Currency markets are risk-on, factoring in a rate hike at the June U.S. FOMC meeting.【May 19, 2023】

Fundamental Analysis

- Major U.S. Stock Indexes Rise; U.S. Debt Ceiling Talks May Progress Next Week

- Dallas Fed President Says He Sees No Basis to Halt Rate Hikes

- U.S. Unemployment Insurance Claims Decline, Signaling Strength in U.S. Labor Market

- Favorable U.S. economic indicators are encouraging investors to anticipate a rate hike in June

- Currency and equity markets remain risk-on, dollar continues to strengthen

Technical Analysis

Expectations that the U.S. debt ceiling negotiations will progress next week have turned the market into a typical risk-on market. Dollar buying prevailed, and the dollar/yen rallied notably. It rose to JPY 138.60 by the end of London time. Gold has fallen to the USD 1,950 level due to the receding default risk.

The dollar-straight currency pairs are leaning toward dollar buying, making the euro-dollar and the pound-dollar vulnerable to a decline.

Dollar-Yen (USDJPY)

Analyze the daily chart of the dollar-yen. Analysis of the equilibrium chart shows that the lagging line is above the candlestick, the conversion line is above the base line, and the candlestick is above the cloud. The “three-factor turnaround” has been completed, suggesting the continuation of the upward trend.

With few factors to buy the yen and the dollar prevailing, we believe that the dollar-yen has a high probability of continuing to rise. Our medium- to long-term trading policy is to buy at the push. However, since the upward momentum was strong, there is a possibility of profit-taking and adjustment selling.

| Estimated range | JPY 137.25 – JPY 139.32 |

| Resistance line | JPY 139.10 |

| Support line | JPY 138.35 |

NASDAQ

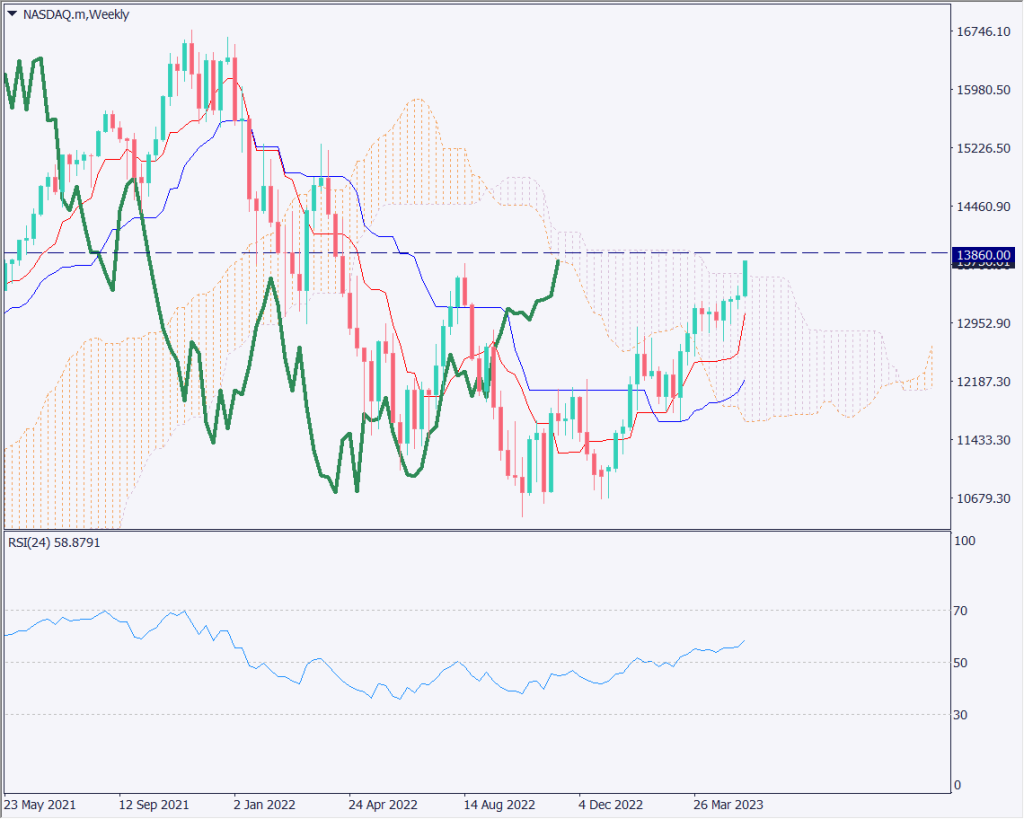

The NASDAQ has been experiencing a more pronounced rise than the Dow Jones Industrial Average and the S&P 500. Analysis of the weekly NASDAQ chart shows that it is currently trying to break above the equilibrium cloud on a weekly basis. Of course, the lagging line is above the candlestick and the conversion line is above the base line. The shape of a three-way reversal has been completed, which is a strong upward signal.

Financial stocks are not affected and are likely to rise, supported by the strong U.S. economy. On the other hand, it is sensitive to interest rate trends, and if the June FOMC meeting decides to raise interest rates, an adjustment may occur. We would like to wait for a push-buying opportunity.

| Estimated range | USD 13,000 – USD 13,900 |

| Resistance line | USD 13,860 |

| Support line | USD 13,200 |

Gold (XAUUSD)

Gold is about to shift from a rising to a falling trend. The dollar’s dominance is expected to continue, and the receding risk of a U.S. default has eliminated buying interest as a safe-haven asset.

Analysis of the Ichimoku Chart shows that the conversion line is below the base line and the lagging line is below the candlestick. The significance of the break below USD 1980, which was an important price area, is significant. The RSI is also below 50. Both signals indicate a decline, and we should be cautious about future moves.

| Estimated range | USD 1,925 – USD 1,985 |

| Resistance line | USD 1,980 |

| Support line | USD 1,930 |

Today’s Important Economic Indicators

| Economic Indicators and Events | JST (Japan Standard Time) |

| Speech by Fed Chair Powell | Midnight |

*Trading advice in this article is not provided by Milton Markets, but by Shu Fujiyasu Jr., a certified technical analyst.