Bank of England raises interest rate by 0.25%, but pound’s gains do not continue【May 12, 2023】

Fundamental Analysis

- Major U.S. Stock Indices Split Direction, Dow Jones Continues to Fall, Nasdaq Rises

- Bank of England Raises Interest Rates by 0.25%; Two Members of the Board of Governors Leave Rates Unchanged

- BoE Governor Comments on Rate Hike Halt if Inflation Slows

- PacWest Bancorp Shares Plunge on U.S. Land Bank Issues, No Conclusion in Sight

- Bitcoin Continues to Fall as G7 Discusses Tighter Regulations; USD 26,000 Near

Technical Analysis

In the currency markets, the dollar and the yen have strengthened, with the dollar losing direction. Meanwhile, the pound sterling has fallen sharply by more than 80 pips after the announcement of the interest rate hike, as selling pressure increased. The pound-dollar has been holding slightly lower at the support line by the round number of $1.25.

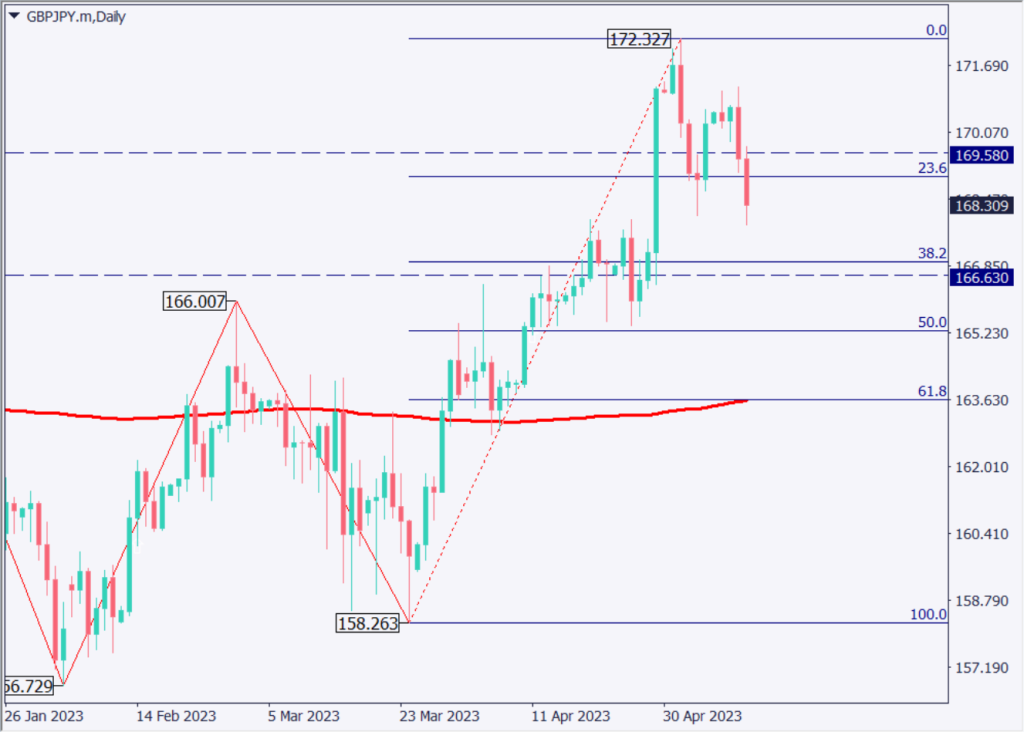

Pound Sterling-Yen (GBPJPY)

Analyzing the daily chart of GBPJPY. The pair has fallen below JPY 168.980, which had been an important support line. It is below the recent low, confirming that the upward trend has ended and turned to a downtrend. Near-term risk is considered to be to the downside. The target price is expected to be around 166.950 yen, which corresponds to 38.2%.

| Estimated range | JPY 166.630 – JPY 169.580 |

| Resistance line | JPY 168.85 |

| Support line | JPY 167.37 |

Bitcoin (BTCUSD)

Bitcoin is also softening. A major factor is the debate over tighter regulation of virtual currencies. The price had been rising as a safe-haven asset, but the risk to the virtual currency itself has prompted profit-taking selling.

The price has fallen below the USD 27,000 level and is expected to reach a milestone resistance level around USD 25,780.

| Estimated range | USD 25,780 – USD 28,200 |

| Resistance line | USD 27,640 |

| Support line | USD 26,390 |

GOLD (XAUUSD)

Gold is also down for the second day in a row. The price has been temporarily rising on the speculation of a halt in interest rate hikes, but is now being held back by selling pressure in the highs. After all, the upside is very heavy above the USD 2,050 level.

Although there are not enough materials to push the price higher at present, the next risk factor could cause the price to rise with stop-losses. We would be cautious in the selling direction due to the smoldering risk of U.S. regional banks.

| Estimated range | USD 1985.7 – USD 2043.9 |

| Resistance line | USD 2,030 |

| Support line | USD 1,996 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| UK GDP | 15:00 |

| University of Michigan Consumer Confidence Index | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.