Slowing U.S. inflation is evident, causing differences in the outlook for interest rate policy in the U.S. and Europe.【April 14, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Sharply Higher; U.S. Economic Indicators Reveal Slowing Inflation

- Following CPI, PPI (Producer Price Index) also fell short of market expectations

- U.S. inflation slowdown is indicated, raising expectations of a U.S. interest rate cut by the end of the year, and stock prices rise.

- Eurozone monetary officials speak hawkishly, but there are differences in the outlook for interest rate policy in Europe and the U.S.

- Australian employment data far exceeded market expectations

- Market attention shifts to timing of U.S. rate cut

- Crude oil falls back, fails to cross 200-day moving average

Technical Analysis

The U.S. Producer Price Index came in below market expectations, clearly indicating a slowdown in U.S. Inflation. The market was dominated by dollar selling. A stock to watch is Gold. It closed near USD 2,040 on a strong large positive line. This is the first close in this price range in a year. All eyes are on the market to see if a third all-time high can be achieved this time.

The dollar fell due to dollar selling, but the downside is limited as the yen is also selling off easily. The euro-dollar is holding steady due to strong dollar selling.

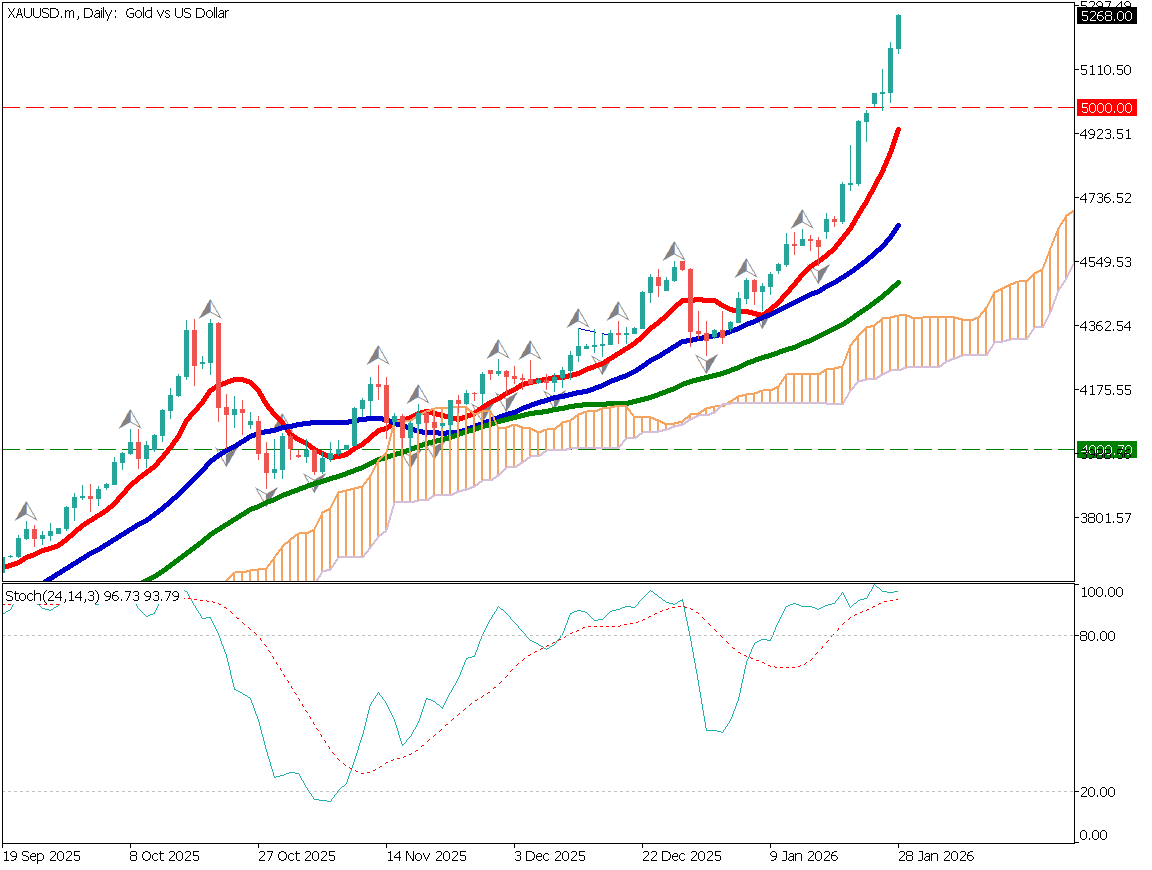

Gold (XAUUSD)

Gold’s all-time high was USD 2,070 in March 2022. This uptrend is the third attempt at a new all-time high. The price is responding to 61.8% of the Fibonacci Expansion, which is drawn based on the starting point of the uptrend. 100% of the Fibonacci Expansion is near USD 2,150, and the near-term focus is on whether the record high of USD 2,070 can be renewed.

The last two times the price was at the USD 2,040 level, the RSI was above 70 in both cases, creating a market environment that was prone to a selloff. This time, however, the RSI reading was 65, leaving room for upside.

| Estimated range | USD 2,005 – USD 2,070 |

| Resistance line | USD 2,048 |

| Support line | USD 2,030 |

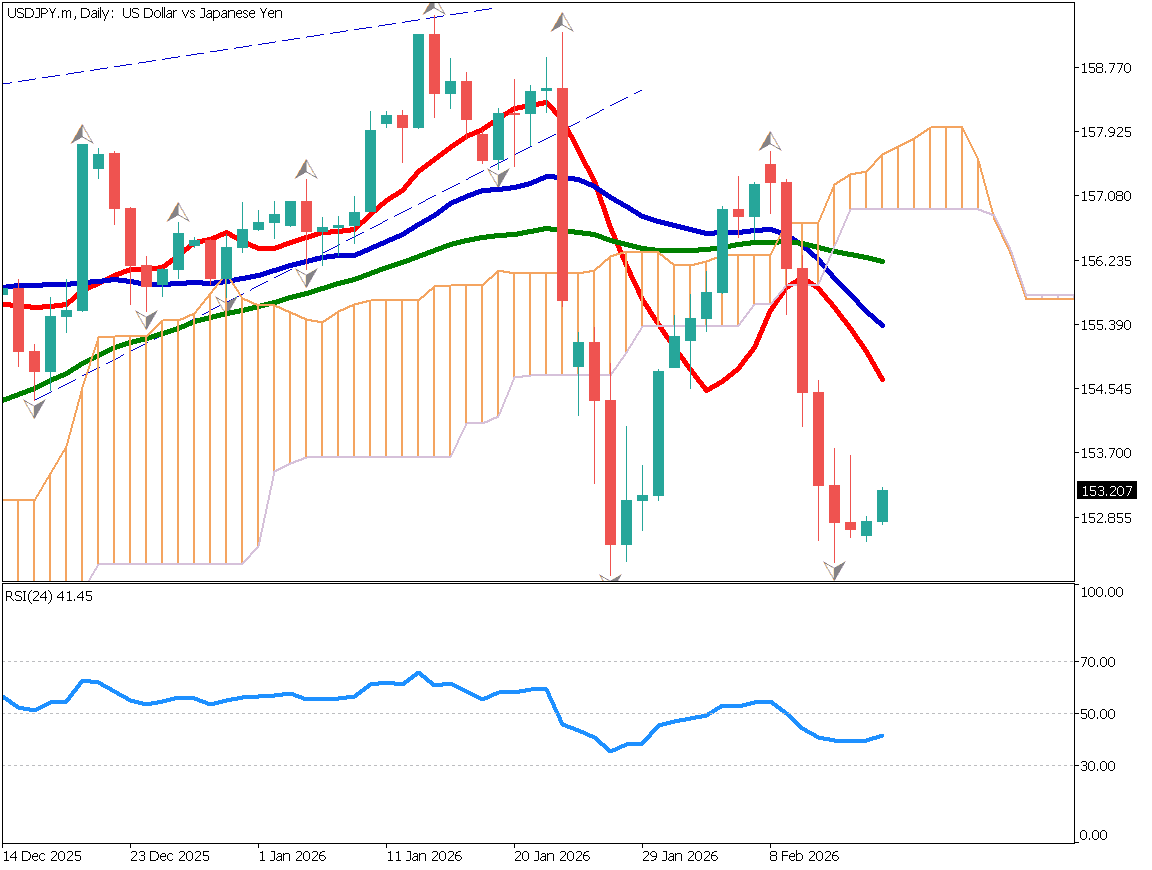

Euro Dollar (EURUSD)

The EURUSD is rising steadily. Drawing the Fibonacci Expansion at the criterion of the uptrend, we can see a clear reaction at 61.8%. We believe that the uptrend is likely to continue as dollar selling is strengthening. The near-term target is around USD 1.1125, which corresponds to 100%.

The differences in interest rate policies between the U.S. and Europe are also being recognized, making the euro relatively easier to buy than the dollar.

| Estimated range | USD 1.090 – USD 1.11868 |

| Resistance line | USD 1.110 |

| Support line | USD 1.10 |

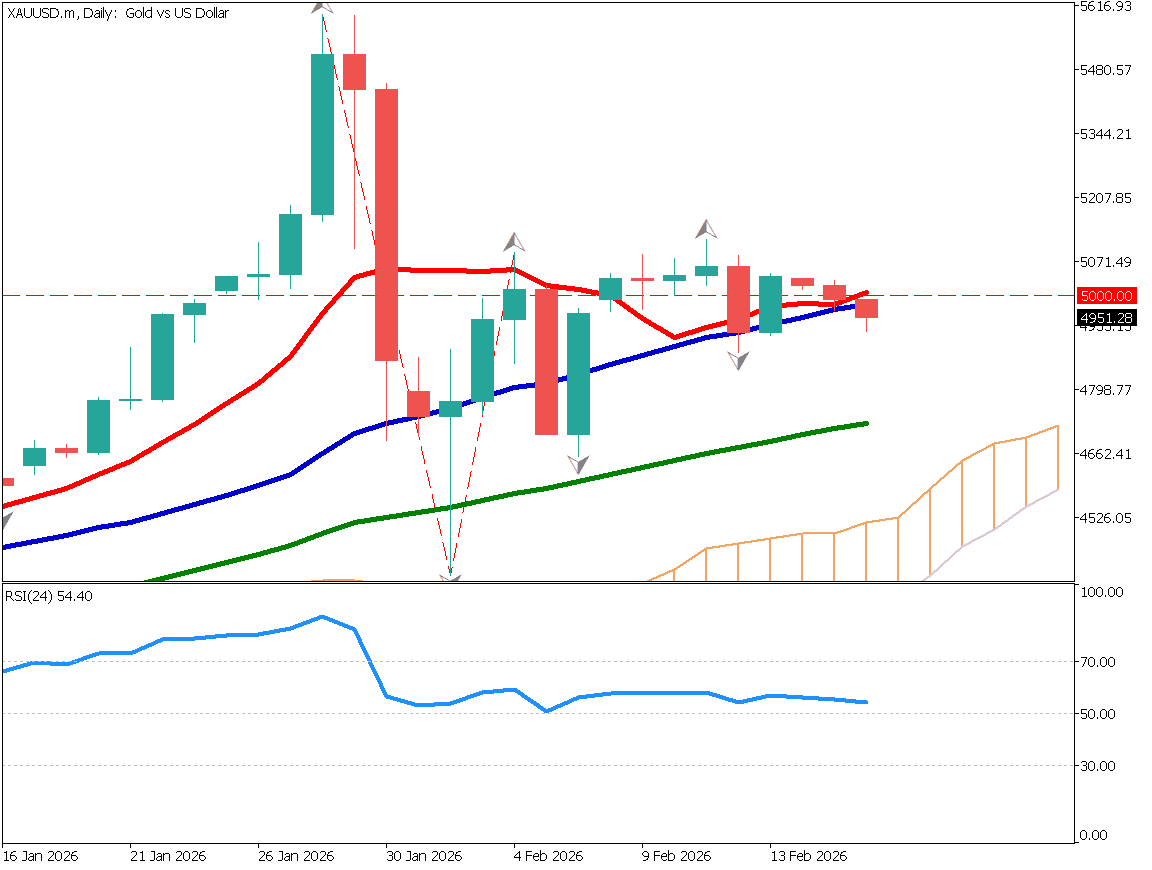

Australian Dollar (AUDUSD)

The Australian dollar has crossed above its 200-day moving average triggered by good employment data. Australia has suspended interest rate hikes, and a favorable employment report is a good buying opportunity for the market. The pair hit a recent high of 0.67930.

We believe that the US dollar is likely to continue to weaken and the Australian dollar will continue to rise; a clear break above USD 0.67930 would expand the blue ceiling to the upside for a while. In other words, there is no major resistance line. We would like to confirm the upward trend and consider buying on the push.

| Estimated range | USD 0.670 – USD 0.6850 |

| Resistance line | USD 0.6830 |

| Support line | USD 0.6740 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Retail Sales | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.