U.S. CPI slows, limited movement despite growing speculation of a halt to interest rate hikes【May 11, 2023】

Fundamental Analysis

- Nasdaq and S&P 500 rise; Dow Jones Industrial Average falls for third day

- U.S. CPI falls below 5% for the first time in nearly two years, suggesting a slowdown in U.S. inflation

- U.S. dollar reacts with weakness as June FOMC meeting may halt interest rate hikes

- U.S. producer price index (PPI) also in focus, with interest in whether PPI will also show a slowdown in inflation

- U.K. policy rate due to be announced; 0.25% rate hike expected

Technical Analysis

U.S. CPI results indicated a slowing trend in inflation. The exchange rate reacted with a weaker dollar and a stronger yen. The yen fell from JPY 135.50 to JPY 134.50 immediately after the announcement, and the yen was also bought in the morning. Stock markets reacted with gains except for the Dow Jones Industrial Average. Gold, however, did not make a new high as strong selling pressure pushed it back from $2,050 to $2,020, although the direction of movement was up due to the suspension of interest rate hikes and rate cuts.

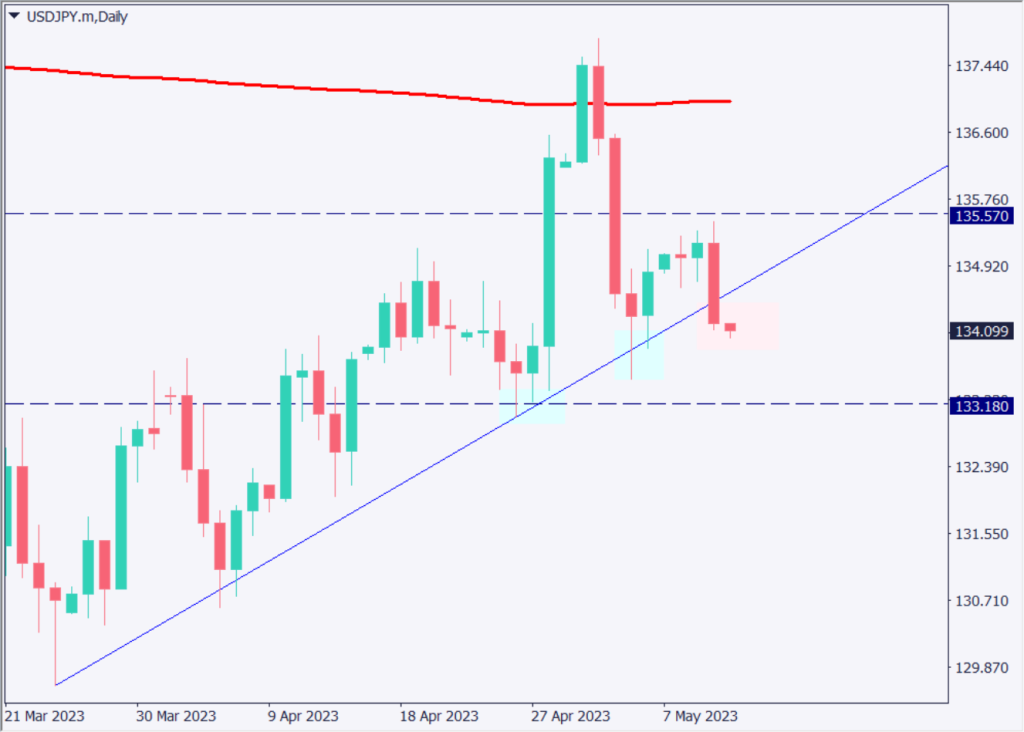

Dollar-Yen (USDJPY)

Analyzing the daily chart of the dollar-yen. The yen has fallen below the milestone support line at JPY 134.480 and is trending higher. The yen will naturally strengthen if the US interest rate hike is suspended and there is no further expansion of the Japan-US interest rate differential.

Our near-term target is near JPY 133.68. There are few support lines in the JPY 133.00 level, so the yen could avalanche to the low JPY 133.00 level in one fell swoop, and a certain degree of caution is needed regarding the risk of a stronger yen. We would like to consider a sell direction for the time being.

| Estimated range | JPY 133.0 – JPY 135.57 |

| Resistance line | JPY 134.90 |

| Support line | JPY 133.18 |

Pound Dollar (GBPUSD)

Today, the UK policy rate is scheduled to be announced, which will be a source of fluctuation for the Pound Dollar. We will analyze and look at the daily chart of the pound dollar. The pound dollar is stuck, and since the upside and downside are tightening, we can assume that a pullout in either direction would result in a big move with stop-losses involved.

In the U.K., there is no sign of slowing inflation, and the government plans to continue raising interest rates. On the other hand, the U.S. may halt interest rate hikes due to a slowdown in inflation. Overall, we are looking to buy the pound dollar, with USD 1.2680 as a major resistance zone. We would like to trade on the outcome.

| Estimated range | USD 1.2539 – USD 1.2708 |

| Resistance line | USD 1.2676 |

| Support line | USD 1.2582 |

NASDAQ

Since the NASDAQ does not include financial stocks, the main drivers of fluctuation are policy rates and corporate earnings. The main factors that will cause fluctuation are the policy rate and corporate earnings. The upward channel is continuing, and we would like to adopt a buy policy. The long-term target is USD 13,900.

| Estimated range | USD 13,160 – USD 13,544 |

| Resistance line | USD 13,435 |

| Support line | USD 13,260 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Central Bank Policy Rate | 20:00 |

| BOE Governor Press Conference | 20:30 |

| U.S. Producer Price Index (PPI) | 21:30 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.