Favorable U.S. economic indicators strengthen the dollar; Gold falls below USD 2,000【May 17, 2023】

Fundamental Analysis

- Dow Jones Industrial Average slumps sharply as deadline looms for U.S. default risk

- House Speaker and President Biden Meet, No Progress in U.S. Debt Ceiling Negotiations

- U.S. Retail Sales Beat Previous Month, Dollar Sells Stronger on Strong Results

- US interest rates rise on hawkish comments from Fed officials, dollar buying strengthens in New York

- Gold slips below USD 2,000, strengthening the dollar and setting the tone for a decline

Technical Analysis

The dollar strengthened strongly in the currency markets. U.S. retail sales exceeded expectations, leading to a predominant buying of the dollar and causing the straight dollar currency pair to fluctuate. Gold was the most volatile among them, falling below the USD 2,000 level, a major level due to strong dollar buying, and dropping to around USD 1,988 with stop-losses involved.

Gold (XAUUSD)

Gold has fallen below its major USD 2,000 level due to the strong dollar; it has closed below its 28-day moving average, and we expect the next support band to be USD 1,984. Risk factors have not disappeared, but the impact of the strong dollar seems to be stronger now.

| Estimated range | USD 1,964 – USD 2,013 |

| Resistance line | USD 2,000 |

| Support line | USD 1,984 |

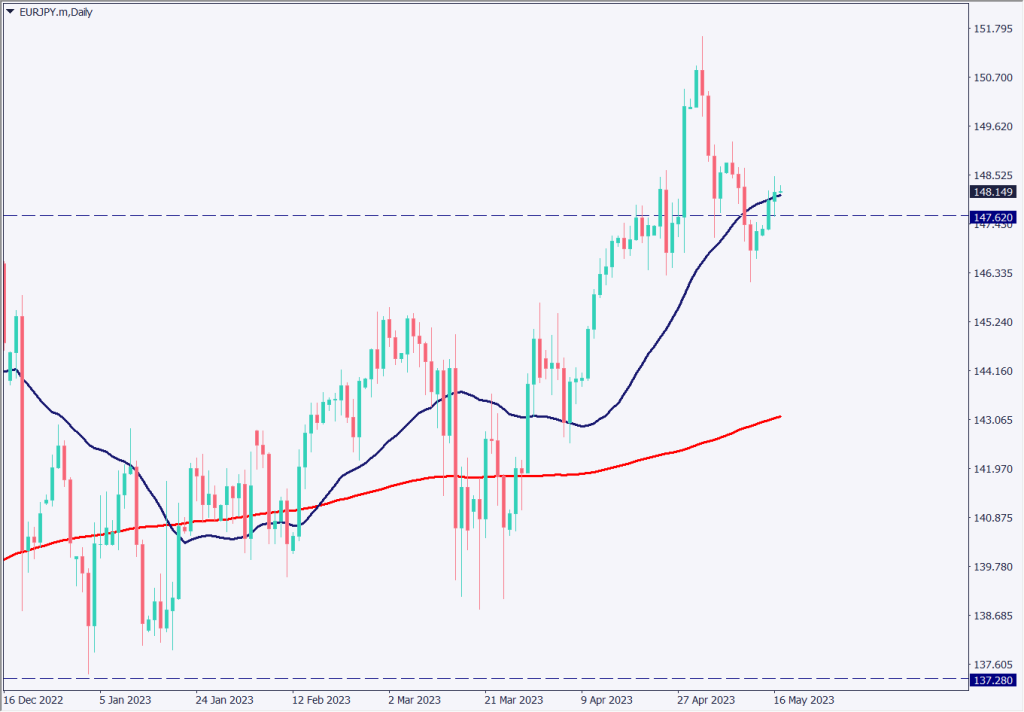

Euro-Yen (EURJPY)

Euroyen is hovering around the 28-day moving average. The focus will be on whether the pair rises above the 28-day moving average again or falls back. Today, the consumer price index for the EU bloc will be released, and if inflation slows, there is a risk of a downward trend.

| Estimated range | JPY 147.00 – JPY 149.30 |

| Resistance line | JPY 149.05 |

| Support line | JPY 147.60 |

Bitcoin (BTCUSD)

Analyzing the 4-hour chart of Bitcoin. Bitcoin is softening due to the direction of tighter regulations on virtual currencies. The 28-day moving average is acting as a resistance line, and considering that the dollar is strengthening, a decline is likely.

This could be an opportunity for a return to higher selling prices and should be watched closely.

| Estimated range | USD 25,960 – USD 28,000 |

| Resistance line | USD 27,500 |

| Support line | USD 26,450 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Japan Gross Domestic Product | 8:50 |

| EU Consumer Price Index | 18:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.