Cross Yen rises steadily but may be subject to adjustment, watch out for adjustment market at the end of the week【April 17, 2023】

Fundamental Analysis

- Major U.S. stock indexes trade slightly lower, temporarily falling back on concerns about interest rate hikes

- Recovered at the end of the day after strong U.S. financial results

- Fed Governor Waller speaks in favor of raising interest rates

- Rate hike at May US FOMC meeting largely factored in

- VIX index of fear indices falls to 17

- BOJ to hold policy meeting in late April under new regime

- If the Kuroda line is continued, the USDJPY downside will be firmer

Technical Analysis

In the currency markets, the dollar is strengthening, with a rate hike at the May FOMC meeting largely factored in. On the other hand, the Japanese yen is selling off on the view that there will be no change in Japanese interest rate policy in the foreseeable future, and there appears to be a renewed focus on the U.S.-Japan interest rate differential, which has been in a major downtrend since 2022.

As the dollar has strengthened, dollar-straight currency pairs and issues have fallen. The decline has been largely an adjustment from the continued rise.

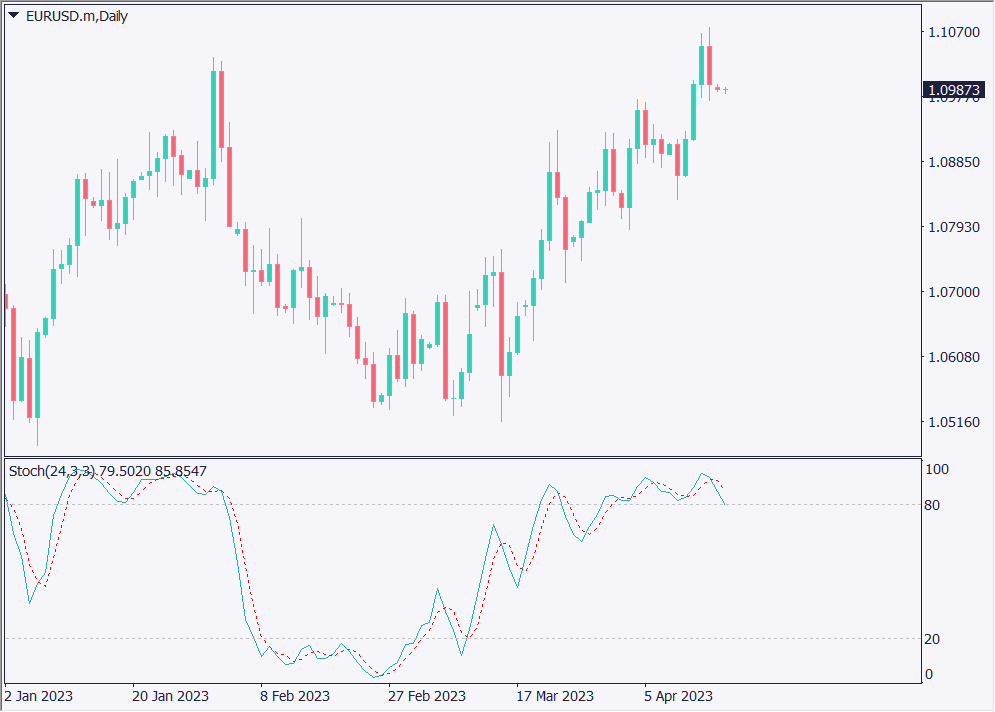

Euro Dollar (EURUSD)

The Eurodollar fell back as the dollar strengthened. The stochastics are about to break below the overbought zone of 80, suggesting the possibility of an adjustment decline. It is also interesting to note that it is forming a wrap-around leg at the highs.

| Estimated range | USD 1.092 – USD 1.1060 |

| Resistance line | USD 1.1070 |

| Support line | USD 1.095 |

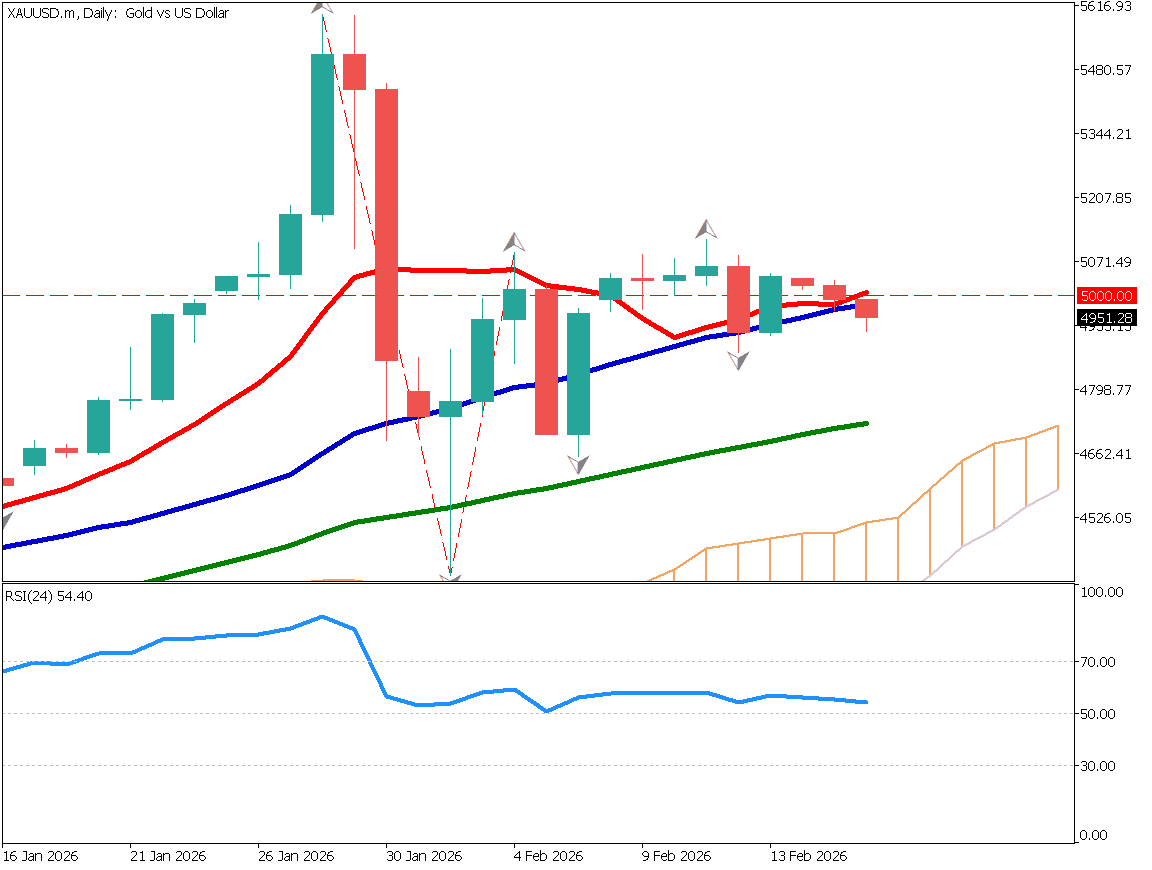

Gold (XAUUSD)

Gold fell back at the milestone of USD 2,040. Like the Eurodollar, it is forming a pincer at the highs and has also broken 61.8%. It seems that the US interest rate statement has had quite an impact.

| Estimated range | USD 1,987 – USD 2,028 |

| Resistance line | USD 2,020 |

| Support line | USD 2,000 |

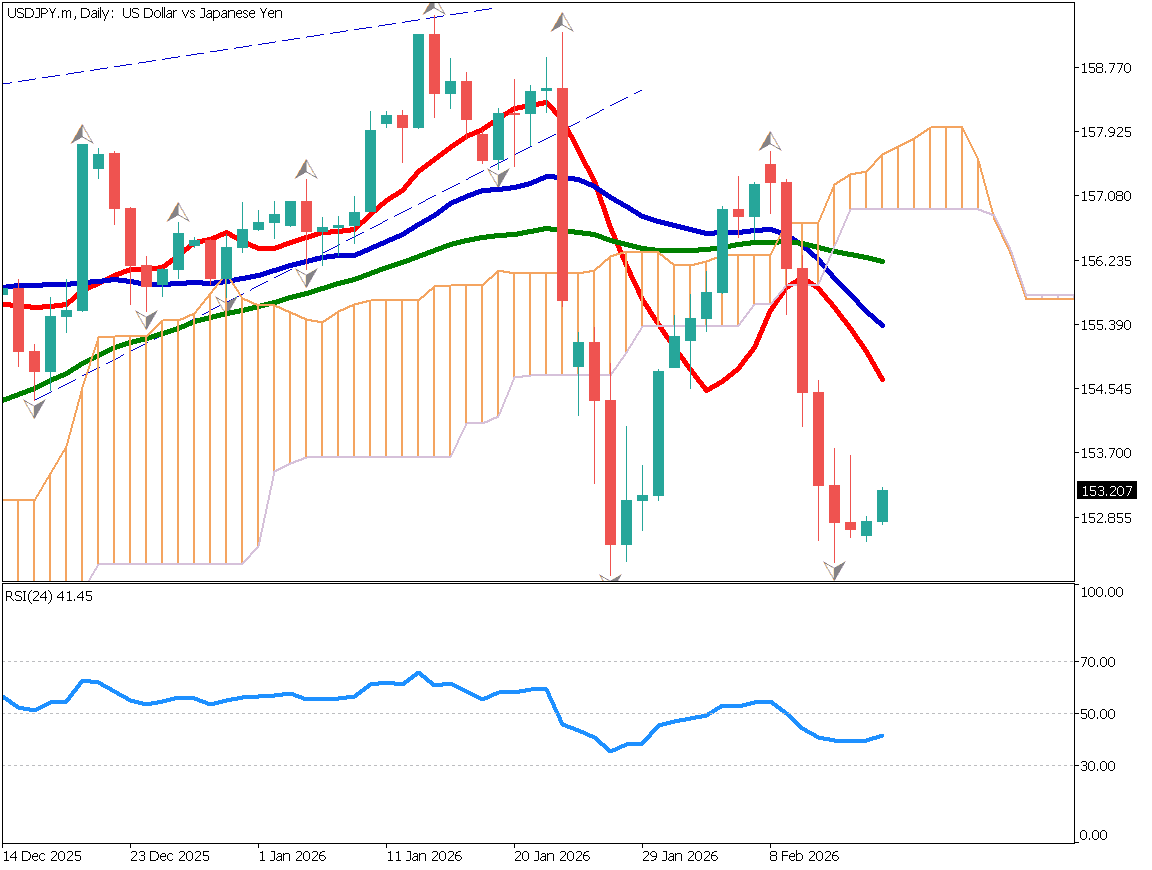

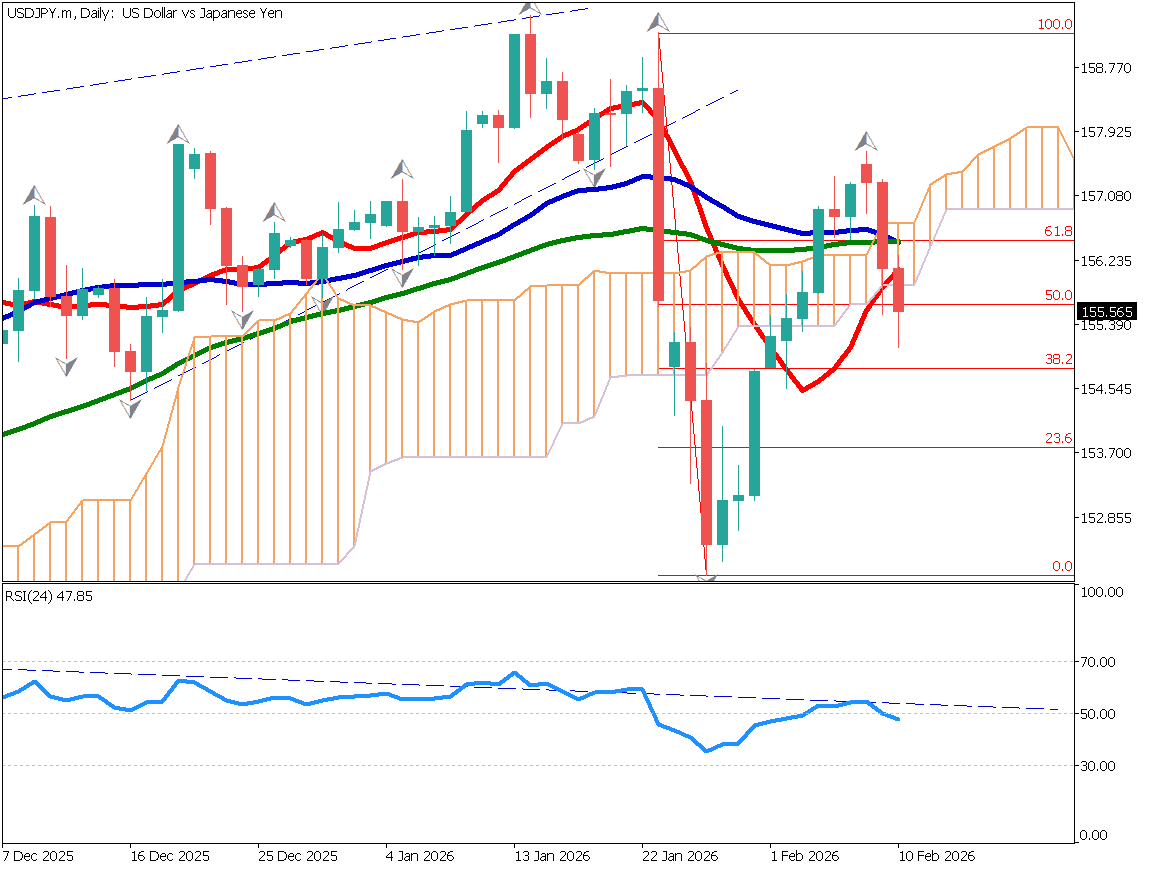

Dollar Yen (USDJPY)

The Stochastic value of the dollar-yen is very high, and it is understandable that the price is in a higher price range when compared to within the past 24 days. The 240-day moving average is still considered to be the milestone.

| Estimated range | JPY 133.30 – JPY 135 |

| Resistance line | JPY 134.50 |

| Support line | JPY 133.45 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Federal Reserve Bank of New York Manufacturing Index | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.