U.S. regional bank risk resurfaces, stock prices plunge due to a combination of U.S. recession fears【April 27, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Continue to Fall; Deposits at U.S. Regional Bank First Republic Down 41 Percent

- First Republic, the U.S. regional bank that survived the March financial crisis with a bailout

- Uncertainty over the U.S. financial system resurfaced, and the risk of demand recession also emerged

- Currency and stock markets show a marked risk-off trend

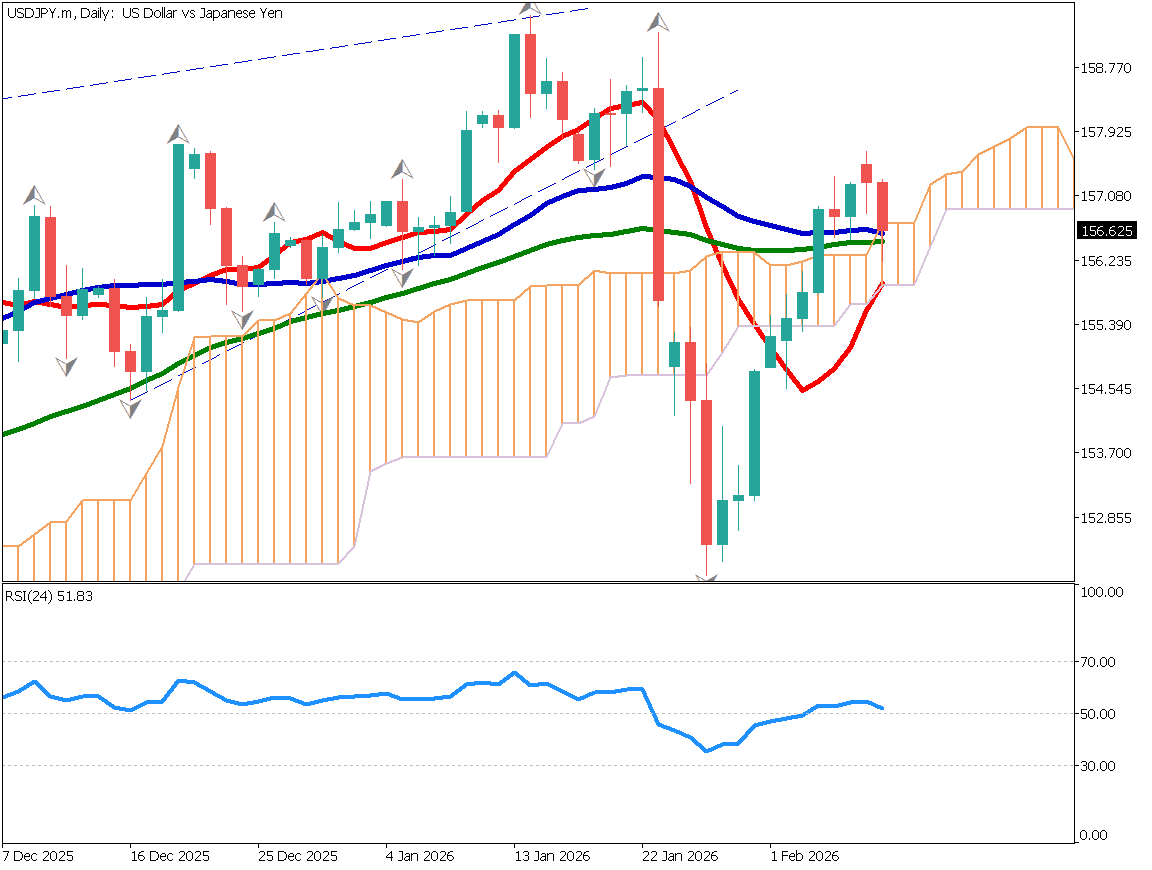

- USDJPY falls to JPY 132, but short-covering moves enter the market.

- Crude oil sharply lower, offsetting gains from coordinated production cuts

Technical Analysis

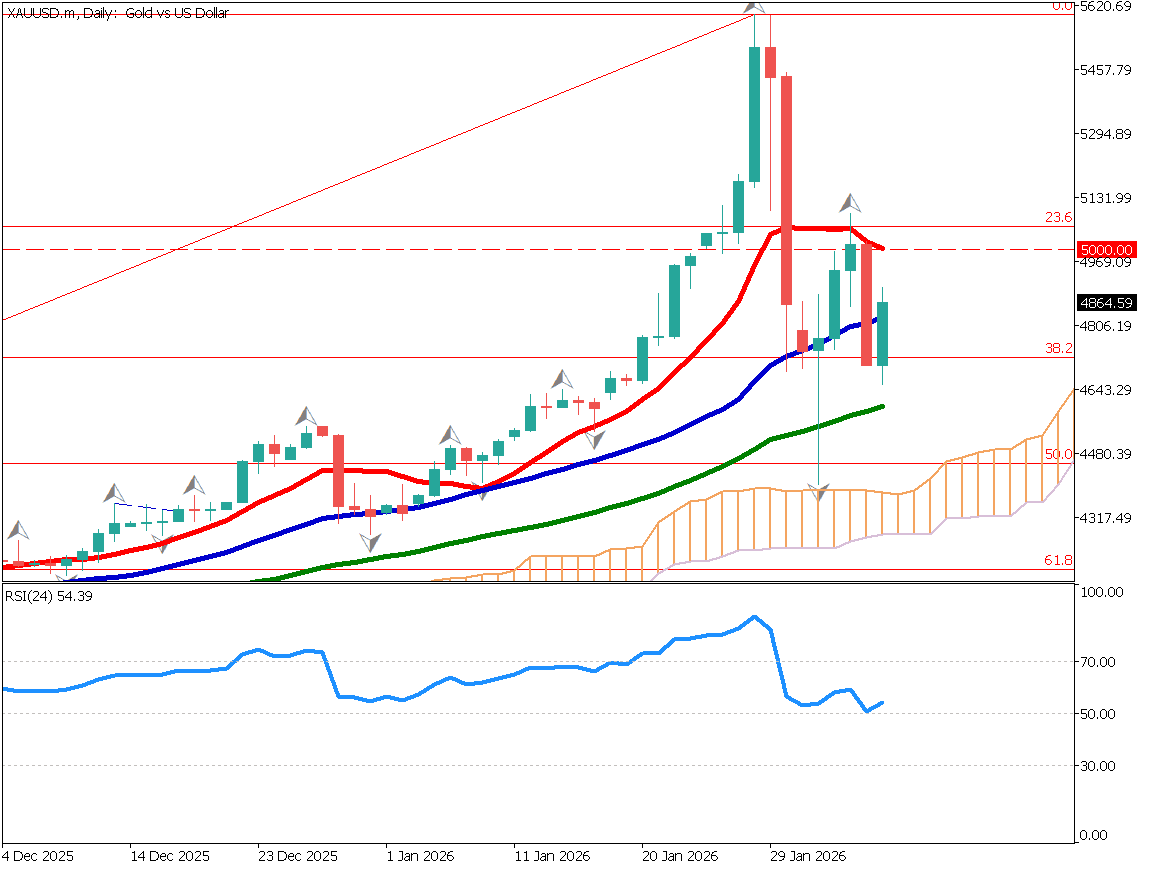

Currency and stock markets have been difficult to trade. The EURUSD fell sharply to close at USD 1.20 due to dollar selling. The dollar dropped sharply to JPY 132, but rebounded. The trend is lacking in decisive materials, and it is difficult to gain momentum. Gold also rallied to USD 2,009 on risk-off, but the rise did not last and is falling back.

Meanwhile, Bitcoin is attracting attention as a safe-haven asset, reaching USD 30,000 at one point. However, it has plunged to the USD 27,000 level in the morning in New York, perhaps due to profit-taking.

Bitcoin (BTCUSD)

Bitcoin was briefly bought as a safe-haven asset to the USD 30,000 level, but has since fallen to USD 27,000 in the morning in New York due to profit-taking selling The 4-hour RSI is at 43, indicating a turn to a bear market. The focus will be on whether the price will rebound again at the moving average.

| Estimated range | USD 26,500 – USD 30,000 |

| Resistance line | USD 28,100 |

| Support line | USD 2,200 |

Crude Oil (USOUSD)

Crude oil’s move to the upside due to production cuts was offset by a move to the downside. Another important technical factor is the completion of the move to fill the window created by the rally. From a fundamental perspective, crude oil is likely to be sold off due to declining demand and risk concerns. We believe that downside risks are greater.

Our guide is the USD 65 level, which is the recent low, but there is a large resistance zone around USD 73.4, so we will be watching to see how far down it goes.

| Estimated range | USD 67.0 – USD 76.0 |

| Resistance line | USD 75.0 |

| Support line | USD 73.4 |

Euro-Yen (EURJPY)

EURJPY is aware of the Fibonacci Expansion: it has rebounded several times at JPY 146.650, which corresponds to 61.8%, and we expect it to rise to around 149.20, which corresponds to 100%, when the euro appreciates. The strategy is to buy on the push, but timing should be emphasized.

| Estimated range | JPY 146.20 – JPY 149.50 |

| Resistance line | JPY 148.80 |

| Support line | JPY 146.60 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| EU Consumer Confidence Index | 18:00 |

| US GDP | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.