U.S. economic indicators deteriorate across the board, a sign of recession【April 21, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Fall Back, Unable to Hold Gains on Deteriorating U.S. Economic Indicators

- U.S. Unemployment Insurance Claims Worsen Most Significantly Since November 2021

- Easing employment environment and economic slowdown combine to signal a recession

- May U.S. FOMC rate hike may be the last

- Crude oil slumped sharply, closing the window at USD 76/bbl

Technical Analysis

The overall exchange rate is difficult to follow, as the direction of the market is slowing. Analyzing currency strength and weakness, the Australian dollar is getting stronger, while the New Zealand dollar is the weakest. The Canadian dollar is also vulnerable to selling off in tandem with low oil prices.

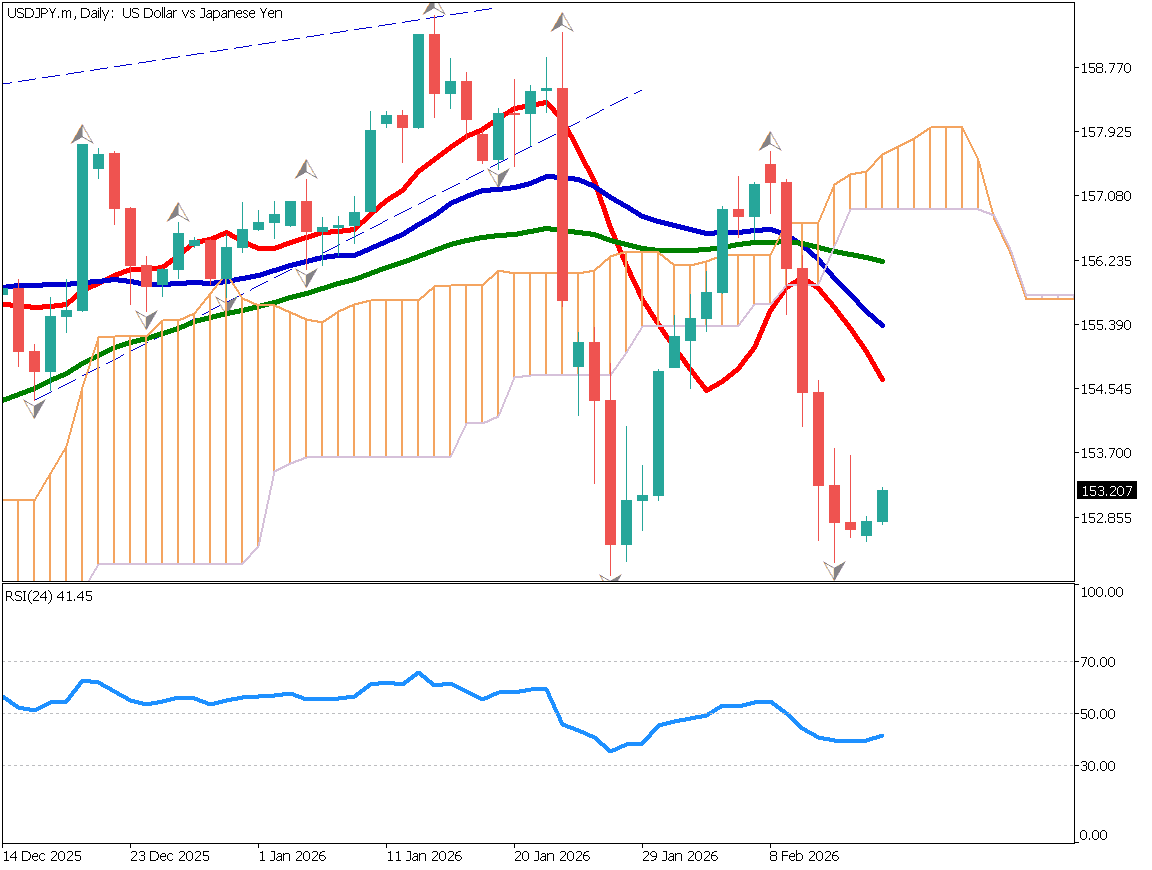

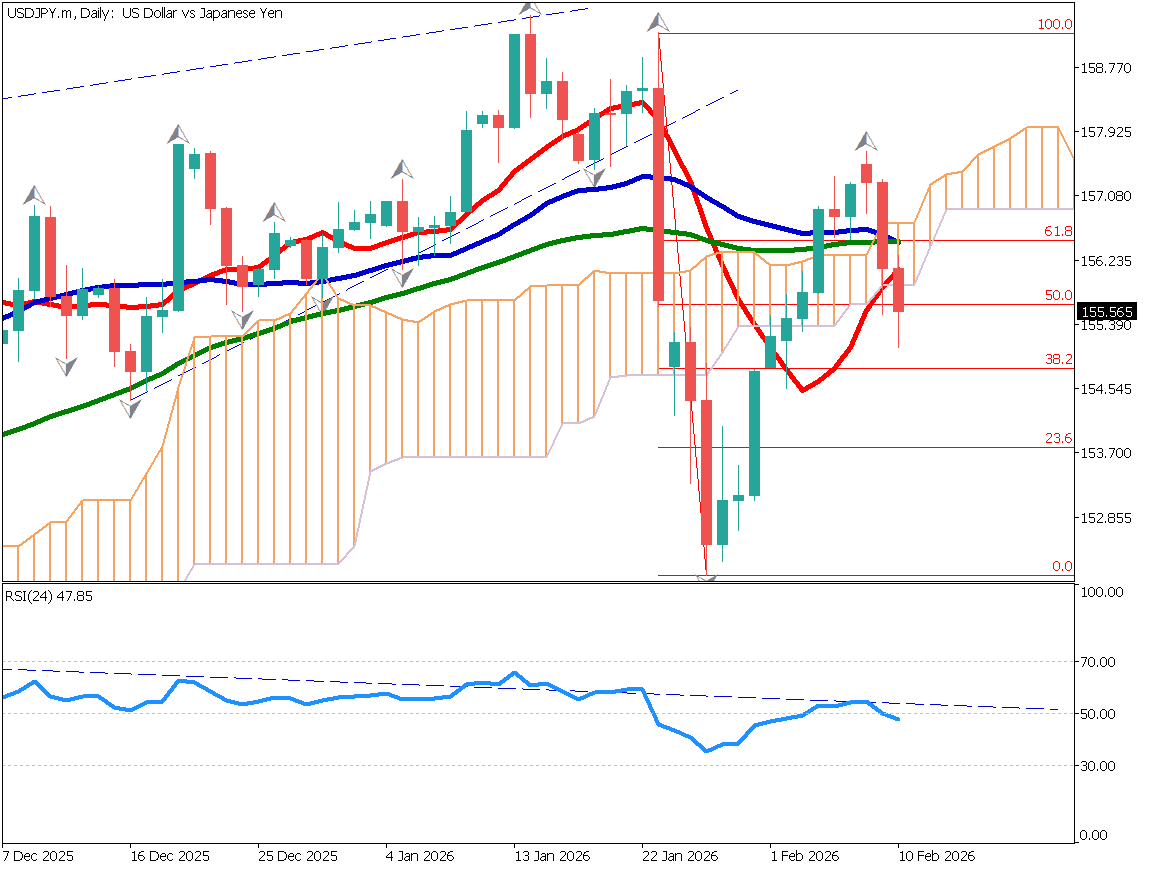

The dollar and the yen are close to each other, and the USDJPY is directionless. If there is no interest rate revision at the next BOJ policy meeting, the yen will likely weaken. However, some overseas players are expecting a rate revision and may be reluctant to move until next week.

Euro-Dollar (EURUSD)

Analyze the 4-hour chart of the Eurodollar. Although it is following the uptrend line, the upward momentum appears to be weakening. There is a lack of material in the overall exchange rate market, and the market seems to be waiting for the next material.

With the euro expected to continue to gain and the U.S. terminal rate near, we assume that the euro-dollar is in a better position to rise.

| Estimated range | USD 1.09 – USD 1.1030 |

| Resistance line | USD 1.10 |

| Support line | USD 1.0930 |

Bitcoin (BTCUSD)

Analyzing the 4-hour chart of Bitcoin. At one point, the price exceeded USD 30,000, but yesterday it fell sharply, falling to the USD 28,000 level. At the time of writing, it is hovering below the milestone of USD 28300 and is 23.6% below.

A horizontal line analysis suggests that a decline to the USD 27,100 area is likely in the future; a break below USD 27,100 would put the 38.2% and the moving average overlap at USD 26,600 on the horizon.

| Estimated range | USD 27,260 – USD 29,300 |

| Resistance line | USD 29,000 |

| Support line | USD 27,700 |

Canadian Dollar (USDCAD)

Crude oil is sharply lower and the correlated Canadian dollar is also selling off. Crude oil is filling its window, and we believe that there is a high probability that selling will prevail again today. Therefore, we assume that USDCAD is likely to rise.

| Estimated range | CAD 1.3420 – CAD 1.3530 |

| Resistance line | CAD 1.35 |

| Support line | CAD 1.345 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.K. Retail Sales | 16:00 |

| U.S. Manufacturing PMI | 22:45 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.