UK inflation hits double digits; additional rate hikes inevitable in the future【April 20, 2023】

Fundamental Analysis

- Major U.S. stock indexes slightly lower, waiting for earnings results of major companies due to lack of materials?

- U.K. Consumer Price Index rose double digits to 10.9%, well above market expectations

- EU CPI was 6.9%, in line with expectations

- UK and EU are far from the 2.0% inflation target, additional rate hikes are inevitable

- USD/JPY fails to hold the JPY 135 level; BOJ policy revision yet to come

Technical Analysis

The pound is appreciating across the board. With the U.K. consumer price index at double digits, inflation has not subsided, and an additional interest rate hike is inevitable. On the other hand, Japan is expected to maintain low interest rates and the U.S. is expected to raise interest rates only once remaining, and the probability is high that the pound-yen and pound-dollar will rise due to the widening interest rate gap with the U.K.

As for crude oil, demand is expected to decline as the global economy as a whole is heading toward contraction. Therefore, there is a high probability that prices will also come under downward pressure and the window will be filled.

Pound Sterling Yen (GBPJPY)

Analyze the daily chart of GBPJPY. Drawing Bollinger Bands confirms the formation of a bandwalk between +1σ and +2σ. The +2σ acted as a resistance line due to yesterday’s rise. Today, we see a strong possibility of a one-time pullback, but if the price approaches +1σ, we would like to push the price down.

However, if the price falls below +1σ, the bandwalk is considered to have ended, and we intend to close the position.

| Estimated range | JPY 166.00 – JPY 169.00 |

| Resistance line | JPY 168.240 |

| Support line | JPY 166.730 |

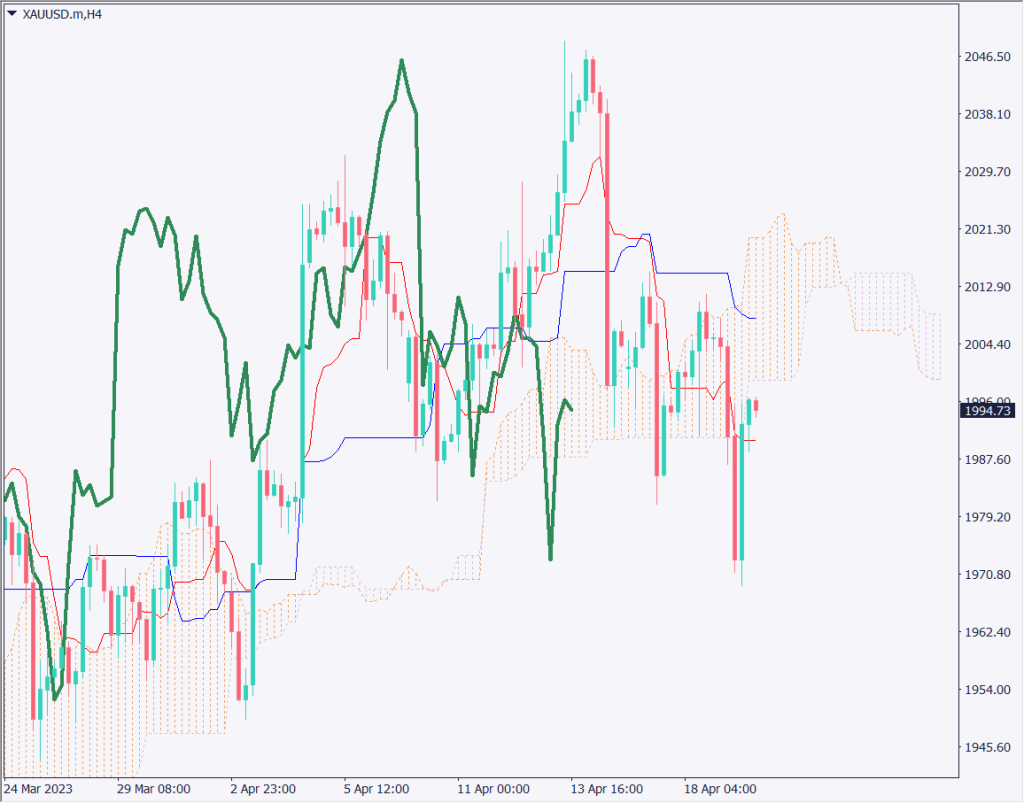

GOLD (XAUUSD)

Analyzing the 4-hour chart of Gold, we can see that the price failed to hold the USD 2,000 level and failed for the third time to make a new all-time high; the 4-hour chart shows that the price has fallen below the equilibrium cloud; after falling back to the 1960 level, the price managed to recover and is above the conversion line, but the cloud is thickening, and we think it will be difficult to move higher without some Without some material, we think it may be difficult for the market to move higher.

However, the buying appetite remains strong, and the market is likely to rise once again when the U.S. interest rate hike is suspended. The market is likely to remain in a firmer market for a while.

| Estimated range | USD1,961 – USD 2,027 |

| Resistance line | USD 2,011 |

| Support line | USD 1,978 |

Crude Oil (OIL)

Analyzing the daily chart of crude oil. It has risen vigorously through the window, and although countries are trying to adjust to the growing trend of production cuts, concerns about declining demand seem to outweigh these concerns. Fundamentally, we think it is unlikely to rise, and technically, the window is likely to be filled.

If we were to enter the market, we would consider a scenario of holding a sell position and closing at the USD 76 level.

| Estimated range | USD 76.6 – USD 81.3 |

| Resistance line | USD 80.16 |

| Support line | USD 77.8 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| European Central Bank Meeting Summary | 20:30 |

| Existing Home Sales | 23:00 |

| Composite Index of Leading Economic Indicators | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.