Lack of materials in exchange rate, BOJ governor reluctant to revise YCC early?【April 25, 2023】

Fundamental Analysis

- Major U.S. stock indexes move modestly, no sense of direction in a wait-and-see market

- USD/JPY rallied to 134.70 at one point but did not continue, with buyers and sellers in close proximity

- BOJ Governor says price outlook will decline, reluctant to revise YCC earlier

- Eurodollar rises, ECB officials hint at possible 0.5% rate hike

- Crude oil rebounded slightly, lacks materials

Technical Analysis

There is a noticeable lack of materials, including in the foreign exchange market, and volatility is low. The market is considered to have a strong technical component. Given the fundamentals, interest rates are expected to continue to rise in the euro and the UK. The U.S. may raise interest rates for the last time, while Japan continues to ease monetary policy. Under normal circumstances, the euro and pound would likely appreciate and the Japanese yen would likely sell off.

Euro-Yen (EURJPY)

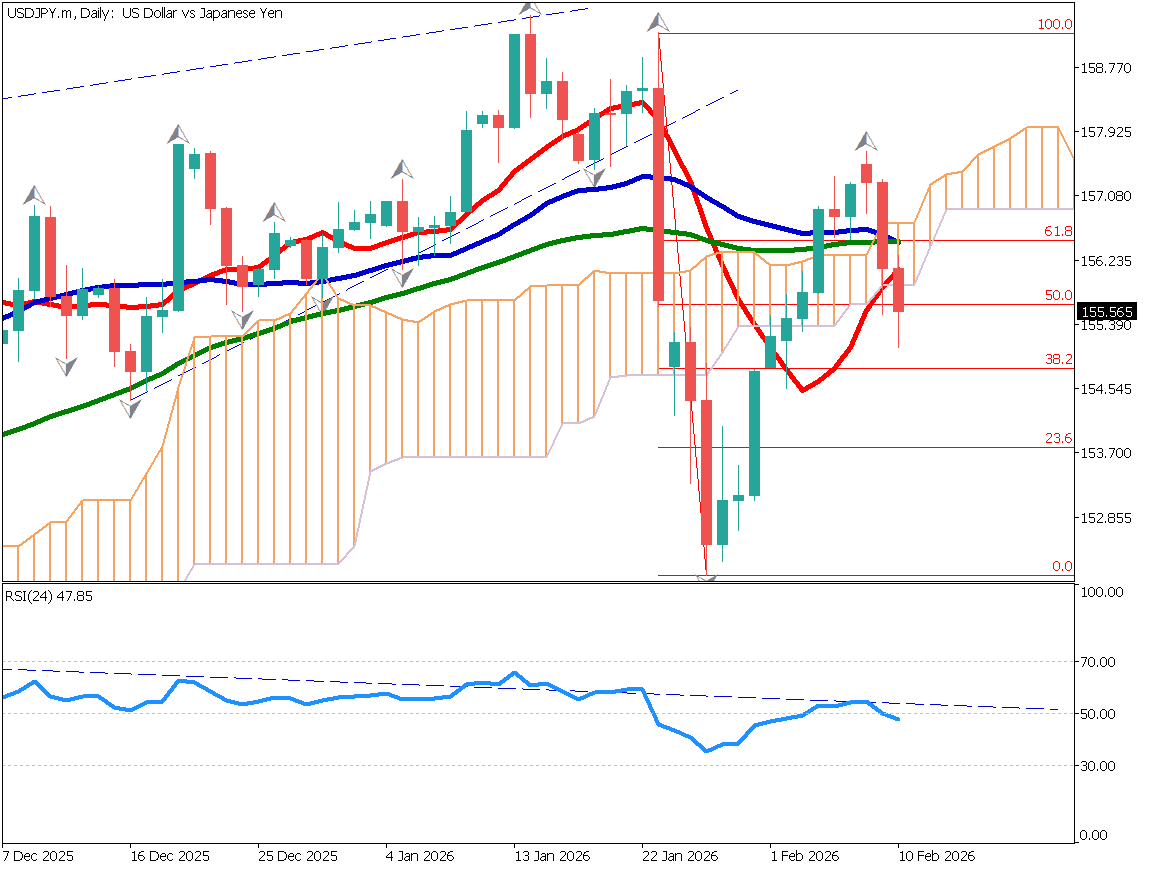

Analyzing the 4-hour chart of the EURJPY. The Euro is strengthening as the possibility of a large gain in the Euro has emerged. Drawing the Fibonacci Expansion, the pair rebounded at 61.8% and then rallied to reach the 100% level.

The price corresponding to the 100% level is around JPY 149.150, and we expect the price to continue to rise today. Since there are few important economic indicators, today will be a day when technical factors will be strong. We would like to use a lower strategy.

| Estimated range | JPY 146.95 – JPY 149.56 |

| Resistance line | JPY 148.10 |

| Support line | JPY 147.52 |

Pound Sterling-Yen (GBPJPY)

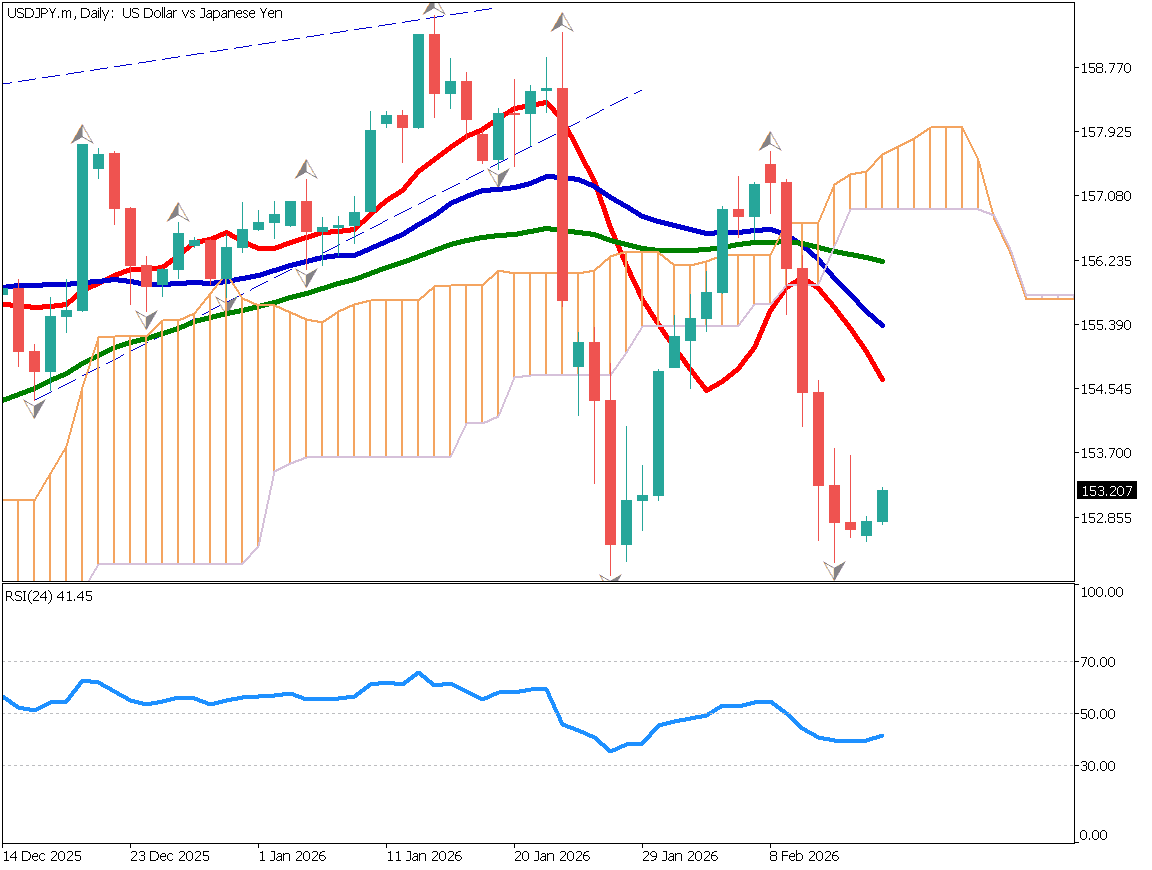

Analyzing the daily chart of GBPJPY, a large resistance zone is ahead at JPY 168.24. The recent move confirms a crosshair candle with a large whisker extending downwards, which confirms that the lower price is consolidating.

We believe that if the recent highs are renewed, there is a strong possibility of a further major move higher.

| Estimated range | JPY 166.15 – JPY 169.03 |

| Resistance line | JPY 168.31 |

| Support line | JPY 166.73 |

GOLD (XAUUSD)

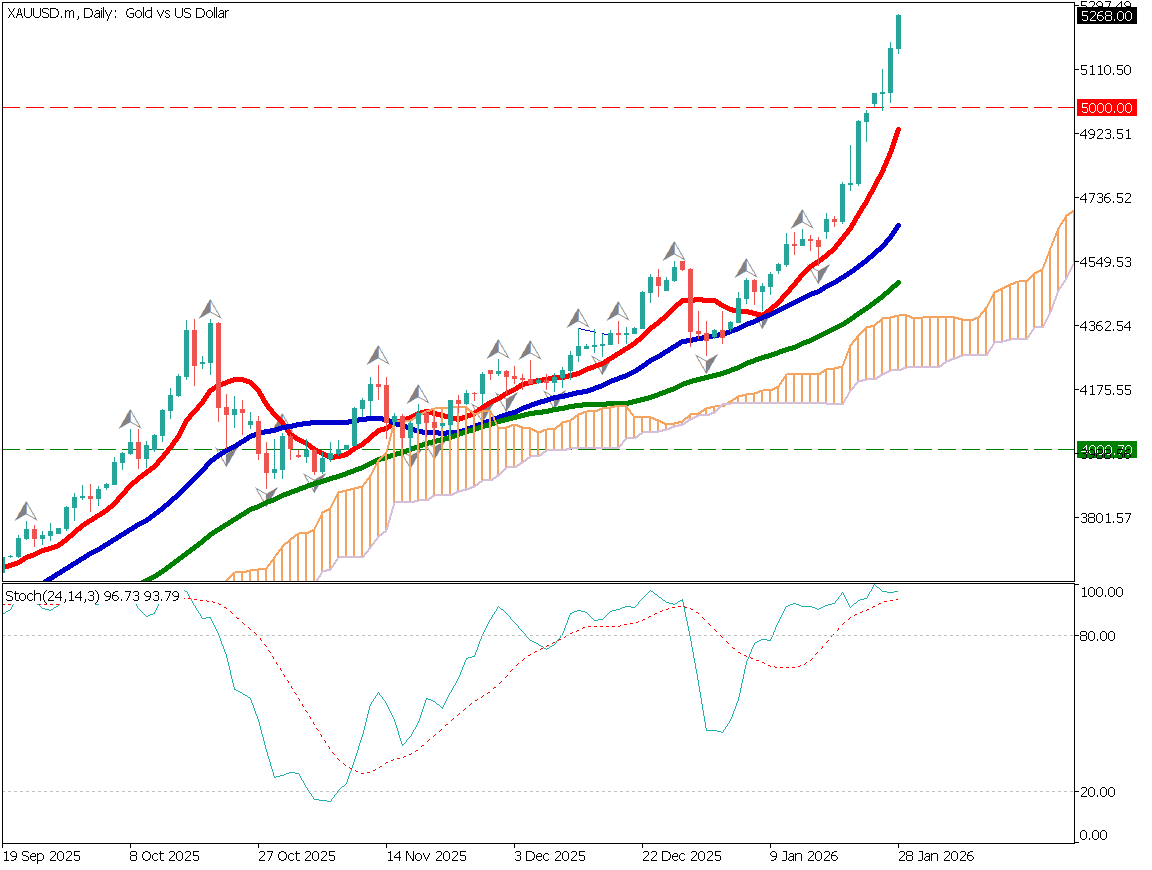

Gold fell sharply due to strong U.S. economic indicators, but there is still strong buying interest at the lows.

At this stage, the lack of a sense of direction makes for a difficult development, but once the suspension of U.S. interest rate hikes becomes more likely, the price may go well above USD 2,000. Selling positions will need to be cautious. Since the market tends to react to statements by key figures, sudden moves should be watched carefully.

| Estimated range | USD 1959 – USD 2018 |

| Resistance line | USD 2003 |

| Support line | USD 1974 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| U.S. Consumer Confidence Index | 23:00 |

| Australia and NZ Public Holidays | – |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.