Coronation Ceremony to be held in the U.K.; Will the Pound Sterling Rise in Celebration?【May 8, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Rise; Risk Easing Mood Spreads, Bank Stocks Buy Back

- Pound Sterling Rises on Celebrations as Britain Holds First Coronation in 70 Years

- The yen weakened across the board on easing risk, with the dollar recovering to the ¥135 level.

- Crude oil rises sharply, surging to $70/bbl from a year low

- Gold falls to $2015, U.S. jobs report better than expected, timing of rate cut uncertain

Technical Analysis

The stock market rallied sharply as bank stocks rallied in response to the risk easing mood. Currency markets are also easing risk in tandem. The oil market has been volatile, with the price of crude oil surging from the low of the year to the $70 level in one fell swoop.

However, banking stocks are on a downtrend and appear to be in an adjustment phase. It is doubtful that this is a full-fledged rally. Since it is difficult to see a sense of direction, investors must be cautious about holding positions in the market.

NASDAQ

The NASDAQ is a stock index that does not include financial stocks, so it is less affected by the regional bank issue than the S&P 500 or the Dow Jones Industrial Average. Analysis of the weekly chart shows an upward trend and is 61.8% above the expansion. The near-term upside target is around $13510, but once above this price, we believe that the stock will rise in the long run toward 100%.

| Estimated range | USD 12,700 – USD 13,800 |

| Resistance line | USD 1,3430 |

| Support line | USD 13,070 |

Nikkei Stock Average (NIKKEI225)

Japan is coming back to the stock market after the end of GW.

Analyzing the 4-hour chart, there is a large resistance zone around JPY 29,400, and we expect that price range to be the guideline upper price today. Since an uptrend line can be drawn, the basic strategy should be a push-buy strategy.

However, if the risk-off mood strengthens in the foreign exchange market, the Nikkei Stock Average is also likely to fall. If the uptrend line is clearly broken, we would like to reconsider our strategy.

| Estimated range | JPY 28,800 – JPY 29,400 |

| Resistance line | JPY 29,250 |

| Support line | JPY 28,950 |

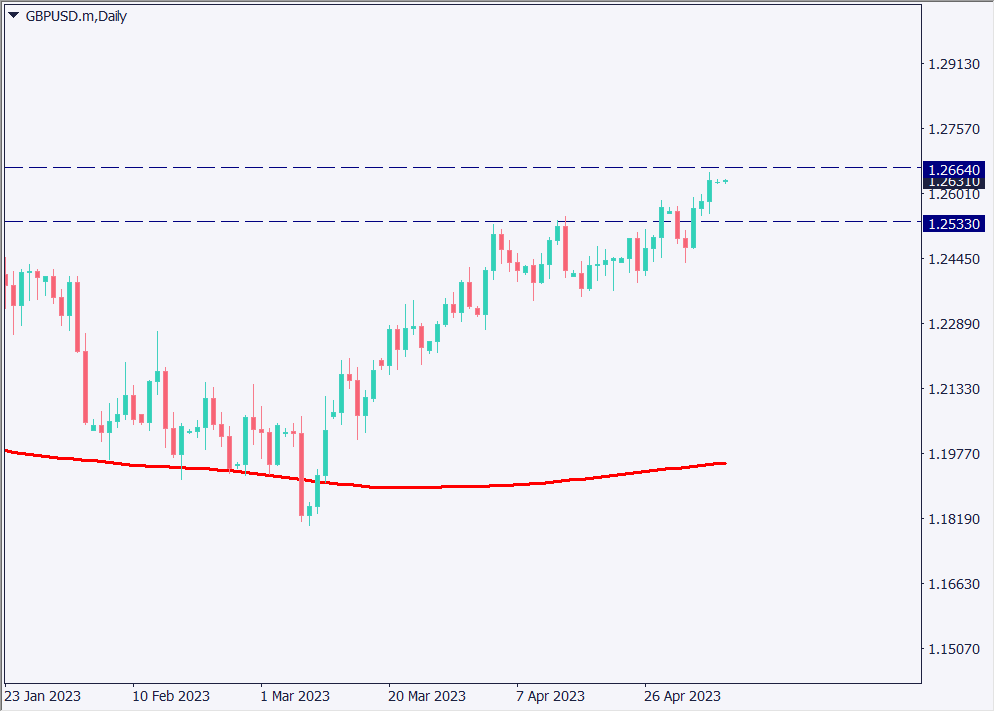

Pound Dollar (GBPUSD)

The pound dollar has broken out of its range and is on an upward trend. What can be considered with this chart shape is the “N calculated value”. Applying the N Calculated Value, the final target price to be calculated is around USD 1.3050.

From a longer-term perspective, we can expect that a break above 1.26640 would very likely lead to the next major resistance zone at USD 1.30.

| Estimated range | USD 1.2554 – USD 1.2703 |

| Resistance line | USD 1.2670 |

| Support line | USD 1.2591 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Keynote Speech at JDB Policy Making Conference | 8:50 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.