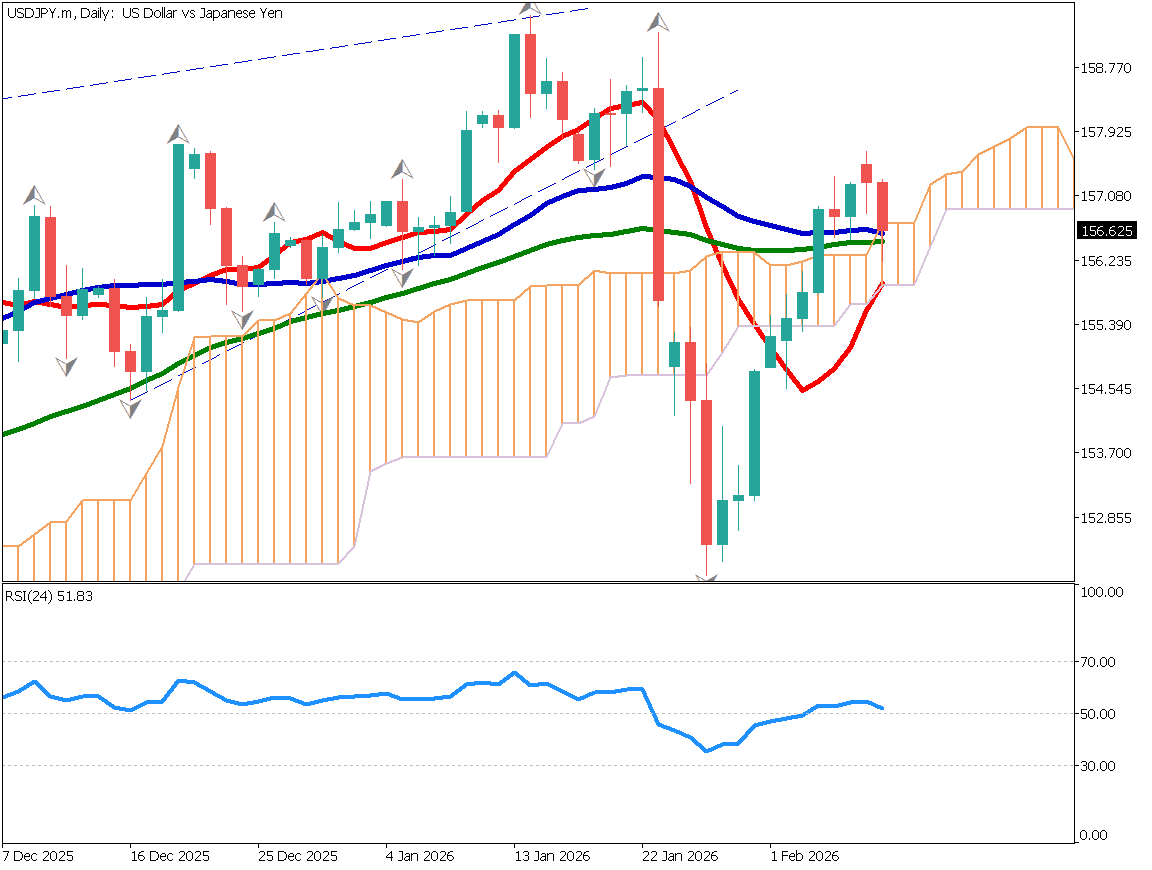

Dollar-Yen (USDJPY)

Analyzing the 4-hour chart of USDJPY, the pair formed a double top and fell after the CPI release. After all, the moving average (240) is still in focus and could not be exceeded. Today’s PPI is also in focus, and if PPI also falls below expectations, dollar selling is likely to accelerate.

We believe that JPY 132.45 is the near-term support band.

| Estimated range | JPY131.85 – JPY 134.27 |

| Resistance line | JPY 134.00 |

| Support line | JPY 132.45 |

Pound Dollar (GBPUSD)

The pound dollar is on the verge of making new highs as it remains above USD 1.2450, where it has fallen back many times in the past. The dollar selling trend is clear, so we would like to maintain a buy policy on the pound dollar.

Immediate resistance is at USD 1.2528 and USD 1.2568. On a weekly basis, there is no major resistance zone until around USD 1.265. In the long term, a buy policy is still a good idea.

| Estimated range | USD 1.240 – USD 1.2568 |

| Resistance line | USD 1.2528 |

| Support line | USD 1.2460 |

Crude Oil (USOUSD)

Crude oil is moving above its 200-day moving average. It has broken out of a long-running range. However, from a fundamental perspective, we would like to trade with caution, as we expect the market to be aware of the economic slowdown and declining demand. Technically, we would like to see if the upper end of the range will function as a support zone.

| Estimated range | USD 80.67 USD 85.20 |

| Resistance line | USD 84.56 |

| Support line | USD 82.40 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australia Employment Statistics | 10:30 |

| UK GDP | 15:00 |

| U.S. Producer Price Index (PPI) | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.