Nikkei Stock Average breaks through the JPY 30,000 level, market tilts toward risk-on【May 18, 2023】

Fundamental Analysis

- U.S. stock indexes are sharply higher, with all major indices rising a strong 1% or more

- President Biden and Speaker of the House express confidence in avoiding default, raising expectations of an agreement

- Nikkei Stock Average breaks above the 30,000 level and continues to rise for 5 days due to the Buffett effect

- Cross-yen exchange rates rose sharply due to the overall weakness of the yen

- USD/JPY breaks above JPY 137.50, approaching the price zone where it has fallen back twice before

- Gold falls to USD 1984, an important support band

Technical Analysis

Volatility surged as both the currency and stock markets turned risk-on. President Biden and the Speaker of the House of Representatives expressed confidence in avoiding default, and the market judged that the risk of debt ceiling negotiations had receded. U.S. stock indexes also rose sharply, and the Nikkei 225 broke above the 30,000 level.

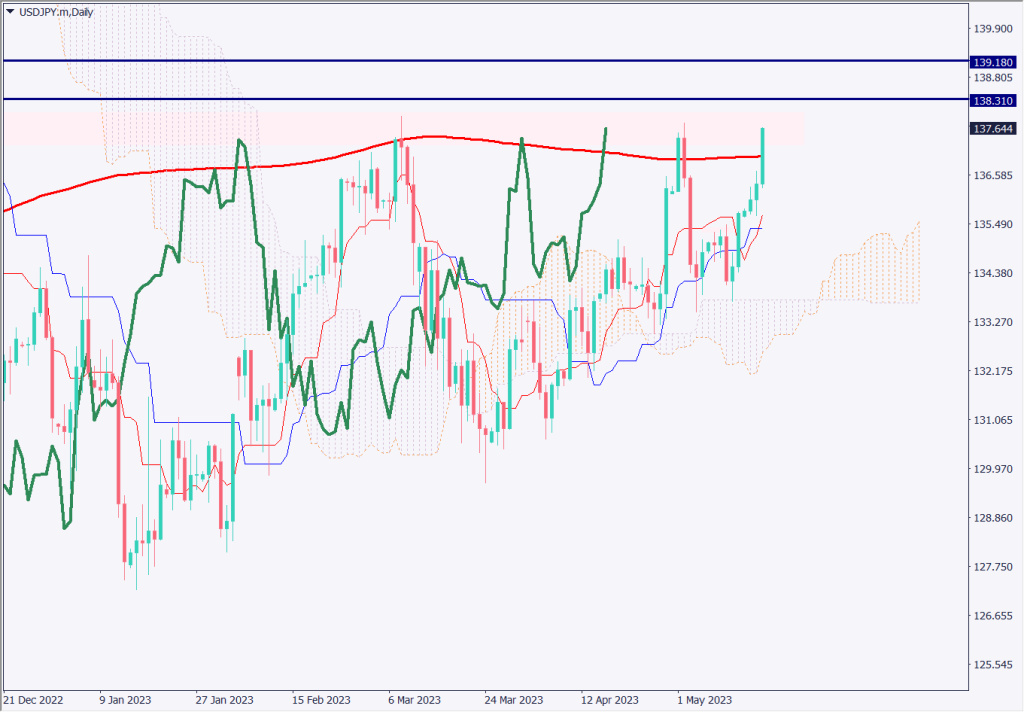

The dollar is approaching the important price range of JPY 137.70-JPY 137.90. This is the price range where the pair has fallen back twice in the past, and this will be the third time the pair will try to move higher.

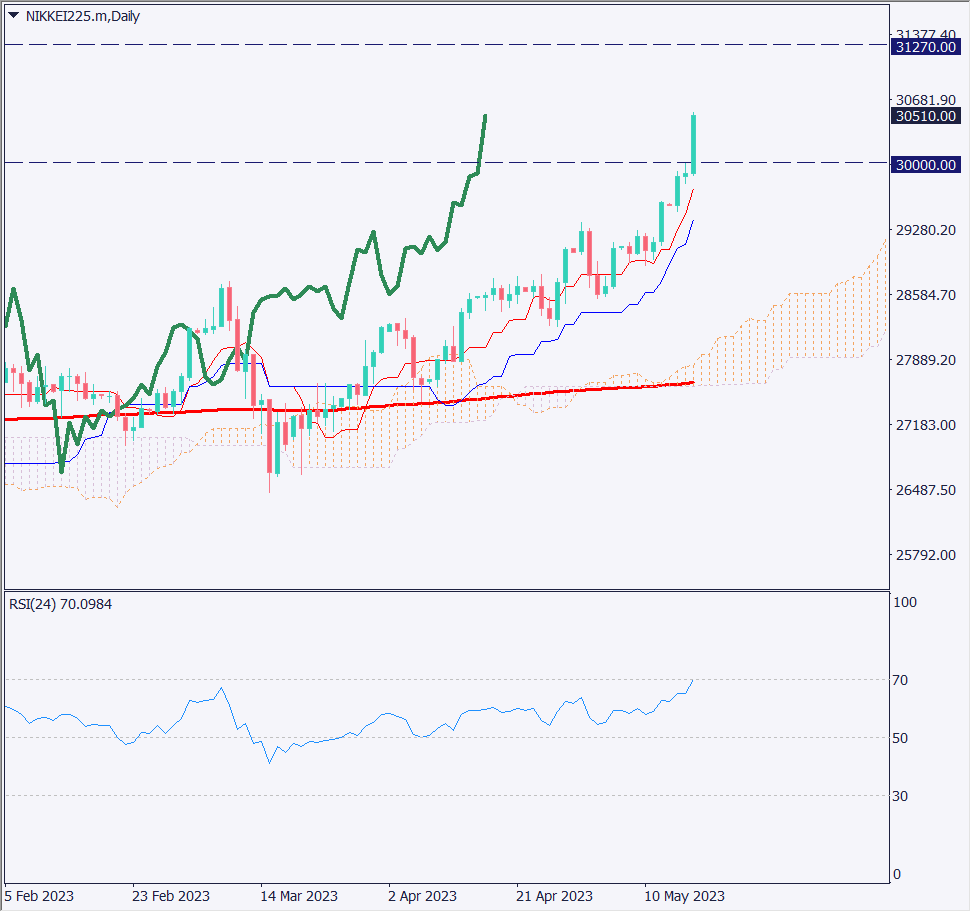

Nikkei Stock Average (NIKKEI225)

The Nikkei Stock Average has broken above the JPY 30,000 level and has risen to JPY 30,500 in overnight trading. The background to the rise is thought to be the fact that global investors’ eyes are on Japanese stocks, triggered by Mr. Buffett’s recommendation of Japanese stocks, combined with the low interest rate policy that has been maintained.

However, the daily RSI is at 70, which is about to reach an overbought level. As there is a possibility of a one-time adjustment, we would like to aim at buying at the push point. The medium- to long-term upside target is JPY 31,270.

| Estimated range | JPY 29,750 – JPY 31,200 |

| Resistance line | JPY 31,000 |

| Support line | JPY 30,000 |

Dollar-Yen (USDJPY)

Analyzing the daily chart of the dollar-yen. The dollar-yen remains in an important price zone that will determine the future direction of the market. The pair has retreated twice before at JPY 137.70 and JPY 137.90, and this is the third time it has tried to do so. The chart pattern is a triangle pattern of rising lows, with a high likelihood of a break to the upside.

A clear break above each high can be expected to facilitate a move higher due to stop loss orders. The trade policy is to buy on the push side.

| Estimated range | JPY 137.10 – JPY 138.31 |

| Resistance line | JPY 137.90 |

| Support line | JPY 137.25 |

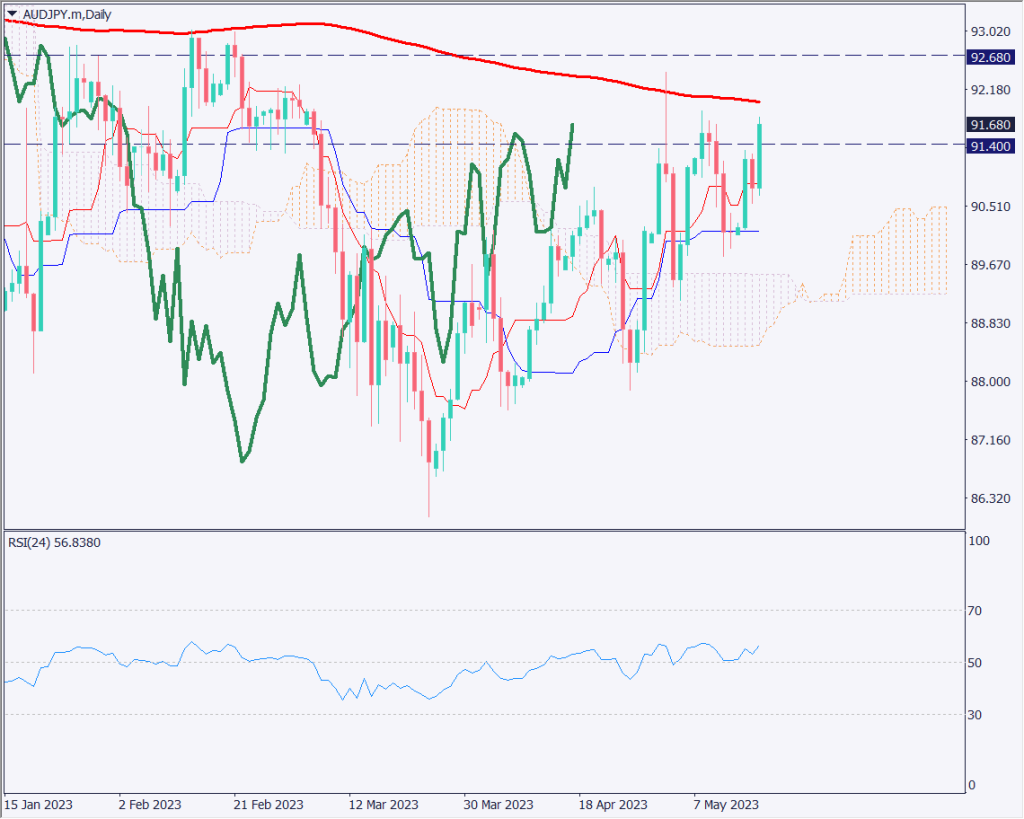

Australian Dollar-Yen (AUDJPY)

The Australian employment report is scheduled to be released and could result in significant volatility. Analyzing the AUDJPY on the daily chart shows a gradual uptrend with the lows cutting off. Of note is the 240-day moving average, which has been conscious in the past. It has been conscious at least three times, and although it will depend on the current employment data, even if it rises, it may be restrained to the upside.

| Estimated range | JPY 91.25 – JPY 92.68 |

| Resistance line | JPY 92.10 |

| Support line | JPY 92.40 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Australian Employment Statistics | 10:30 |

| U.S. Unemployment Insurance Claims | 21:30 |

| U.S. Existing Home Sales | 23:00 |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.