Exchange rates were little changed, waiting for U.S. inflation indicators, or wait and see【May 9, 2023】

Fundamental Analysis

- Major U.S. stock indexes were little changed, waiting for U.S. inflation indexes?

- No major fluctuations as UK markets were closed

- Currency markets were little changed

- Possibility of large movement depending on tomorrow’s U.S. inflation indicator

Technical Analysis

The Oceania currencies are holding steady. The Australian dollar is above its 240-day moving average for the sixth day in a row, while the NZ dollar is also up for the fifth day in a row. The dollar and the euro were closed in London, so there was little significant movement, and the market is waiting for the U.S. inflation indicator to come out. Low volatility makes it difficult to trade, so trade cautiously.

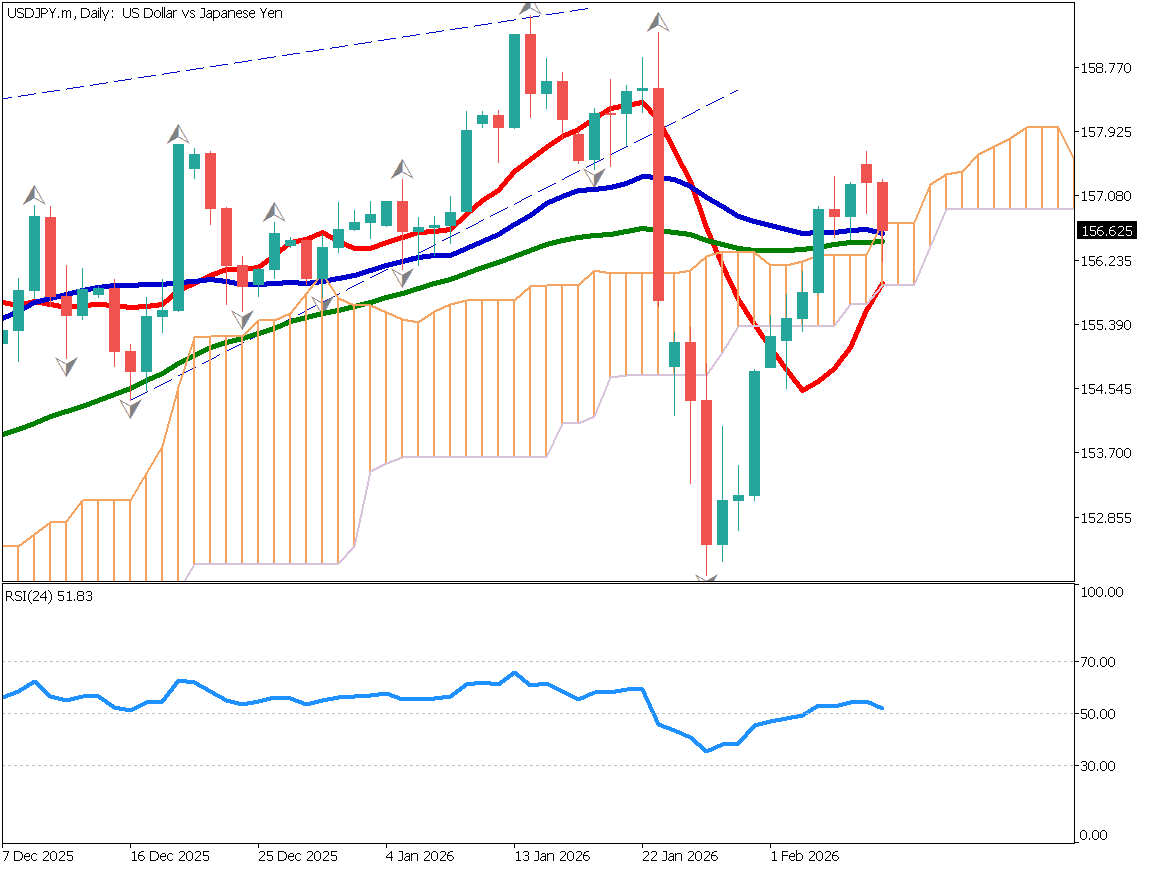

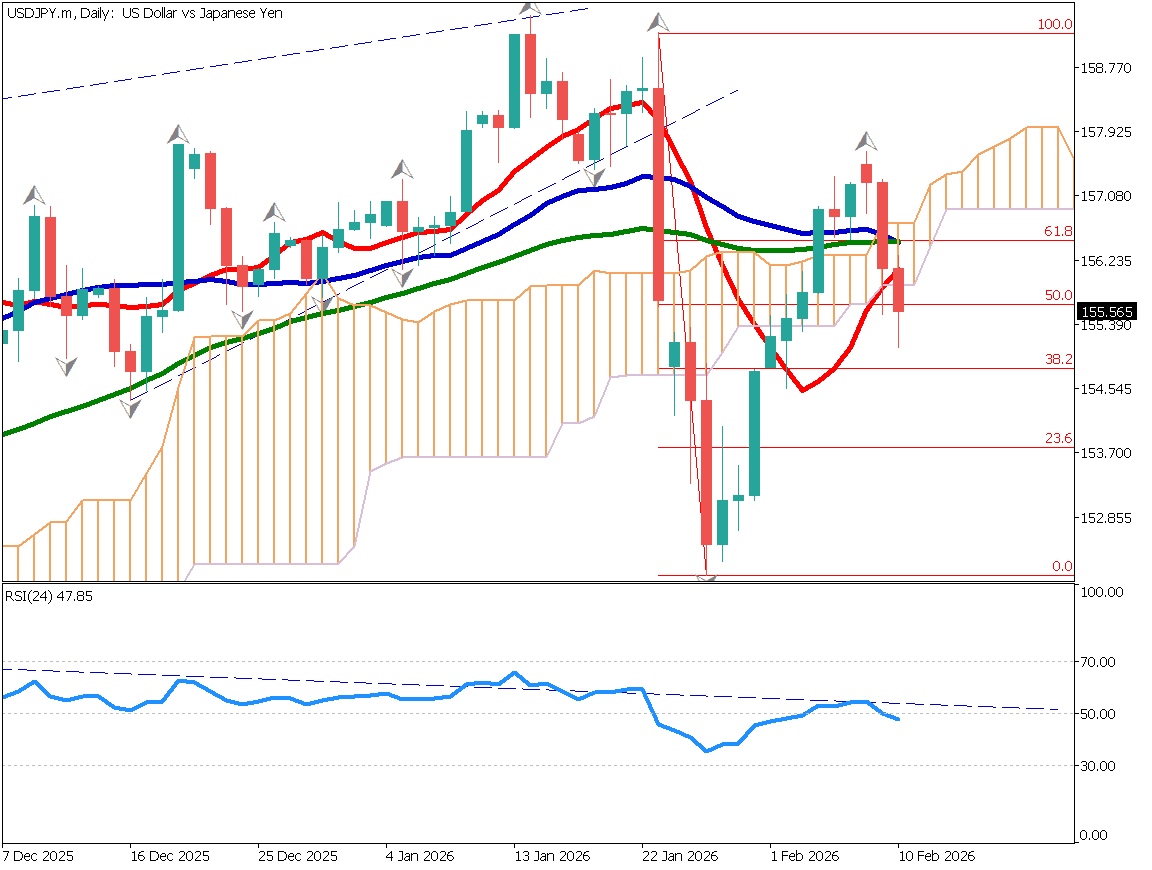

Dollar-Yen (USDJPY)

Analysis of the hourly chart of the dollar-yen shows that it is above the range. Although it is difficult to get a sense of direction, we expect a rally to the JPY 135.60 area; at around JPY 136.00, we want to be cautious as a return sale may enter the market.

| Estimated range | JPY 133.78 – JPY 136.21 |

| Resistance line | JPY 135.60 |

| Support line | JPY 134.48 |

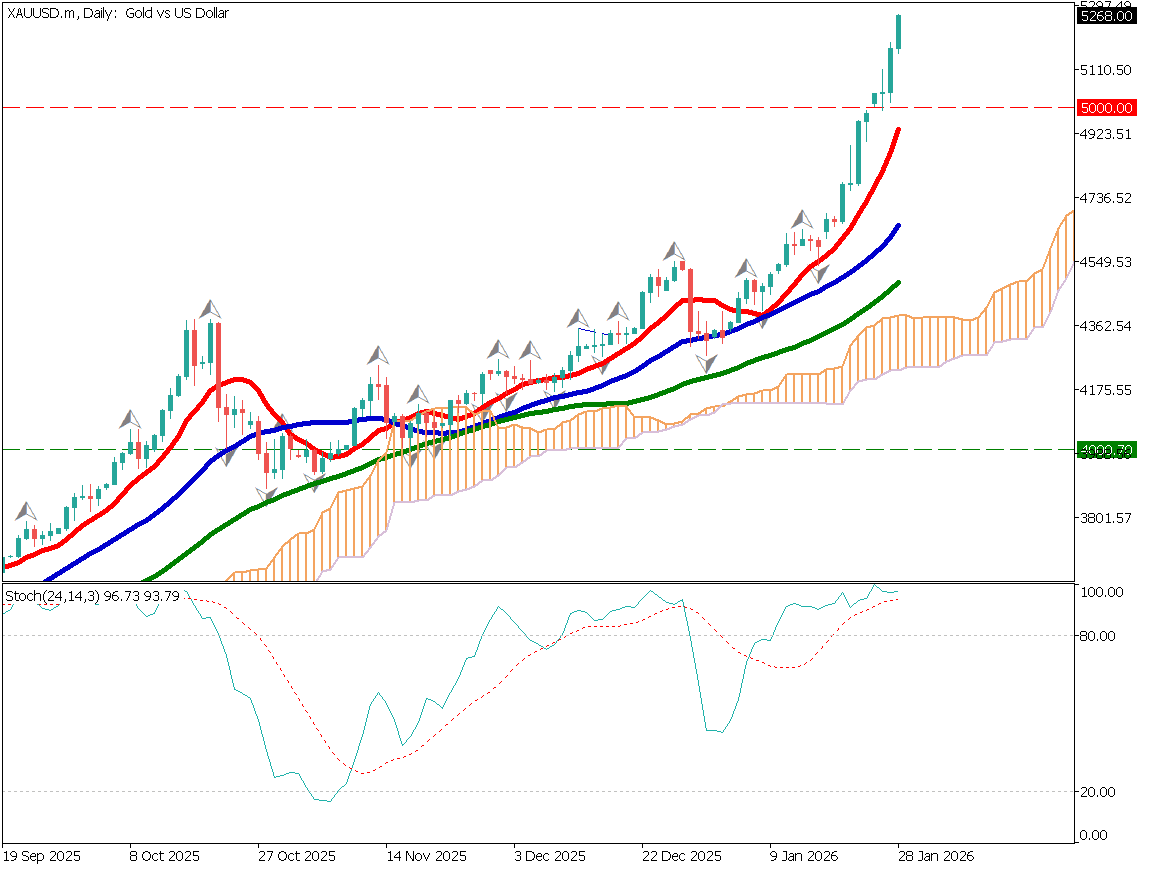

Ethereum (ETHUSD)

The 4-hour chart of Ethereum has broken below the 240 moving average. A large sell order is likely to have been placed, but the market is likely to remain range-bound for some time.

| Estimated range | USD 1,748 – USD 1,945 |

| Resistance line | USD 1,875 |

| Support line | USD 1,790 |

Australian Dollar-Yen (AUDJPY)

The AUDJPY is steady, but the 240-day moving average is approaching. This is a moving average line that has been recognized at least three times so far, and there is a possibility that an adjustment will be made at least once this time. We expect JPY 92.15 to be the upper price target. While being aware of the buying rotation, we intend to take profits in small increments.

| Estimated range | JPY 90.62 – JPY 92.50 |

| Resistance line | JPY 92.150 |

| Support line | JPY 90.86 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| None in particular | – |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.