Renewed U.S. financial system anxiety? Risk-off movement in the overall exchange rate【April 26, 2023】

Fundamental Analysis

- Major U.S. stock indexes plunge, rekindling concerns about the U.S. financial system

- First Republic, a U.S. regional bank, announces larger-than-expected deposit outflows

- Risk-off moves across the markets, with the dollar falling against the yen and gold rising

- Bank of France Governor Says Euro Inflation Peaks Now

- Bank of England Chief Economist Says Inflation Factor Temporary

- Euro and Pound sensitive to officials’ comments

Technical Analysis

Risk-off movements were evident in the overall currency markets. On the currency markets, the yen strengthened across the board, while other currencies turned lower. The Eurodollar appeared in the form of an outside bar (wrapping leg) at the highs and can be considered to be in the process of forming a double top.

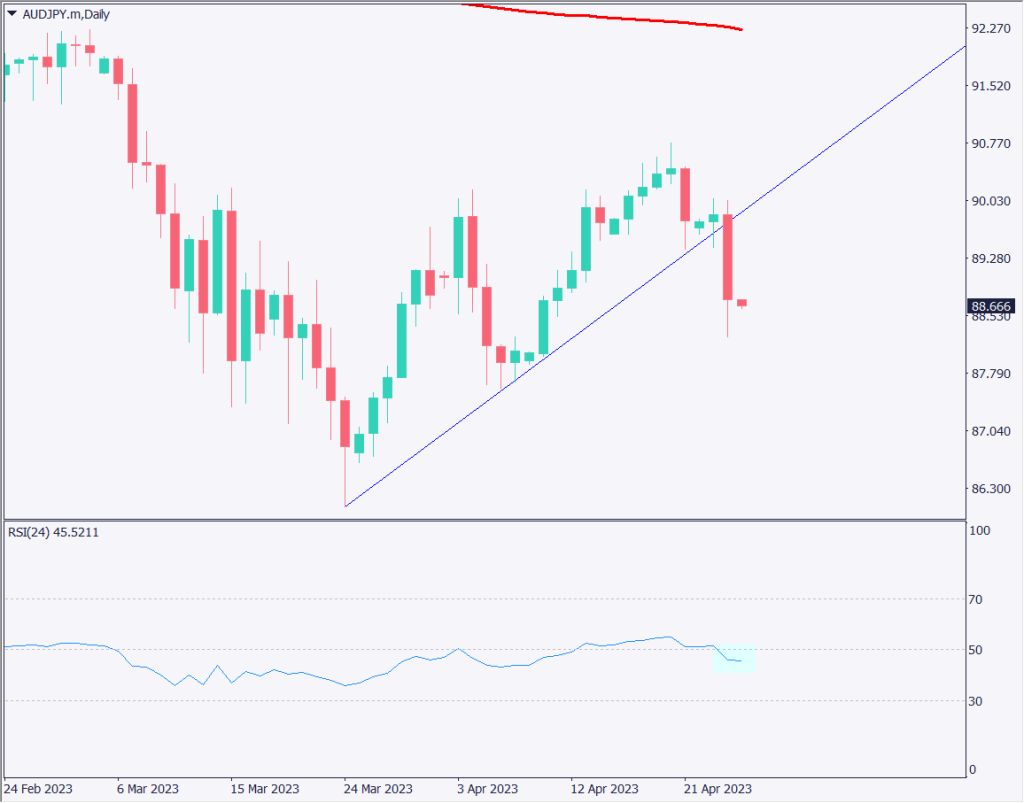

Yesterday, Australia was on a holiday, but the pair fell below an important technical trend line, completing a falling flag. The Australian dollar was all-time low and the yen was all-time high, which caused the AUD/JPY volatility to increase.

Australian Dollar-Yen (AUDJPY)

Analyzing the daily chart of the Australian dollar-yen. The AUDJPY continued its short-term rise within a major downtrend. Of note is the fact that the price was clearly below the important trend line and the RSI value was below 50 and hovering around 45.

The fact that the price fell below the important uptrend line completes the bearish flag and suggests the possibility of a further decline. Also, with the RSI at 45, there should be plenty of room for a decline, and a clear break below 88.30 yen could trigger a quick plunge.

| Estimated range | JPY87.67 – JPY 89.50 |

| Resistance line | JPY 89.03 |

| Support line | JPY 88.14 |

Euro-Dollar (EURUSD)

Analyze the daily chart of the Eurodollar. What is of interest on this chart is the candlestick forming the high. It is clear that this is a double top, but both candles forming higher highs are negative, i.e., high negative.

The market is expected to see more downside pressure temporarily, with a near-term downside target near USD 1.09.

| Estimated range | USD 1.089 – USD 1.105 |

| Resistance line | USD 1.10 |

| Support line | USD 1.093 |

Pound Dollar (GBPUSD)

Analyzing the daily chart of the Pound Dollar. The pair is forming a “left shoulder + top + right shoulder,” resembling a head-and-shoulders shape; there is a large support band at USD 1.235, which is the neckline of the head-and-shoulders; a break below USD 1.2350 would complete the reversal sign at the highs and increase the downward pressure.

| Estimated range | USD 1.2319 – USD 1.2493 |

| Resistance line | USD 1.2450 |

| Support line | USD 1.2350 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Consumer Price Index | 10:30 |

| U.S. Core Durable Goods Orders | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.